October 26, 2024 | Trading Desk Notes for October 26, 2024

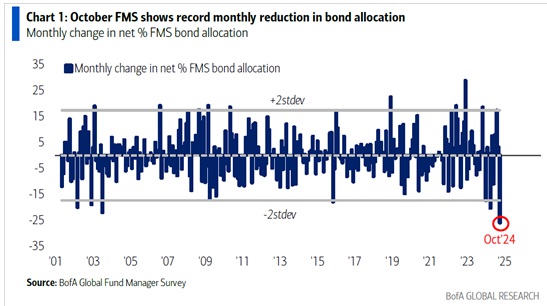

US interest rates have surged higher since September 18, when the Fed cut short rates by 50 bps.

US 2-year yields were near a 22-month low of ~3.63% on September 18 but closed this week at ~4.12%. In this chart of 2-year Treasury futures, the blue ellipse is September 18, and the black ellipse is October 4, when the non-farm payroll report showed much more robust than expected employment gains.

The 30-year bond futures have a similar pattern, with yields rising from ~4.02% on September 18 to ~4.50% at this week’s close.

The June 2025 SOFR futures (Secured Overnight Financing Rate) were pricing 3-month money at ~3% on September 18, but that rose to ~3.8% at this week’s close.

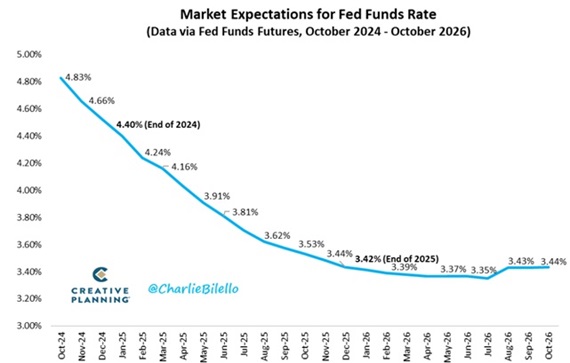

The forward curve continues to price Fed cuts over the next 18 months, but not as much as expected a month ago.

Rising US credit market yields are pricing in a more robust economy than previously expected. There are also concerns that government debt and deficits will continue to increase regardless of who wins the election, weakening the dollar’s purchasing power and contributing to higher inflation. These “concerns” have added to the “term premium” in bond prices. (My friend of many years, Hubert Marleau, co-founder of Palos Management in Montreal, describes term premium as “the extra compensation demanded by investors for the risk of holding government debt over a longer period of time.…..this makes sense to me because bond volatility has not only surged but gone through the roof.”)

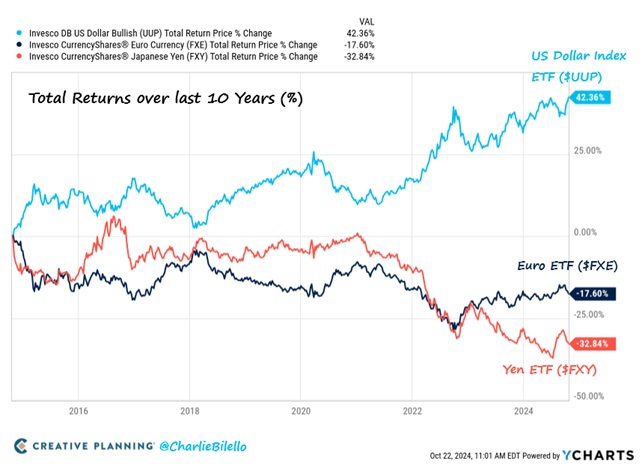

Surging US interest rates are boosting the US Dollar.

