November 2, 2024 | Trading Desk Notes for November 2, 2024

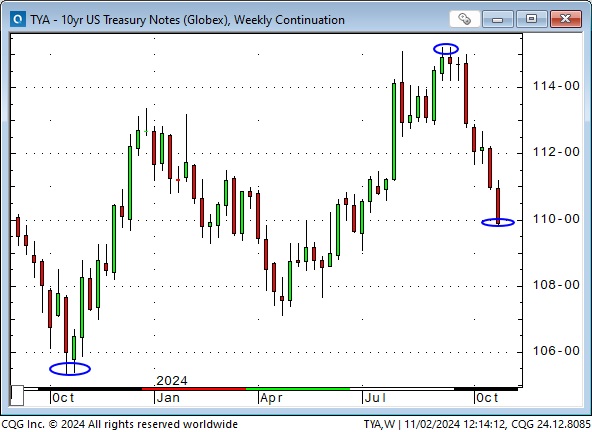

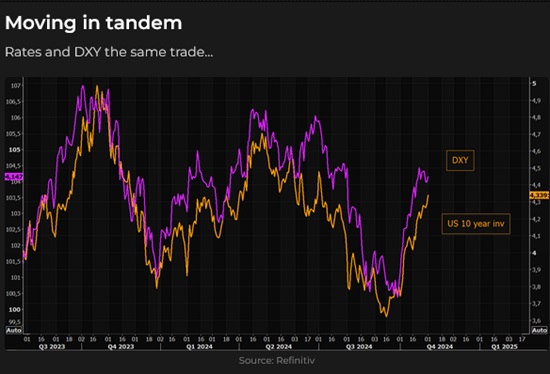

Bond yields have risen sharply since the Fed cut short rates on September 18.

When the Fed cut rates in September, the 10-year yield was ~3.6%, an 18-month low. It was ~80 bps higher at 4.4% at Friday’s close. In October 2023, the yield was ~5%, a 16-year high.

In this daily chart of the 10-year Treasury futures, the blue ellipse is Fed cut day; the pink ellipse is the day employment data was much, much stronger than expected, and the green ellipse is Friday’s much, much weaker than expected employment day. Note that the market initially rallied on Friday’s weak employment report but then reversed hard and closed the week right on the lows. Yikes!

The short rates market has a similar bearish chart pattern. Since the September 18 Fed cut, the June 2025 SOFR futures (which trade at a discount to par) have re-priced ~80 bps lower. Like the long end, prices initially rallied on Friday’s weak employment report but then reversed hard and closed on the lows.

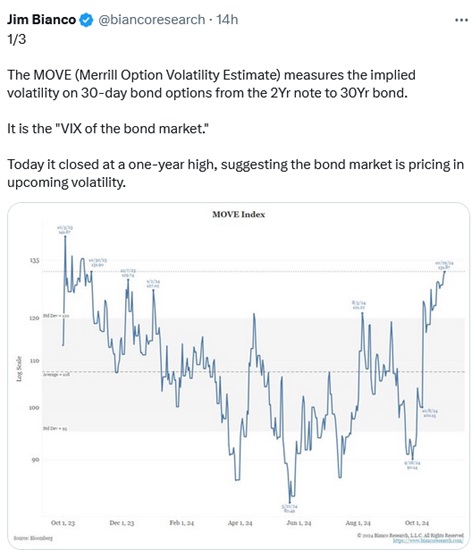

Last week, I noted that rising “term premiums” drove bond yields higher as investors demanded a greater return for the risk of holding bonds for an extended time. Bond market volatility (as measured by the MOVE index) has also risen sharply and is approaching October 2023 levels, when bond yields hit a 16-year high of ~5%.

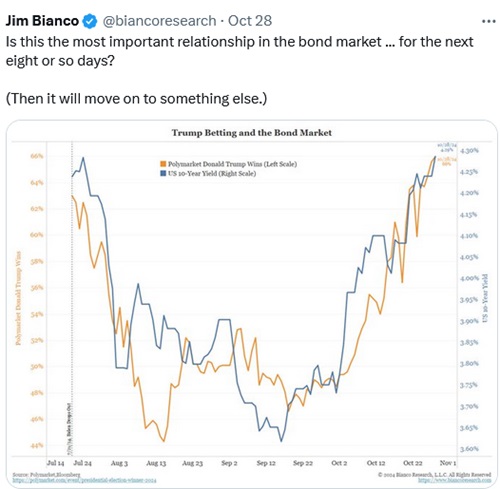

Jim Bianco also notes that bond yields have risen since mid-September in virtual lock-step with increasing odds that Trump will win the election next week.

