September 9, 2024 | Jobs, Not Rates

Happy Monday Morning!

The Bank of Canada slashed rates again, the third time in this rate cutting cycle, and more cuts are coming. Markets are pricing in another 50bps of rate cuts by year end. Will this be enough to resuscitate the housing market back to life?

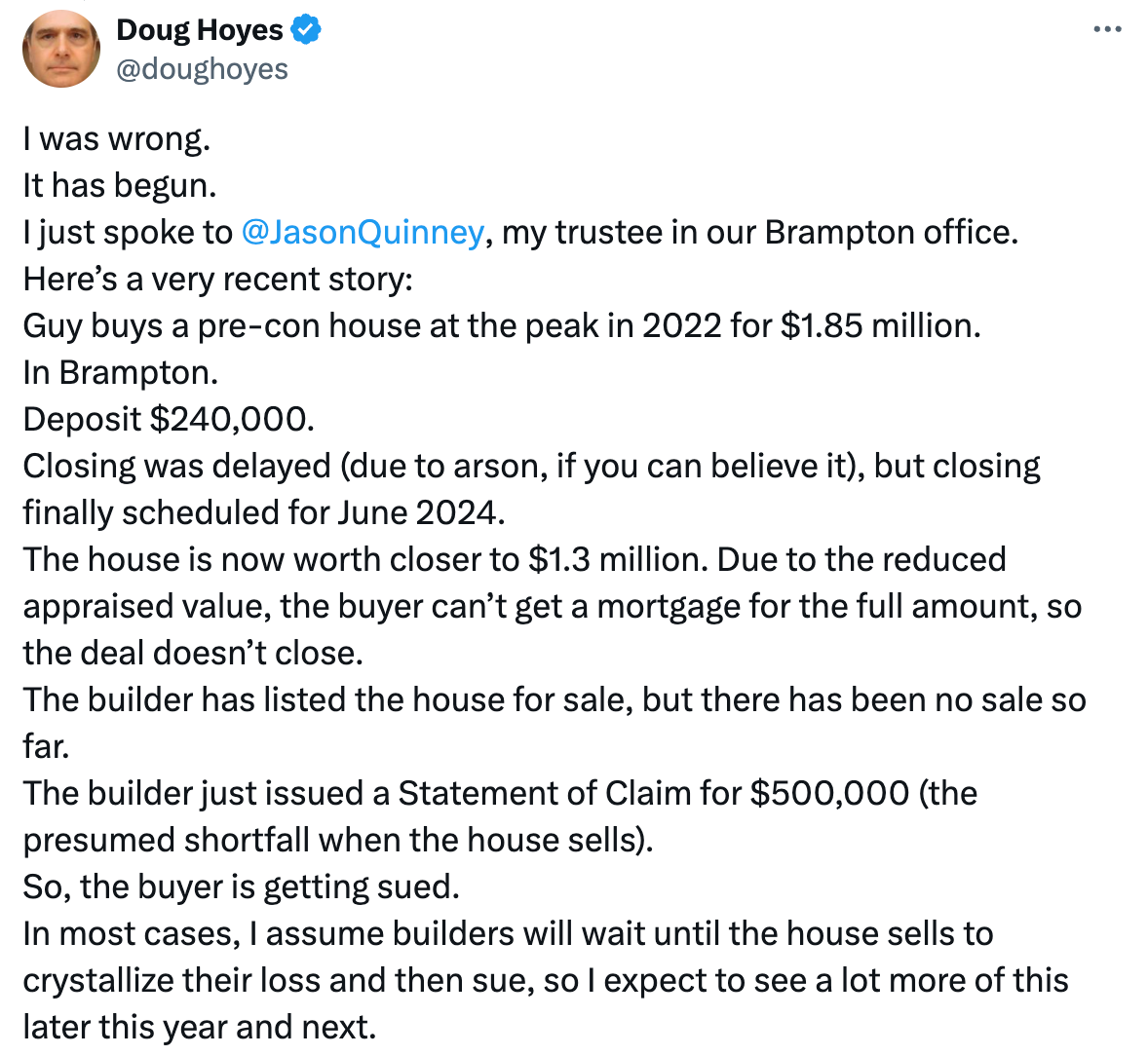

The Real Estate industry certainly wants to belive so. After all, new home sales in the GTA are at 20 year lows, and in Vancouver they’re at decade lows with no signs of perking up. It’s crunch time, with stories of distress piling up. Here’s one from insolvency trustee Doug Hoyes.

Rate cuts won’t save many of these reckless pre-sale gamblers but they will soften the blow for the average borrower. I think its fair to say that interest rates are no longer the primary concern for the housing market, instead we have to turn our attention to the labour market.

Canada’s labour market continued to weaken in August with the unemployment rate jumping up to 6.6%. The unemployment rate has now risen 1.8 percentage points from its cycle low of 4.8% in July 2022. Youth unemployment is now at its highest rate in eight years, and its taking unemployed Canadians longer and longer to find a job.