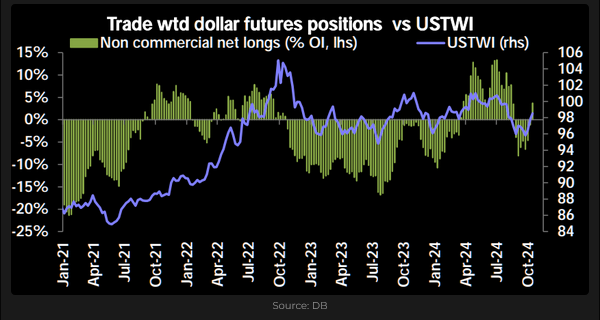

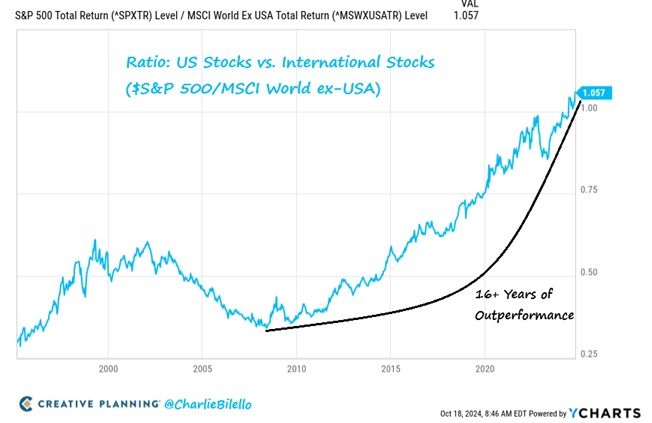

The US Dollar Index was near 2-year lows at the end of September (after falling ~6% from July highs) on market expectations that the Fed would cut rates more aggressively than other central banks. That expectation has been 100% reversed over the past four weeks, and the USDX is up ~4% (the best monthly gain in over two years.) The American economy is more robust than other economies, and the US stock market outperforms other markets. Capital comes to America for safety and opportunity.

Trade-weighted futures positioning shows that speculative accounts have reversed from being net short the USD this summer to net long as the USD rallied in October.

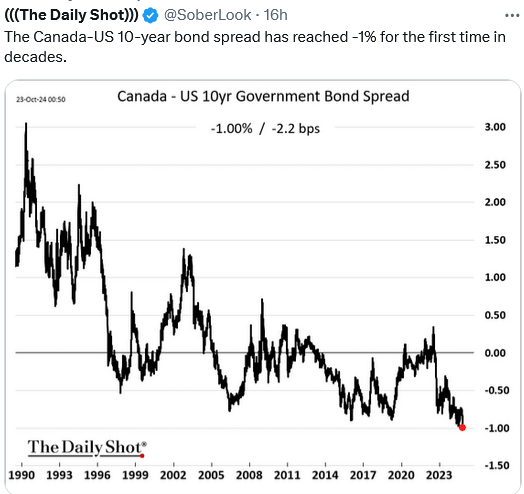

The Canadian dollar has dropped nearly 2.5 cents from late September highs, closing this week near the lowest level in more than four years. The Bank of Canada cut 50 bps this week (as expected) to 3.75%. Markets are pricing an additional ~60 bps in cuts by January. Two weeks ago, US short rates were a premium of ~67 bps over Canadian rates. This week, the spread is ~100 bps – near the widest in 24 years. At the 10-year tenor, the spread is also ~100 bps.

The net speculative short position against the CAD is the largest of any CME currency futures.

The CAD closed this week at its lows—near the level where it reversed higher in early August.

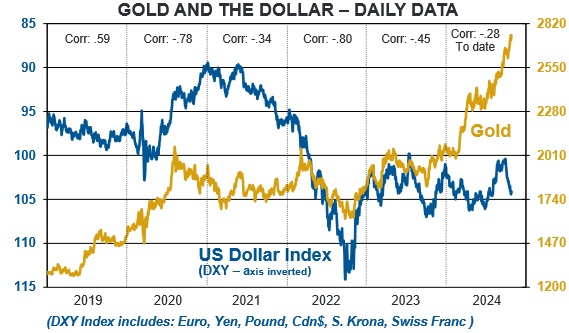

Gold hit record highs against all major currencies this week.

Gold has closed higher against the USD for 12 of the last 13 months, rising ~$950 (53%.) Silver is up ~66% in the same period, reaching a 12-year high this week at ~$35.

