September 27, 2024 | Employment Cycle Drives Reactionary Monetary Policy

Stock markets have soared further on soft landing hopes, just as they initially did when the U.S. Fed cut base rates by 50 basis points in January 2001 and September 2007. Other more prescient leading and coincident economic indicators warn of cause for pause.

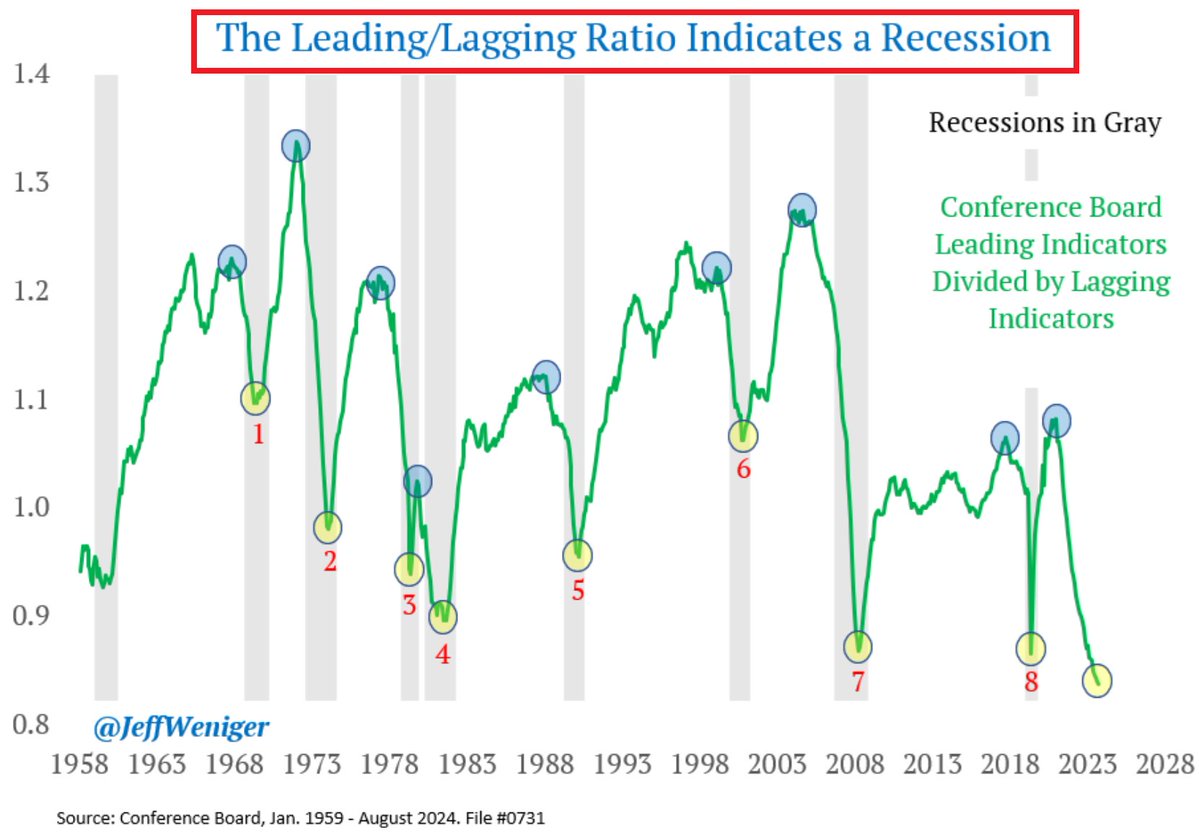

As shown below (courtesy of Jeff Weniger), the ratio of leading economic indicators divided by lagging indicators is now below the pandemic and 2008 financial crisis lows and a level only seen during past recessions since at least 1956 (grey bars highlighted).

At the same time, the Conference Board U.S. Consumer Confidence Index fell in September. Based on consumers’ short-term outlook for income, business, and labour market conditions, the Expectations Index declined by 4.6 points to 81.7, just above the 80 threshold that usually signals a recession ahead. The cutoff date for the preliminary results was September 17, 2024.

