December 19, 2024 | And This Is BEFORE the Coming Recession

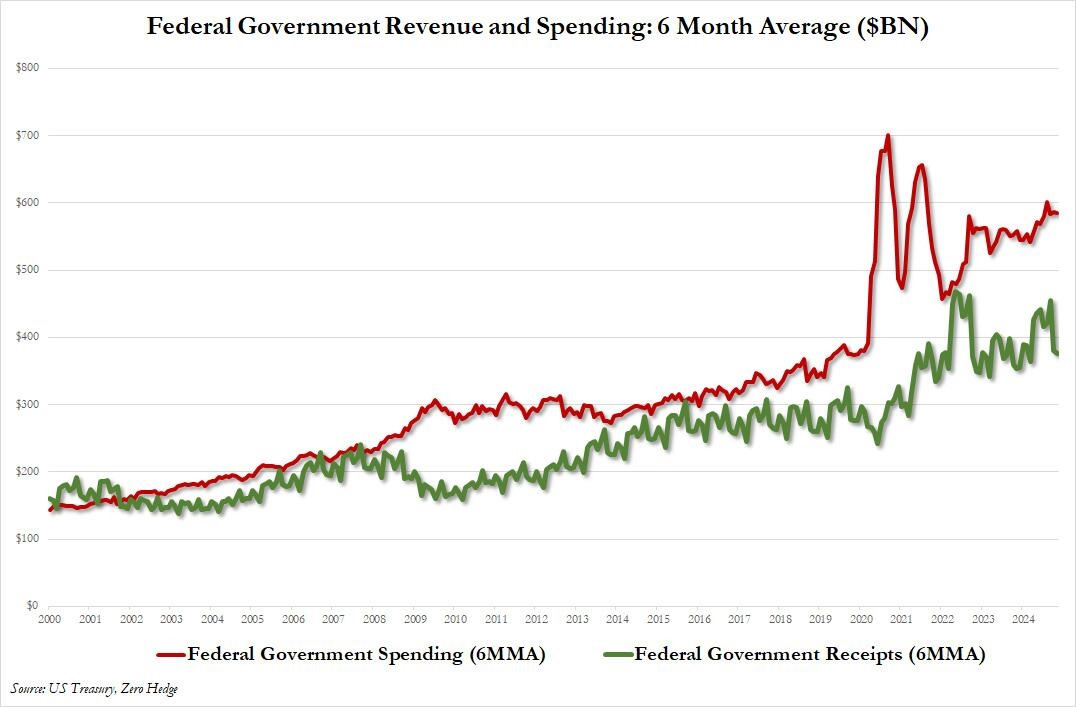

Government finances usually look their best at cyclical peaks when lots of people are working and paying taxes, relatively few are drawing unemployment benefits or welfare, and financial asset prices are way up, thus generating lots of capital gains tax revenue. If a government is ever going to balance its budget, that’s when it happens.

