November 4, 2024 | Pigs at the Trough

Happy Monday Morning!

We do our best to steer clear of politics in this newsletter. However, housing is political. Housing is impacted by all levels of government, from the federal government at the top, the provincial government in the middle, and all the way down to your municipal council member.

Our housing crisis is largely self-inflicted, with all three levels of government pointing the finger at each other. You can debate which one is more at fault, but what we can all agree is that housing has been the golden goose of tax revenues. It’s been a multi-decade long housing bull market, so like pigs at the trough we’ve all been getting fat off it. Higher house prices, higher tax revenues, higher fees, all to feed the machine. It has reached a point where the entire system is breaking down.

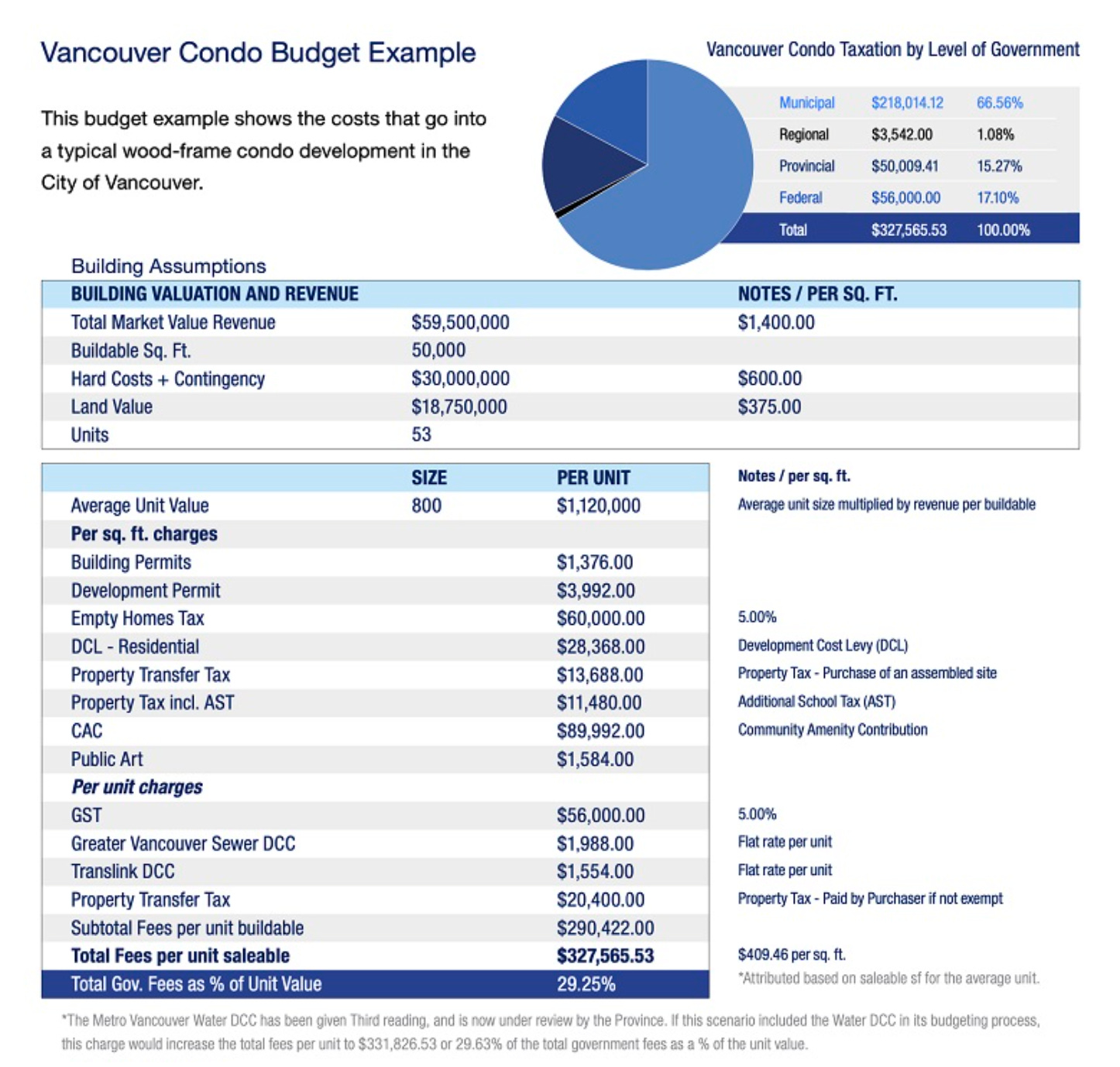

Government fees and taxes now account for 30% of the cost of a new home in places like Vancouver & Toronto.

The scary part is this analysis is from 2023, the fees have only increased since.

