September 23, 2024 | Watch the Housing Bust Play Out in Real-Time

Most asset classes have their own unique, repeating cycles. For housing, it usually looks like this:

Demand for homes rises faster than sales, causing prices to increase. Seeing this, would-be sellers hold off to see how much more they can get a year or two hence. Would-be buyers note the rising prices and shrinking supply and succumb to fear of missing out (FOMO), accepting and then pre-emptively topping asking prices (which become the basis for negotiating upward rather than downward). Bidding wars become common.

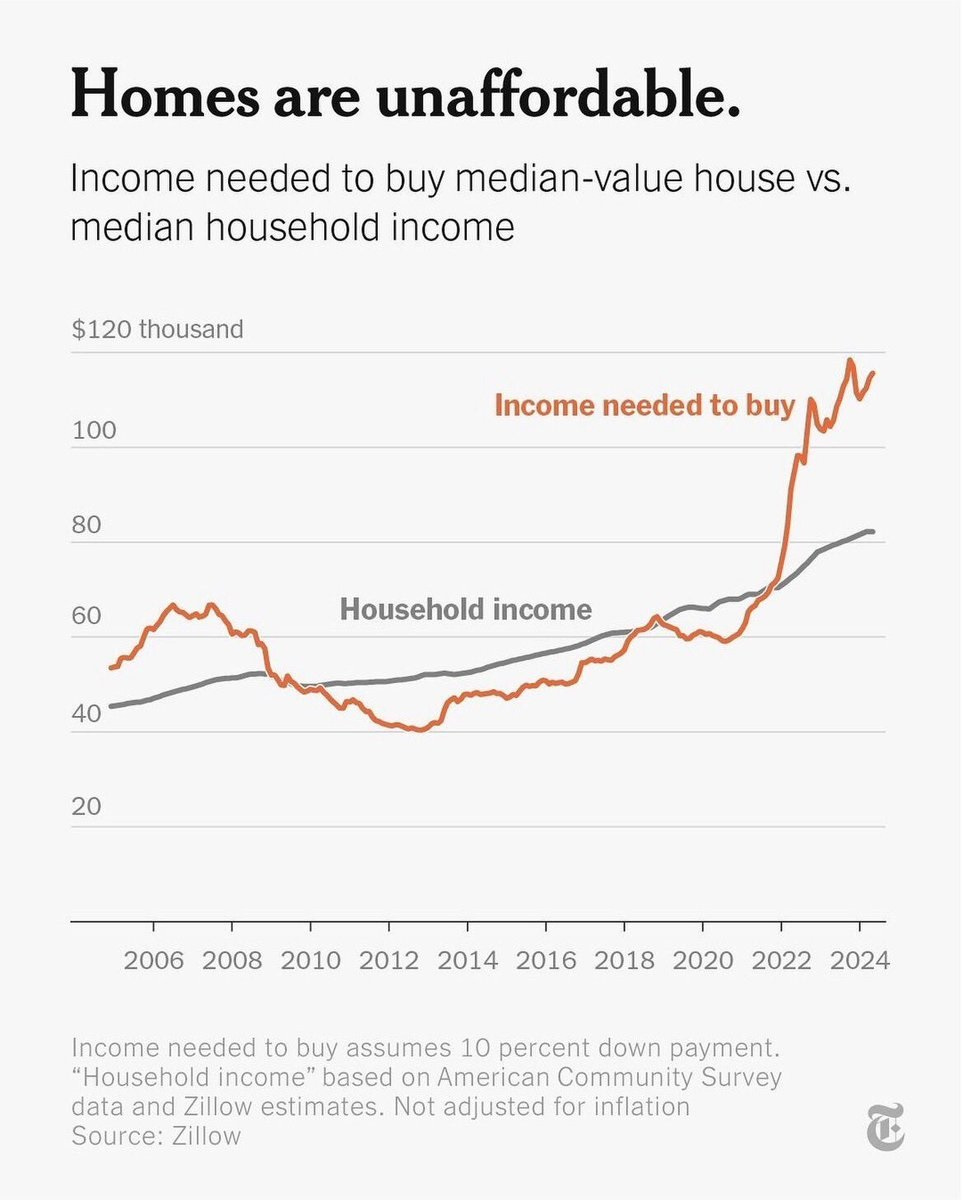

As prices spike, houses become “unaffordable” — defined as the average person being unable to afford anything remotely like the average house. We entered this territory in 2022 and went deeper into it this year. From a June 2024 New York Times article:

