September 7, 2024 | Trading Desk Notes for September 7, 2024

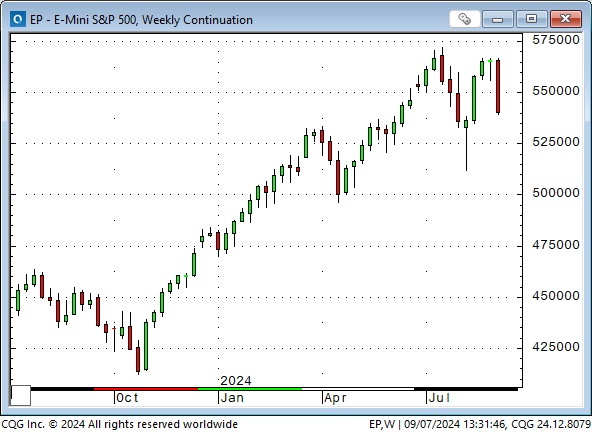

The S&P fell over 4% this week, its worst weekly performance in 18 months

The leading American stock indices fell every day this week, with the S&P giving up ~50% of the gains made during the rally off the August 5 lows.

The weekly S&P chart shows a classic bearish “double-top with lower 2nd high” pattern.

The NAZ looks worse than the S&P.

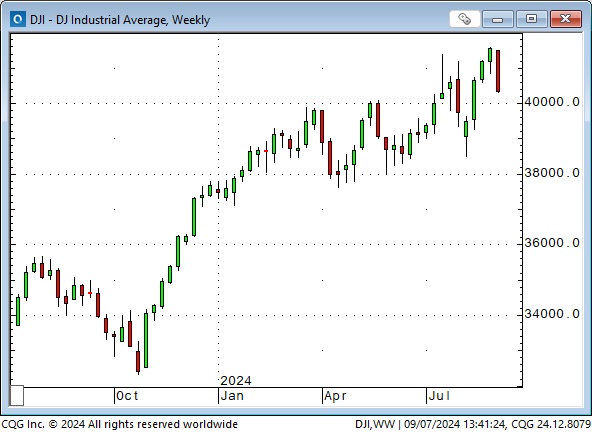

The DJIA closed at record highs last week but closed on its lows this week, down ~1,200 points and below the lows of the previous two weeks.

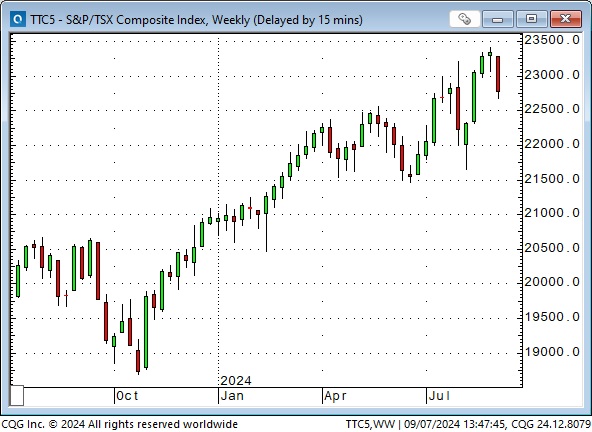

The Toronto Composite also closed at a record high last week but fell ~560 points (2.5%) this week to close below the lows of the previous two weeks.

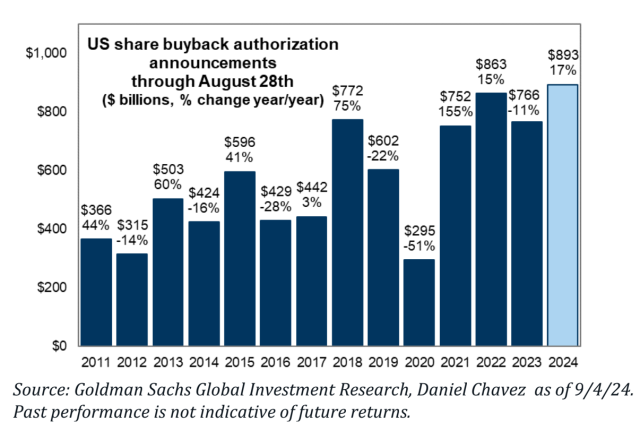

The decline in the leading American stock indices came despite near-record levels of corporate buybacks. Buybacks will be substantially reduced following September 13 as corporations enter the “blackout” period ahead of their quarterly reports.

