The Fed cut the Fed Funds rate by 50 basis points on Sept 18th.

Why the Cut?

It was NOT because the markets (stocks and real estate) have started to roll over and head south. They are both at record highs.

Nor was it because the economy is in recession. Atlanta Fed’s GDPNow forecast is now nearly 3% for Q3 2024, which is higher than where it was before the last Fed meeting at the end of July

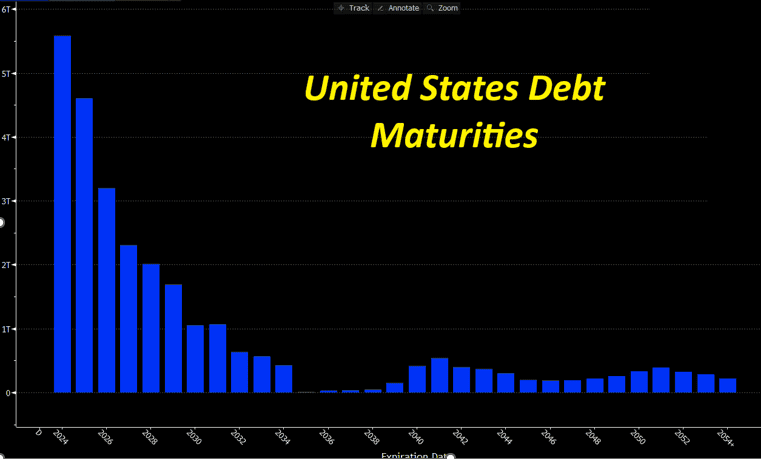

Instead, the Fed cut rates to get ahead of the massive $10 trillion of US debt that is coming due in 2024 and 2025 – which needs to be re-financed.

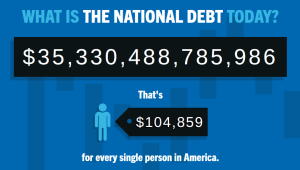

U.S. National Debt

The US National Debt rose to $35.3 trillion in Sept 2024 – up over $8 trillion since 2020. As I pointed out here, this is why inflation is today’s #1 financial problem.

Interest on the national debt will rise to a staggering $1.2 trillion in 2024 – more than double what it was in 2020 – and 50% more than US currently spends on national defense ($800 billion).

When this maturing US debt gets rolled over at higher interest rates, the money needed to service the US debt is of course going to increase – and much of that added debt servicing costs are going to end up in the US budget deficit.

What’s Down the Road?

While I have always let the markets tell me what to do, it’s my belief that we’ll experience a new era of persistent inflation in the coming decade – and a move out of financial assets and into hard assets.

As some of you know, I would not be surprised to see the price of gold soar to heights that will blow your mind in the coming years.