December 17, 2024 | Are We Back to “Higher For Longer”?

The Fed is expected to cut interest rates today. But that might be it for a while. Consider:

Consumer spending is exceeding expectations:

Motor vehicles, online purchases boost US retail sales in November

(Reuters) – U.S. retail sales increased more than expected in November amid an acceleration in motor vehicle and online purchases, consistent with strong underlying momentum in the economy as the year winds down. Spending jumped 0.7% last month after an upwardly revised 0.5% gain in October, the Commerce Department’s Census Bureau said. Economists polled by Reuters had forecast retail sales, which are mostly goods and are not adjusted for inflation, advancing 0.5%.

Labor market resilience, characterized by historically low layoffs and strong wage growth, is underpinning consumer spending and keeping the economic expansion on track.

The solid increase in retail sales came despite a late Thanksgiving holiday that pushed Cyber Monday into December, and was consistent with a strong start to the holiday shopping season. It was also in spite of a less favorable seasonal factor, the model that the government uses to strip seasonal fluctuations.

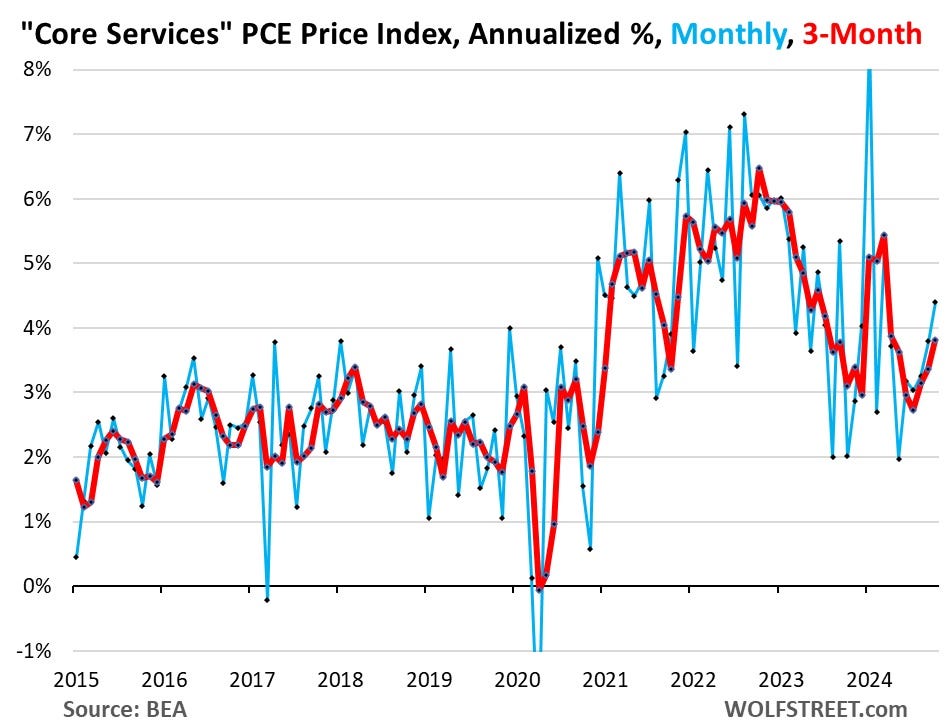

Inflation is above the Fed’s 2% target and trending higher:

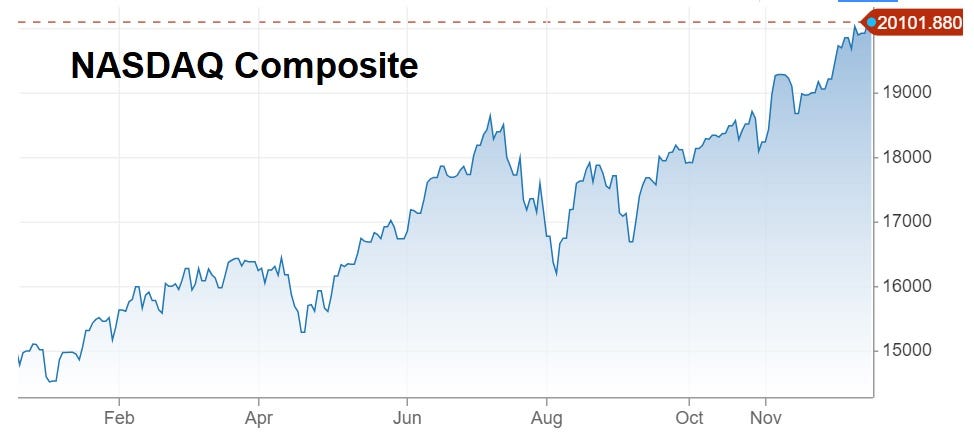

Equities are rocking:

The quantum computing bubble is taking over as AI falters:

Quantum Surge! Mind-Blowing Growth Stuns Investors

(Jomfruland) – Quantum Stocks Soar: The quantum computing sector witnessed a thrilling upswing at the start of the trading week, igniting excitement among investors. The burgeoning interest in quantum technology pushed Quantum Computing’s (NASDAQ:QUBT) stock skyward, with shares skyrocketing 25% by late morning on Monday. This impressive leap is part of a staggering 250% increase over the past month.

Rising Enthusiasm: Despite the fact that commercial applications for quantum computing are still on the horizon, investor confidence continues to build. The potential of quantum technology to disrupt multiple industries, from cybersecurity to pharmaceuticals, has captivated market watchers.

Market Movement: Alongside Quantum Computing, other players in the sector, like D-Wave Quantum (NYSE:QBTS), are also riding this wave of positivity. As anticipation grows, companies in the quantum computing space are being closely watched by analysts and investors alike.

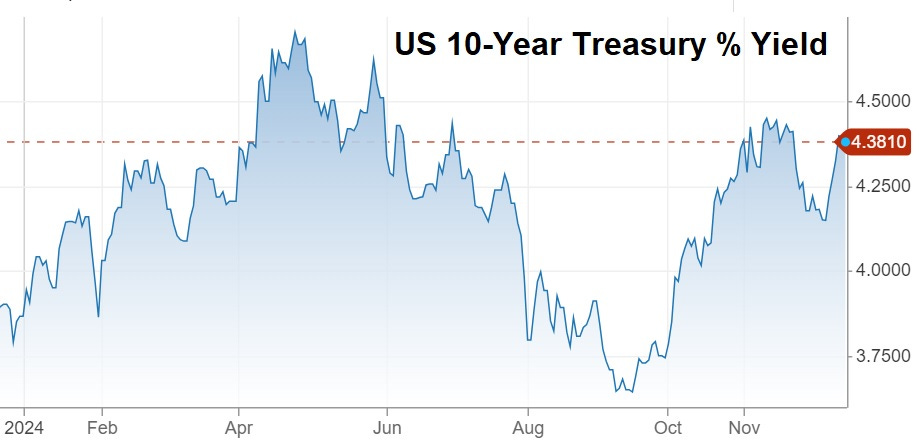

Long-term interest rates are rising again:

Shouldn’t the Fed Be Tightening Here?

This is the kind of environment where central banks normally start tightening — hard. That, however, is impossible in today’s over-leveraged casino.

But forgoing future rate cuts is possible, and today it became probable. So we’re back to “higher for longer until something breaks.”

The question then becomes “What breaks first?” And the answer, as it has been for a while is “Any number of things.” Commercial real estate, consumer spending, government interest costs, overvalued equities, and soaring credit card debt are all primed for trouble, and the sequence in which they blow up hardly matters at this point.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino December 17th, 2024

Posted In: John Rubino Substack

Next: Balance Sheet Repair Takes Years »