September 13, 2024 | China Property Meltdown

China continues to experience a significant collapse in its property sector, which is weighing heavily on Chinese families.

Numerous attempts at stimulating the sector have failed.

When will China’s property sector start to recover?

There is a view suggesting that Beijing has lost control of the property market, which could be very damaging to the confidence of Chinese residents in their government. An unwritten rule that has existed for decades is that the government would never let house prices fall, which led most Chinese families to put their life savings into properties. Some families own multiple properties in projects that are built but unoccupied, as the ownership of these apartments represents a “store of wealth” to the burgeoning middle class of China.

But there are alarm bells ringing loudly that the party may be over.

Tao Wong of UBS says China’s “growth momentum has been weak”, with “no notable improvement”. The main drag is the property market, with business and consumer confidence weak. Government programs to subsidize unfinished developments have had little impact. But UBS does not expect large new stimulus programs for the economy, unless things get a lot worse.

New property developments, formerly a major driver of growth in the economy, are running at about one-third of peak levels. And these could drop even further as home sales are also very weak. A survey by UBS discovered that 48 percent of respondents had “no intention to buy ever”.

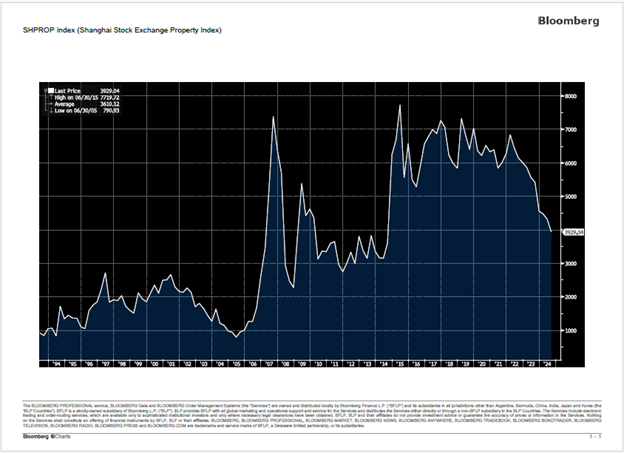

Share prices of large property developers have been slumping for years, starting with a default by China Evergrande in 2021, three years after the company was the world’s most valuable real estate company.

In China the home buyer pays the full cost of the apartment before the project is completed. Many of these buyers are still waiting for some of those projects to be finished by China Evergrande and other developers.

Property company shares are down almost 50 percent from the 2014 high, but could drop further.

The central government in May urged more than 200 cities to buy unsold homes, but only 29 have done so, and in small quantities. Only $1.7 billion or 4% of the available funds have been spent to the end of June.

The Communist Party’s 3rd Plenum in July 2024 highlighted “sustained economic growth” but focused on the transition to “high quality growth”. The phrase “letting the market mechanism play a better role” provided no comfort to developers.

The risk is to the downside as the crisis is now affecting local governments who, as in North America, rely on real estate sales, fees and taxes for revenue.

One potential bright spot is exports as China leads in most aspects of the new energy transition such as solar panels, batteries, wind turbines and electric vehicles. But the U.S., Canada and Europe have announced punitive tariffs on Chinese imports, as high as 100 percent on electric vehicles.

China, the world’s second largest economy, will struggle for years with its current property crisis.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Hilliard MacBeth September 13th, 2024

Posted In: Hilliard's Weekend Notebook