So job losses are piling up, and real GDP on a per capita basis has declined in 7 of the past 8 quarters. For all intents and purposes the Canadian economy is in a recession. Yet every homeowner we chat with today simply parrots media headlines proclaiming falling interest rates as a reason to be blindly optimistic on housing and to hold the line on listing prices, despite a lot of product still stagnating on the market.

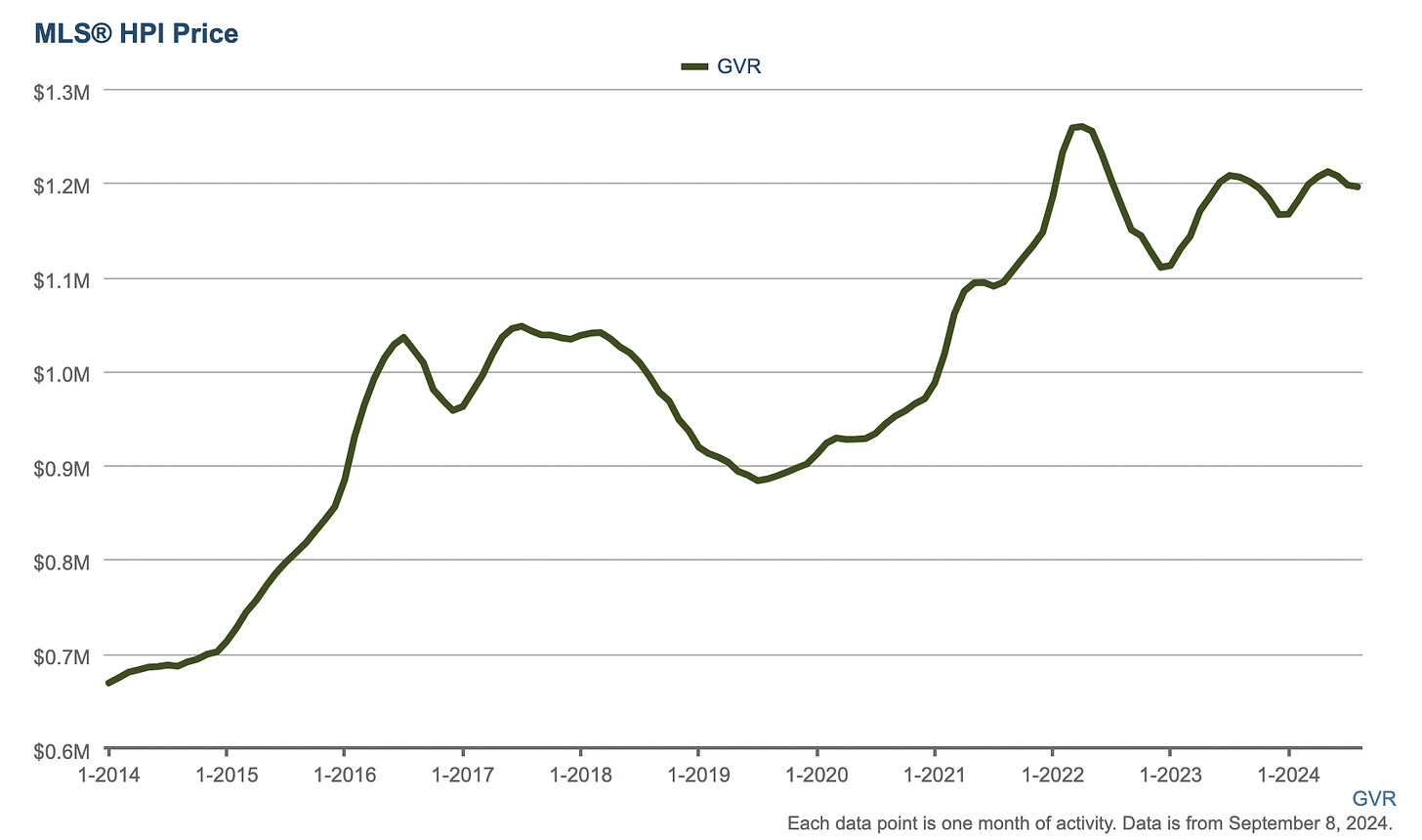

Yes, mortgage rates are lower but home buyers are still proceeding with caution, worried about their job, the economy and still grappling with some of the worst housing affordability of our lifetimes. It’s not like housing has gone through some significant price correction to offset interest rates. Take a look at Greater Vancouver home prices. Their down 5% from the peak, and just 1% over the past twelve months.

In other words, don’t be surprised if declining interest rates fail to spur any meaningful uptick in housing activity and particularly prices.

Even if the BoC cuts rates another 50bps by year end that will bring most variable rate mortgages to around 5%. The problem is most borrowers aren’t going with variable rates, mostly because they’re still priced well above fixed rates. Fixed rates are currently hovering around 4.5%, and even lower when push comes to shove.

