September 13, 2024 | Chinese Bust Cycle is Contagious

From 2019 to 2022, rounds of “free” money courtesy of central banks and governments fuelled gullibility and blind risk-taking in many countries. The effects were particularly short-lived in China, the world’s second-largest economy, where consumer confidence has been moribund over the past three years (below since 2016).

Hampered by relatively low household incomes and a limited social safety net, Chinese households must save large portions of their income to self-fund things like sick care and retirement.

In 2005-07, as Chinese exports expanded, hopeful households poured what they could into equities, creating a self-fulfilling bubble that drove asset valuations to irrational highs. Chinese stock prices (Shanghai Composite below since 2000) then tumbled about 70% into 2008. Despite a couple of short rebounds in 2014-2016 and 2019-2021, Chinese stocks have slumped since and are today about the same level as in 2006.

Between 2015 and 2021, the masses doubled down on the housing market, borrowing as much as they could in hopes that rising prices would win them financial stability. For many, it did the opposite as debt and overhead costs ballooned.

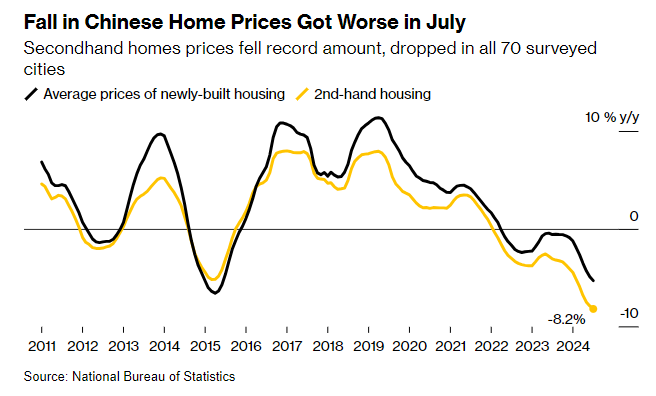

Pressures are now intensifying as home prices fall in many areas. Chinese home prices for new and existing properties have tumbled to 2015 levels in the 70 largest cities (shown below 2011).

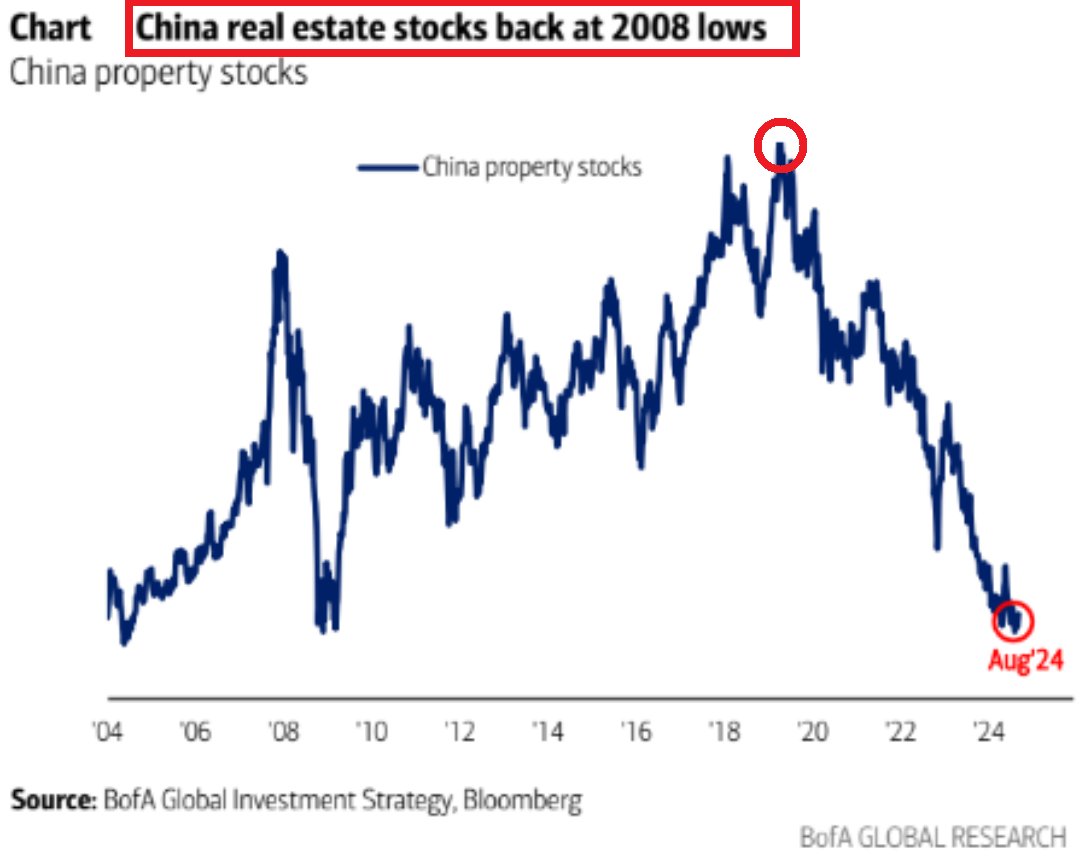

At the same time, Chinese real estate company shares (below since 2004) have slumped more than 80% since 2020 and are now trading at the lows of the 2008 financial crisis.

