September 16, 2024 | Connecting the Dots

Happy Monday Morning!

Today we’re going to play a game of connect the dots. As we already know, the resale condo market is weak, particularly in Vancouver and Toronto. Rates went up a lot, basically destroying the math behind owning rental properties in these two cities.

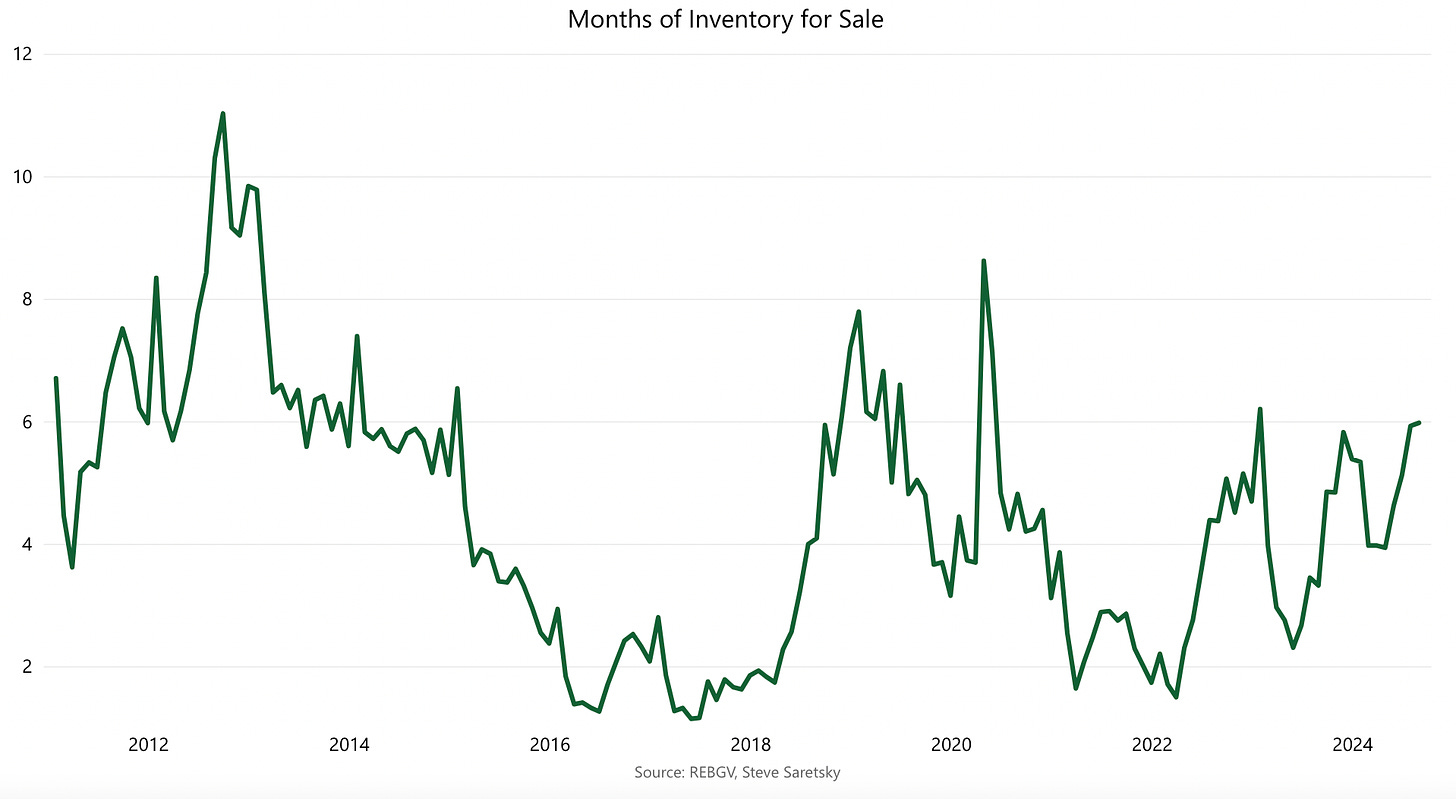

Condo investors are suddenly faced with rising mortgage payments, and unable to pass through costs to their tenants due to government tenancy laws in BC and Ontario. So they are trapped, in many cases hemorrhaging cash on a monthly basis. For some, the simplest solution is to sell. Unfortunately for sellers, supply is now outpacing demand, pushing inventory higher.

