December 9, 2024 | Housing Vibes

Happy Monday Morning!

We’re in a recession, I wouldn’t even call it a technical one. Those were the words from former Bank of Canada Stephen Poloz this past week. It appears Poloz also agrees with our view, that despite the finance ministers best attempt at quieting the animal spirts, this is not a vibecession, but rather, a recession that needs to be taken seriously.

Remember, just a week ago we learned the Canadian economy grew at an annualized rate of one per cent in the third quarter, well below the Bank of Canada’s 1.5% forecast, and GDP per capita has contracted for six consecutive quarters.

Meanwhile, labour market weakness is deepening as well.

The latest jobs report showed Canada had 1.5 million unemployed people in November, propelling its jobless rate to a near-eight-year high outside of the pandemic era. The unemployment rate now sits at 6.8% and moving higher. Any remaining job growth is coming from government, a trend that has been going on for several years now. As my good friend Ben Rabidoux notes, a whopping 45% of all jobs created in Canada over the past 5 years have come from government. This is no way to build an economy, and it’s all coming home to roost now.

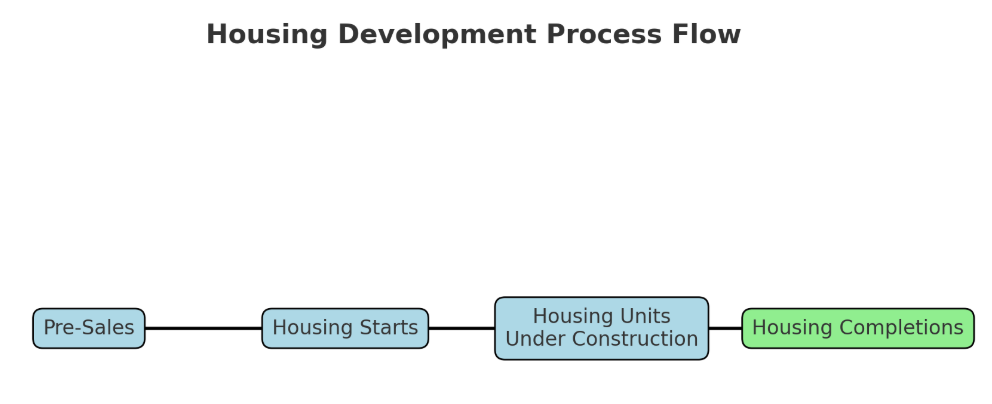

We do have concerns the weakness in the labour market is barrelling full steam ahead towards the construction sector where nearly 9% of Canadians are currently employed. Condo units under construction are at all time highs but once those projects complete the pipeline looks bleak. Remember, pre-sales lead housing starts, housing starts lead units under construction, which eventually become housing completions.

As we know, Toronto pre-sales are running at 27 year lows. Investors are finding out prices don’t always go up and are jumping ship. Sentiment is so bad The Globe & Mail is writing articles suggesting the pre sale market may never return to its former glory.