Amid elevated interest rates, high debt loads and feeble real estate activity, banks are pulling out all the stops.

During a recent conference call, Dave McKay, chief executive of Royal Bank of Canada- the country’s biggest mortgage lender — confessed that RBC is battling through what he called “historic” and “intense competition.” RBC’s mortgage business is earning just a third of what it used to earn.

Banks are now giving up margin to protect market share. We’ve seen clients quoted as low as 4.3% on a 3 year fixed rate mortgage. We haven’t seen those types of numbers in several years.

This is welcome news for borrowers staring down the mortgage renewal cliff. Coming off a mortgage rate of 2% and renewing at 4% is a lot more manageable than the 6% rates we saw just a year ago.

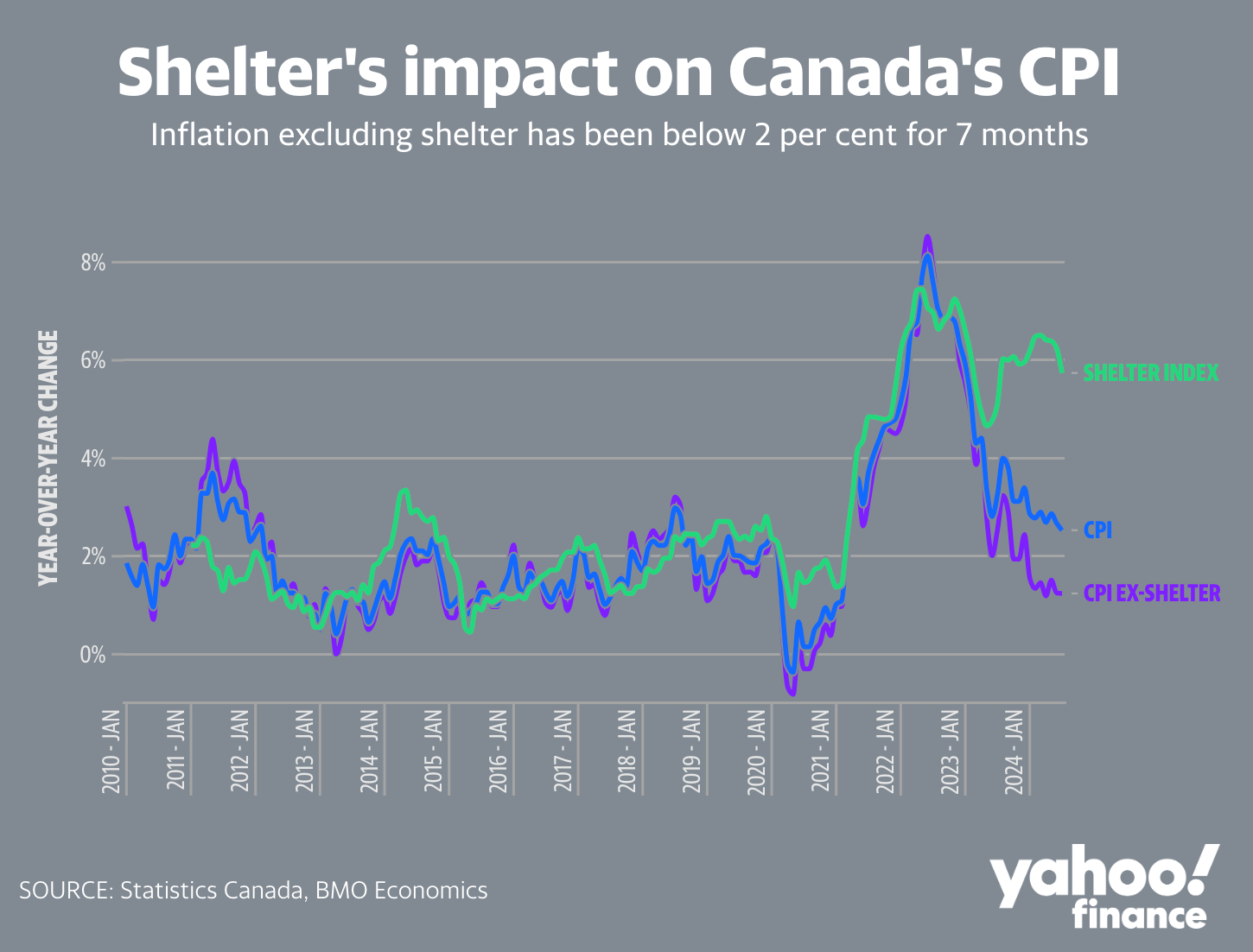

Mortgage interest costs will continue to ease, bringing the lagging shelter inflation component lower in due course, and providing the Bank of Canada further air cover to ease interest rates.

Yes, the rate nightmare appears to be over, but we are far from signalling the all clear. Any lender will tell you, when it comes to mortgage delinquencies there’s only one thing worse than rising interest rates, and that’s job losses.

Let’s watch.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky September 9th, 2024

Posted In: Steve Saretsky Blog