December 22, 2024 | The Euro is Doomed if Germany Fails

Since the creation of Europe’s common currency in 1999, Germany has been the key to the whole project. The European Central Bank stood ready to buy up all the (for instance) Italian debt that the markets couldn’t or wouldn’t absorb, and Germany stood ready to back the ECB with its industrial might and financial wealth. So in effect, Italian (and Greek, Spanish, and French) bonds were viewed by the markets as German bonds, super-safe and therefore worth owning even with low yields.

This worked reasonably well while Germany was a manufacturing powerhouse that ran trade and budget surpluses. But it’s not working nearly as well since Germany committed an almost comical series of blunders that threaten to end its reign as Europe’s superpower. Among other things, Germany (mostly under the once-respected Angela Merkel):

- Allowed itself to become dependent on cheap Russian natural gas — and then stood by while the US (or its Ukrainian proxies) blew up the main gas pipeline from Russia to Europe.

- Shut down its fleet of perfectly functional nuclear power plants and tried to replace the lost 20% of national electricity production with solar and wind —apparently neglecting the fact that its climate is neither sunny nor windy. The result: massively higher energy costs for an economy designed around cheap power.

- Opened its borders to millions of migrants who, without going into potentially offensive detail, have been a source of turmoil rather than strength.

- Collapsed its government and is considering banning its most popular political party from upcoming elections.

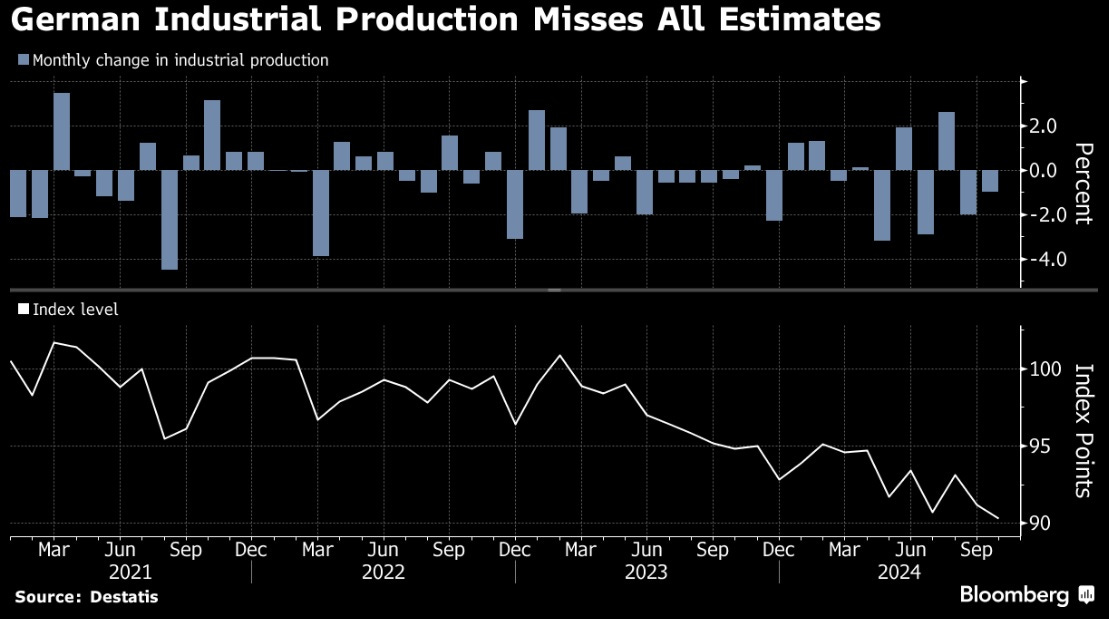

The following chart shows Germany’s recent industrial production numbers. Note the big net decline in 2023 and 2024.

