October 3, 2024 | Canadian Rough Patch Getting Rougher

Canadian businesses are closing at one of the fastest rates in history. See: Canada Just Saw One in Twenty Businesses Close in a Month, Biggest Wave Since the Pandemic.

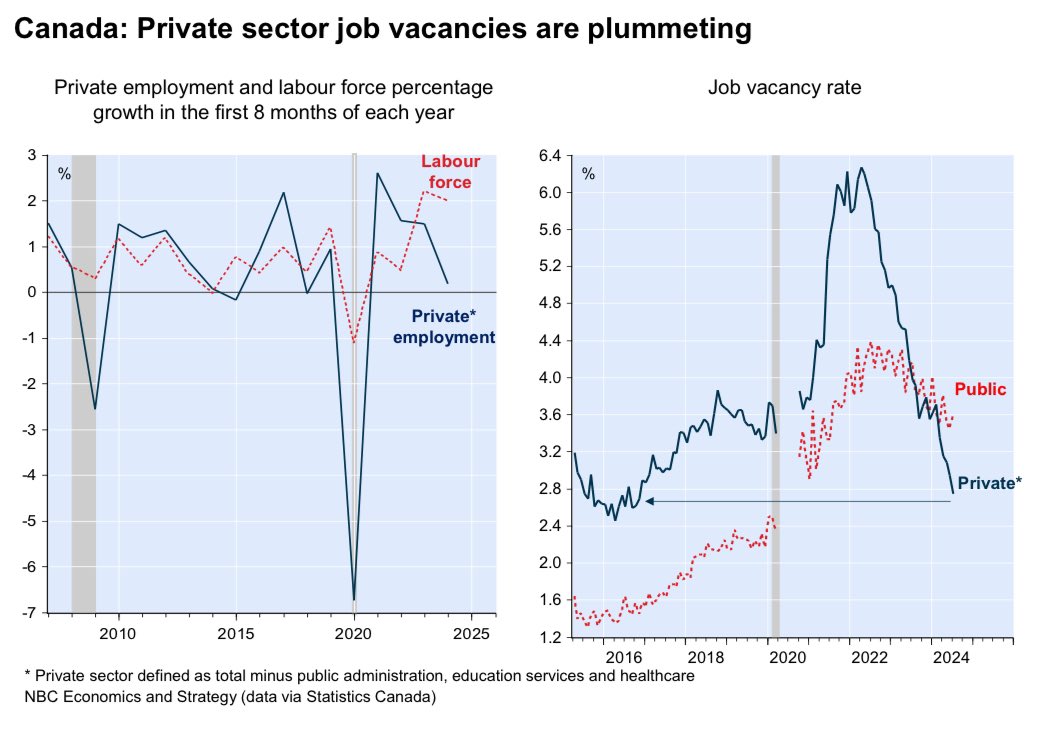

Since the vast majority of private sector job growth is driven by small—to medium-sized companies, it’s not surprising that job vacancies (blue line on the lower right since 2014, courtesy of NBC, government job openings in red) are plunging along with the employment rate (blue line on the lower left since 2007, with labour force growth in red).

While the official unemployment rate of 6.6% (up from 4.8% in June 2022) is, so far, significantly below the 8%+ seen in past recessions, record household indebtedness is magnifying fragility. According to the latest Hoyes, Michalos Consumer Solvency Report, consumer insolvencies in Canada are already just 5% below the recessionary high set in August 2009:

In August 2024, insolvency volumes increased by 8.9% across Canada and 15.4% in Ontario compared to the previous year. When adjusting for two fewer working days in 2024, the average daily volumes show an even starker rise: 19.3% nationwide and 26.3% in Ontario.

The current figures are alarmingly close to previous records. Canadian consumer insolvencies are just 5% below their peak for the month of August, which was set in 2009 as the country emerged from the last major recession. Ontario’s insolvency numbers are only 18% short of their August 2009 highs.

It bears remembering that historically, recessions have arrived within 24 months of the first-rate hike (March 2024 marked the 24-month this cycle) and ended within 18 months of the first-rate cut (January 2026 would be 18 months after the BoC’s June 2024 first cut this cycle).

At the end of August, Canadian GDP growth was tracking at a mere .9% for 2024. Retrospective measurements will revise this estimate multiple times in the coming quarters. But the trend is not friendly. GDP per capita has been shrinking since 2022, similar to the contractions seen at the outset of the deepest recessions of the past 45 years (grey bars below since 1980).

Canadian inventory-to-sales ratios for manufacturers, wholesalers, and retailers are already near the highs of the 2020 and 2008 recessions, higher than in 2001.

Excess inventories suggest disinflation and potentially some coming deflation in the price of goods. They also suggest many companies are overstaffed, with thirteen of fifteen sectors reporting a fall in output per employee between the third quarter of 2022 and the second quarter of 2024. From here, an acceleration in layoffs, financial strain, and central bank easing efforts look likely.

When Canada’s unemployment rate was 6.6% in 2017, the Bank of Canada had base rates in the banking system at .50% versus 4.25% today. See NBC report, Bank of Canada needs to step up the pace:

With widespread inflation a thing of the past in Canada, we believe the door is wide open for the Bank of Canada to return its policy rate to neutral (between 2.5% and 3.0%) as soon as possible. In the meantime, the damage to the labour market could be greater than necessary. We anticipate economic growth of just 0.9% in 2024 and 1.3% in 2025, which would translate into an unemployment rate of around 7.4% by mid-2025.

In past recessions, 80 to 90% of the prior rate hiking cycle was ultimately reversed, but only after widespread financial pain, including crashing stock markets.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Danielle Park October 3rd, 2024

Posted In: Juggling Dynamite