November 1, 2024 | The Great Mortgage Reset in Canada will Hit Hard

Canadian policy makers are worried about potential weakness in the economy due to higher interest rates. One of the biggest challenges facing Canadians is the increase in monthly payments that comes with higher rates.

Although there have been four Bank of Canada rate cuts this year, mortgage rates have not come down as much as policy rates. Mortgage rates move with 5-year government bond yields, not the BOC rate.

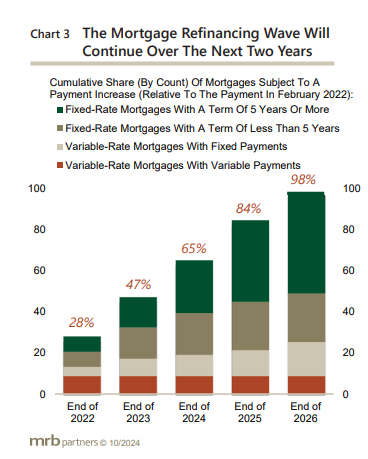

MRB Partners issued a report last week that highlighted household indebtedness in Canada and the number of mortgage loans that will be refinanced at higher rates in the next two years.

The problem is large and will not just go away with time.

This debt problem has been growing for decades, and governments — both Liberal and Conservative — haven’t dealt with it. Lenders kept lending and house prices kept rising. Consumer buying has held up, but that consumption was kept at an elevated level at the expense of savings (paying down debt) and investing for retirement.

Without this consumer spending, economic growth would have been much weaker.

This is a structural problem with the Canadian household sector, which I highlighted in the 2015 and 2018 editions of my book, “When the Bubble Bursts: Surviving the Canadian Real Estate Crash”.

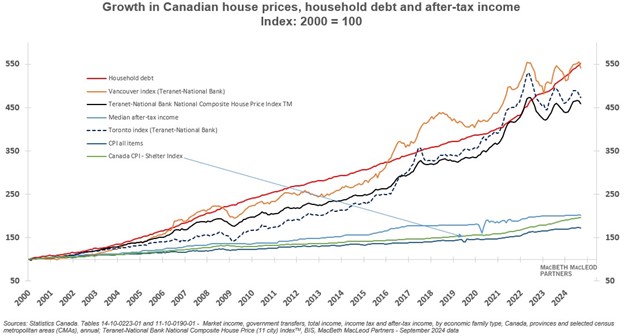

For years we have tracked house prices against debt and after-tax income as well as inflation, and there’s been no letup in the growth of debt. Since 2000 household debt has been growing about twice as fast as CPI inflation. Recently, starting in 2021, the rate of growth of debt increased further as shown by the steepening of the red line.

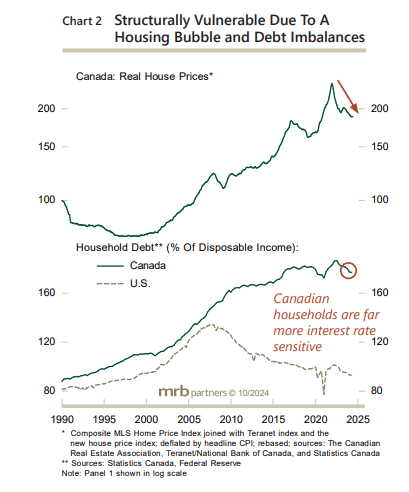

MRB shows how much more indebted Canadian households are compared to Americans:

The interest rate reset will hit Canadians much harder than Americans for two reasons. First, Canadians face a new interest rate much more frequently as they have variable rates or fixed rate terms, but almost all mortgages reset within five years. See the first chart above. Americans get 30-year mortgage rates which insulate them from rate increases and many of them refinanced when rates were low.

And second, as the lower panel shows, Canadians are much more highly indebted than Americans at about 180 percent of disposable income versus less than 100 percent for Americans.

The Bank of Canada, regulators and other policy makers are well aware of this problem, but there is little that they can do in the short term.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Hilliard MacBeth November 1st, 2024

Posted In: Hilliard's Weekend Notebook