November 16, 2024 | Trading Desk Notes for November 16, 2024

Stock indices, interest rates, and the USD rose sharply last week following Trump’s victory. This week, stock indices fell, interest rates rose, and the USD soared to 12-month highs.

NAZ futures hit record highs during the Sunday overnight session, up ~6.5% from election-day (circled) lows, but gave back ~63% of those gains by Friday’s close.

SOXX rallied on the election but closed red the last six days.

S&P futures also hit record highs during the Sunday overnight session, up ~5.5% from the election day lows, but gave back ~25% of those gains by Friday’s close.

The S&P futures trade nearly continuously (23 hours a day) from Sunday to Friday afternoon. I closely monitor them for trading because they are an excellent overall risk barometer. However, I also monitor the cash S+P index (which trades only 6.5 hours a day) because that is “the market” for most of the investment world. There have been many gaps (between one day’s close and the next day’s opening) on the cash S&P chart over the last two weeks. Gaps indicate a rapid “rate of change” in market sentiment.

The XLF (Financial sector ETF) sustained its post-election rally to record highs.

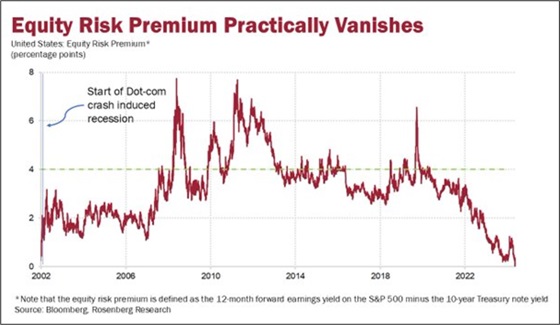

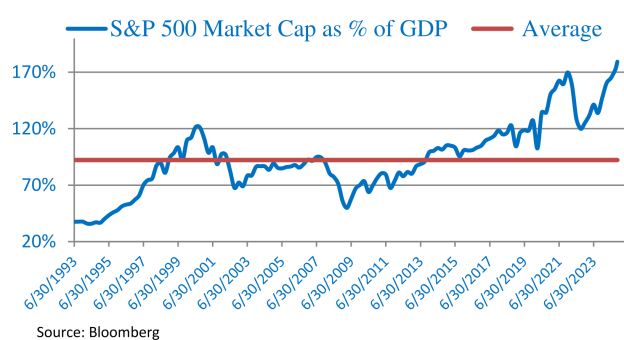

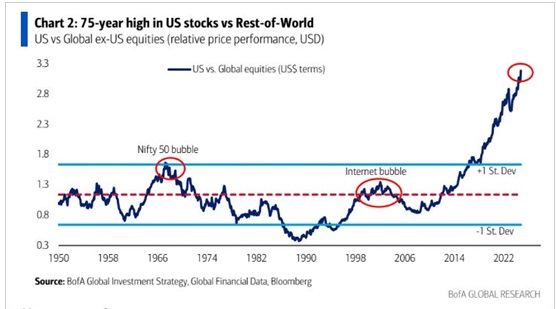

US equities are trading historically “rich” on many traditional valuation metrics.