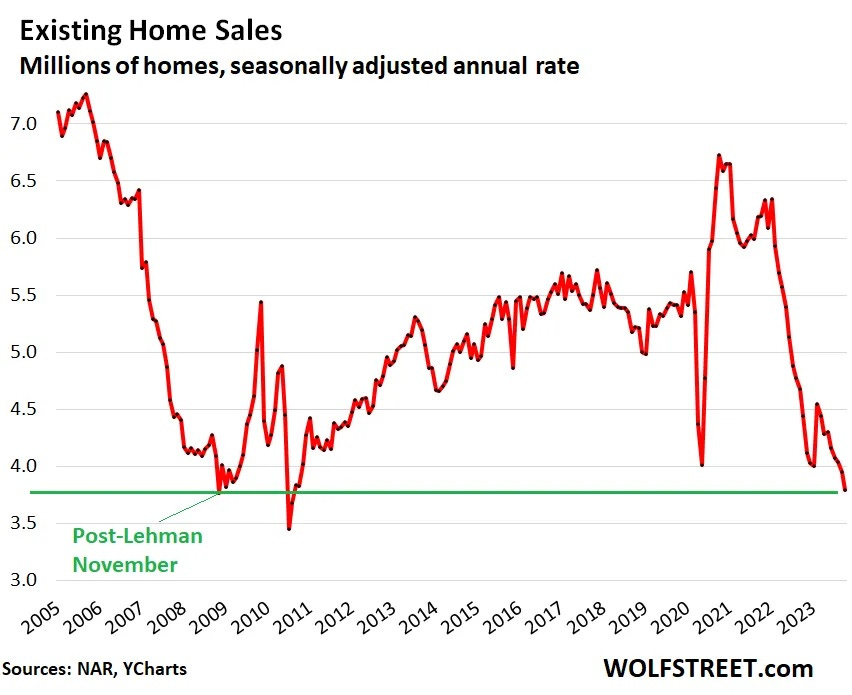

Buyers, now mathematically unable to buy, stop trying. Sellers, unwilling to sell for less than the price someone recently told them their house was worth, delay listing their property in the hope that the frenzy will resume. The number of sales plummets. We are now there:

Enter the Bust

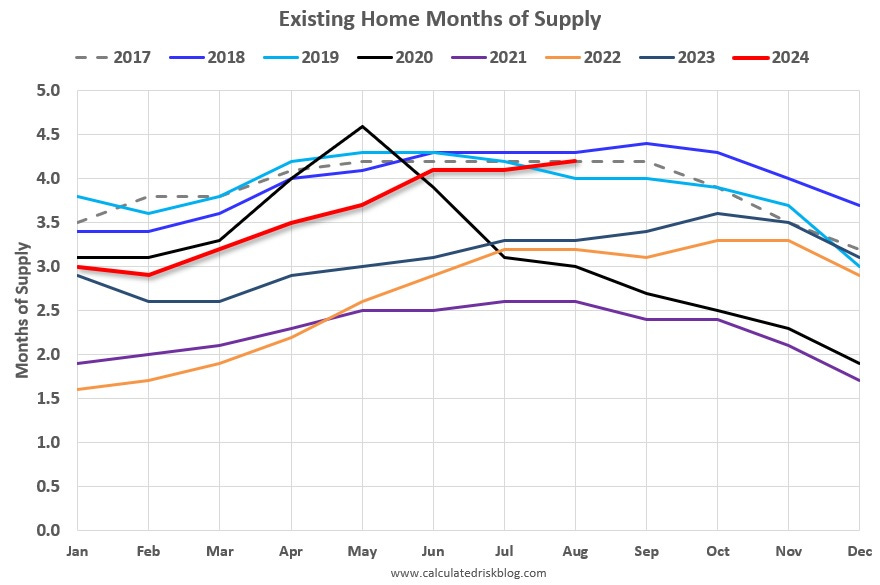

With home prices at record highs and very few actual sales taking place, a growing number of would-be sellers decide to list their properties at current prices, causing the number of houses on the market to rise, both in nominal terms and when compared to the volume of signed deals. The “months of supply” on the market starts to rise. Note the red line depicting the 2024 trend, which has now exceeded all but one year since 2017.

But sales don’t go up because houses at current prices remain unaffordable. Watching their properties languish with no offers and few visits, sellers start to cut prices. By July of 2024, this became a discernable trend:

Nearly 1 in 4 US sellers cut home prices as inventory grows, Zillow report says

(Fox Los Angeles) – A new report reveals that sellers are slashing asking prices for their homes to attract buyers as inventory in the market grows.