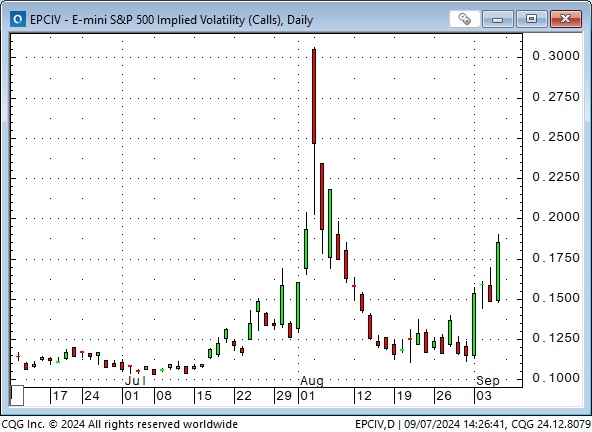

Stock index volatility spiked higher this week as stocks fell but paled compared to the spike in early August.

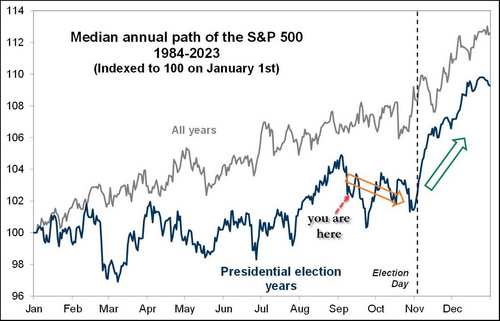

Seasonality

Since “everyone” knows that the second half of September is historically the weakest period of the year for the S&P, perhaps there was a broad-based move to front-run the dip (and then cleverly BTD for the rally into Christmas!) This chart shows two versions of seasonality over the last forty years: 1) all years and 2) Presidential election years. Dip buyers should be patient this year.

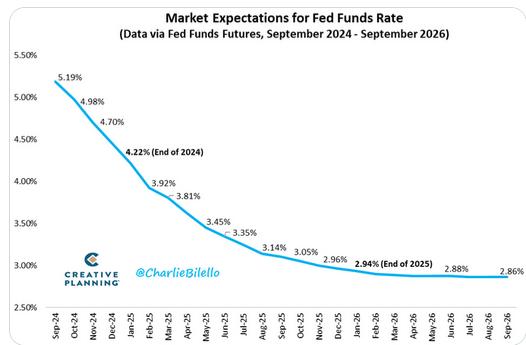

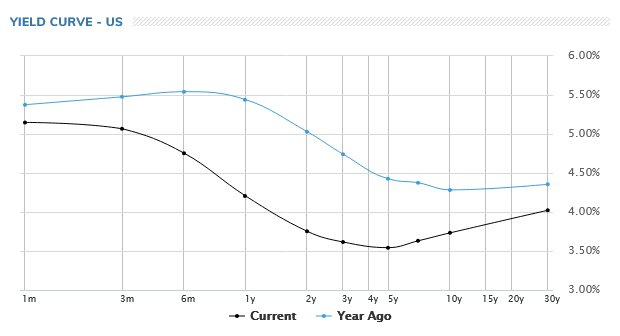

Interest rates: will the Fed cut 25 or 50 bps on September 18?

Bond prices rose every day this week (as S&P prices fell), with the yield on the 10-year reaching 15-month lows.

Friday’s NFP report was “inconclusive” regarding whether the Fed’s September 18 cut would be 25 or 50 bps, but the short end of the curve closed higher on Friday, up ~20 bps on the week.

The forward market is pricing over 100 bps of cuts before year-end, and since there are only three more Fed meetings this year, expectations are for at least one 50 bps cut at a meeting (or expectations may not be met.) This chart was created Thursday before the NFP report – levels were slightly lower on Friday.