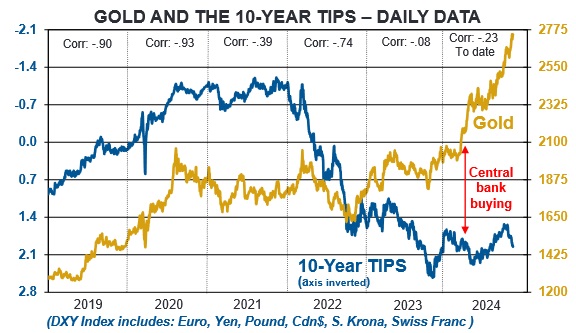

Gold is rising due to central bank buying, geopolitical concerns, and a loss of confidence in governments (fiscal irresponsibility), causing currencies to lose their purchasing power. Gold is also rising due to momentum/positioning. Net speculative long positioning in the COMEX futures market is ~$80 billion, the highest ever outside of a brief spike during the March 2020 covid crisis.

Gold has historically been negatively correlated with the US dollar and interest rates. Still, over the past twelve months, gold has rallied relentlessly without regard to the ups and downs of the USD and interest rates (other things, like central bank buying, geopolitical concerns, and a loss of confidence in governments, matter more.)

Charts courtesy of Martin Murenbeeld’s GOLD MONITOR. Click here for a free trial.

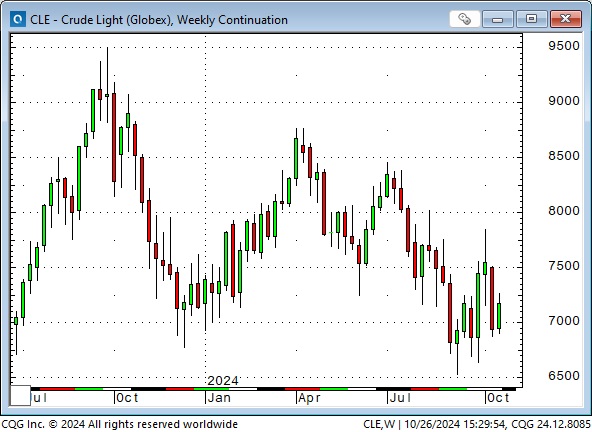

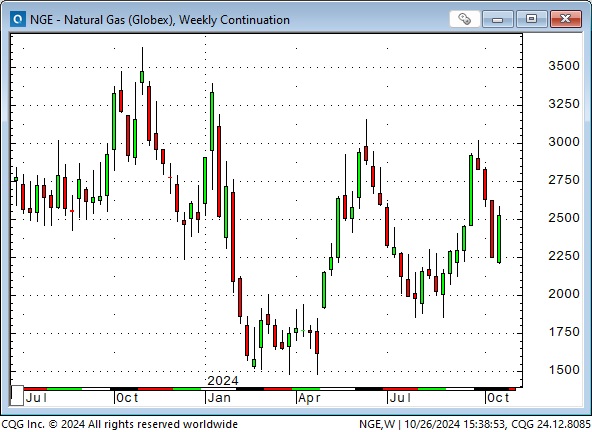

Energy markets

WTI crude oil fell to a 16-month low near $65 in September but bounced back to a high of ~$78 this month when markets were concerned that Israel might attack oil targets in Iran. As those concerns diminished, WTI dropped below $70.

Natural gas prices fell to around 20+ year lows early this year but then doubled in two months. Price action remains (has always been) volatile!

Uranium was “in the news” over the last two months, with reports of big tech companies scrambling to secure nuclear power to provide electricity for data centers. My “bellwether” for the uranium space is Cameco (mining high-grade uranium in Saskatchewan), and the CCJ share price jumped over 60% to record highs last week. I think the enthusiasm for uranium is overdone in the short term.