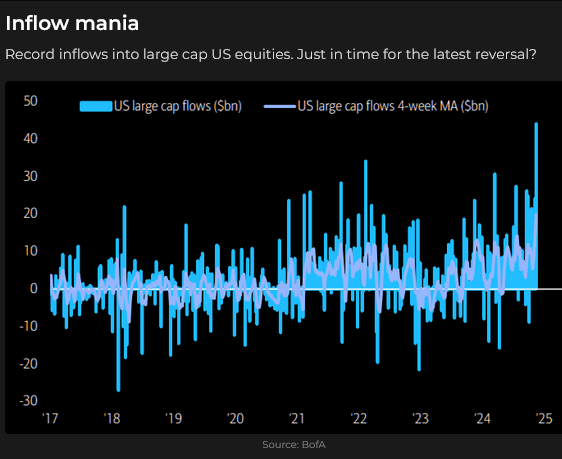

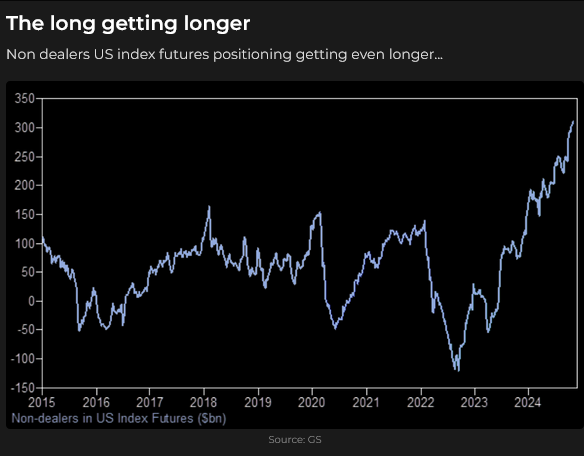

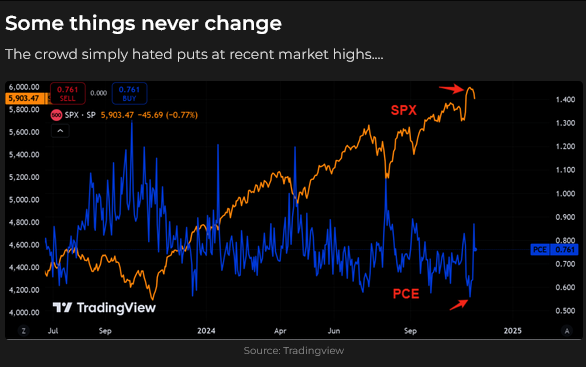

Bullish positioning is historically extreme.

The American stock market is outperforming the rest of the world.

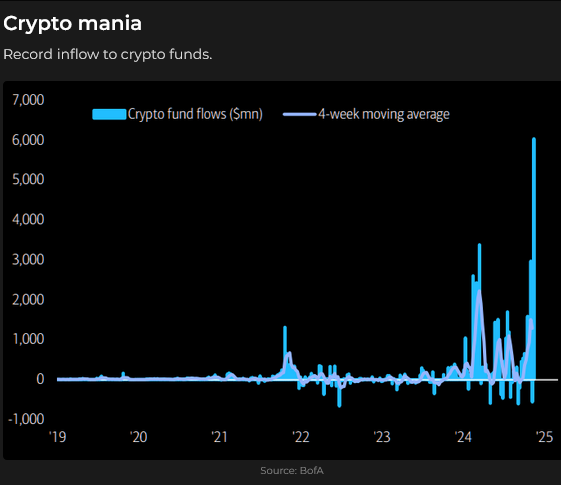

Crypto markets are surging to record highs, which signals aggressive risk sentiment.

Interest rates

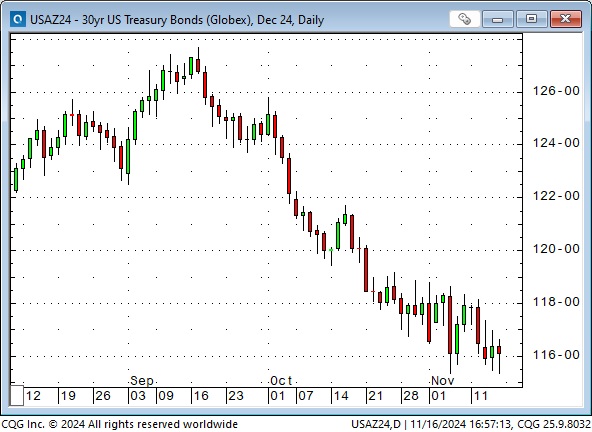

The 10-year Treasury yield hit a four-month high of ~4.4% on Friday on concerns that Trump’s aggressive fiscal plans may increase debt and deficits (despite the best efforts of Musk and Ramaswamy). The yield was ~3.62% in mid-September.

