November 19, 2024 | Euphoria Bounces Back

Since stock markets hit a two-year low last October, prices reflated on bets that artificial intelligence and central bank easing could solve spreading insolvency. Then came this month’s Republican sweep in the US election, and the crowd ordered another round.

Risky assets went parabolic before selling off last week—the S&P 500 and Canada’s TSX remain 3.3% and 4% higher than on October 31.

Rising security prices have further loosened financial conditions for publicly traded companies, and US Fed members have talked down easing expectations once more.

The trouble is that Treasury yields set fixed-term interest rates in the economy, and those have risen. Debt-carrying costs and elevated housing expenses—shelter accounting for about a third of Canada and America’s overall Consumer Price Indexes—continue to exert elevated strain on the masses.

As the Bank of Canada delivered 125 basis points of rate cuts since July, the Loonie has tumbled along for the ride, further inflating the cost of goods for Canadians.

The three other periods in the last 25 years when central banks have lowered policy rates in 50 basis point+ increments were during major financial dislocations: 2001, 2008 and 2020. In all three incidents, the backup in Treasury yields proved short-lived before safety-seeking flows accelerated into government bonds and caused their yields to fall.

With half of Canadian mortgages renewing in 2025, rate relief can’t come fast enough. Mortgage rates have historically bottomed with Treasury yields many months and quarters after the first Fed cut.

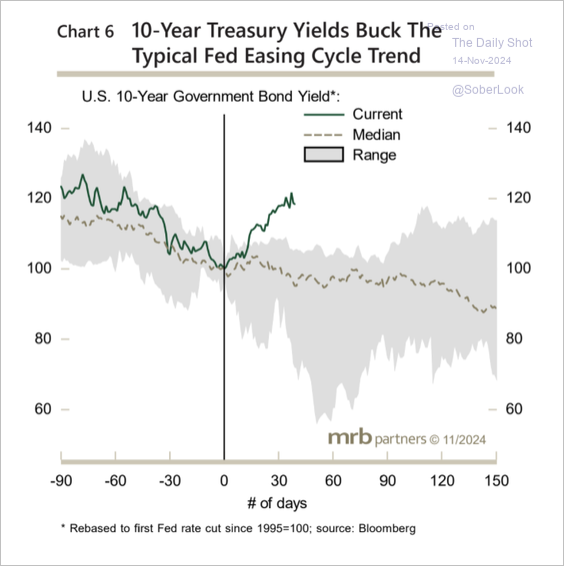

The recent jump in the US 10-year yield since the Fed’s first rate cut (green line below courtesy of MRB Partners and The Daily Shot) stands out as far above the median (dotted line) and range (grey shading) since 1995.

Since 1969, recessions have begun shortly after the first Fed cut, and the stock market did not bottom until months later.

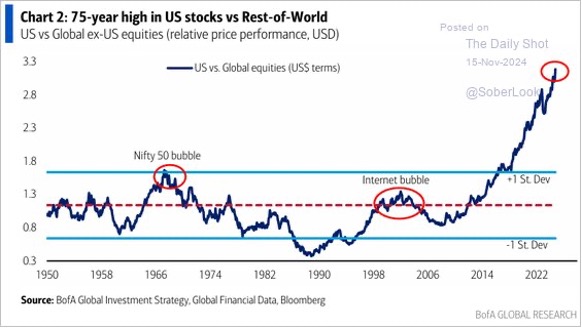

As a starting point, today’s over-pricing and concentration in US stocks relative to the rest of the world have never been higher (shown below since 1950, courtesy of Bank of America and The Daily Shot). Lesser overshoots in 1966 and 2000 resolved in secular global bear markets that spent years growing back losses.