We now have 6 months of condo inventory for sale in Greater Vancouver.

This is putting downwards pressure on prices. Good for buyers, bad for sellers. However, here’s where it gets interesting. The weakness in the resale market is filtering through into the new construction market. This makes sense, after all if resale prices are coming down, why pay a premium for a pre-sale condo?

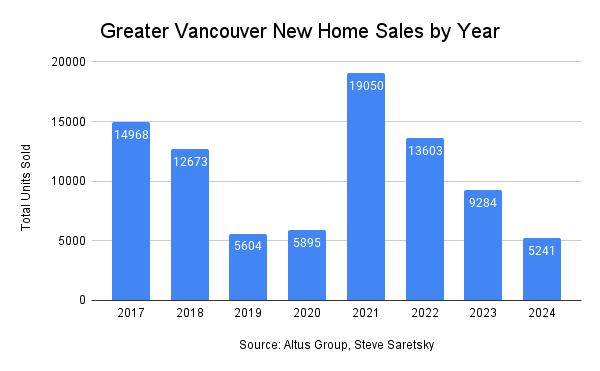

The result is new home sales in Greater Vancouver are faltering. Year to date there are just over 5000 new home sales and the prime selling season is nearly over. Developers have another eight weeks to move product before the fall selling season ends and we slip into the dark and quiet days of winter.

Remember, policy makers have promised us 4 million homes by 2031! Yet new home sales, which lead building permits and housing starts, are weak. It only gets worse in the GTA where new home sales are at 20 year lows!

But let’s stick with Vancouver for now. New home sales are weak. Developers are competing with a shrinking investor base and falling resale prices. There’s only so much developers can cut on prices before profits are wiped out.

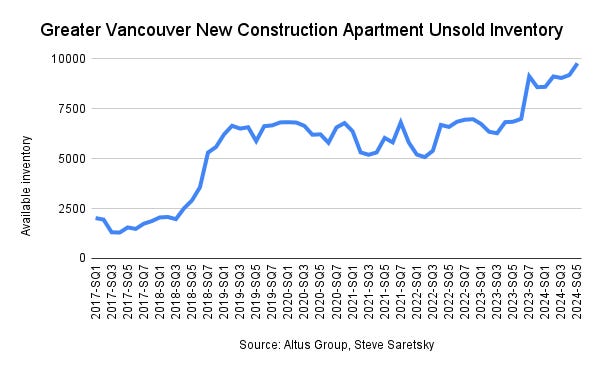

Per data i’ve compiled through Altus Group, inventory is piling up. Developers are sitting on a lot of available inventory. This inventory is predominately off market, and not listed on the MLS. Let’s call it shadow inventory.

So either investor demand needs to return quickly or the discounting will continue. It’s a battle of attrition right now as more developers struggle to keep the lights on.

As we have noted time and time again this year, new housing development is going to come to a standstill over the coming 24 months regardless of how much the Bank of Canada cuts rates.