The yield curve “uninverted” this week, with the 10-year yield now a few ticks above the 2-year for the first time in over two years.

Currencies

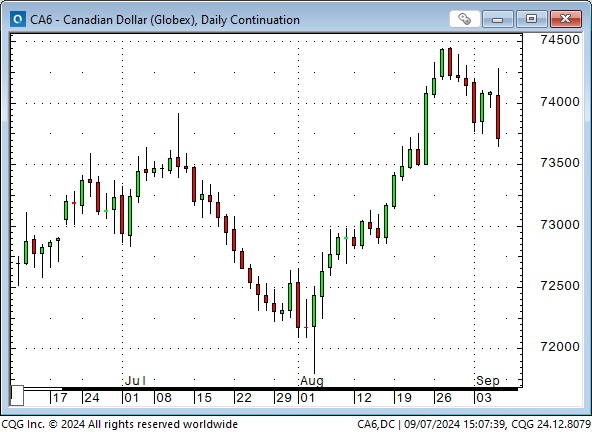

The US Dollar Index fell ~5% from late June to the lows of the past three weeks. During that time, the Yen rallied ~12% from 36-year lows (intervention by Japanese authorities on July 11 sparked the covering of massive speculative short positions). There was also substantial short covering in the Swiss Franc and Canadian Dollar. Given that the rally in the USDX in 2022 was accelerated by the Fed rapidly raising interest rates, the recent decline may have been partly due to expectations that the Fed will aggressively cut interest rates. Overall positioning in the currency futures market is now the most USD bearish in several months.

Speculators in Canadian Dollar futures built a massive net-short position between April and early August but began to cover those positions as the CAD rallied ~2.5 cents to a 6-month high during August. As of the September 3 COT report, ~70% of those net-short positions have been closed. The BoC cut rates by 25 bps last week and is expected to cut another 25 bps at the October 23 meeting.

Gold

Gold traded sideways in a ~$50 range over the last three weeks, while the USD traded sideways. Speculators hold the largest net-long position in over four years. (They are using substantial leverage to hold gold at record-high prices.)

Energy

WTI crude oil fell to a 15-month low this week, down ~$10 in the last eight trading days. Prices fell despite OPEC+ announcing that they would postpone a planned increase in production quotas at their October meeting. The market is likely pricing an expectation of reduced demand in the USA and China. The geopolitical risk premium appears to have shrunk, and crude prices fell in sync with stocks this week. Speculative net-long positioning in WTI crude oil futures has fallen ~37% from the July highs to around 50% of the 5-year average.

Wholesale gasoline prices fell to 33-month lows, down ~20% from July highs.

The energy-heavy Goldman Sachs commodity index fell to near 3-year lows this week.

My thoughts

Over the years, I’ve seen many examples of the market opening with a BANG after Labour Day, reversing August’s price action.

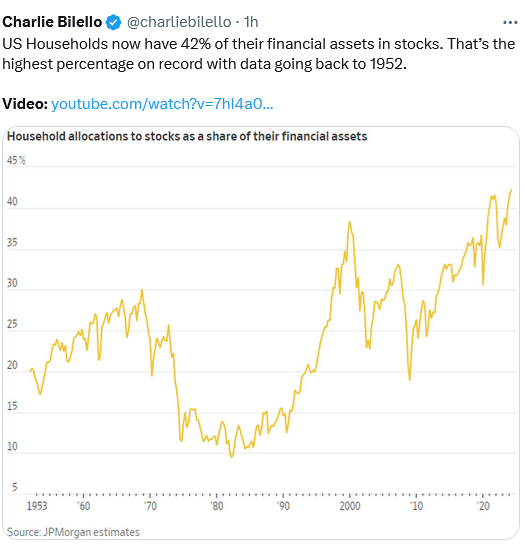

In last week’s Notes, I wrote, “Shares are richly priced. The S&P is trading at ~21X forward earnings (which are at new highs.) This is a momentum market, not a value investors market.”

