October 11, 2024 | More Great Gold Miner Earnings Reports Coming Soon

A rising gold price boosted second-quarter (June-August) earnings for the best-run gold miners. See:

Q2 Gold Miner Earnings Might Liven Up the Summer Doldrums

Portfolio Update — Q2 Earnings Edition

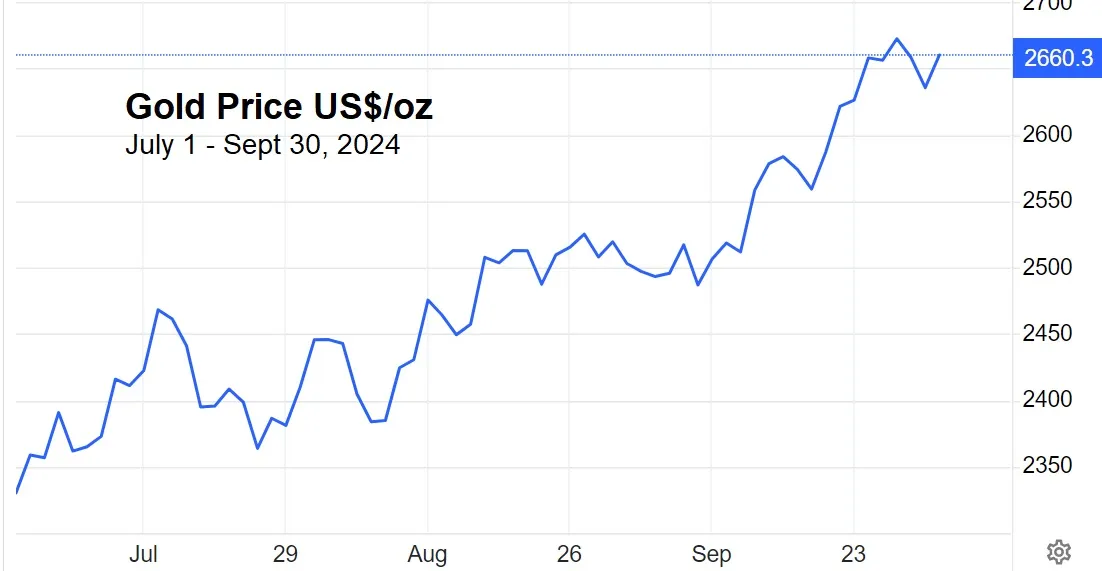

And earnings for Q3 — which ended on September 30 and will be reported shortly — should be even better, thanks to continued gains for gold:

Gold miner share prices, which had languished for years, have started to come alive as generalist investors, who don’t know mining but do know positive earnings trends, have gotten interested. In the following chart, the blue line shows the price action for the GLD ETF, which tracks the price of gold, while the green line shows the GDX large-cap gold miners ETF. As you can see, the minters are finally starting to outperform the underlying metal.

Will the miners continue to outperform as they report great Q3 earnings? Very possibly. Adam Hamilton, a precious metals analyst who tracks the miners’ fundamentals, thinks this earnings season will be “epic.” Here’s an excerpt from his latest post:

Gold Miners’ Epic Quarter

The gold miners are on the verge of reporting another best quarter ever. Q3’s earnings season ramping up soon will prove epic, fueled by dazzling record gold prices and slightly-lower mining costs. That ought to double sector unit profits, extending gold stocks’ long trend of massive earnings growth. Such fantastic results should increasingly catch fund investors’ attention, with their inflows driving this sector way higher.

Gold stocks remain out of favor, greatly lagging gold’s monster upleg over this past year. This has proven one of gold’s mightiest advances in many years, soaring 46.8% over 11.7 months! Historically larger gold miners dominating the leading GDX gold-stock ETF have seen their stock prices amplify gold uplegs by 2x to 3x. Yet instead of seeing normal 95%- to-140% upleg gains, GDX has merely rallied 60.7% at best!

That very-poor 1.3x upside leverage to gold has been a real kick in the teeth for contrarian speculators and investors. Gold stocks need to way outperform their metal to compensate for the big additional operational, geological, and geopolitical risks they heap on top of gold price trends. Yet so far that sure hasn’t happened in this upleg, leaving traders increasingly disappointed with this lucrative high-potential sector.

Two major factors contributed to this surprising anomaly. First gold-stock sentiment was crushed in mid-2022 and hasn’t recovered. Then the Fed’s most-violent rate-hike cycle ever catapulted the US Dollar Index up an incredible 16.7% in 6.0 months to an extreme 20.4-year secular peak! That spawned colossal gold-futures selling, slamming gold 20.9% lower in 6.6 months. GDX cratered a brutal 46.5% during that!

Second while gold blasted up 26.4% year-to-date, traders have been overwhelmingly distracted by the AI stock bubble. While gold achieved 35 nominal-record closing highs so far this year, the S&P 500 bested that with a whopping 44 of its own! Gold and gold stocks are alternative investments, thriving the most when general stock markets grind lower. Instead they’ve been surging, spinning off vast greed and euphoria.

But sooner or later all that will pass, and gold stocks will be bid way higher to reflect these lofty prevailing gold prices. The gold miners’ phenomenal fundamentals overwhelmingly support this bullish thesis.

Q3’s record gold levels have been set in stone, they can’t be revised lower like Biden Administration jobs reports. So the only variable driving sector unit profitability is the GDX top 25’s average all-in sustaining costs. Over the past four quarters they have been trending lower on balance, clocking in at $1,304, $1,317, $1,277, and $1,239 per ounce. That averages $1,284, a conservative baseline.

The majority of these elite major gold miners provide and update AISC guidance throughout the year. And many of them are forecasting higher production and thus lower mining costs in H2’24 compared to H1. Gold mining has massive fixed costs, which growing output spreads across more ounces reducing unit costs. A surprising number of major gold miners continued guiding to considerably-lower costs in Q3 and Q4.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino October 11th, 2024

Posted In: John Rubino Substack

Next: This week in Money »