September 21, 2024 | Trading Desk Notes for September 21, 2024

The Fed cut 50; here’s a quick take on how different markets reacted

The Notes will be brief this week. I’m hosting the Moneytalks show and playing in the Oceanside Special Olympics golf tournament, and we’ve got a houseful of guests who will be golfing with me.

The golf tournament is fully booked, which is good news for the 50 or so special needs athletes in the Oceanside area of Vancouver Island. Please click here if you would like to donate. Every dollar helps and is appreciated! This is the only fundraiser for our local chapter of Special Olympics, and every dollar raised is used to pay for the athletes’ activities.

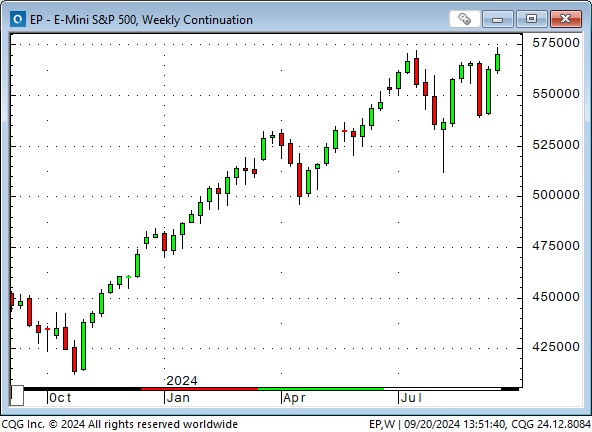

Markets had the usual short-term choppy price action around the cut announcement and during Powell’s presser, but the leading stock indices were slightly lower at the end of Wednesday’s session. They rallied overnight and made new all-time highs early Thursday but turned marginally lower on Friday.

The S&P had another record-high close on the weekly chart.

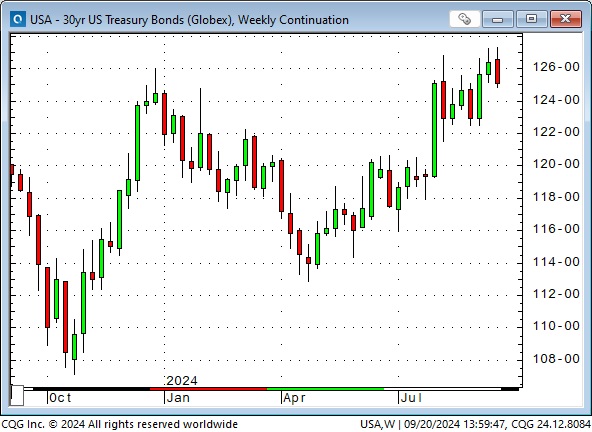

The 30-year bond futures had the highest daily close in over a year on Monday but sold off Tuesday through Friday, with a good chunk of that sell-off happening after Wednesday’s cut.

The weekly bond chart had a Key Reversal Down. As noted last week, small speculators in the long bond held their largest-ever net long position going into the Fed meeting.

Comex gold futures swung in a ~$50 range on Fed Day, hitting new all-time highs but closed in the red. Gold rallied overnight and continued higher on Thursday and Friday to close the week at new record highs. Gold is up ~$825 (46%) from the pre-Hamas lows made last October. COT data as of September 17 shows speculators’ net long positioning at new 4-year highs. The Fed cut helped boost gold, but part of the rally into the weekend had to be inspired by higher Israeli/Hezbollah tensions.

The US dollar index fell to 14-month lows following the Fed cut on Wednesday, bounced back to make new highs for the week on Thursday, but closed lower on the week.

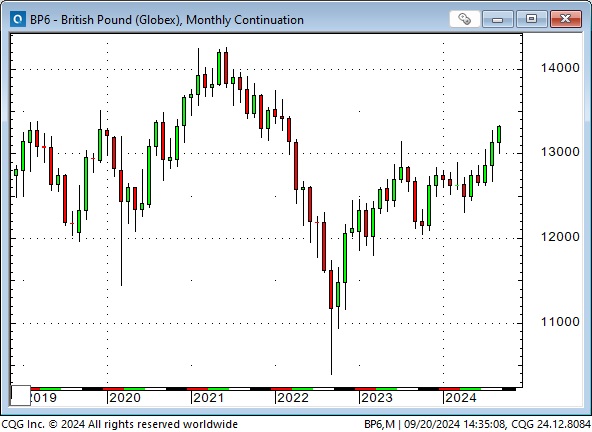

The US dollar index raced to a 20-year high in 2022 as the Fed raised rates aggressively to control inflation. Maybe it “makes sense” that the USDX has weakened over the past three months as markets expected the Fed to begin cutting rates.

The British Pound fell to a 37-year low in 2022 as the USDX soared to a 20-year high. It hit a 30-month high this week.

The Yen fell to a 38-year low in July but rallied 16% to this week’s highs.

The Canadian dollar fell to nearly a 3-year low in early August as speculators built their largest-ever net short position against the Looney. Still, it rallied over 260 ticks during August as speculators scrambled to cover their shorts.

