September 6, 2024 | A Weak U.S. Jobs Report

A weakening trend for the economy in the U.S. was confirmed on Friday. A recession is likely, although the official notification of recession will not come until 2025. The Federal Reserve will start to cut interest rates later in September after declaring victory in the battle against inflation.

We seldom get definitive clues regarding the direction of the economy. But recently evidence is piling up to show that a recession is imminent, or has already started, although the “soft landing” faction is still getting the most attention.

The Federal Reserve will take a gradual approach to lowering interest rates for their Fed Funds rate, but the market is already moving interest rates lower before any Fed cuts.

The exact starting date of a recession is not that important except to economists. Usually by the time that the U.S. Bureau of Economic Research makes the recession official key indicators have provided enough hints for investors to make their own assessment.

In a piece in the New York Times on August 16 2024, Peter Coy outlines the methodology used to declare an official recession. The academics on the Business Cycle Dating Committee use this definition — “a significant decline in economic activity that is spread across the economy and that lasts more than a few months”.

The committee watches six indicators closely for signs of a recession. These are household employment, payroll employment, industrial production, manufacturing, wholesale and retail sales, personal consumption and personal income excluding transfers.

But because these indicators will usually be too late to be of much use to investors, many analysts have tried to find a “leading indicator” for recession. The Sahm Rule, named after economist Claudia Sahm, is the most often cited such measure. The Sahm Rule was triggered with the July 2024 unemployment number, which was released in early August, when unemployment in the U.S. rose to 4.3 percent from the low of the cycle in 2023 at 3.5 percent. Here is my post on the Sahm Rule.

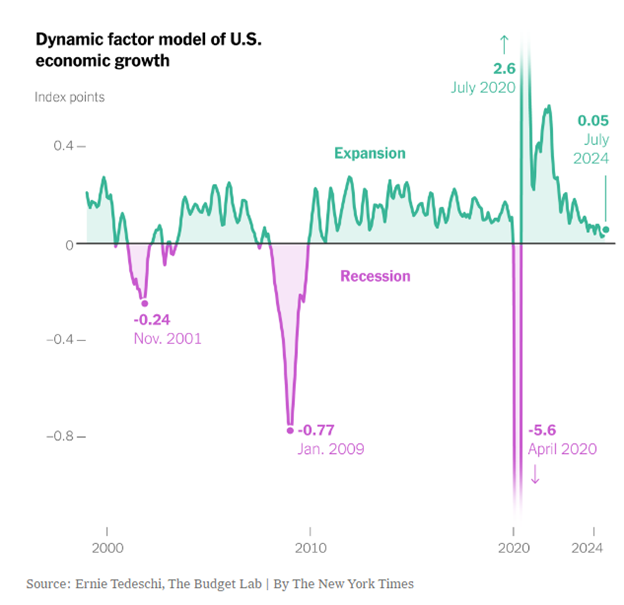

Ernie Tedeschi, director of economics at the Budget Lab at Yale University, uses a dynamic model of U.S. growth, which shows that the U.S. economy is slowing but had not yet reached recession:

On Friday the August unemployment numbers for the U.S. were released and they were generally weak. Revisions to past months were downward, indicating that a weakening trend has been in place for several months.

Jobs had been averaging gains of about 200,000 per month for the trailing twelve months. The revised numbers for June and July plus the release for August show a 3-month average of 116,000 jobs, which is much lower than the normal growth rate that we have been seeing since the short recession in 2020.

These numbers guarantee a Fed rate cut on September 18, which will be the first cut in four years. Although nothing is certain when it comes to predicting the future, it is likely that a recession is here or will be soon.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Hilliard MacBeth September 6th, 2024

Posted In: Hilliard's Weekend Notebook