August 31, 2024 | Trading Desk Notes for September 31, 2024

The bloom is off the AI rose; capital rotates to other sectors

Wednesday’s NVDA quarterly report was strong overall but failed to meet investors’ high expectations; the share price closed the week near its lows, down ~15% from the record highs made in June.

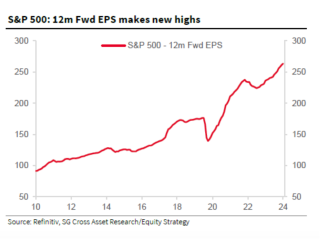

The robust gains from big-cap tech provided most of the gains for the S&P from October 2023 through July 2024. Still, capital is rotating away from the tech sector to other sectors as the S&P and DJIA registered all-time high weekly closes, despite the tech-heavy NAZ being down ~7% from its highs.

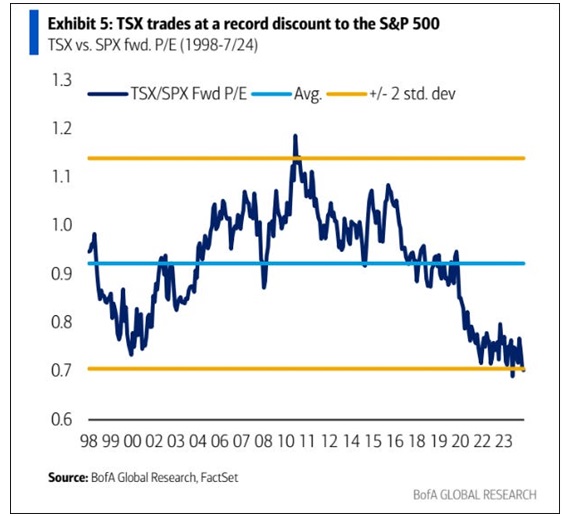

The Toronto Composite Index also had a record-high weekly close.

Shares of Royal Bank of Canada have rallied ~50% since last October’s lows to hit all-time highs this week. (This chart is RBC on the TSE in Canadian dollars.)

JP Morgan shares in New York are up ~66% from last October’s lows.

Shares are richly priced

The S&P is trading at ~21X forward earnings (which are at new highs.) This is a momentum market, not a value investors market. Warren Buffet continues to sell stocks, taking his cash position to new record highs.

Despite (or perhaps because) shares are richly priced, capital continues to flood into the share market with estimates of YTD capital inflow to US-focused stocks at ~$235 billion.

Retail did not panic during the mid-July to early August correction, which saw the NAZ tumble ~20% (and the Nikkei ~28%); instead, retail saw the correction as a BTD opportunity.

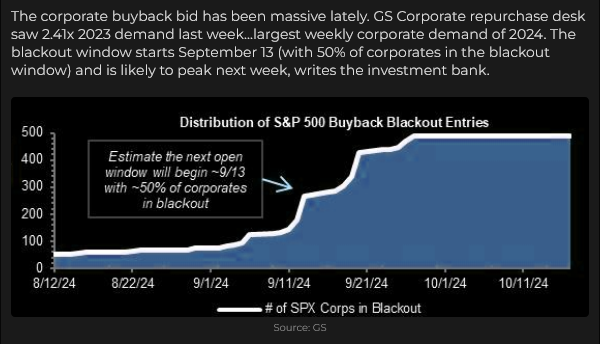

Buyback programs and buying by “systematic” funds (which were net sellers during the early August decline) appear to total more than $10 billion a day currently. The buyback programs will go into a blackout period ahead of September quarterly reports.

Seasonality shows that the 2nd half of September is the weakest period of the year for stocks.

Gold closed August at a record high above $2,500

Comex gold futures have closed higher for seven consecutive months for the first time since trading began in 1975. (Gold closed higher for 10 of the last 11 months.)