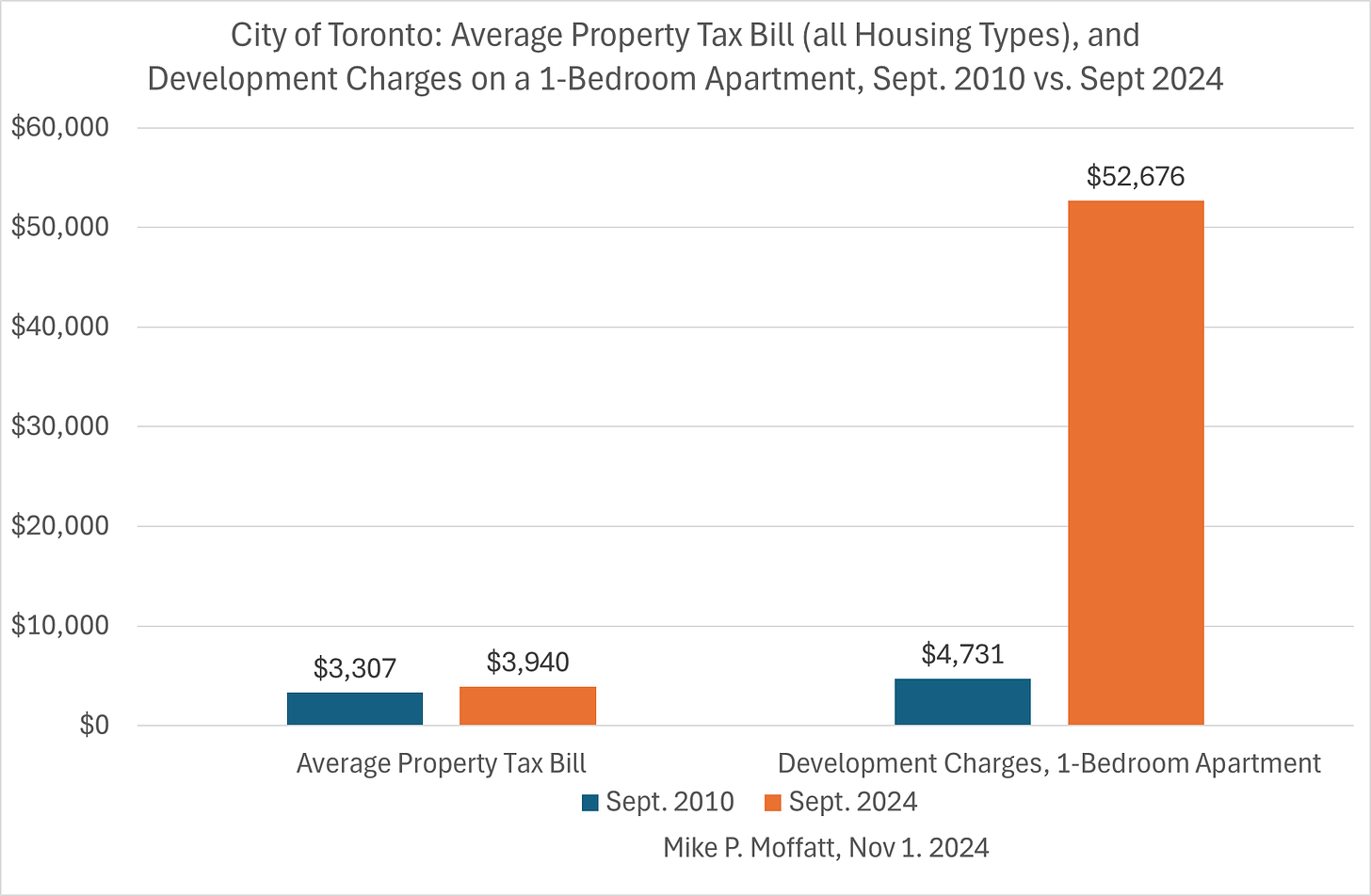

In Toronto, development charges for single-detached homes have increased from $12,910 in 2010 to $141,139 in 2024 — a whopping 993% hike.

Development charges on a 1 bedroom condo have gone from $3940 in 2010 to $52,676 in 2024. What the hell happened? Governments shifted the tax burden away from existing property owners (property taxes) and hid them where the average voter wouldn’t notice (development charges).

It’s no wonder the cost of new housing has inflated to such incredible heights, rendering new home prices uneconomical and uncompetitive when compared to the resale market. This is a huge reason why pre-sales have fallen off a cliff over the past year. Quite simply, new house prices make no sense today. The market isn’t interested in paying a 10-20% premium above resale, so developers who have little fat left to trim, are simply closing up shop.

You need to make new housing more competitive, hence the recent announcement from the federal conservative government to remove GST on all new homes under $1M. This immediately reduces the cost of a new home by 5%. It’s so straight foward even Liberal housing pundits are getting on board.

In order to pay for the removal of GST, the conservatives say they will kill the recently created housing accelerator fund. A program we warned back in June was well intentioned but proving to be nothing more than a heist of tax dollars.