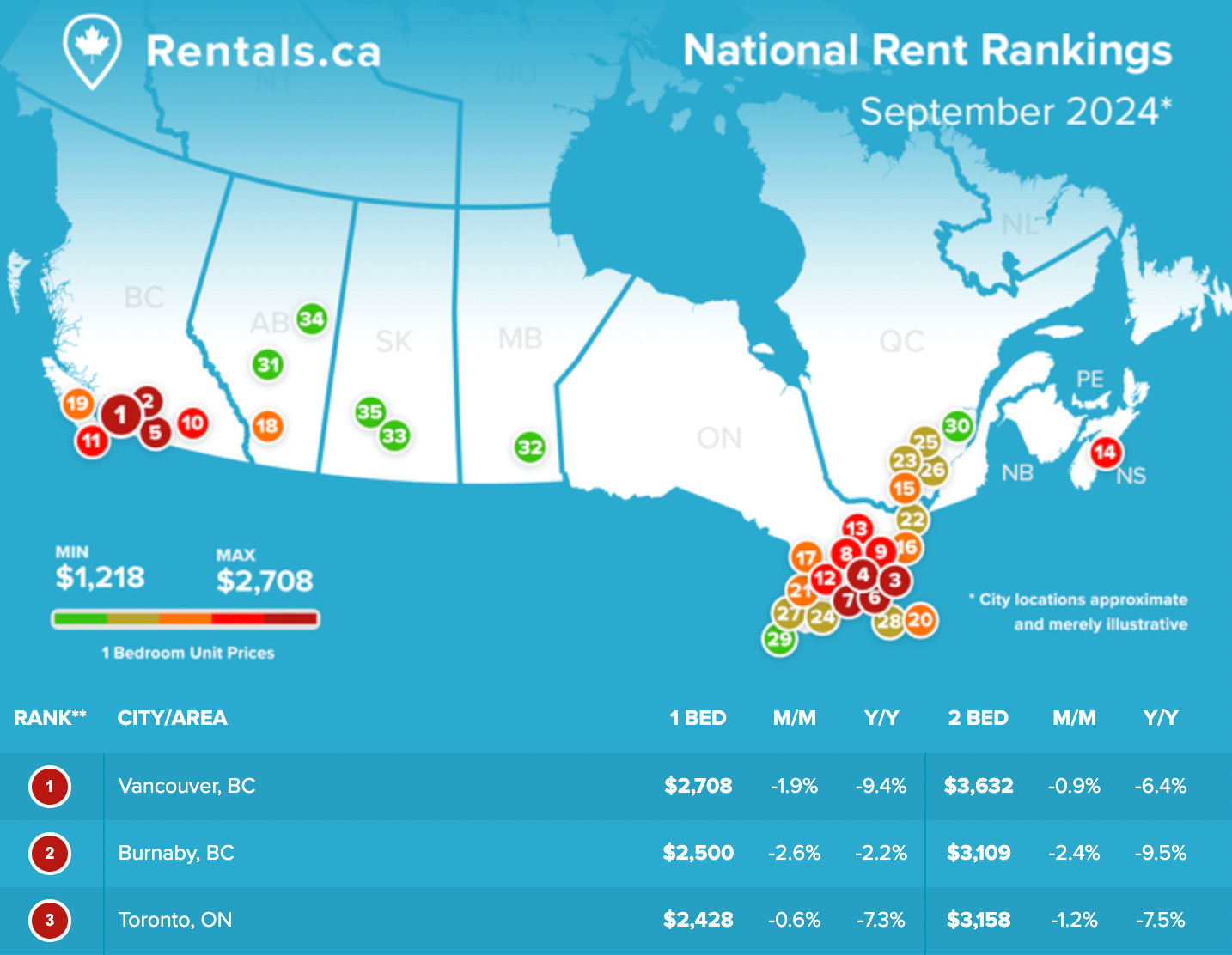

The unemployment rate is up 1.8 percentage points from the lows and poised to push higher in the months ahead. A weakening labour market also impacts the rental market which showed signs of peaking a year ago, and by most measures, rents are now outright declining.

My property managers on the ground are providing anecdotal evidence that lines up with the data above. Yes it’s true, declining rents are good for tenants, but they’re definitely not good for investors or developers.

So let’s connect the dots, we have a weak resale market that is flowing through into the pre-sale market. Inventory is building, prices are declining, and there’s downwards pressure on rents which looks poised to continue given the softening labour market. If this continues it will add to issues around appraisal values upon completion.

It’s not all doom and gloom though. The reality is lower prices and falling interest rates will improve housing affordability in the near term. The collateral damage are the investors, developers, and lenders who are ultimately responsible for funding future housing supply. In other words, today marks the beginning of the future housing crisis.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky September 16th, 2024

Posted In: Steve Saretsky Blog