Sharply rising US interest rates have likely been a significant factor in the recent stock market decline.

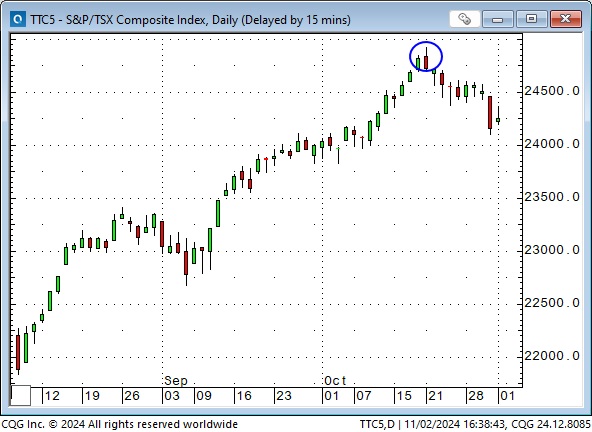

The S&P, the DJIA, and the TSE indices hit record highs in mid-September but have closed lower in the past two weeks. De-risking ahead of next week’s election likely also contributed to the decline.

The DJIA rallied over 10,000 points (~32%) from October 2023 lows to October 2024 highs, with about half of those gains occurring from June to October 2024. (The S&P rose ~43%, and the TSE ~32% YoY.)

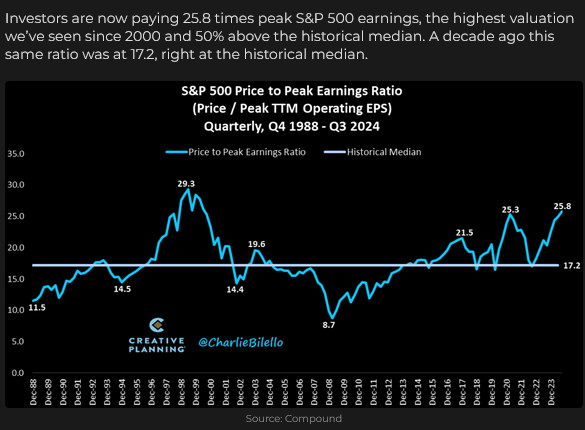

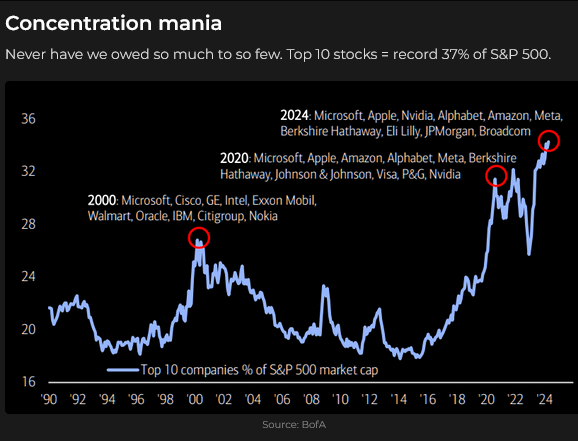

Equity market bulls are paying a historically high premium for corporate earnings growth.

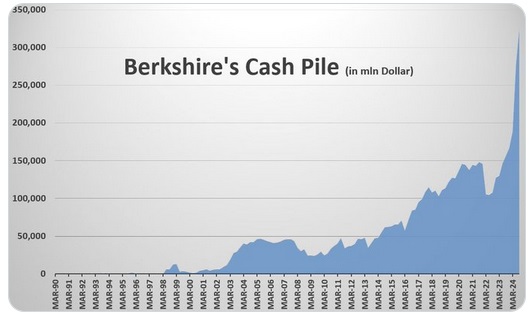

Warren Buffett, the granddaddy of value investing, has been a big seller of stocks (~$100B worth of AAPL in the last six months) as the indices rose to record highs. (He now sits on a record high of ~$325 billion in cash.)

Currencies

Sharply rising US interest rates have contributed to the ~4% rise in the US Dollar index over the last four weeks.

The Canadian dollar has fallen nearly 3 cents (4%) against the US dollar since late September. The premium of short-term US interest rates over Canadian rates has increased from ~70 bps (in late September) to ~1.07 bps on Friday, a 24+ year record. The CAD has closed lower for five consecutive weeks and closed at a 4.5-year low this week.