Powell hinted that it might “take a while” to lower inflation, and there was no need for the Fed to hurry rate cuts. The FOMC meets on December 17/18 and again on January 28/29. The market is now pricing 3-month SOFR rates ~110 bps higher than mid-September when the Fed initiated a rate-cutting cycle with a 50 bps cut.

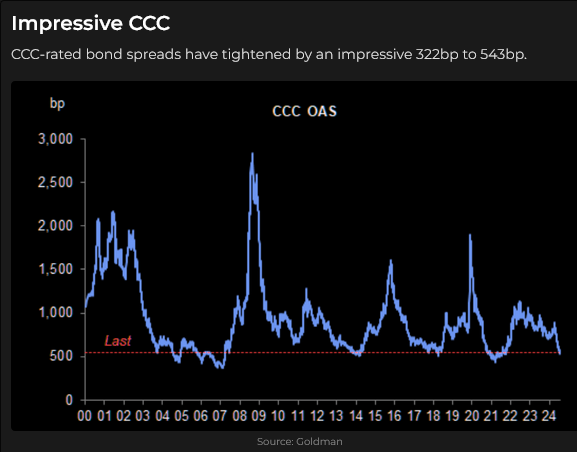

Credit spreads are historically tight.

Currencies

The US Dollar Index traded down early on election day but reversed sharply higher late in the day on indications of a looming Trump victory. The surge continued this week, with the USDX hitting a 1-year high.

The USDX has rallied ~7% since late September as 1) the market perceives that American monetary policy will be tighter than other countries and 2) American exceptionalism in equity markets, innovation, opportunity, and safety will be sustained, which means that capital will continue to flow to America.

The “Trend Is Your Friend” in the currency markets, but the USDX’s upswing of 6.5% in six weeks is extreme.

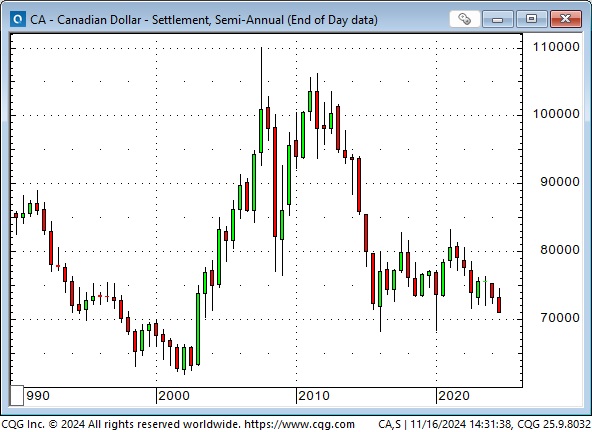

The Canadian Dollar tumbled ~3.5 cents (~5%) from late September to Friday’s four-and-a-half-year low.

Outside of spike lows in 2016 and 2020, the CAD is at a 20-year low; it now takes C$1.41 to buy US$1.00.

US interest rates across the curve are at multi-decade premiums (~110 bps) over Canadian rates. Speculators in the currency futures market hold a near-record massive net short position against the CAD. With ~78% of Canadian exports going to the USA, Canada may be at risk of Trump tariffs.

Metals

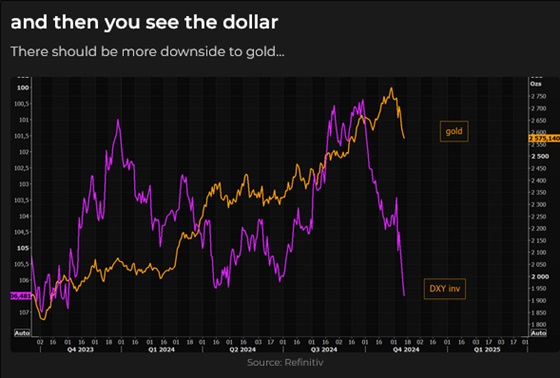

Comex December gold futures hit a record high of ~$US 2,802 at the end of October, then fell ~$260 (9%) to this week’s low (the worst week in three years) as higher interest rates and a surging US Dollar took a toll on gold.