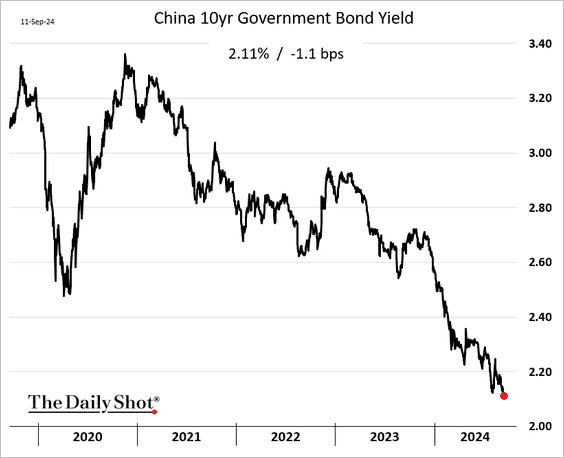

As the economic outlook deteriorates, Chinese government bonds have continued to rise on safety-seeking inflows, and the 10-year government Treasury yield has fallen to 2.11%, the lowest level since 2005 (below since 2019).

With mortgage growth stalled, China’s government is trying new schemes to reduce mortgage carrying costs without wiping out bank lending profits. See China Weighs Cutting Mortgage Rates in Two Steps to Help Shield Banks.

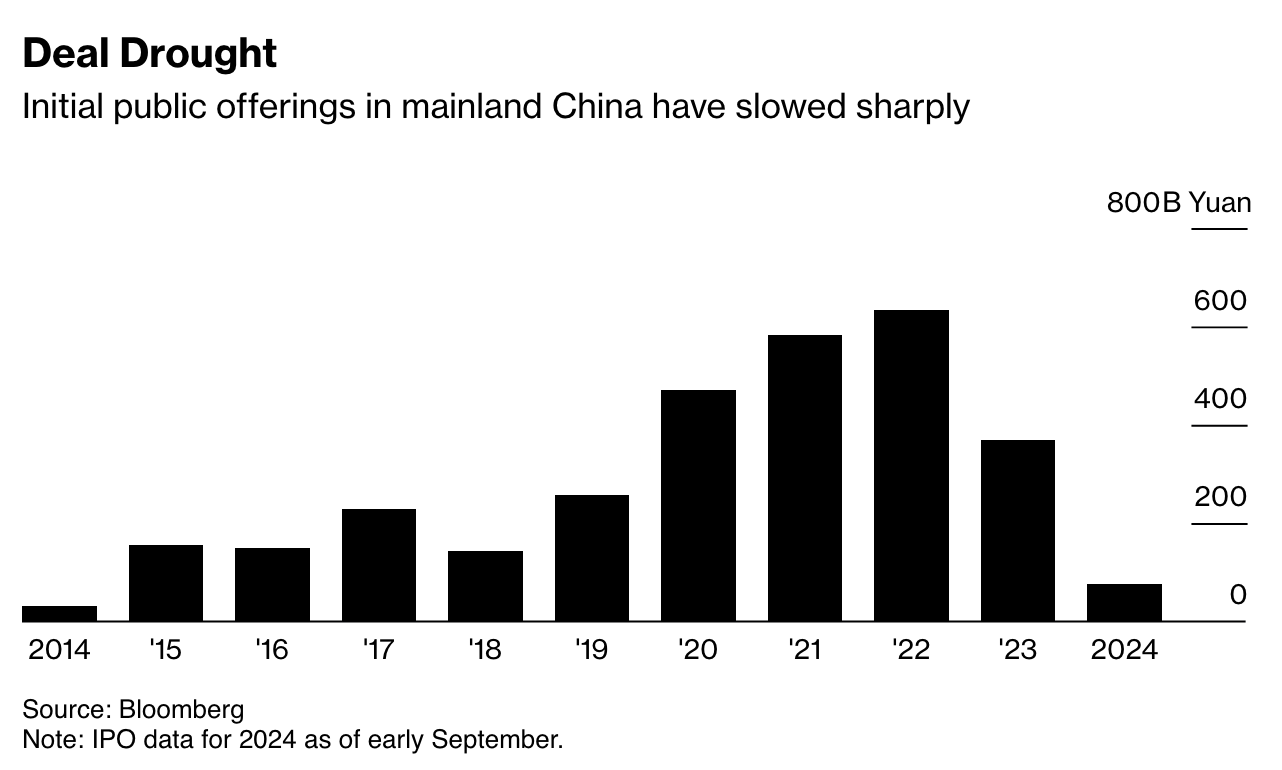

While investment dealers benefited from a resurgence in initial public offering fees between 2019 and 2022 (shown below since 2014), crashing asset prices have extinguished investor interest again in 2024.

Amid rising unemployment and social unrest, it is common for governments to come after the finance sector once their risk-magnifying harm is widely evident. The Chinese government is leading the global charge in an intensifying ‘crackdown,’ see China Detains Investment Bankers, Takes Passports in Corruption Sweep:

Chinese authorities have been trying to clean up the country’s $66 trillion financial sector since at least 2021, when President Xi set his sights on corruption in the industry. Wide-ranging probes have led to the detentions and arrests of numerous financial professionals at Chinese banks, brokerages, asset managers and insurance companies. The most severe punishments for financial crimes have included death sentences or life imprisonment for former top executives of some institutions.

Similar sentiment will likely spread to other countries as economies contract and asset prices tumble further.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Danielle Park September 13th, 2024

Posted In: Juggling Dynamite

Next: China Property Meltdown »