October 4, 2024 | Canada is Falling Behind The U.S.

Canada is falling behind the U.S. in economic growth. Up until a few years ago, Canada and its huge neighbour to the south grew by about the same annual rate.

But since 2022 Canada is falling behind by most measures.

What happened?

The Economist wrote an article on September 30, 2024 titled “Why is Canada’s economy falling behind America’s?” This might be behind a paywall.

Using IMF data, the article claims that Canada’s national income per capita has fallen to about 70 percent of the U.S., compared to 80 percent just five years ago.

Canada was slightly richer than Montana, which is the ninth poorest state, but now is equivalent to the income of Alabama, a state which is only 3 states away from being the poorest.

Apparently, Canada did well during the recovery from COVID, probably because of the massive federal government deficit of close to CAD$ 500 billion that was spent into the economy, a much larger amount than what was done in the U.S. But since 2022, Canada has gone backward which the Economist blames on two factors. The American consumer has switched from buying goods, which Canada exports to the U.S. to spending money on services which are consumed from U.S. based businesses primarily. Think of restaurant sales and legal services for example.

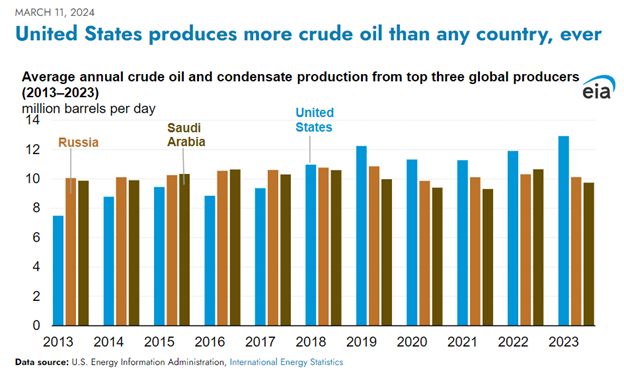

Canada also exports a lot of petroleum to the U.S., and by dollar value this amounts to about 16 percent of total revenue from exports. But the U.S. has grown its home-grown production of crude at a torrid pace, especially from the Permian Basin in West Texas. The U.S. is now the world’s largest producer of crude oil and even exports a significant amount of crude oil and natural gas.

Crude oil, in the form of bitumen, is a key export from Canada and those exports have continued even as the U.S. production has grown. But growth is slowing in that important industry.

For six years now the U.S. has been the largest producer of crude:

As cars switch to electric power the crude oil consumption will shrink, and U.S. imports of crude oil will cease. The U.S. needs about 20 million barrels daily, and Canada supplies about 4.3 million. Total imports by the U.S. are 7.1 million bbls/day. As the demand for crude shrinks those imports from Canada are at risk.

The Economist points out that Canada has missed the technology boom.

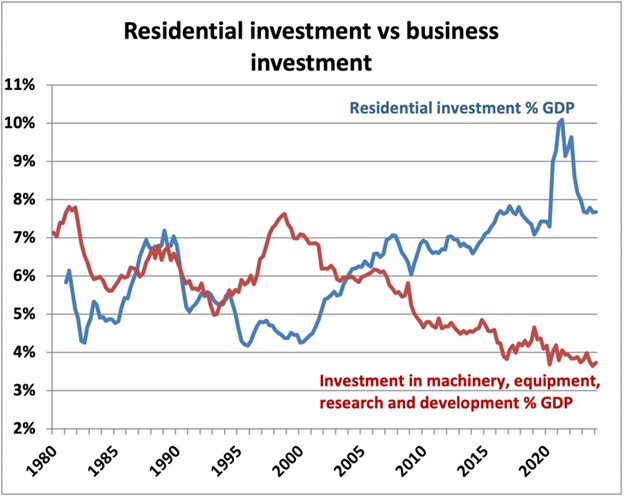

And one aspect of this is the unusual lack of investment in research and development as Canada has chosen to invest in real property rather than research.

Source: StatsCan, Ben Rabidoux

This underinvestment in machinery, equipment and R&D shows up as lagging productivity for the labor force.

The boom in AI is an example. Three universities —University of Toronto, Alberta and McMaster — were important leaders in the early stages of AI but now the growth in commercialization is in the U.S. and elsewhere.

Canada is resting on its laurels and that could be very costly.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Hilliard MacBeth October 4th, 2024

Posted In: Hilliard's Weekend Notebook