Here’s a quick recap on the $4B housing accelerator slush fund.

- Municipalities apply for funding from the $4 billion federal fund in exchange for implementing measures to boost housing supply faster than historical averages.

- Eligible initiatives include increasing densification, speeding up approval times, tackling NIMBYism, establishing inclusionary zoning, encouraging transit-oriented development, and investing in e-permitting systems.

- Funding is flexible and can support capacity increases, land purchases, infrastructure upgrades, policy changes like inclusionary zoning, etc.

- Cities receive 25% of funds upfront upon signing the deal, and the remaining 75% in installments tied to achieving milestones over 4 years until 2026-27.

It all made sense on paper, but in the real world, politics took over.

In December 2023, the City of Toronto announced that it would receive $471 million in funding from the program.

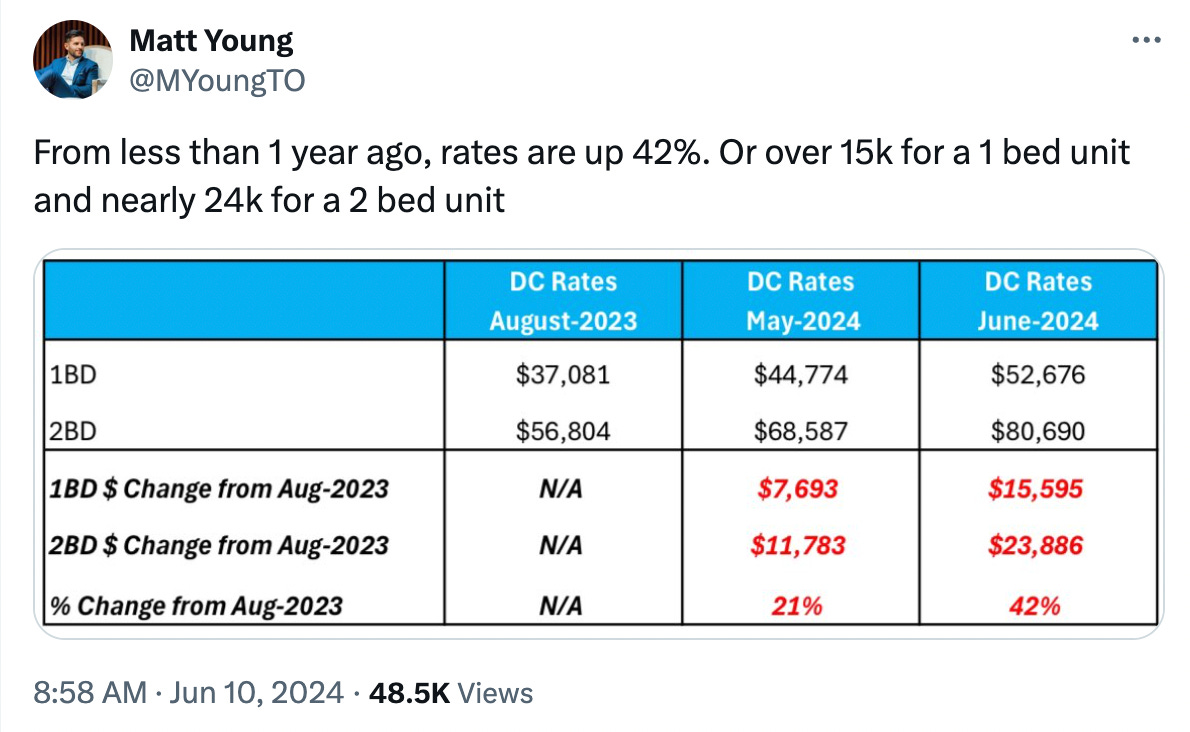

On May 1, development charges on Toronto condos increased 20.7%, adding millions to the cost of a new development.

Just one month later, on June 06, the city of Toronto announced Bill 185, Cutting Red Tape to Build More Homes Act. The bill to cut red tape came with another increase in fees!

The cutting the red tape bill increased development fees by a whopping 42%. Development fees for a one bedroom condo in Toronto jumped to $52,676, and $80,690 for a two bedroom.

But wait, there’s more.

The city of Burnaby, whom was recently approved for $43M of “housing accelerator” dollars also pulled a similar bait and switch. Once approved they jacked their development fees for high density by nearly $50k per unit.

Like we said, a well intentioned program that proved to be nothing more than a heist of tax dollars.

So now we’re cutting from the top. No 5% GST.

It’s true cutting the GST won’t fix housing, there is no silver bullet. But it will make new housing slightly less expensive, while rendering some projects to become, once again, economically viable. That’s an important feat when you realize how dependent all three levels of government have become on housing, and that housing starts, and the revenues that come with it are in the process of falling off a cliff.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky November 4th, 2024

Posted In: Steve Saretsky Blog