Gold rallied ~$730 (~40%) from the October 2023 lows (made immediately before the Hamas attack on Israel) to this month’s close. Gold was the only primary asset that outperformed US tech YTD.

Commitment of traders (COT) data as of August 27 shows net speculative long positioning in gold at its highest level since the COVID panic in March 2020 (specs are more net-long now than they were immediately following the Russian invasion of Ukraine).

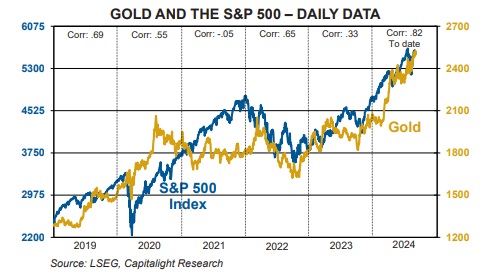

The correlation between gold and the S&P

This chart from my good friend (and internationally respected gold analyst) Martin Murenbeeld (click on this link to get a free trial of his weekly Gold Monitor) shows a tight correlation between gold and the S&P as both markets reached new record highs this week.

Note that both markets made a significant low in October 2022, when the Fed was raising interest rates to rein in inflation. The yield on the US 10-year hit a 15-year high in October. The US Dollar had been soaring and hit a 20-year high in October 2022. Gold had spiked to a record high of ~$2,080 in March of 2022 following the Ukraine invasion, but by October, it had dropped for seven consecutive months, falling ~$460 as higher interest rates and a soaring USD took their toll.

I wondered what the catalyst was for the October 2022 Key Turn Date when the trends in the US Dollar, long bond yields, the S&P, and gold all changed direction. I entered the Archives and read the October 15, 2022, Trading Desk Notes. The defining moment for the turn seemed to be the October 13 CPI report, which was hotter than expected, causing the S&P to fall to new 2-year lows – but it bounced back ~200 points (~6%) to close sharply higher on the day. (A classic example of a news event signal – the market rallied and closed higher after initially falling on “bad news.”) October 13, 2022, was the lowest point for the S&P in the last four years. Gold traded a little lower over the next two weeks and then spiked higher in early November 2022.

So, what now? Will the tight correlation be sustained? Will the S&P and gold soar or fall together, or will the two markets go in different directions? I can easily imagine any of those scenarios playing out. A serious geopolitical scare, for instance, could result in stocks falling and gold soaring.

My intuition (which seems to have been zero for five lately) sees a higher probability of both markets falling together, given each market’s bullish sentiment/positioning level. Still, I’d need a “news failure” or a technical confirmation of a trend change to bet any serious money on that idea.

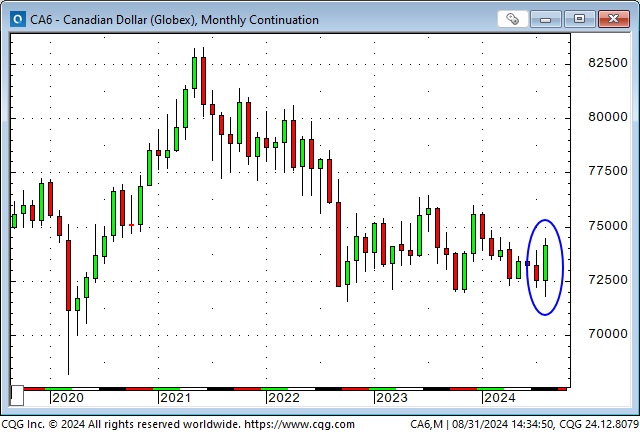

The Canadian dollar

The Canadian Dollar had its best month of the YTD in August, rising ~2.65 cents from the 2-year lows it made on August 5 when the S&P and other stock indices made their recent lows.