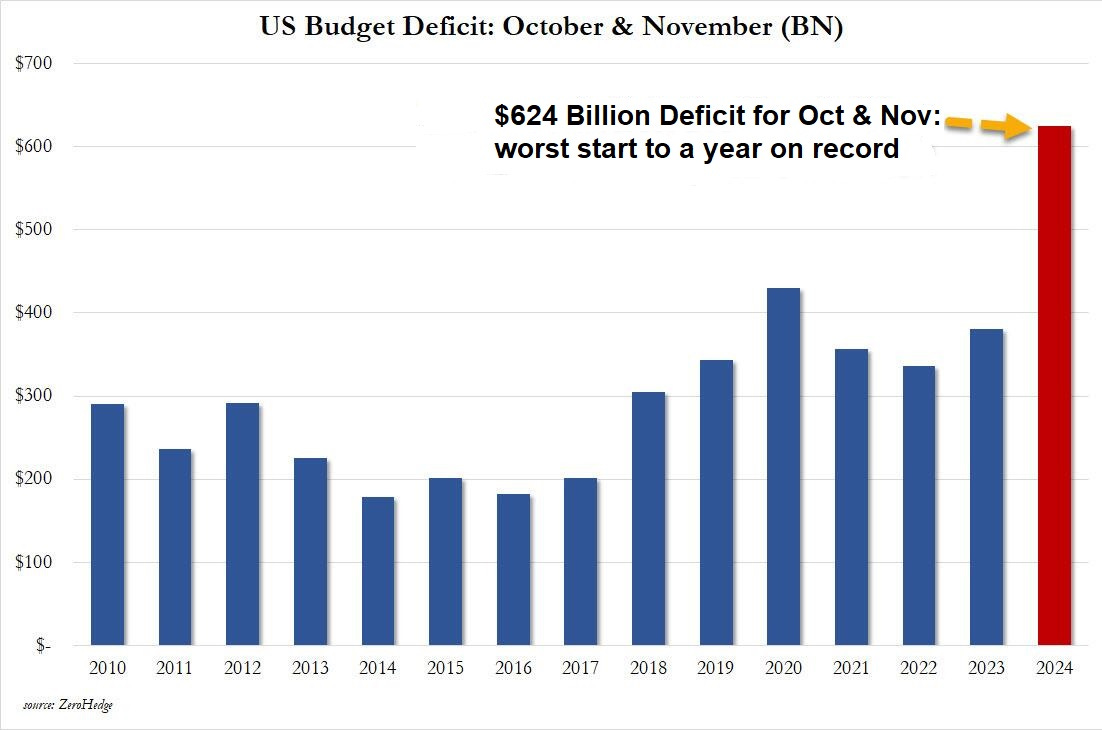

Yet here we are, fifteen years into an expansion and equities bull market, and the gap between US government revenues and spending is exploding (note that Washington’s fiscal year starts in October):

It seems that the outgoing administration and Congress are making the most of their last few months of being able to create money out of thin air, probably in the hopes of impressing the corporations and lobbying firms they hope to work for next. Note the current battle over the absolutely surreal stopgap spending bill that Congress just tried to sneak past the incoming administration.

But It’s Structural Now

The last few months’ deficit spending was about corruption, pure and simple. But the longer-term trends are about demographics. With baby boomers retiring en masse and drawing Social Security and Medicare, higher spending is baked into the actuarial cake. In other words, the US deficit is now structural rather than cyclical.

What Comes Next

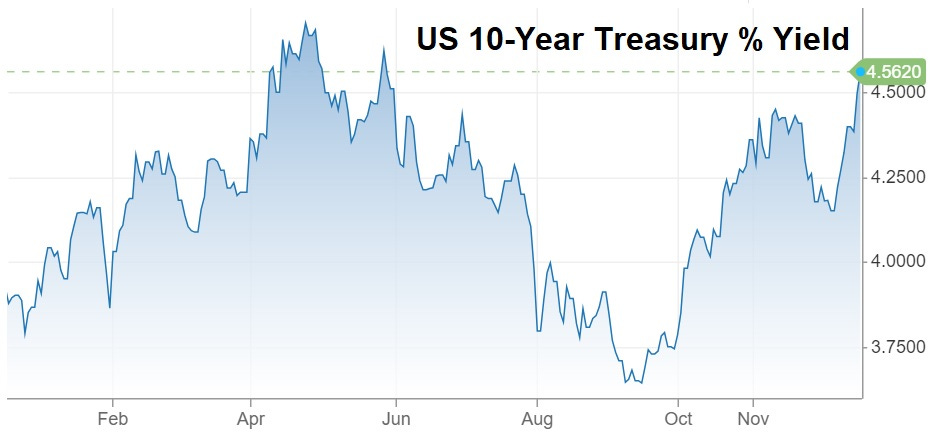

The bond market responded to yesterday’s Fed rate cut by spiking the 10-year Treasury note yield, which implies (or more accurately, “screams”) that markets no longer trust the government to manage inflation:

Higher interest rates will produce the long-overdue recession, during which several things will happen:

- Workers will lose their jobs, stop paying taxes, and start collecting benefits.

- Stock prices will either correct or crash, depending on the way the recession plays out, cutting capital gains tax revenue and increasing capital gains losses.

- Governments at every level will step in with emergency bailouts, all borrowed, of course.

The result: Today’s already catastrophically high deficits will double, interest expense will spike, and the world will begin to question not just the year-ahead GDP growth rate but the validity of the whole fiat currency/fractional reserve banking system.

For more background, see:

Are We Back to “Higher For Longer”?

Crash Alert: Priced for Perfection in an Imperfect World

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino December 19th, 2024

Posted In: John Rubino Substack

Next: TM: Bubbles End Badly »