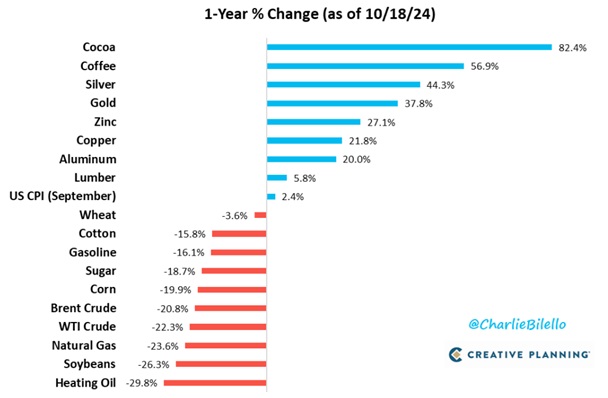

Commodity winners and losers over the past year

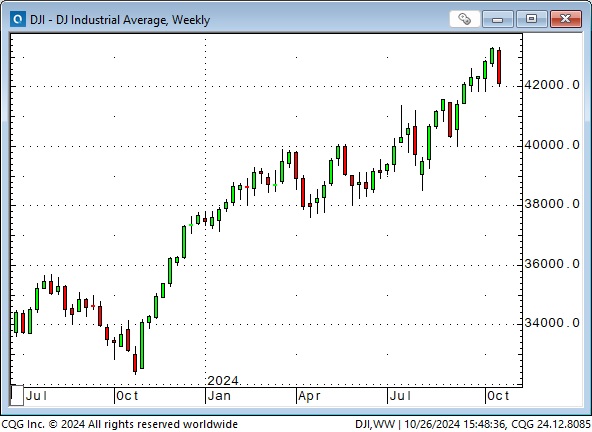

North American, European and Japanese stock indices were lower this week.

The DJIA closed this week down over 1,200 points from last week’s record-high close.

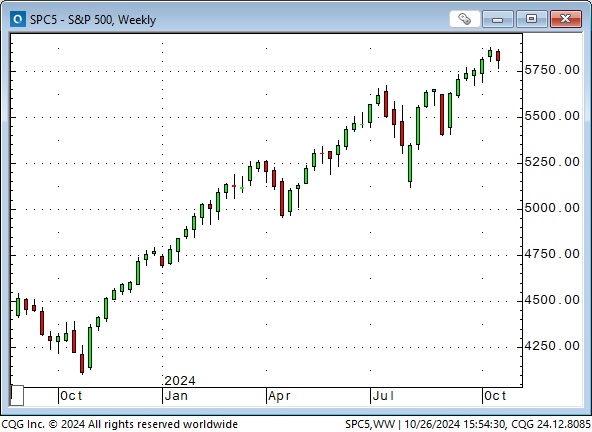

The S&P has closed higher for 11 of the previous 12 months but closed lower this week after rising for six consecutive weeks. Stocks have been rising as forward earnings expectations have risen.

