August 4, 2024 | The Hunger Games: The Fed Version

I am just a poor boy

Though my story’s seldom told

I have squandered my resistance

For a pocket full of mumbles

Such are promises

All lies and jests

Still, a man hears what he wants to hear

And disregards the rest…

-Paul Simon, The Boxer, 1969

Let the wise hear and increase in learning,

And the one who understands obtain guidance…

He who answers a matter before he hears it,

This is folly and disgrace to him.

-King Solomon, Proverbs 1:5 and 18:13, circa 970-930 BC

The Federal Reserve is between the Rock of Gibraltar and the Rocky Mountains. The data they use to explain their policy choices is in apparent transition. A self-aware analyst, seeing the conflicting data, knows that the right policy choice will only be understood in hindsight.

Monetary policy decisions typically need 12 to 18 months to have an economic effect. That means they must forecast the unknowable at least a year ahead. That’s why rate cuts often happen only after it is clear the economy is already, using technical economic terms, in the toilet. In this case, the Fed let inflation get out of control in 2021 and only began tightening after, as we say in Texas, the horse was already out of the barn and in the north 40.

Now, it seems that Powell and Company will soon begin the process of lowering rates, even though inflation has not reached their “magical” 2% inflation target. This time, they want to be ahead of the curve. But the problem with curves is we can’t see around them.

Paraphrasing Paul Simon, you can justify any decision depending on what data you choose to see, what data you deem most important, and what data you relegate to the appendix. The problem is, from their standpoint, they have to decide something because they painted themselves into a corner. Powell essentially sang, “See You in September.” What data will they see in just 47 days between now and the September 17–18 meeting? It could be anything… like Friday’s employment numbers. But will they want to disappoint the market after they have already teased it? I’ll take the under on that, please.

Quick rant. First, this highlights a point that I have made more than a few times: Why is it that we believe 12 human beings can sit around a table and decide the price of the most important commodity in the world—interest rates on the world’s global reserve currency. The market is perfectly capable of setting that rate on its own. It is the hubris of man, and especially Keynesian Man and their offspring, who think the economy needs managing by wise and thoughtful people and not the mere hoi polloi. It’s the whole elite thing I write about. I mean, these are trained economists with literally a battalion of even more trained economists at their beck and call, so surely we should trust their judgment. I mean, look at their track record (note sarcasm—it is not called the dismal science for no reason).

Now with that off my chest, today we are going to look at some of that conflicting data. And in a more realistic and less self-righteous tone, acknowledge that the Fed has a very difficult call. If they cut rates too soon, inflation could come back with a vengeance. If the economy is truly softening, then not cutting rates could produce a recession rather than the soft landing they want. Honestly, there isn’t enough money or prestige that could make me want to make that decision. It is much easier to Monday morning quarterback.

Half Full or Half Empty?

Let’s start with the half full data. I have long been a fan of Torsten Sløk. He is now at Apollo (I still have fond memories of speaking at their annual client dinner maybe a decade ago) where he seems freer to speak his mind. He is bullish and said months ago there would be no rate cuts this year because the economy would stay strong. Let’s look at some of his data and charts.

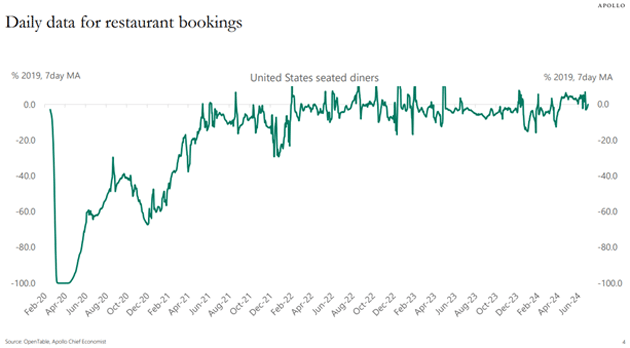

Restaurant bookings have been back at 2019 levels for a long time:

Source: Apollo Global

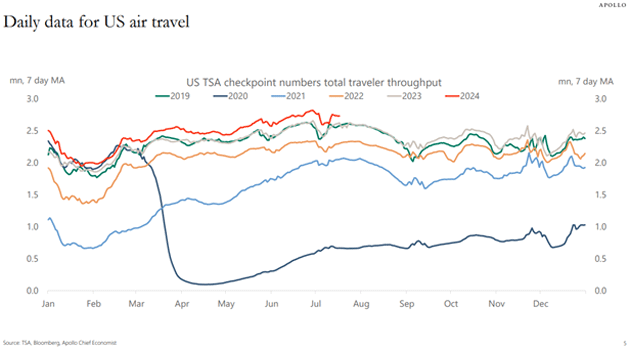

Air travel is solid and above any of the five previous years (2024 is the red line):