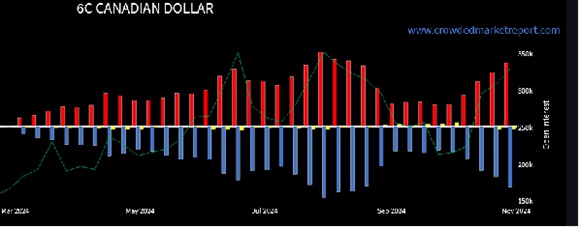

Speculators in the currency futures market have aggressively increased their net short position against the CAD over the last four weeks as open interest increased by ~60%. In this chart from Crowded Market Reports.com, the net long commercial position (in red) is ~175,000 contracts as of October 29, offsetting the combined net short position of large (blue) and small (yellow) speculators. 175,000 contracts equals ~US$12.5 billion. The record net speculative short position was on July 30 at ~204,000 contracts (~US$15 billion), just a few days before the August low in the chart above.

This CMR chart shows that speculators reduced their net short position from ~204,000 contracts at the end of July to ~60,000 contracts at the end of September as the CAD rallied from ~7200 to an 8-month high of ~7450. Over the next four weeks, speculators ramped up their net short position from ~60,000 contracts to ~175,000 contracts as the CAD plunged from ~7450 to ~7180.

I highly recommend Crowded Market Reports for traders who want an excellent source of COT data in an easy-to-use format.

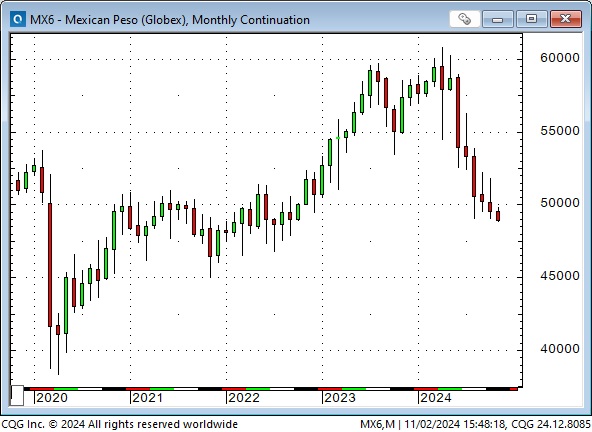

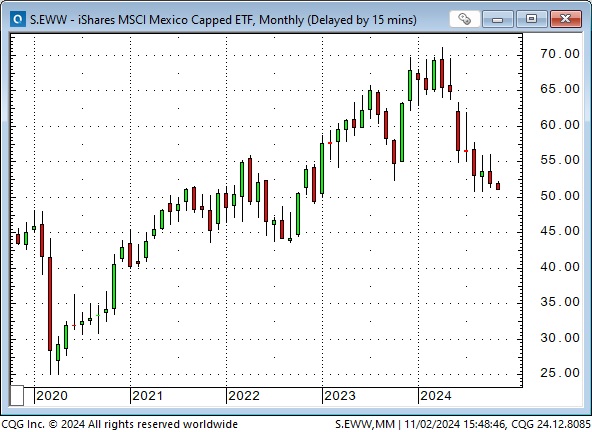

The Mexican Peso was the “strongest currency in the world” early this year as 11%+ short-term interest rates were a magnet for capital, especially for the carry-trade guys who borrowed Yen and invested in Pesos. Mexican rates are still high, but the Peso is down ~12% from its highs and the “Mexico ETF” is off ~28% as capital worried about the new government under President Claudia Sheinbaum.

Gold

December Comex gold traded to a record high above $2,800 this week but dropped ~$60 on Thursday in sync with the stock market drop. Rising gold prices have been “divorced” from rising USD and interest rates. A loss of confidence in governments (fiscal irresponsibility) and momentum (animal spirits) are likely the key drivers of the gold price. Gold closed on Friday near its lows for the week and below last Friday’s close. Upside momentum is fading.

Energy

WTI gapped ~4$ lower on Monday following the “measured” Israeli retaliation against Iran last weekend but bounced back ~$5 by mid-week.

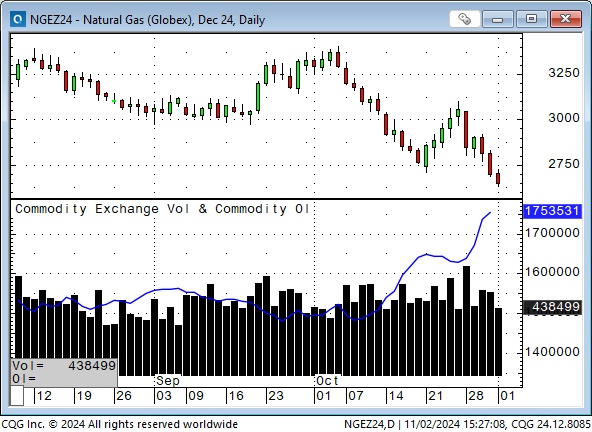

Natgas prices trended lower for most of October as open interest (blue line on the chart) soared to record highs, and net short speculative positioning soared to 18-month highs.