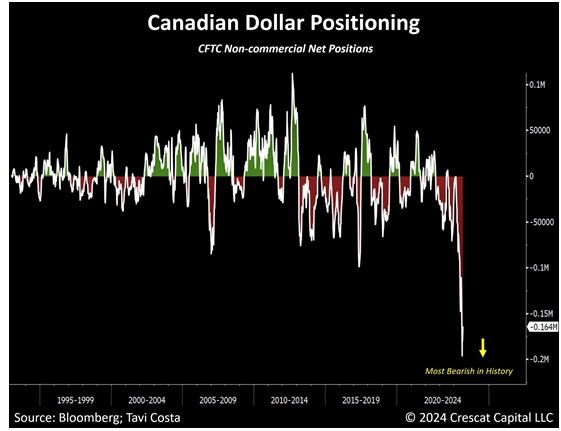

I’ve written several times recently about the “massive” speculative short position built up in the Canadian dollar futures market from March to August. While recognizing that the CAD could continue to fall, my “best idea” was that if the CAD started to rally (for whatever reason), then the speculators holding those short positions (my best guess was that their average short price was ~73 cents) might start covering, which would accelerate the rally.

That seems to be what happened. The COT data as of August 27 shows that net short speculative positioning has fallen about 50% from its peak at the end of July. The Bank of Canada is expected to cut interest rates by another 25 bps at their September 4 meeting.

The Yen

Speculators, spurred on by the July 11 (US CPI day) intervention from Japanese authorities, have covered their massive net short positioning in the Yen and are now slightly net long.

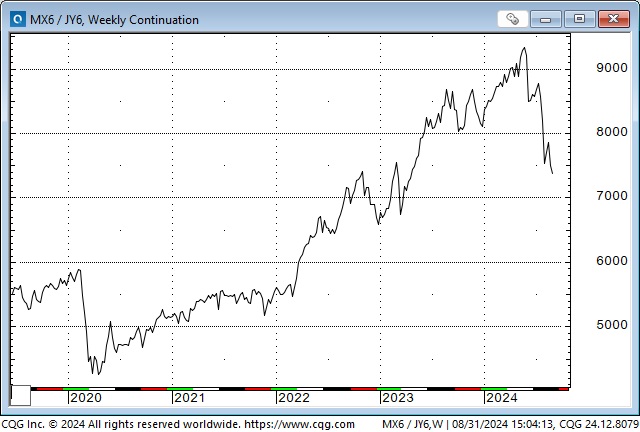

The Mexican Peso

The MEX was the strongest currency in the world earlier this year (11% short rates will draw a lot of carry trade capital), and I wrote several times about the massive rally in MEX/YEN (up 100% from mid-2020 to April 2024, but now down ~20% from the April highs.) )

Speculators built a significant net-long position in the MEX that peaked in early April. The USD rallied in mid-April (triggered by hotter-than-expected CPI), and the MEX began to weaken. The initial intervention by Japanese authorities in April to strengthen the Yen did little to boost the Yen against the USD but caused the MEX to spike lower. The Mexican Federal elections in early June weakened the MEX further, and it has continued to fall on political concerns. Speculators have slashed their net-long positioning by ~80% as the MEX has fallen ~18% from the 9-year highs it reached in April despite Mexican short rates remaining ~11%.

Interest rates

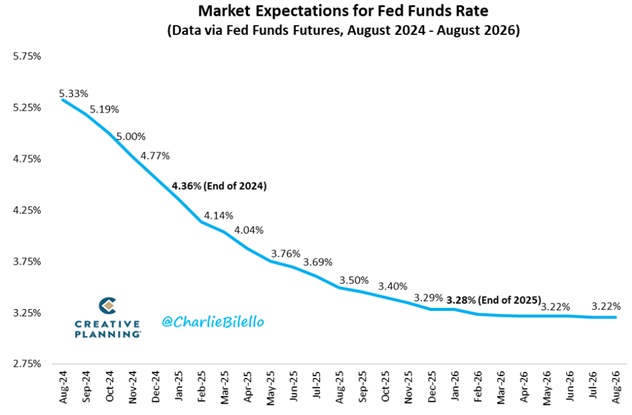

Following Powell’s Jackson Hole comments, markets are “convinced” that the Fed will cut interest rates by 25 bps at their September 18 meeting. If the September 6 NFP data is “weak,” the Fed may cut by 50 bps. The September 11 CPI report would have to be shockingly stronger than expected to cause the Fed to change course.