Source: Apollo Global

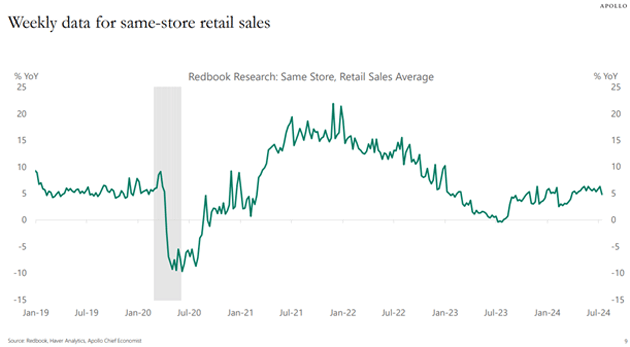

Weekly same-store retail sales growth is solid:

Source: Apollo Global

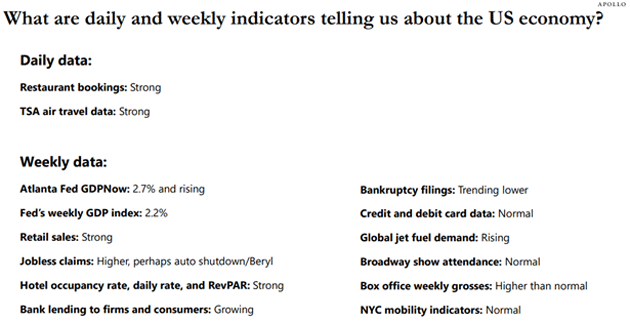

Torsten tracks a lot of data, some of it arcane. Here is his front-page summary:

Source: Apollo Global

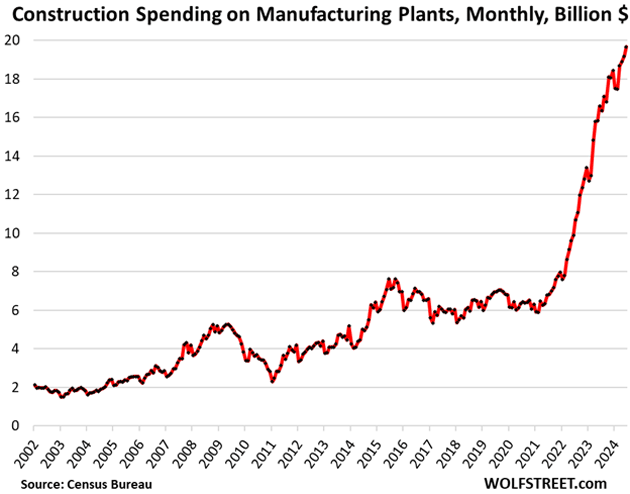

Ok, you skeptics say, Torsten is bullish. What about…? Let’s look at Wolf Richter at Wolfstreet.com (a fun daily read). Construction spending on manufacturing plants is to the moon, Alice! Yes, I know government [read: your taxes] is behind this, but it is real nonetheless. Here’s Wolf:

“Companies invested a record $19.7 billion in June in the construction of manufacturing facilities, up by 18.6% from the already surging levels in June 2023, up by nearly 100% from June 2022, and up by 209% from June 2019, according to the Census Bureau today.

“The investment totals here only cover the actual construction costs of the facilities, not the costs of the manufacturing equipment and installation that can dwarf the construction costs of the building. The total cost of a big chip plant might reach $20 billion, but the construction costs are the smallest part of it. So the total amounts invested in manufacturing plants, including the equipment and installation, are much higher. But here, the amounts only refer to the construction of the plants and can be seen as a directional indicator of total investment in manufacturing.”

Source: Wolf Richter

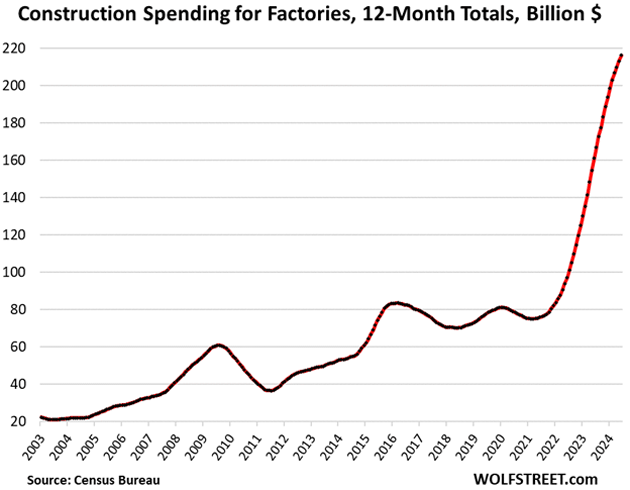

The 12-month total of investment in manufacturing plants jumped to $235.5 billion, up by 19% from the same period a year ago, up by 100% from two years ago, and up by 217% from the same period in 2019.

Source: Wolf Richter

There’s more but it is all bullish, even as inflation for construction (non-residential) measured by the PPI is actually lower.

From Peter Boockvar:

“Q2 productivity rose more than expected, by 2.3% q/o/q annualized. The estimate was 1.8% and follows a .4% increase in Q1. Versus last year, productivity was up 2.7% y/o/y and is the 4th quarter in a row with a 2 handle after a multi-year stretch of subpar growth as we managed thru COVID.