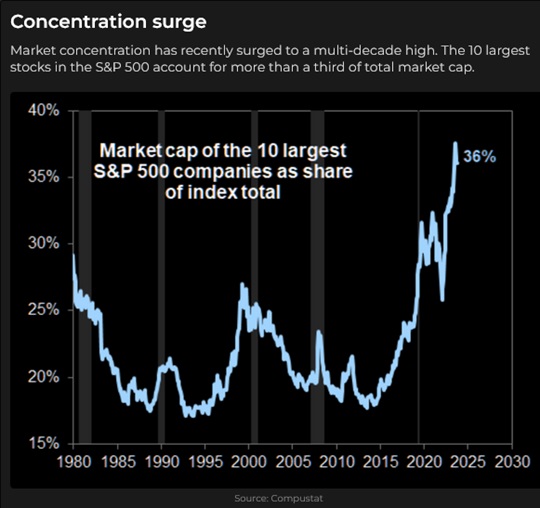

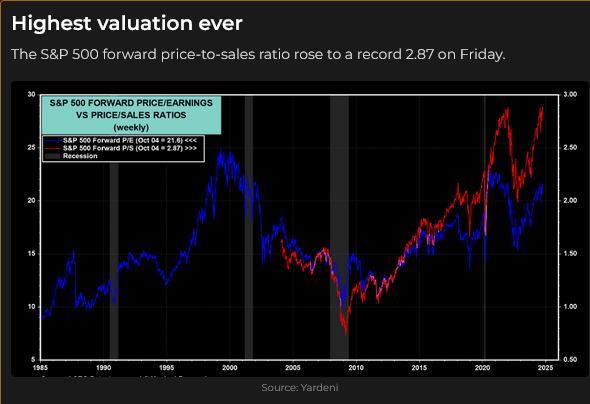

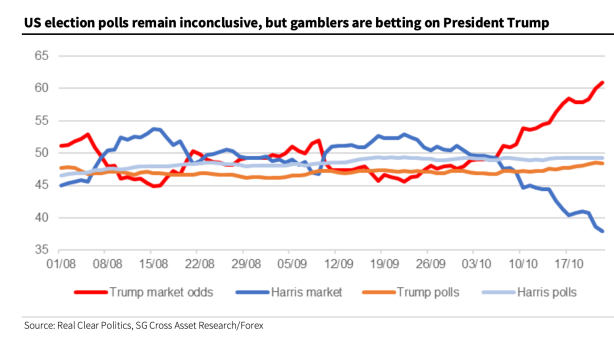

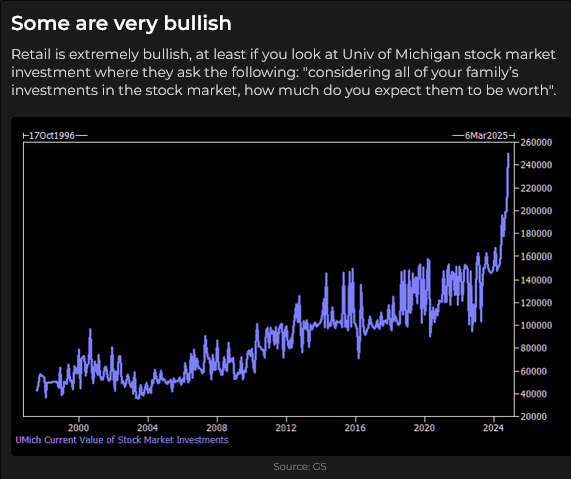

Last week’s enthusiasm for the “Trump trade” (a Red Sweep) faded as interest rates rose further this week. Goldman Sachs sees limited upside over the next several years after the S&P rose ~3X from the 2020 lows. Their big concern is the market’s concentration, high earnings expectations and valuations. P/E ratios are now ~22X. They were ~17X in October 2023. Ed Yardini sees the S&P rising ~11% per year over the next few years as earnings growth continues, with the index hitting 8,000 by 2030, up ~36% from current levels.

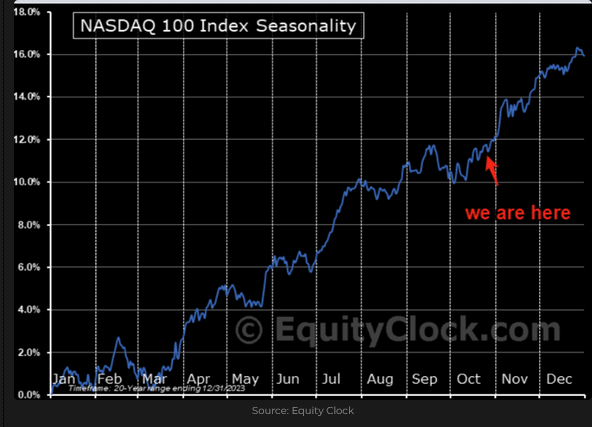

The American Federal election is two weeks away. (If you think Harris wins, short TESLA—but be prepared to lose if Trump wins!) Seasonality favours a strong rally to year-end.

Several Big-Cap tech quarterly reports are due next week, and corporate buybacks will resume. (Goldman Sachs estimates ~$6 billion of corporate buybacks for each trading day in November to total ~$114 Billion. They estimate 2025 corporate buybacks at a record high of $1 trillion.) Corporate buybacks are the largest buyers of US stocks.

Thoughts on trading.

I pay close attention to markets where speculators are heavily positioned, either long or short, relative to their historical positioning. I can get a “feel” for positioning by watching the news and the market’s reaction to the news, but for hard data on positioning, I follow the Commitments of Traders report issued weekly by the CFTC. I subscribe to an excellent service called Crowded Market Reports by Jason Shapiro, which presents the COT data in a very easy-to-use format. (Jason has several videos posted on YouTube that you can watch free of charge.)