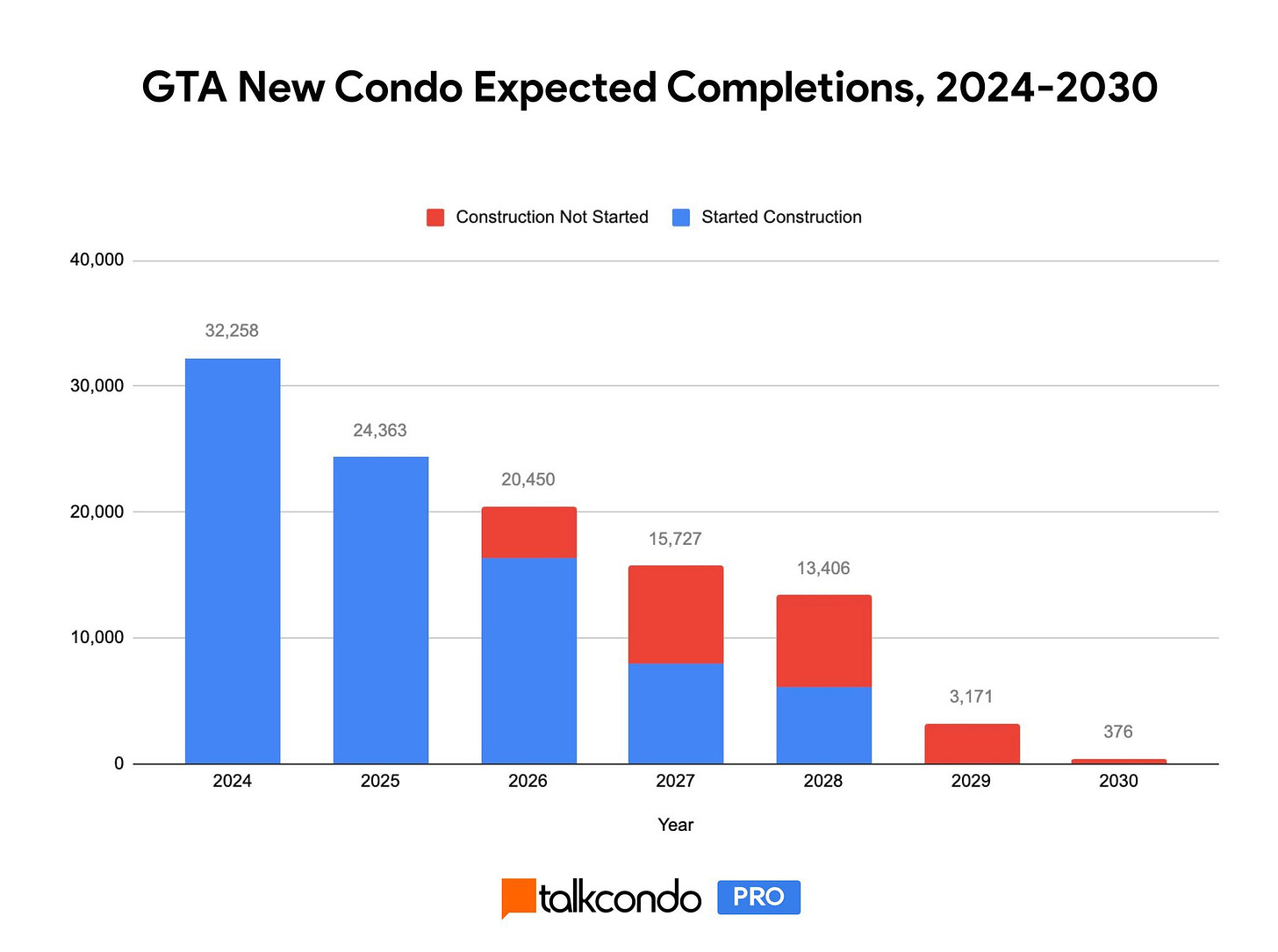

From a sentiment perspective, there’s only one way but up from here, however relief is not imminent. Based on current projections from Toronto Real Estate brokerage, TalkCondo, new condo completions in the GTA are heading to (almost) ZERO by 2030.

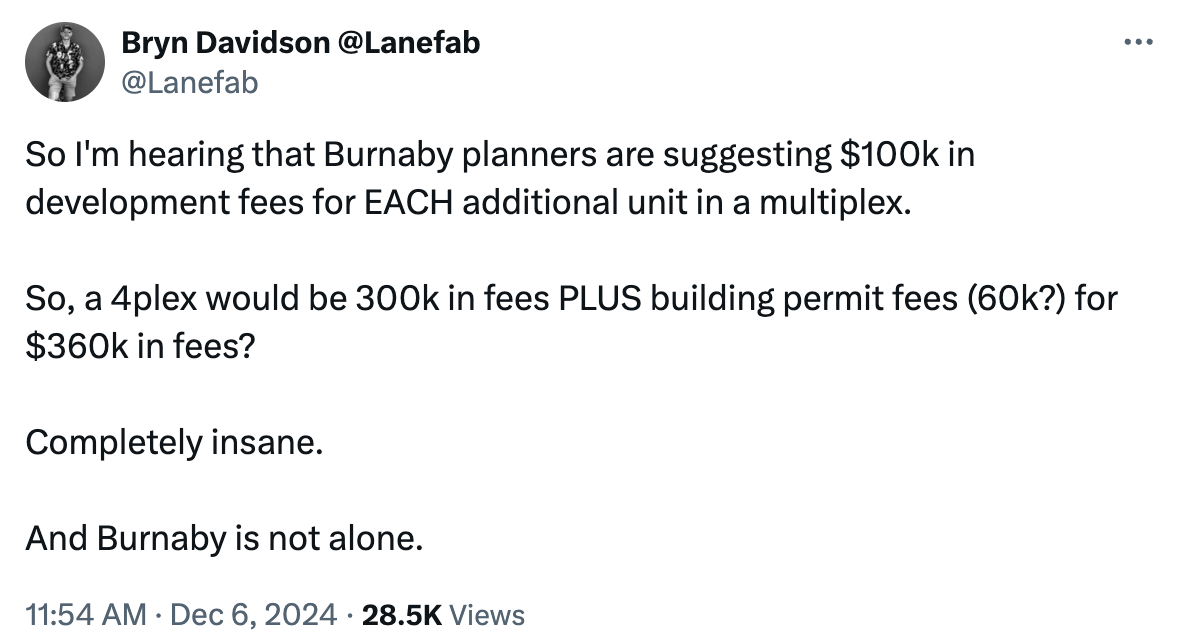

We know the feds are trying to stem the tides. It’s exactly why they introduced jumbo uninsured mortgages a few months ago, ditto for the housing accelerator fund. Unfortunately we continue to receive mounting evidence that the housing accelerator fund is all bark, no bite. Cities are rezoning for higher density to obtain accelerator funds and then immediately raising development charges in order to kill the viability of higher density developments once the cheque has cashed.

