November 10, 2024 | Does There Still Have To Be A Currency Crisis?

The fiat currency experiment had produced a hyper-leveraged financial system that would soon fail spectacularly. Existing currencies would be replaced via a monetary reset, probably involving some kind of gold standard.

This would be a messy but survivable process in which people who shifted out of financial assets like bank accounts and government bonds and into real things like precious metals, oil wells, and farmland would survive and maybe thrive. The thesis could be explained in a 15-minute podcast, and the actionable advice could be implemented with a few hours of research.

Then everything changed. “Neocons” took over in Washington, and the US — dragging a hapless NATO in its wake — started blundering into WW III. A government/academia/social media “censorship industrial complex” emerged and began silencing legitimate dissent. The criminal justice and public health systems were weaponized against the political opposition. And America’s southern border was thrown wide open to millions of unvetted military-age men and unaccompanied children.

We found ourselves falling head-first into a dystopia with one-party rule, secret police, and endless war.

In response, the straightforward gold-bug financial crisis strategy had to be expanded into full-spectrum prepping, complete with guns, second passports, bugout bags, “strategic relocation,” and aggressive privacy protection. “Survivalist” became the logical lifestyle choice, as our formerly simple world became darker and far more complicated.

Back to Simple?

This alone puts DJT in company with the greatest U.S. presidents since Lincoln. The globalist project has laid siege to democracy and freedom across the globe. The USA is the final redoubt. President Trump just launched freedom’s counterattack. https://t.co/2brXEjTByg

— Robert F. Kennedy Jr (@RobertKennedyJr) November 9, 2024

So Why Does There Still Have To Be a Currency Crisis?