This chart is courtesy of Martin Murenbeeld’s GOLD MONITOR. Click here for a free trial of Martin’s excellent weekly gold report.

Highly leveraged futures speculators recently held their largest net long gold position in four years, but (as of November 12) they have reduced their position by ~15% since the end of October. Open interest has fallen ~11% since the end of October.

The GDX (gold shares ETF) hit a four-year high in mid-September and turned lower about ten days before the bullion price. This week’s close was down ~20% from the October highs.

Comex copper futures hit record highs of ~$5.20 in May as speculators enthusiastically embraced the “electrification of everything” narrative. Two months later, the price was down ~20%, and open interest had dropped by a third. Copper rallied into late September but has fallen (as the US Dollar has risen) back to the “pivot level” of ~$4.00.

Energy

Front-month Nymex WTI futures closed at ~$67 this week, their lowest weekly close in 18 months, as analysts continued to reduce estimates of total demand growth for 2024 and 2025.

Interestingly, the XLE (Energy Select Sector ETF) rallied to six-month highs after someone in Washington was heard saying, “Drill, baby, drill.”

Thoughts on trading

The election: It feels like Nixon’s “silent majority” gave Trump a mandate to make significant changes; now, the market has to figure out what Trump will try to do and his chances of succeeding. Here’s a link to an excellent piece by my favourite political analyst, Greg Vallerie, on what the voters want. It’s a three-minute read.

The GOP have a majority in the house and the senate – but will all of the Republicans back Trump 100%?

Inflation: Regular readers know that I don’t expect inflation to get back down to where central bankers would like to see it (without, as Martin Murenbeeld says, a recession.)

My rational is that continuing government deficit spending will reduce the purchasing power of currencies and that is the essence of inflation. Additionally, people will try (go on strike) to earn more money (wage inflation) to “keep up” with rising prices. In Canada we have (essential) railroad and port workers who wanted to strike being forced back to work by the government. Postal workers are striking. Air Canada employees are threatening strike action. I expect more people will go on strike because they know the prices of things they need/want to buy have gone up more than the CPI.

The 400 million dollar man: A young man on Vancouver Island starts trading TSLA shares and options with ~$88,000. Within a few years his account is up over $400 million, but then he loses it all and sues his broker.

My short-term trading

I started this week with only one position held over from last week, a T-Note strangle (short puts and calls.) I had sold short-dated OTM puts ahead of the election because 1) I thought the Notes had fallen too far too fast and 2) the implied volatility on the options had soared to the highest level in a year. Following the election, VOL collapsed and, despite Note prices falling my puts were making money. The Notes rallied a bit late in the week and I sold OTM calls to hedge my risks. Theta (time decay) was always working in my favor. I covered the strangle for a decent profit early this week.

I shorted the S&P on Monday, Tuesday, Wednesday and Thursday as the market fell away from Monday’s record highs. The Monday to Wednesday trades resulted in a small net gain, but I covered the Thursday shorts on Friday for a good profit.

I bought the S&P as it came off Friday’s lows and held that position into the weekend.

I bought gold on Thursday as it came off its lows and held that trade into the weekend.

I shorted short-dated bond puts on Friday as the market started to bounce back from 5-month lows. Click here for a great 5-minute read written by my friend Lance Roberts about why he disagrees with Paul Tudor Jones and likes the US bond market at these levels.

The Barney report

My cell phone was broken yesterday ( a lot of cars drove over it!) so the latest pictures of Barney are “unavailable!” Here’s one of my favourite Barney photos taken by my wife earlier this year. He is a handsome boy!

Listen to Mike Campbell and I talk about markets on the Moneytalks show

This morning Mike and I talked about the tumbling Canadian dollar, crude oil and gold. You can listen to the entire show here – don’t miss my friend Lance Roberts. My 8 minute spot with Mike starts around the 1-hour mark.

The Archive

Readers can access weekly Trading Desk Notes from the past seven years by clicking the Good Old Stuff-Archive button on the right side of this page.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new, usually four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair November 16th, 2024

Posted In: Victor Adair Blog

Next: The King of Bullshit Money »