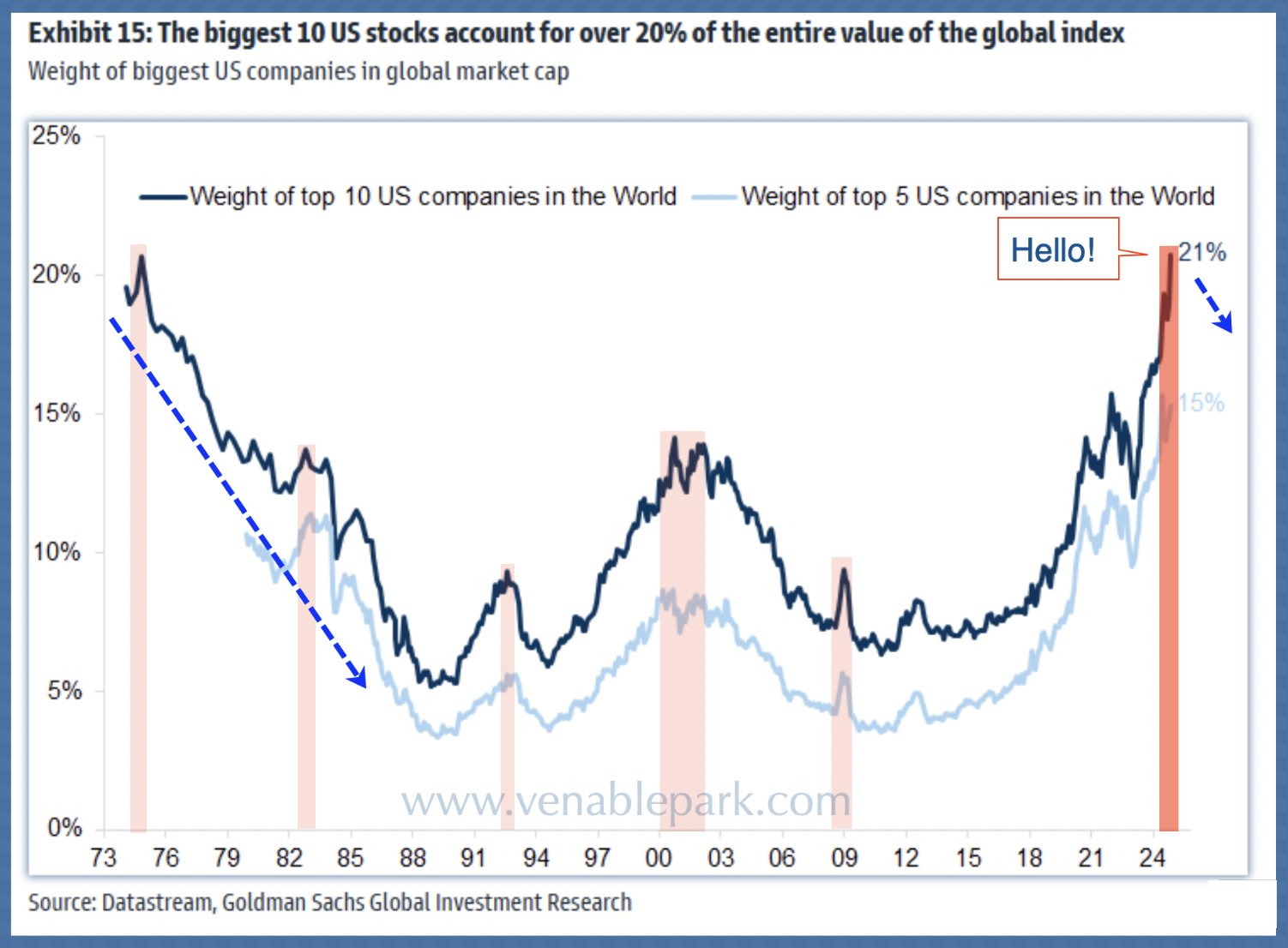

Just 5 US tech stocks account for a record 15% of the global equity market capitalization (blue line below since 1973, courtesy of Goldman Sachs), nearly double the weight seen at the 2000 tech top. The top 10 most expensive US companies account for 21% (black line).

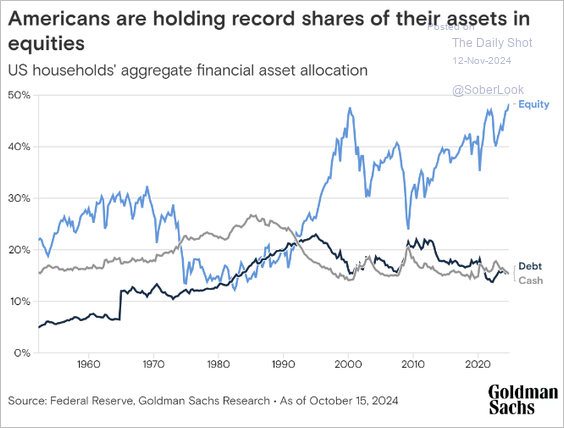

Twenty-four years older than in 2000, and apparently none the wiser, the masses today hold the highest portion of their life savings at risk since the infamous bubble peaks of 2000, 2007 and 2021 (household equity allocations below since 1950 in blue versus bonds in black and cash in grey, courtesy of Goldman Sachs and The Daily Shot). Their odds aren’t good, and it’s not just Americans at risk here.

All we know is that there has never been an asset bubble that did not collapse, and today’s stock market bubble has never been so vast and obvious. Of this, we can be sure.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Danielle Park November 19th, 2024

Posted In: Juggling Dynamite

Next: Even Higher Hopes »