Regular readers may remember my comments this summer about speculators building up a massive net short position in the Canadian dollar. I patiently waited for a signal that the decline in the CAD might be over, and I started buying the CAD, thinking that those speculators would probably begin to buy back their positions. That worked.

In my September 28 TD Notes, I wrote that Iran and proxies (increasingly) appear to be “no match” for Israel, militarily, and if/when markets came around to that view, they might start to price less geopolitical risk rather than more. Following this morning’s “measured” Israeli attack on Iran, I’m more convinced of my “no match” theory.

I’m looking for a signal to short gold. COT data shows speculators currently hold their largest-ever net long position outside of a few weeks in 2020 during the covid crisis. I think one of the reasons speculators are long gold is because they expect an escalation of geopolitical risk in the Middle East. If that doesn’t happen, and prices start to decline from record highs, then, at the margin, they may turn sellers.

My short-term trading

I was away from my trading desk for several days during the first three weeks of October and didn’t do much trading because I felt out of touch with the markets. I was back at my desk this week and cautiously started trading again.

I shorted gold a couple of times for a tiny net loss. I did not want to be short going into the weekend, especially with gold closing on its high Friday, but I will watch for more opportunities beginning Sunday afternoon.

I shorted the S&P a couple of times for a modest net gain and remained short going into the weekend, with the S&P closing on its low Friday.

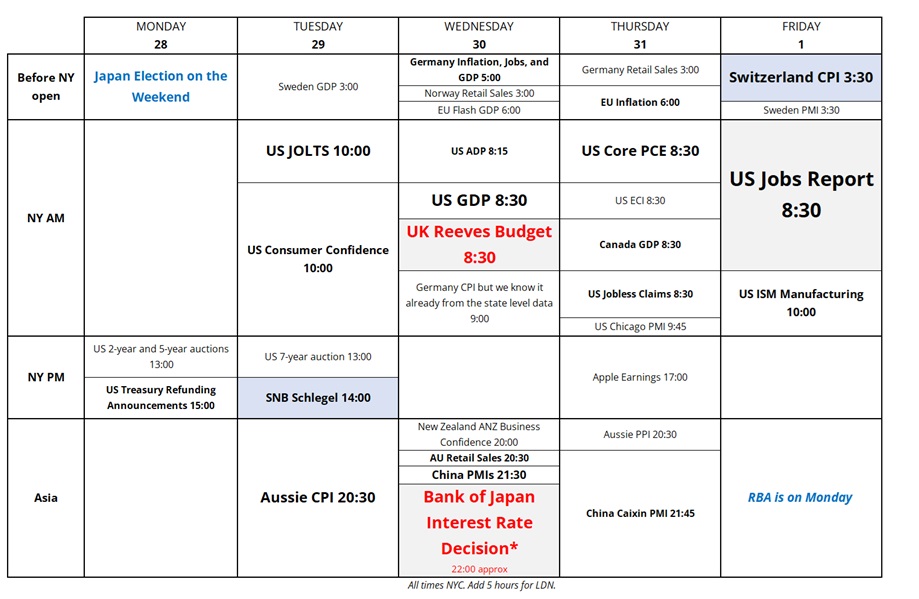

On my radar

This coming week, in addition to corporate reports, election news, and geopolitical risks, there are many scheduled risk events. Here’s a great calendar from Brent Donnelly.

The Barney report

Barney loves to dig holes, so occasionally, I take him to a sand bar in the forest where the digging is easy.

It is so easy that he is “neck deep” in no time!

Listen to Victor talk markets with Mike Campbell.

On the Moneytalks show this morning, Mike and I discussed the recent sharp rise in American interest rates and their impact on other markets, especially the Canadian dollar. You can listen to the whole show here, including Mike’s conversation with Martin Armstrong. My spot with Mike starts around the one-hour/seven-minute mark.

The Archive

Readers can access weekly Trading Desk Notes from the past seven years by clicking the Good Old Stuff-Archive button on the right side of this page.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new, usually four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair October 26th, 2024

Posted In: Victor Adair Blog