Energy

WTI prices have been very choppy but have trended lower since this year’s highs were made in early April on “geopolitical stress” (would Israel and Iran go head to head and ignite a conflict throughout the mid-east?) This week’s close was the lowest since January on reports that OPEC+ would consider raising production quotas at their October meeting and continuing concerns about Chinese demand.

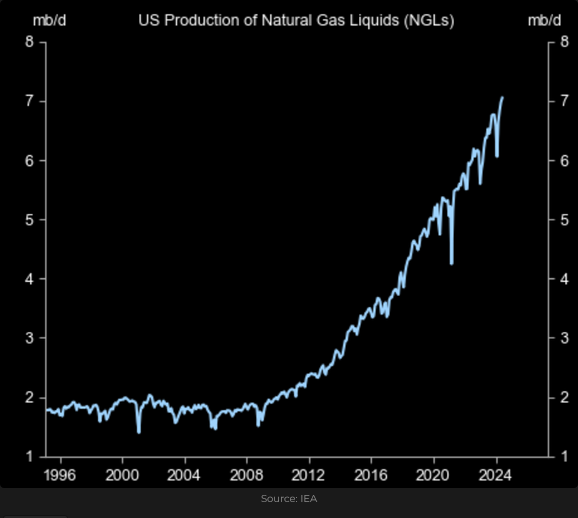

Natural gas prices remain near historic lows.

And the reason for the low prices is…

Grains

Grain and oilseed prices soared following the Russian invasion of Ukraine in March 2022. The front page image for my May 21, 2022, Trading Desk Notes was this Economist Magazine cover:

Chicago wheat prices fell to 4-year lows this week, down ~60% from the post-invasion highs. Corn is down ~50%, Soybeans are down ~46%, and cotton is down ~55%.

My short-term trading

I started this week short CAD and was stopped for a slight loss on Monday. I traded the CAD from the long side for most of August, but I’ve started to think the rally is overdone. I re-shorted it on Friday and carried that position into the weekend.

I shorted gold on Friday and stayed short into the weekend.

I shorted the S&P three times this week and had tiny losses each time, as the market fluctuated in a narrow range for most of the week.

I’m happy to say goodbye to August, and look forward to September!

The Barney report

Summer is winding down too fast for my liking, but Barney and I have had some great off-leash walks this week. He loves to climb up on something to get a better look around. Here he is on a crumbling old fir log on the side of one of our favourite hiking trails.

Listen to Victor talk about markets with Mike Campbell

On this morning’s Moneytalks show, Mike and I discussed the market reaction to Nvidia’s quarterly report and how capital seems to be “rotating” away from big-cap tech to other market sectors. We also discussed the terrific rally in the gold market, the unwinding of the massive short Canadian Dollar position, and the market’s expectations around interest rate cuts from the Fed. You can listen to the entire show here. My segment with Mike starts around the 50-minute mark.

Oceanside Special Olympics

The local chapter of Special Olympics is holding its annual golf tournament on September 21 at the Pheasant Glen golf course in Qualicum to raise money for the 50 or so special needs athletes in the Oceanside area of Vancouver Island. This is the chapter’s one-and-only fundraising event of the year. My team will play (and donate) again this year, and Mike Campbell and Martin Murenbeeld (and their wives) will also participate.

Here’s a link with information about the event. Please consider playing, donating, or becoming a sponsor. You will never regret it! Thank you.

The Archive

Readers can access weekly Trading Desk Notes from the past seven years by clicking the Good Old Stuff-Archive button on the right side of this page.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new, usually four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair August 31st, 2024

Posted In: Victor Adair Blog