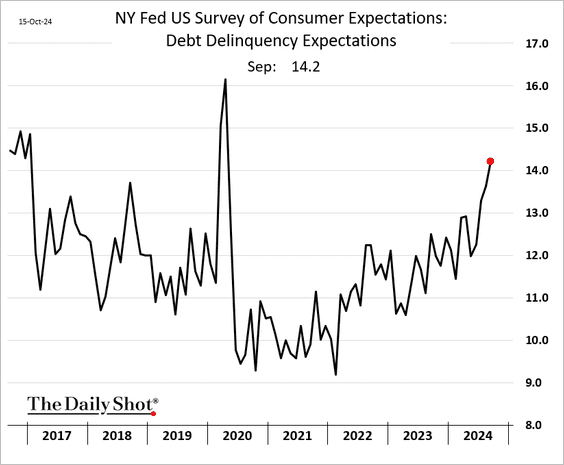

The percentage of US consumers expecting to fall behind on their debt has been rising, now the highest since early 2020 at the outset of the pandemic (below courtesy of The Daily Shot).

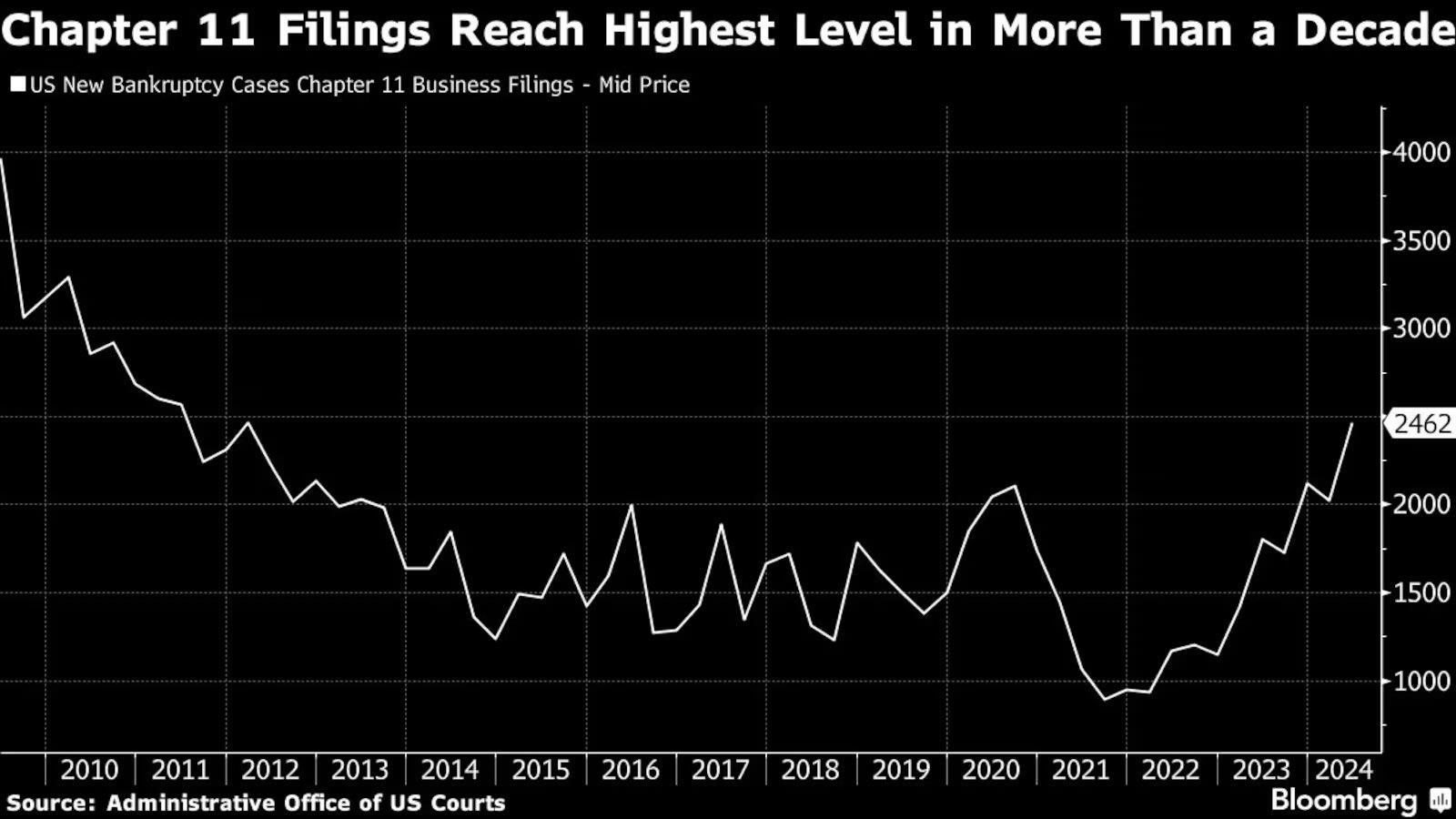

US bankruptcy filings are already the highest in over a decade and more than in 2020 (via Bloomberg).

At the same time, the S&P 500 is trading at 3x sales (second only to the 2021 peak) and well above the 2.4x sales paid at the 2000 cycle peak (shown below since 1990, via Bloomberg).

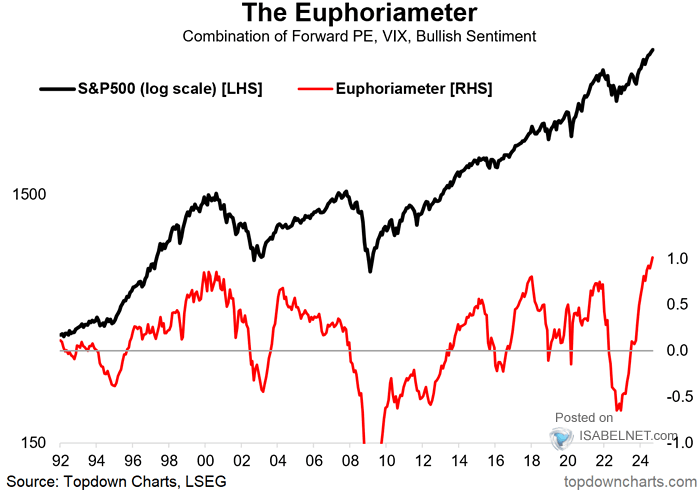

