December 14, 2024 | Rhyming History: France’s First Hyperinflation

Back in the 1700s, France was ruled by a small group of inbred idiot aristocrats who started a series of ruinously expensive wars (see, history is rhyming already). As the bills came due, there wasn’t enough gold to pay creditors, and the government faced that era’s version of bankruptcy.

Then along came a Scottish economist/con man named John Law, who convinced the Duke of Orléans, France’s Regent, that issuing paper currency was the key to national salvation. The government could produce as many notes as it wanted, said Law, and as long as they were useful for buying and selling, national wealth would soar in line with the money supply. As Forbes Magazine tells the story:

In June 1716, the Banque Générale was established. It issued paper money that was not fully backed by specie (gold or silver). Instead, government bonds were used to back 50% of the paper money issued by the Banque Générale. This fractional reserve setup was approved by the Crown, and the Banque’s paper money was granted legal tender status.

This represented a breakthrough for Law because one of his ideas was to replace specie-based banking systems with credit-based systems. Instead of counterbalancing banks’ liabilities (paper money and deposits) with gold or silver assets, the liabilities in a credit-based system would be counterbalanced with loans.

Law’s next venture was the establishment of the Mississippi Company. It was granted monopoly rights for trade and development in France’s Louisiana and Canadian territories. And through a series of takeovers and mergers, it became a giant holding company that controlled a vast empire of French trading companies. In short, France privatized its treasury under Law’s plan. The Mississippi Company took over most of the financial functions of the Crown. These included the sole right to coin money, to collect all direct and indirect taxes, and to manage the Crown’s debt.

The objective, in part, was to facilitate a debt-for-equity swap in which the company’s shares were issued in exchange for the Crown’s debt. The Crown was thus able to unload its entire stock of high-yielding debt.

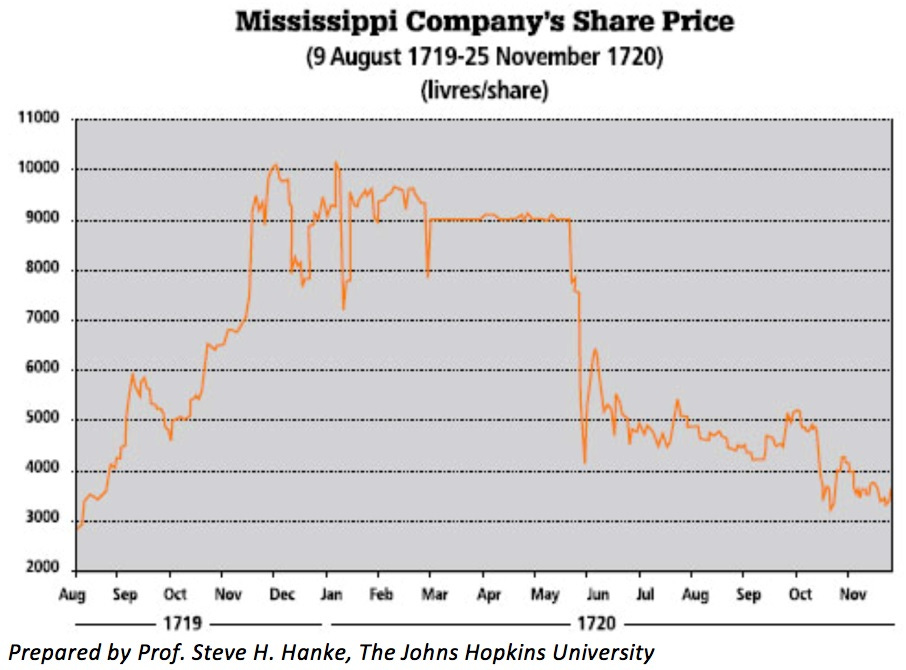

Along the way, Law’s Mississippi Company became one of the world’s first hyper-growth stocks.

With the prospect of spectacular returns, Paris became swollen with investors from all parts of Europe. The price of the Mississippi Company’s shares soared. So did Law’s fortunes. Among other things, in December 1719, he was appointed controller-general of finances — a position that made him the virtual prime minister of France.

The Inevitable End

In January 1720, speculators started selling Mississippi Company shares to buy land, gold, and other commodities. The price of Company shares declined while commodities rose — which is to say inflation accelerated.

Law reacted to this loss of confidence in his paper currency by going authoritarian. He declared that only banknotes were legal tender in an attempt to make gold less attractive. He merged the Mississippi Company and the Bank Generale and froze the price of Mississippi Company stock.

But it was too late. Speculators had lost faith in financial assets, and took advantage of the fixed share price to dump their holdings back onto the government. Law responded by lowering the fixed price, but this just enraged the remaining shareholders, who headed for the exit en masse.

In 1720 Law fled the country, and gold once again became the economy’s base money. But not before an entire generation of citizens saw their savings evaporate.

A Happy Ending (for this Cantillon guy)

Let’s finish with a story that illustrates the right way to approach a financial bubble:

Just before he fell, John Law summoned Richard Cantillon—one of the System’s main speculators, who was threatening the “System” by converting his profits to cash and taking them out of both market and bank—to attend upon him forthwith. The story has it that Law imperiously told the Irishman:

“If we were in England, we would have to negotiate with one another and come to some arrangement; in France, however, as you know, I can say to you that you will spend the night in the Bastille if you don’t give me your word that you will have left the Kingdom within twice twenty-four hours.”

Cantillon mulled this over for a moment replied, “Very well, I shall not go, but shall help your system to success.”

In fact, knowing this summary treatment signaled Law’s desperation and that the end of the mania was at hand, what Cantillon did next was immediately to lend all his existing holdings of stock out to the exchange brokers. Cashing in the paper money he received in lieu of his securities, he redeemed it for gold once more and then promptly quit the country with it, to watch the unfolding collapse—and Law’s final discomfort—in ease and safety.

By doing so, Cantillon inadvertently followed an important investment wisdom, which states that once an investment mania comes to an end, the best course of action is usually to exit the country or sector in which the mania took place altogether, and to move to an asset class and/or a country that has little or no correlation with the object of the previous investment boom.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino December 14th, 2024

Posted In: John Rubino Substack