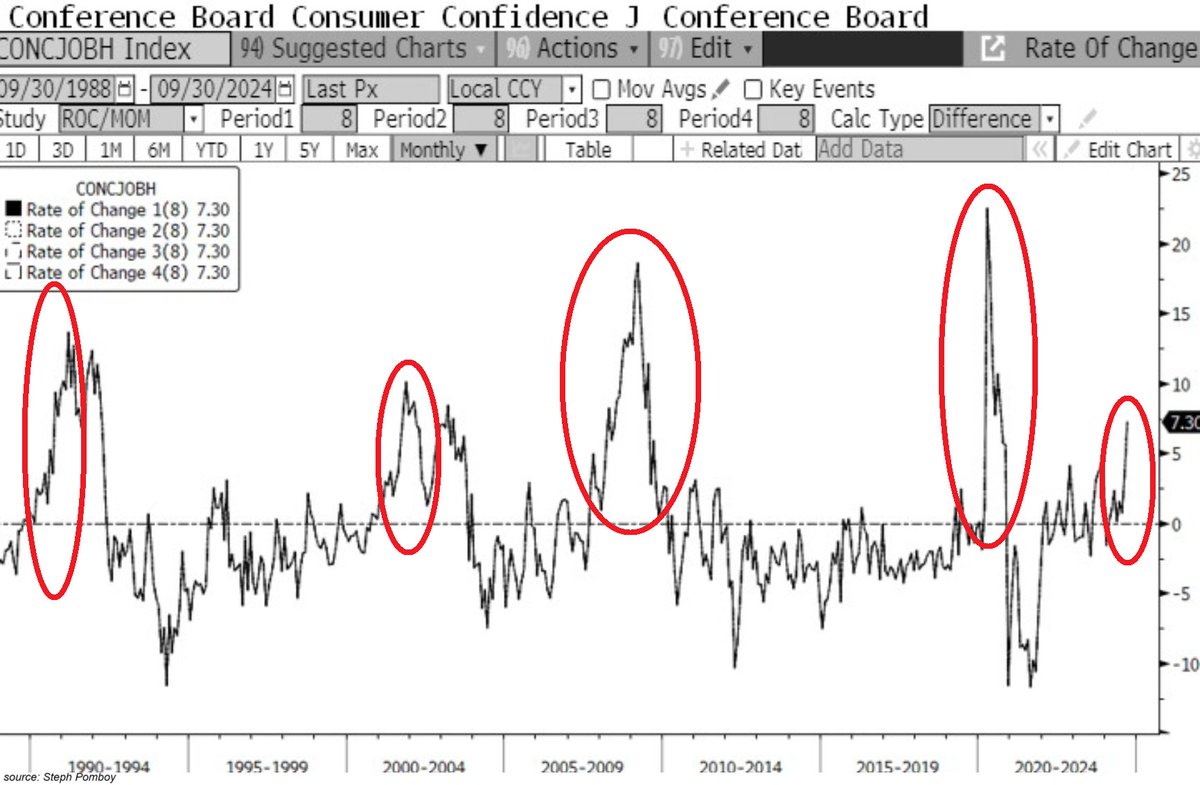

More than eighteen percent of consumers’ appraisals of the labour market said jobs were “hard to get,” up from 16.8% in August. Over the last eight months, the share saying jobs were hard to get has leapt by 7.3 percentage points, a change consistent with previous recessions since the 1980s (as circled below, courtesy of Global Markets Investor).

The ‘gig’ economy allows more people to try food delivery and Uber driving, but as layoffs rise in most sectors, there’s also less demand for food and transportation services.

With the Fed finally easing, it’s worth remembering that monetary changes move with a multi-quarter lag. The unprecedented 22-fold rate increase from March 2022 through July 2023 is still moving through the economy and will be for the next year and beyond.

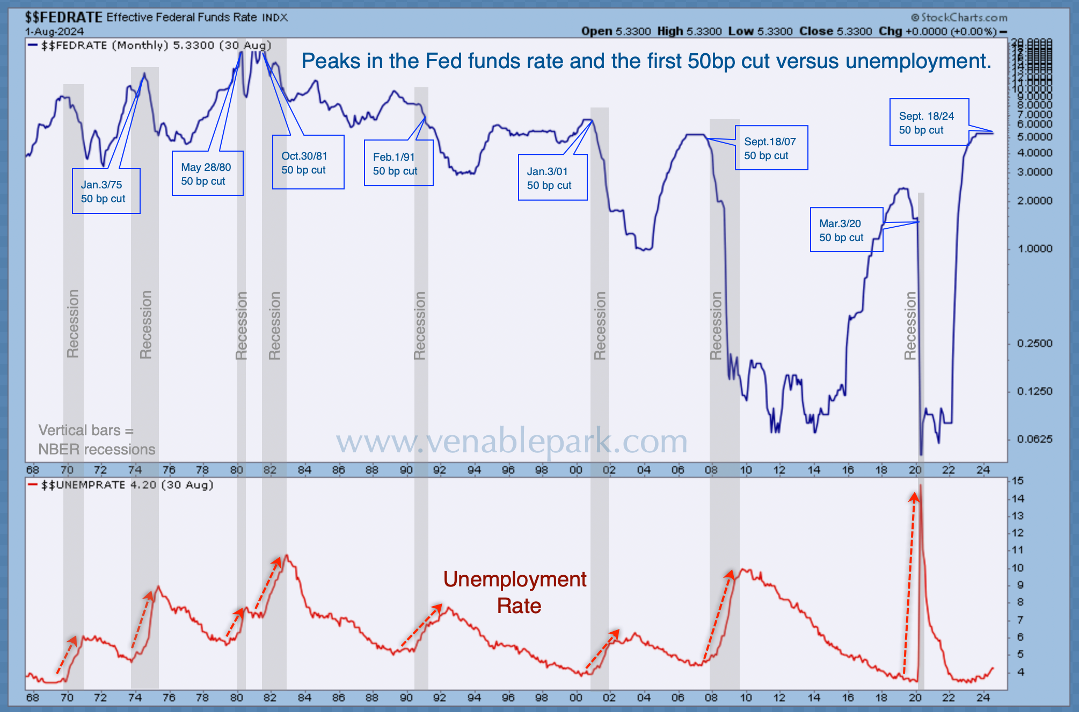

Meanwhile, rate cuts have always been reactionary (50bp reductions highlighted in boxes below since 1968, courtesy of my partner Cory Venable), signalling the onset of the most punishing part of economic downturns and bear markets.

Unemployment (in red below) has risen through past cutting cycles, and recessions (grey bars below) have always started coincidentally or within a few months of a first 50 bp cut.

Employment has a more significant economic impact in consumption-driven economies than interest rates and the stock market. The negative feedback loop intensifies when workers and investors lose income and savings because they all want to raise cash by selling any possible assets.

Manias come and go, on and on. There will always be mobs goading us to abandon reason and gamble. However, self-discipline and avoiding the madness of crowds are critical to building and maintaining financial stability and strength for ourselves and those who look to us for leadership. Well worth the effort.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Danielle Park September 27th, 2024

Posted In: Juggling Dynamite

Next: China Moves into Panic Mode »