Cameco shares soared to record highs near $59 in mid-October as the market loved the “data centers will need tonnes of uranium” story. The share price has backed off ~12% from the highs and is now up ~20% YTD.

Thoughts on trading

The leading stock indices were all down this week despite corporate buybacks, strong seasonality, and, in some people’s minds, TINA. The S&P, NAZ and DJIA closed red for October. Interest rates soared, and the market seemed to fade the chances of a “Red sweep.” Close to 40% of the S&P market cap reported this week, including a handful of big-cap tech stocks, and on balance, that weighed on prices. Month-end rebalancing saw net selling.

The election winner may not be officially known by Wednesday, but the market will likely be making an early bet on who will be President and what Congress will look like.

The Fed meets on Wednesday/Thursday, and the market sees a nearly 100% chance of a 25 bps cut followed by an 80% chance of another 25 bps in December.

In the last couple of TD Notes, I’ve written that the market (and likely military and government people in the Middle East and beyond) realized that Iran and its proxies were “no match” for Israel militarily (especially Israel backed by the USA), which meant lower, not higher geopolitical stress in the Middle East. That idea showed up in crude oil on Monday (it gapped down $4) but not in gold, which left me wondering about “what” is driving gold higher (obviously not geopolitical stress.) I think the gold rally is fuelled by a loss of confidence in government (irresponsible fiscal policies) and by momentum, and momentum is at risk of a correction. (Highly levered speculators hold a net long position on the Comex valued at ~$80 billion.)

I think the spike in interest rates is overdone and due for a correction. See this article, “Can Paul Tudor Jones and Stanley Druckenmilleer Be Wrong?”

If interest rates fall, that could lead to a correction in the USD. If the USD corrects, any significant unwinding of the massive short position in the CAD could goose a CAD rally similar to August.

I think the TSE made its high for the year on October 21.

The news flow from Europe is unrelentingly bearish, and large speculators are now the most net short the Euro they have been in over four years. Remember, the Euro is the Anti-dollar.

My short-term trading

After being away on trips during the first three weeks of October, I started trading cautiously last week and began this week with a short position in the S&P. I covered that for a tiny loss on Sunday afternoon (October 27), thinking it was wrong to be short with geopolitical risk down and the odds of a Trump win rising.

I shorted the S&P on Wednesday and covered for a gain of 40 points when it fell sharply on Thursday. Later on Thursday, I bought the S&P, looking for a bounce but covered for another tiny loss. I shorted the S&P on Friday after it fell back from 5800 resistance and held that into the weekend.

I shorted gold on Sunday, expecting it to fall on reduced geopolitical risk (and a momentum breakdown), but I was stopped for a tiny loss on Monday. I shorted gold again on Wednesday and covered for a gain of $35 per oz on Thursday.

I bought the Euro on Sunday when it rallied on news that Volkswagen would be closing three plants and laying off thousands of workers. (Buy a market that has fallen 4% in a month and then rallies on bad news.) I was stopped for a tiny loss on Monday.

I bought the Euro again on Tuesday and sold it for a gain of 55 points on Thursday.

I shorted OTM T-Note puts on Tuesday and covered them at breakeven on Wednesday. On Thursday, I reshorted the puts at much better prices and held that position into the weekend. (I’m selling puts with bonds sharply lower and VOL at 12-month highs. I’m looking for a bounce.)

I had a decent realized P+L gain on the week, and it felt good to be back trading again! I’m anticipating some dramatic moves next week, likely reversals of the October trends.

The Barney report

Barney and I were out on the abandoned railroad tracks for his midday run today. That boy loves to find a good stick, chew on it and then run with it!

Listen to Victor and Mike Campbell talk about markets.

On this morning’s Moneytalks show, Mike and I discussed the impact of the recent sharp rise in US interest rates on bonds, stocks, and currencies, especially the Canadian dollar and gold. You can listen to the show here. Don’t miss Mike’s interview with Tony Greer, which starts at around the 7-minute mark. My spot with Mike starts around the 1-hour, 4-minute mark.

The Archive

Readers can access weekly Trading Desk Notes from the past seven years by clicking the Good Old Stuff-Archive button on the right side of this page.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new, usually four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair November 2nd, 2024

Posted In: Victor Adair Blog

Next: One-Way Road to Crisis »