For example, the city of Burnaby, which was rewarded a $43M cheque from the accelerator fund earlier this year, then raised their development fees for high density by nearly $50k per unit this year. On a 1 bed condo that’s nearly 10% of the price. But wait, it gets better, they’re planning to charge nearly $100K per door for new multiplex housing. If you want to build a fourplex in place of a single family house that’s going to cost you $360,000 just for the permits.

When government tax revenues plunge alongside housing starts, at least we’ll know why.

So there you have it, the economy stinks, the labour market is weak, and housing starts are going down the tube. How’s that for a vibe?

On the bright side, interest rates are about to move lower again. The odds favor another 50bps cut from the BoC this week as they see what their former leader sees. Mortgages are getting cheaper, and that’s relieving concerns of the mortgage renewal cliff.

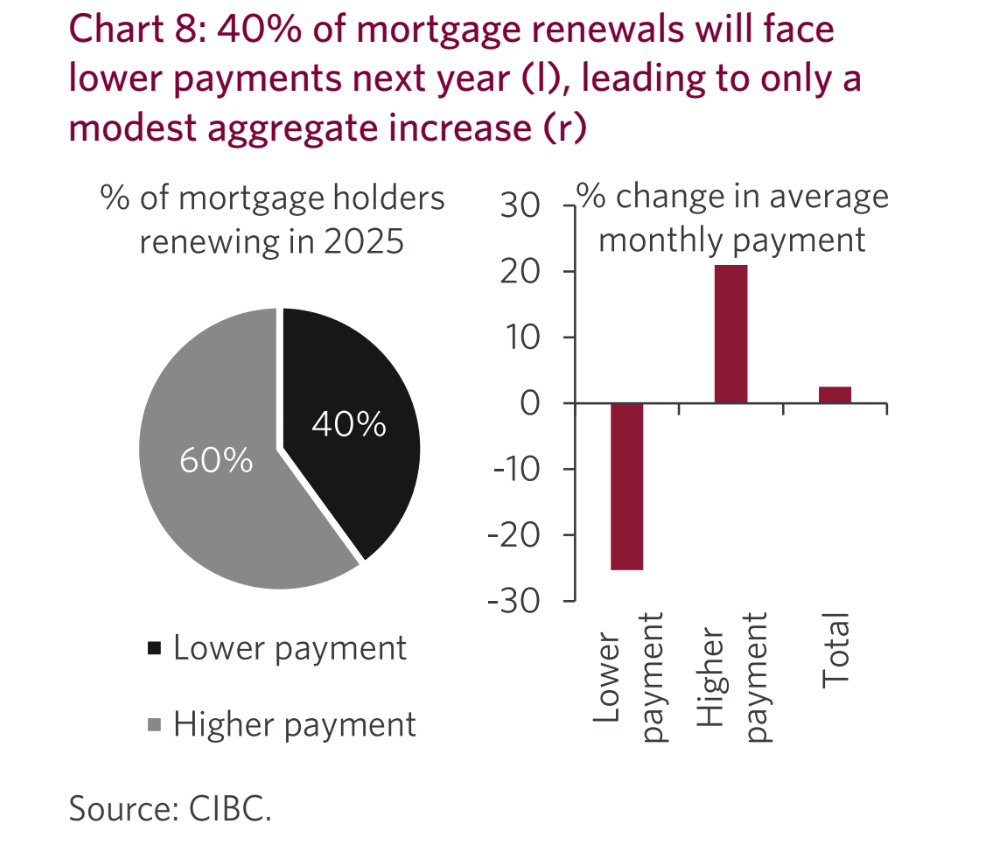

As CIBC notes, about 40% of mortgages renewing next year will see lower monthly payments. About 10% of them will see an increase of less than 10%. That leaves the remaning 50% of renewals next year facing an average 20% payment shock, but that doesn’t look so scary if you consider the fact that over the past 5 years, both wages and home prices have risen by more than 30%. Overall, CIBC estimates that the total payment shock in 2025 will average just 2.5%. Manageable.

You see, it’s not all bad news, so long as you can keep your job. Vibe on.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky December 9th, 2024

Posted In: Steve Saretsky Blog