Major retailers have noted a pullback in consumer spending, and same-store traffic is down across restaurants this year, particularly at sit-down chains. Most are ramping up discounts and promotions to lure customers. See, After years of Increases, Companies are Rolling Back Prices:

Retailers, restaurants and other companies spent years lifting prices. Now that consumers are closing their pocketbooks, some companies are turning to discounts to win back business.

Businesses that sell a range of products from IKEA sofas to Air Jordan sneakers have said in recent weeks that they have lowered prices this year. Many companies increased prices in the pandemic when supply chain and labor costs rose, and consumers were willing to pay more.

But demand for many goods that aren’t necessities, such as home furnishings or pricey sneakers, has fallen, leaving companies sellers in a battle for a larger piece of a smaller pie.

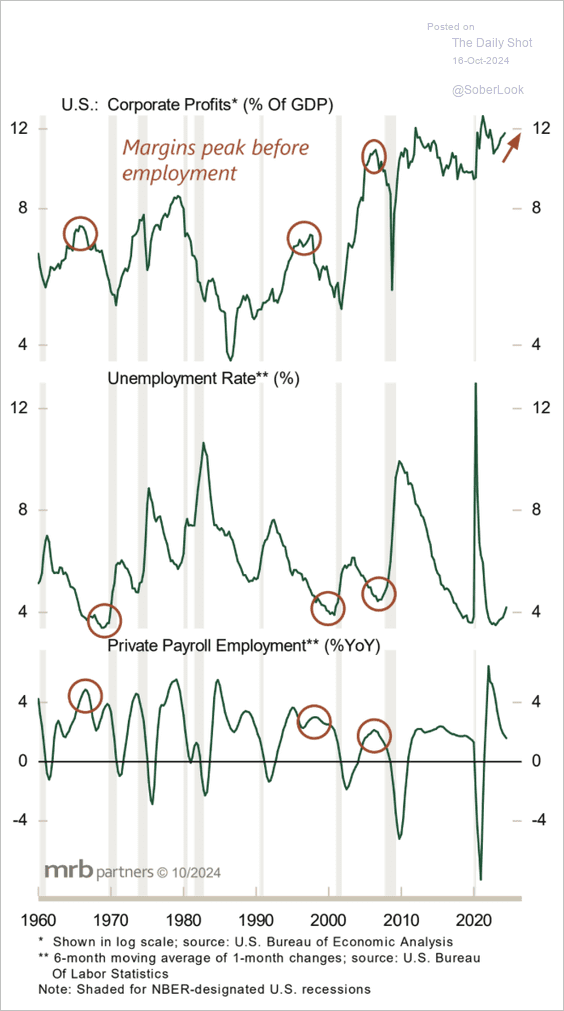

Price cuts and slumping demand compress corporate revenue and, finally, profits. US corporate profits, at 12% of GDP, are off all-time cycle highs (top panel below since 1960, courtesy of The Daily Shot) even as stock prices have continued to rise. Historically, corporate profits have reliably been mean-reverting, leading employment lower (bottom panel below) as they fall (unemployment rising, middle panel shown, with recessions in grey bars). Maybe this time is different.