“Despite (or perhaps because) shares are richly priced, capital continues to flood into the share market with estimates of YTD capital inflow to US-focused stocks at ~$235 billion.”

“Retail did not panic during the mid-July to early August correction, which saw the NAZ tumble ~20% (and the Nikkei ~28%); instead, retail saw the correction as a BTD opportunity.”

I see the S&P as a terrific risk barometer, and this weekly chart shows that risk appetite is cooling. There is a very good chance that it will continue to cool.

There has been a sustained multi-year rally in risk assets, encouraging people to use more leverage, take bigger positions and trade riskier markets. I suspect many of today’s market participants have never experienced a margin call and genuinely believe that, over time, the stock market only goes up.

China is deflationary, with bond yields at record lows and the stock market at 7-month lows.

The US election is less than two months away, and there may be a serious dispute over who won. Will investors with significant capital gains decide to take profits before the election to avoid political uncertainty and the prospect of higher capital gains taxes?

My short-term trading

I started this week short CAD and gold. I was not short the S&P despite shorting it three times last week and getting stopped for slight losses each time. (Trading is not a game of perfect!)

I didn’t find a good setup to short the S&P this week.

I covered the short CAD and gold positions near breakeven before Friday’s NFP report (a risk management decision) and reestablished them at better prices after the report. Those were the only positions I held into the weekend.

On my radar

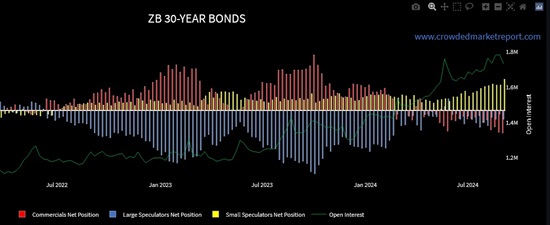

Small speculators have steadily increased their net-long positioning in the 30-year bond futures over the past 3+ months. They are now the most net-long they have been in at least ten years, if not much more. I will be looking for a setup signal to short this market.

Crowded Market Reports produce this chart. I subscribe to this service and highly recommend it to my readers. Jason Shapiro is one of the Unknown Market Wizards in Jack Schwager’s book. The yellow bars are small specs, the blue bars are large specs, and the red bars are commercials.

The Harris/Trump debate on Tuesday evening will kick off intense political activity for the next two (or more months), which will impact the markets I trade.

The CPI report on Wednesday morning may tip the balance on the Fed going 25 or 50 on September 18.

The Barney report

I was away from home Tuesday and Wednesday, playing golf with friends in Victoria (no wonder I didn’t find a good setup to short the S&P). When I arrived home Wednesday night, Barney was delighted to see me and stuck to me like glue. What a boy!

Listen to Victor talk about markets

On the Moneytalks show this morning, Mike Campbell and I discussed this week’s sharp stock market fall, the market’s anticipation of Fed interest rate cuts, gold, and the Canadian Dollar. You can listen to the entire show here. My spot with Mike starts around the 44-minute mark.

This morning, I did my monthly 30-minute interview with Jim Goddard on the This Week In Money show. We started our discussion with a macro market overview and then drilled down on the upcoming Fed interest rate decision, the volatility in the equity markets, copper, crude oil, the Canadian dollar, gold, the US Dollar, and the American election. You can listen to the entire show here. My spot (following my long-time friend and excellent technical analyst, Ross Clark) begins around the 13-minute mark.

Oceanside Special Olympics

The local chapter of Special Olympics is holding its annual golf tournament on September 21 at the Pheasant Glen golf course in Qualicum to raise money for the 50 or so special needs athletes in the Oceanside area of Vancouver Island. This is the chapter’s one-and-only fundraising event of the year. My team will play (and donate) again this year, and Mike Campbell and Martin Murenbeeld (and their wives) will also participate.

Here’s a link with information about the event. Please consider playing, donating, or becoming a sponsor. You will never regret it! Thank you.

The Archive

Readers can access weekly Trading Desk Notes from the past seven years by clicking the Good Old Stuff-Archive button on the right side of this page.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new, usually four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair September 7th, 2024

Posted In: Victor Adair Blog