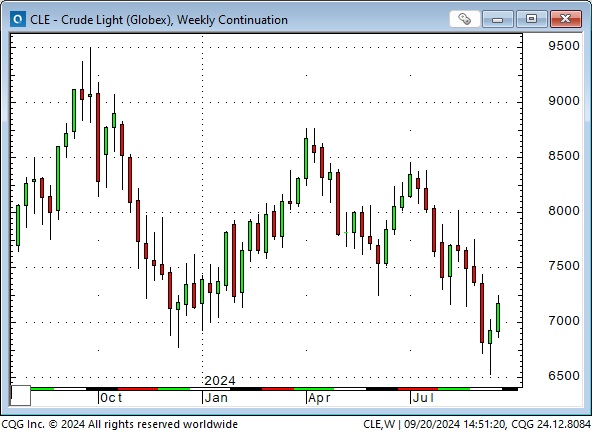

Nymex WTI futures fell to 16-month lows near $65 last week, down over $20 from the April highs when markets worried that Israel and Iran might spark a significant Middle East conflict. WTI closed this week nearly 10% above last week’s lows. Weakening global demand has weighed on prices, but Israeli/Hezbollah tensions may have boosted prices this week.

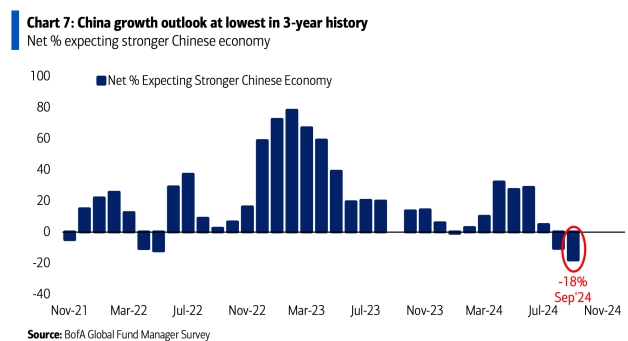

The Chinese deflation story may be more important than the Fed rate cut story

China is on a deflationary trajectory. Some analysts call it a balance sheet recession, which happens when highly leveraged assets (Chinese real estate) collapse in value, but the debt remains, causing investors to delever. (Think of Richard Koo’s description of Japan a few years ago.)

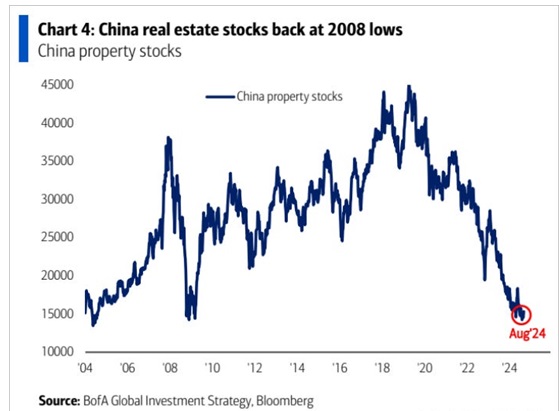

The slump in real estate values is significant because over 60% of Chinese household assets are in real estate. Chinese real estate stocks are also falling.

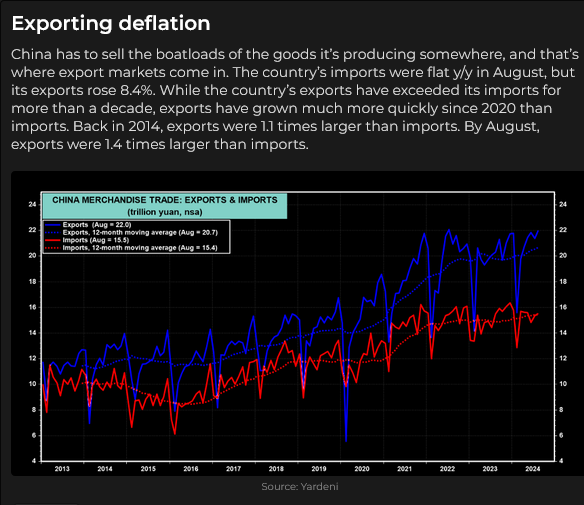

China is exporting deflation to the rest of the world, and the ROW doesn’t like it and is retaliating with tariffs.

My short-term trading

I started this week short the Canadian dollar and long puts on the 30-year bond. I kept those positions all week and did nothing else. At the end of the week, both positions were modestly ahead.

The Barney report

This is Barney’s favourite rock. It’s about four feet high, and he likes the elevated view.

One of our favourite walking places is the abandoned trail tracks that run through the forest near our house.

Listen to Victor talk about markets with his guests on the September 21, 2024, Moneytalks show

My guests this week were Joseph Schachter talking about the energy markets, Ozzie Jurock talking about the real estate market and Rob Levy talking about gold, currencies, stocks and interest rates. You can listen to the entire show here.

The Archive

Readers can access weekly Trading Desk Notes from the past seven years by clicking the Good Old Stuff-Archive button on the right side of this page.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new, usually four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair September 21st, 2024

Posted In: Victor Adair Blog