September 23, 2024 | Fire in a Crowded Theatre

Happy Monday Morning!

Last week I wrote a note titled ‘Connecting the Dots’ in which we highlighted the impending crisis brewing in the new construction market. New home sales are at 20 year lows in the GTA, and there’s nearly 10,000 unsold units in Greater Vancouver. People who bought pre-sale near the peak paid way too much, and many units would face appraisal challenges at completion.

In summary, we connected the dots as such, we have a weak resale market that is flowing through into the pre-sale market. Inventory is building, prices are declining, and there’s downwards pressure on rents which looks poised to continue given the softening labour market. If this continues it will add to issues around appraisal values upon completion.

It’s not all doom and gloom though. The reality is lower prices and falling interest rates will improve housing affordability in the near term. The collateral damage are the investors, developers, and lenders who are ultimately responsible for funding future housing supply. In other words, today marks the beginning of the future housing crisis.

Just hours after we dropped that note, the Federal Government announced it was increasing the CMHC insured mortgage ceiling from $1M to $1.5M. Finance minister Freeland called it, “the most significant mortgage reforms in decades.”

So, why now? All you have to do is connect the dots above.

For years the Federal Government has pushed back on lobbying efforts from the mortgage and development community which has been begging the feds to increase the limit from $1M to $1.25M. Suddenly, out of nowhere they announce they are increasing it to $1.5M, and extending 30 year amortizations to first time buyers and any buyer of new construction. Bon Appetite!

While every media outlet was so focused on how this would immediately impact buyers and home prices, they completely missed the bigger picture. The timing of this policy change signals just how worried they are about the pre construction market. This is the Feds oh shit moment.

Of course you don’t shout fire in a crowded theatre so they played it off as a move to help young buyers access the housing ladder.

That sounds a lot better than Falling house prices are bad for our reelection so we’re letting you borrow up to 98% LTV (including insurance premium) on a $1.5M house to keep the bubble going. And by the way, developers and banks are up shits creek without a paddle so we’re going to shift that risk on to the tax payer.

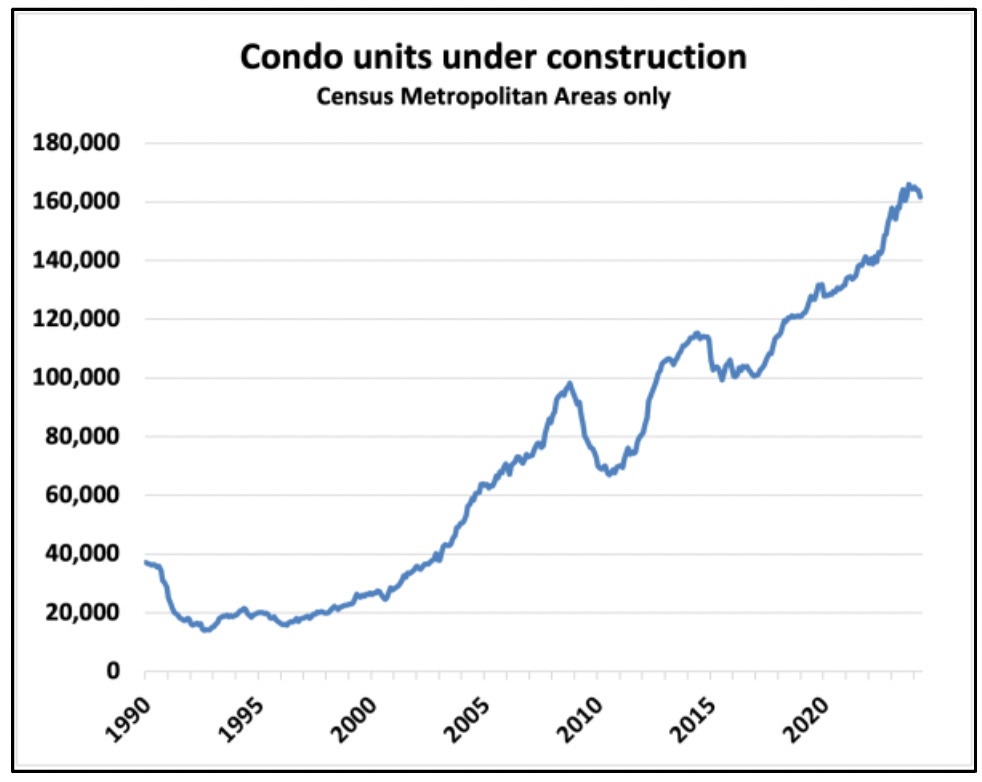

Picture this, there are a record 160,000 condo units under construction across the country. A good chunk of them are underwater. Appraisal risks are a growing concern. There’s a reason Freeland also called this change a “supply side measure.”

Let’s play this out. A buyer of a $1.5M condo is set to complete next year. Under old rules they must put down 20%, or $300,000. The bank provides the remaining $1,200,000.

The condo market has dropped so the bank only appraises the unit at $1.4M. At 80% LTV, this means the bank will only lend $1,120,000. The buyer must now come up with $380,000.

Multiple this across tens of thousands of units and you’ll see the magnitude of the issue. Cue the new rule changes. Assuming the buyer qualifies, they can just take on more leverage and jam the mortgage through CMHC.

On that $1.5M purchase the buyer would only have to put down $125,000. So even with the appraisal shortfall at $1.4M the buyer would only need $215,000 to close. That’s $165,000 less cash needed than before the rules changes!

Crisis averted, we saved the buyer, the developer, and the banks who funded the developers construction loan. So what’s the big deal?

Critics will argue buyers still need to qualify for the increased leverage and that it only applies to owner occupied dwellings. But let’s be honest, a lot of buyers have co-signors, and mortgage fraud is often ignored. When you’re a pre-sale investor at risk of losing your six figure deposit because you can’t close, you’ll go to great lengths to avoid that, including telling your lender you intend to occupy the property as a principle residence.

Isn’t it funny that the Feds had time to change the CMHC insurance limits but not enough time to link CRA with the banks so they can verify income? After all, it’s not like this is a new concept.

Using the CMHC, a taxpayer funded crown corporation to boost housing demand just as prices are falling reeks of moral hazard. Every time housing starts to wobble the feds come in to save the day. We saw this in 2008/09 with the IMPP program, a secret $69B bailout for the banks. We saw it again during the pandemic where Canadians were told they could stop paying their mortgages for six months, not to mention the disastrous zero interest rate policy over the past decade. Every time housing starts to wobble, policy makers rush in to save the day.

What happened to free markets? Housing has become a one sided trade! It’s no wonder Canadians are obsessed with speculating on ever higher house prices.

If you want house prices to become more affordabe they must fall, but that won’t get anyone reelected. PM Trudeau said the quiet part out loud in a podcast with The Globe & Mail a few months ago, “Housing needs to retain its value, It’s a huge part of people’s potential for retirement and future nest egg.”

Everyone wants housing to be affordable, but nobody wants their house to become more affordable. So instead we got CMHC taxpayer funded jumbo mortgages. Has anyone checked in on Evan Siddall?

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky September 23rd, 2024

Posted In: Steve Saretsky Blog