The S&P 500’s price-to-earnings ratio has risen with bullish sentiment and equity volatility (euphoria meter in red below since 1992, courtesy of ISABELNET.com) to the highest level in at least 32 years (with S&P 500 price on top in black).

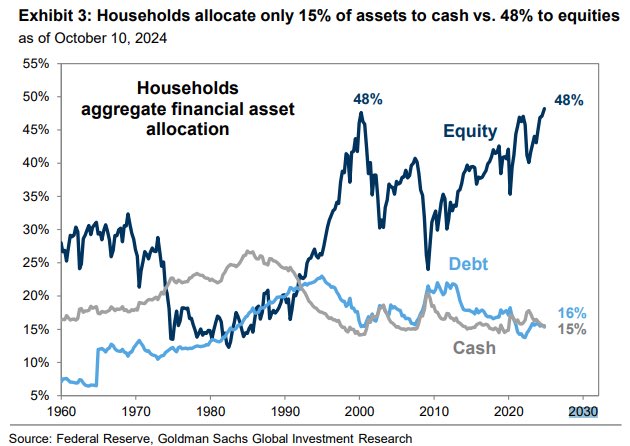

Households are entirely in with 48% of their financial assets in equities (top dark blue line below since 1960, courtesy of Goldman Sachs), a risk exposure not seen since the last tech bubble top in 2000. At the same time, cash and bond (debt investment) allocations are near the lows of the last 24 years.

