December 9, 2024 | Crash Alert: Priced for Perfection in an Imperfect World

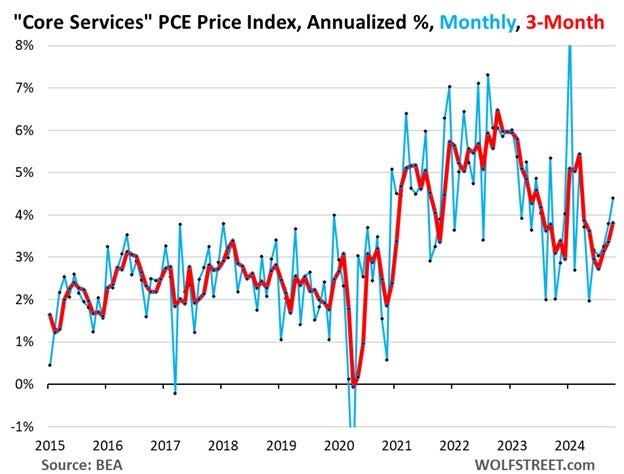

The last few US inflation reports have been ominous, with the general trend morphing from sharp decline to gradual increase. Here’s the Core Services index, which is now rising at a 4% annual rate:

Stocks, meanwhile, are priced for perfection, with the second highest price/earnings ratio on record:

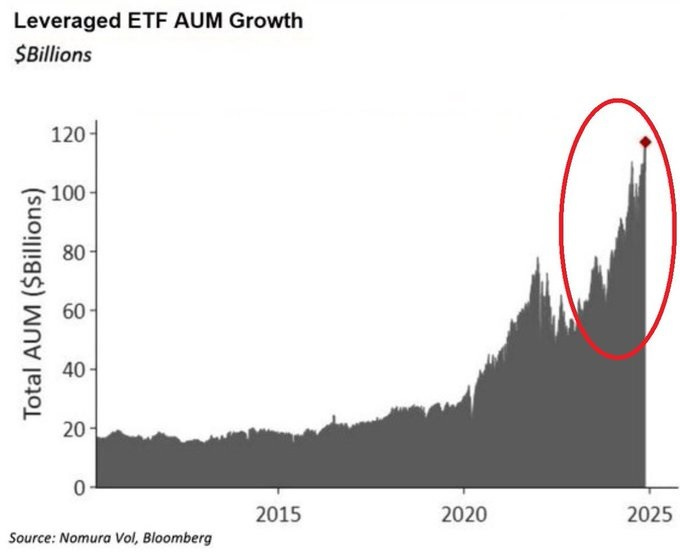

Investors are getting cocky, as evidenced by the soaring popularity of leveraged ETFs:

And gold has shaken off its post-election correction and is now threatening its all-time-high:

Can the Fed keep easing into all this?

Today’s stock market enthusiasm is based in part on the expectation of ever-easier money for the balance of the decade. But can the Fed really deliver this in the face of soaring financial assets, off-the-charts speculation, and rising general inflation? Wouldn’t that spike inflation? Probably. So at some point in 2025 the Fed will have to stop lowering rates.

What happens then? Well, check the above P/E chart for what became of the last few priced-for-perfection markets.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino December 9th, 2024

Posted In: John Rubino Substack

Next: Housing Vibes »