Nearly one-quarter of home listings (24.5%) got a price cut in June 2024, representing the highest rate during the summer dating back to 2018, according to Zillow’s report.

The real estate company reported that housing inventory is higher this year than in 2023 in all the 50 largest U.S. metropolitan areas except two — New York and Cleveland — and rose month over month in all but five.

“A growing segment of homes that aren’t competitively priced or well marketed are lingering on the market. Sellers are increasingly cutting prices to entice buyers struggling with affordability,” Skylar Olsen, a chief economist for Zillow, said in a company release.

Now For the Great Re-Pricing

To bring this kind of out-of-balance market into equilibrium, one of two things has to happen: Incomes have to rise dramatically, or prices have to fall by at least 20%. The first—higher incomes—is almost inconceivable given record levels of consumer debt and the approaching recession. The second is easier to envision and achieve: Sellers just have to start accepting what the market can offer.

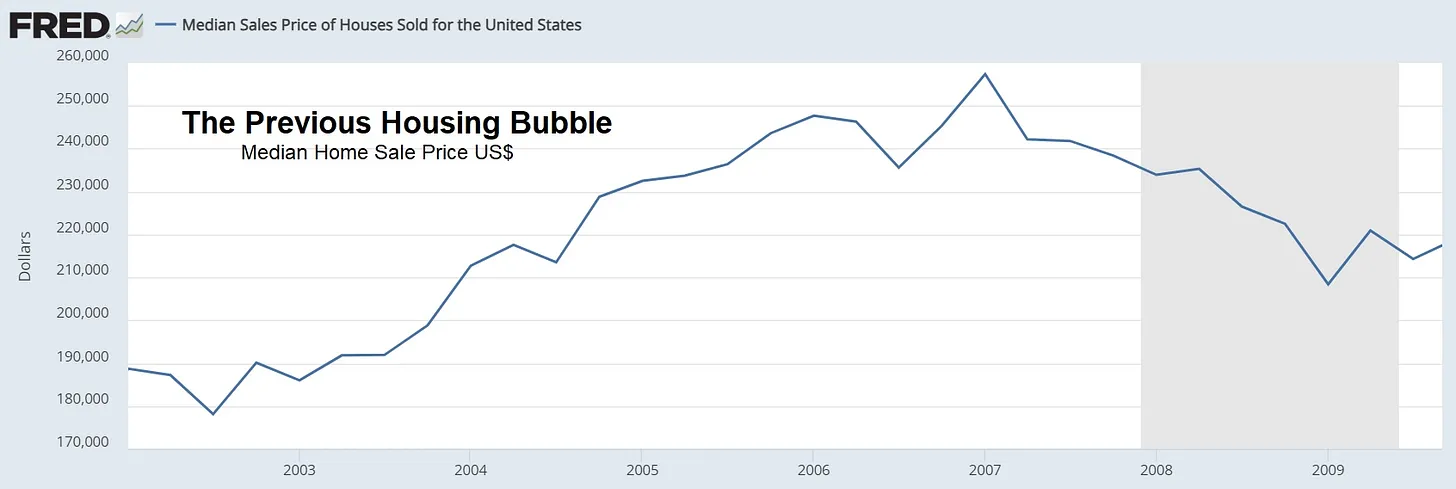

Here’s how that played out in the Great Recession: The median home price fell by about 19%, with much steeper drops in the most overpriced markets.

With houses more overvalued relative to incomes than ever before, price declines at least as dramatic as last time around are possible. And sooner rather than later.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino September 23rd, 2024

Posted In: John Rubino Substack

Next: Fire in a Crowded Theatre »

The maestros at the Fed can take another bow, hopefully just before they exit the stage of monetary manipulation for good. Mispricing the cost of money causes the mispricing of virtually every other asset on the planet that takes money to purchase. Now stock investors are all giddy about a 50 basis point cut in the Fed Funds rates, the shortest point in the yield curve, when resurging inflation, political uncertainty in the U.S., and a Dollar swirling down the toilet bowl of history are going to push longer rates higher and higher. I almost forgot the Government borrowing to the moon that will increase longer rates with more and more U.S. paper coming to market and fewer and fewer buyers thinking U.S. debt is a safe bet. 5% is hardly a high interest rate historically, and is about where Fed Funds has been, on average, since WWII. Powell needed to help our his political wizards in Washington and he sees, yet does not admit, that the Recessionary/ Depressionary storm clouds are not just approaching, but are hanging, deluge ready, right over our very heads. The Fed is always too little too late or too much for too long.