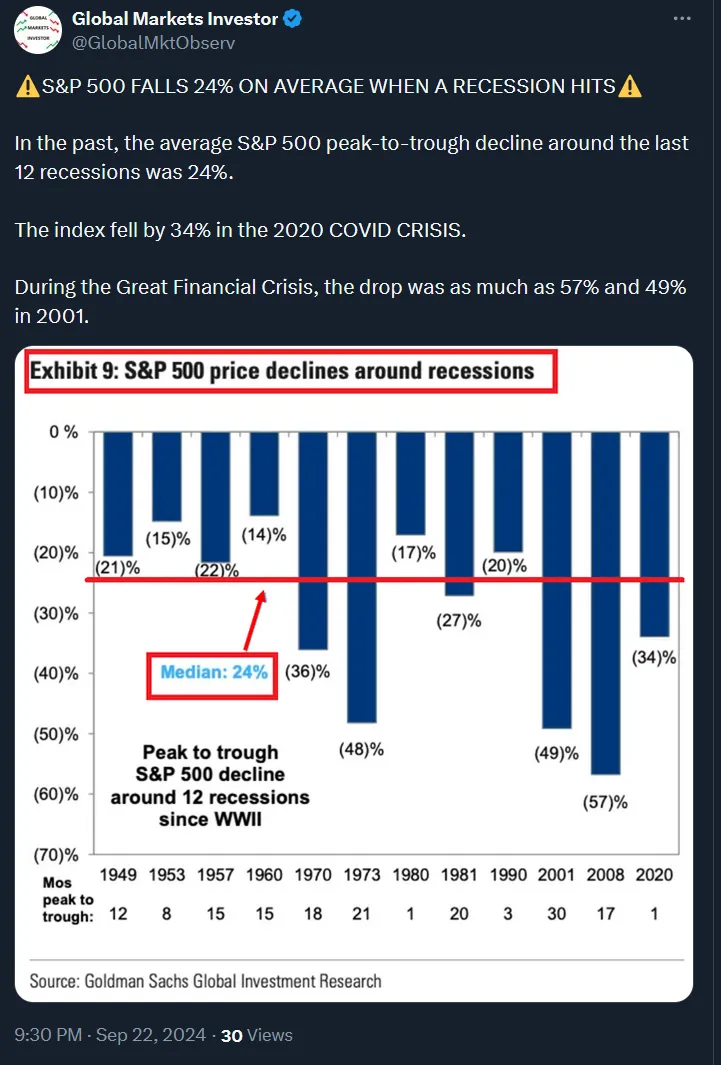

The S&P 500 has fallen an average of 24% during the 12 recessions since 1949. In cycles where stocks entered the downturn at valuation highs like 2000, 2007 and 2020, the price declines were 34 to 57% (shown below courtesy of Global Markets Investor).

All of this suggests that an extraordinary investment opportunity is in the offing for capital that can remain liquid, rational and out of harm’s way today.

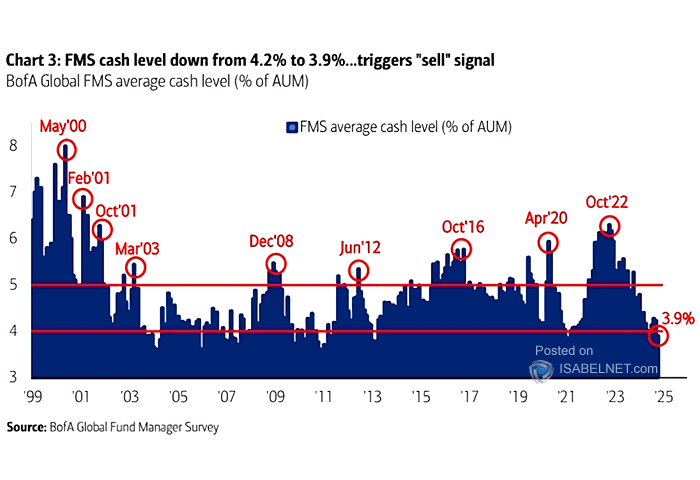

However, those thinking/hoping that their professional fund managers will be able to capitalize when equity markets mean revert are likely to be disappointed. The percentage of cash held by professional managers, at 3.9%, is the lowest since the market peaks of 2021 and 2007 (below since 1999, courtesy of ISABELNET.com).

Financial discipline takes constant effort and self-control. But following the herd is a recipe for financial disaster. There’s no dry powder here. Individuals need to ensure they have a self-preserving approach.

Financial discipline takes constant effort and self-control. But following the herd is a recipe for financial disaster. There’s no dry powder here. Individuals need to ensure they have a self-preserving approach.