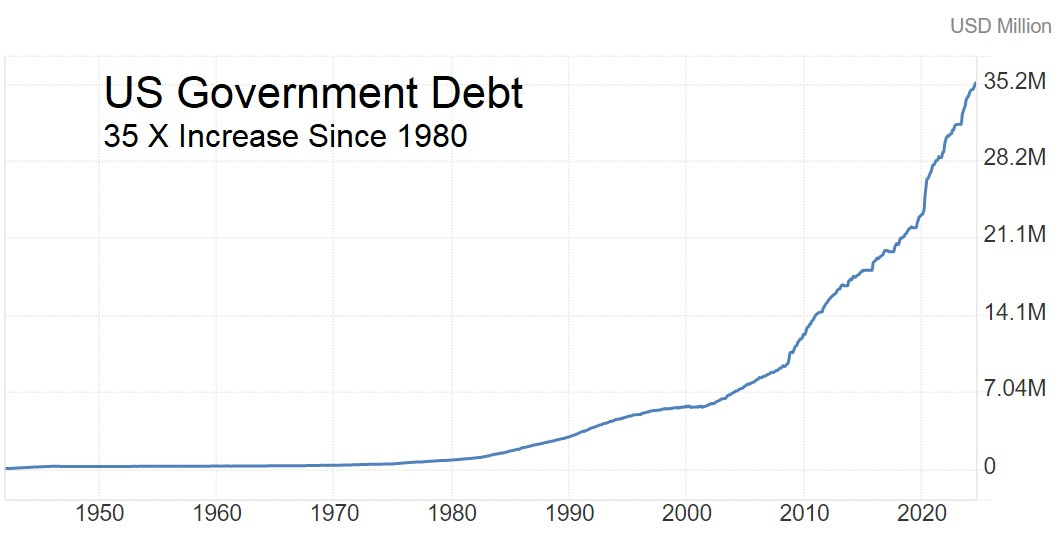

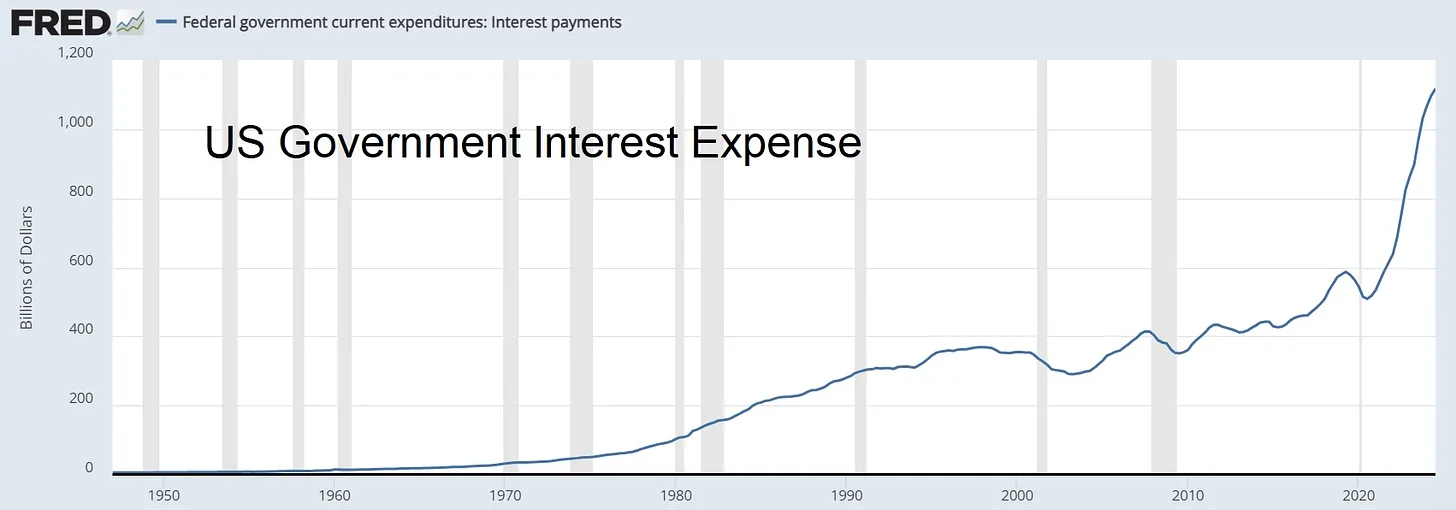

Money is about math, not politics. When debt reaches a certain point relative to the size of an economy, chaos ensues no matter how well or badly the government is run. And the US, along with most of the rest of the developed world, passed that point long ago. You’ve all seen these charts…

…and you probably understand that government debt is just the beginning of the story. Credit card debt, student loans, mortgages, commercial real estate loans, underfunded pensions, and car loans are all at debilitating levels for various groups. And derivatives, well, no one really understands those things, but the notional value of the credit, interest rate, and currency swaps on bank balance sheets now approaches half a quadrillion dollars.

Can’t We Just Eliminate the Debt — Or At Least the Deficit?

There was a time, maybe as recently as the 1990s, when it was mathematically possible to bring the government’s “structural” deficit into reasonable balance. But those days are long past, for several reasons:

Demographics. Social Security and Medicaid were designed to generate surpluses early on and then spend that extra money on retiring Baby Boomers in this decade. But the surpluses were, by current accounting, $75 trillion too small and will soon be gone, leaving the government with two options: cut Boomer benefits (politically impossible) or borrow whatever it takes to finance millions of joint replacements and chemo rounds. We’ve chosen the latter course, and no one is proposing to change it.

Interest expense. As the above chart illustrates, debt has risen to the point where the resulting interest is a major budget item. Which means interest rates will have to stay artificially low to prevent interest costs from swamping government budgets. Put another way, the Fed no longer has the tools to control inflation, and the currency death spiral has begun.

The death spiral is global. Past currency crises were country-specific. One government would spend and borrow too much and its currency would collapse. But everyone else remained on a gold standard, so the damage was limited to the badly run country and its main creditors. This time, most of the developed world is running fiat currencies with US-level budget deficits, so the crisis and resulting currency reset will be global in scale. More widespread means harder to control.

“Drill baby drill” won’t eliminate the national debt. Energy independence is a good thing. But ramping up oil, gas, and coal production sufficiently to retire trillions of dollars of Treasury bonds will, by definition, lower the price of those fuels. This will cause energy companies — which need future prices to be high enough to produce a profit — to green-light fewer projects, causing production to fall short of expectations. So you can’t fix the deficit this way.

It’s Already Starting

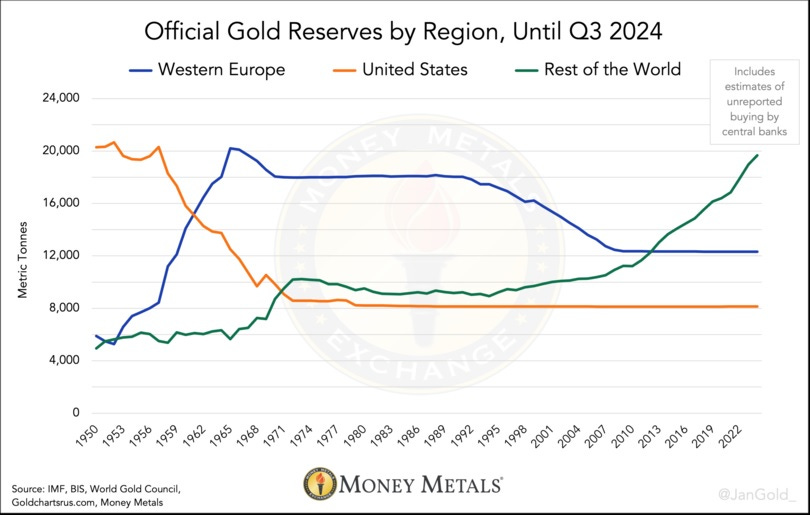

The BRICS countries are aggressively buying gold while discussing ideas for a shared (possibly gold-backed) currency. Eastern European countries are doing something similar. See: Europe Is Finalizing Preparations for a Gold Standard, which features this chart showing the US and Western Europe being left behind in the race to accumulate gold:

A return to a developed-world gold standard would require a gold price of at least $10,000 per ounce. So that part of the gold-bug investment strategy remains intact.

Meanwhile, Other Commodities Look Great

Let’s assume the easy money and rising inflation that produce tomorrow’s currency crisis also enable the financing of multiple AI server farms, electric car factories, and nuclear reactors. We’re talking ridiculous amounts of copper, silver, and uranium, which will only be mined if prices rise enough to make that mining profitable. So the commodities investment thesis is, if anything, more positive in our hypothetical free speech/low regulation world.

There is, in short, serious money to be made in what’s coming. Let’s figure out how.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino November 10th, 2024

Posted In: John Rubino Substack