I recently spoke with Soar Financially’s Kai Hoffman, who is based in Germany. He’s not happy with his country’s leaders:

And here’s demographic analyst Peter Zeihan on Germany’s now-moribund auto industry:

Bloomberg, meanwhile, predicts something worse than a recession in the year ahead:

German economy is ‘unraveling’ – Bloomberg

Germany is approaching a point of no return amid a deepening economic downturn and political uncertainty, Bloomberg reported on Monday.

Facing a second year of zero growth, the EU’s largest economy is on a path to decline that threatens to become irreversible, the outlet warned.

Estimates show that after five years of stagnation, the German economy is now 5% smaller than it could have been if the pre-pandemic growth trend had persisted.

The global economic slowdown, along with years of “poor” decisions has hit Germany hard, the article stated. Its export-driven industry, accounting for about 30% of its GDP, faces structural challenges, such as the loss of cheap Russian energy and the struggles of automotive giants Volkswagen and Mercedes-Benz, hit by soaring energy costs and increased competition from China.

The decline in national competitiveness translates to a loss of around €2,500 ($2,600) per household annually, according to Bloomberg calculations. The “unraveling” of the German economy would send ripples across the rest of the EU, experts warn.

”Germany doesn’t collapse overnight. That’s what makes this scenario so absolutely gut-wrenchingly terrifying,” Amy Webb, CEO of Future Today Institute, which advises German companies on strategy, told the outlet. According to Webb, a gradual, prolonged downturn will affect not only German companies or cities, “but the entire country and Europe gets dragged down with it.”

Can the Euro survive without Germany?

Probably not. If the ECB isn’t backed by near-limitless German resources, who in their right mind would want to own bonds issued by Italy (debt 136% of GDP) or France (budget deficit 6% of GDP and government that keeps collapsing)?

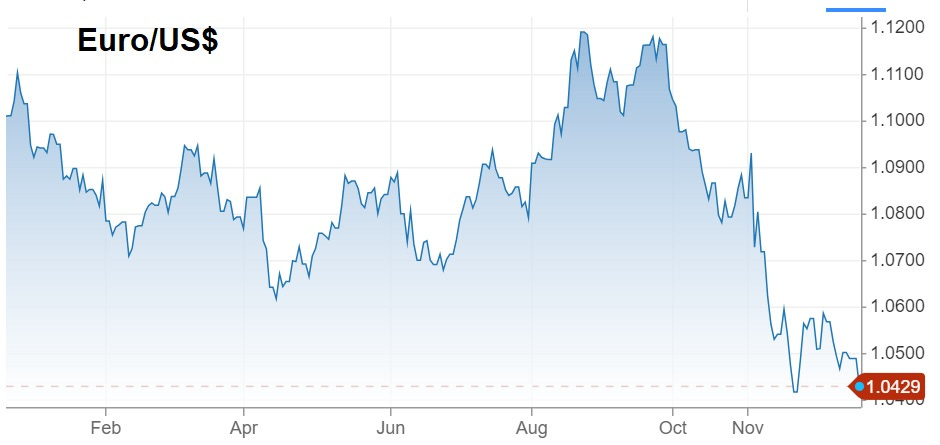

This prospect partially explains the euro’s recent slide towards parity with the US dollar, generally considered to be a very dangerous level.

What happens if the euro fails?

At least three things:

- The eurozone and EU fragment as the various members try to find their proper levels. Some will go back to their old currencies — and their old patterns of frequent devaluations.

- Euro-denominated debt will start trading according to the issuing country’s financial strength, which means Italy’s long-term interest rates will spike to 10% or more, forcing a quick default/devaluation. Other weak economies like Greece and maybe France will face variations on this theme.

- All those euros now out in the world will come pouring back home, spiking European inflation and causing years of turmoil.

Will this be the straw that breaks the back of the fiat currency experiment? We won’t know until after the fact. But the EU is big and the euro is important. Their failure will send the financial markets on a hunt for who’s next, and there will be no shortage of candidates.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino December 22nd, 2024

Posted In: John Rubino Substack

Next: Quantum Supremacy »