“After a 3.8% jump in Q1, unit labor costs were up .9% and are up .5% y/o/y.”

Productivity up big? Labor costs up y/o/y at less than1%? How is that not bullish?

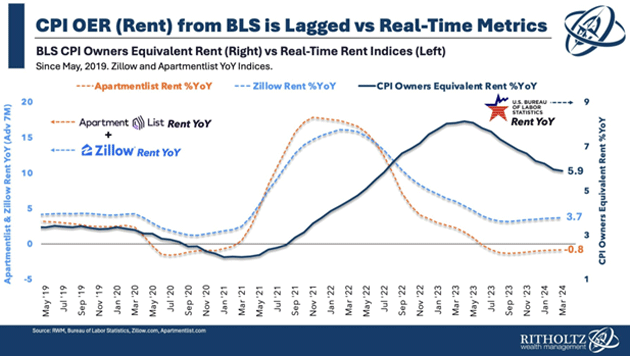

I have written on numerous occasions about the lagging effect of real-time rents versus the CPI owner’s equivalent rent. The CPI runs 12–18 months behind real-world experience, for reasons I’ve outlined. Nonetheless, my friend Barry Ritholtz shows us that rent for apartments (which affects home rentals) is falling. This will have a huge effect on CPI in the coming months:

Source: Barry Ritholtz

Awesome! Unless you own apartments. Note that rents are down even with what many think are millions (we lack precise data) of additional immigrants in the last few years.

Housing construction is only weak in comparison to the hot post-COVID market. Before that, you have to go back to the housing bubble in 2006 to get better numbers.

GDP is better than I had thought it would be at the mid-2% range, which is solid given the times.

Mortgage rates should fall further IF the Fed cuts. Historically, long-term mortgage rates have been something like two percentage points above the 10-year Treasury yield. Recently it’s been more like three points. My friend Barry Habib, continually rated as the best mortgage rate analyst in the US, shared this chart this week showing how the spread is coming down. He believes it will return to the normal range which, combined with lower Treasury rates, could bring mortgage rates down to the 5% zone. This would let many refinance, which would be good for consumers.

It’s All About That Base Unemployment

Powell in his press conference on Wednesday and a speech on Thursday expressed relative confidence that inflation is heading toward their 2% target. For the first time in a long time, he talked about unemployment increasing.

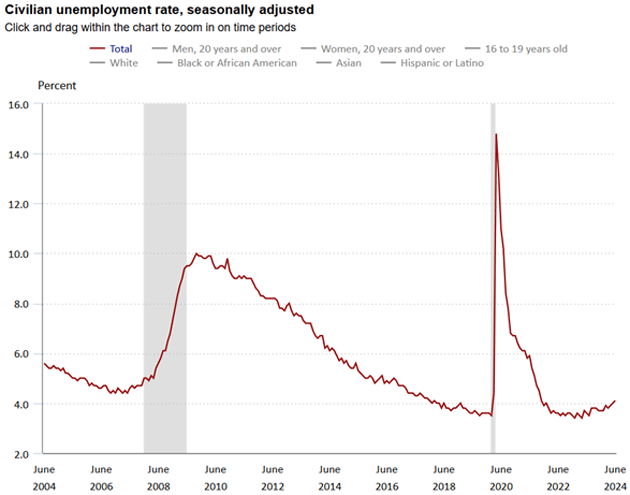

The July data showed unemployment up to 4.3%, still historically low, but still an increase from the recent low of 3.4%. Frankly, it is surprising that employment remains so strong, given the context of history and the number of new potential workers, Let’s look at the chart:

Source: BLS

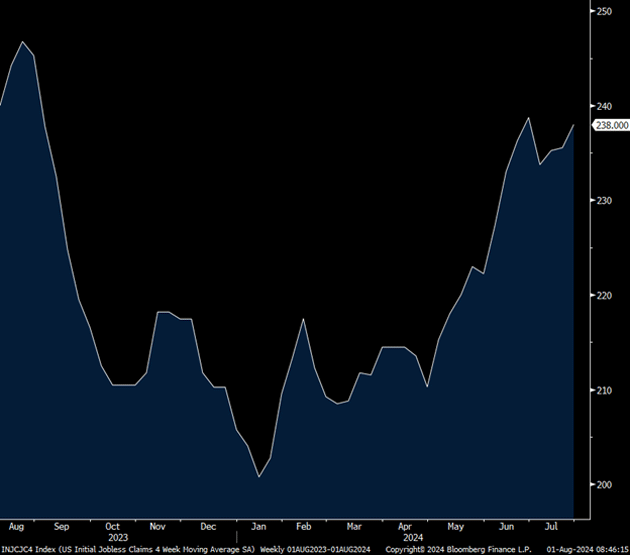

You have to go back 7 years (September 2017) to find an unemployment rate higher than today’s, except for the brief COVID era. But 4.3 is still lower than the go-go years of the early 2000s, before the Great Recession. Unemployment claims are ticking up.

Source: Peter Boockvar

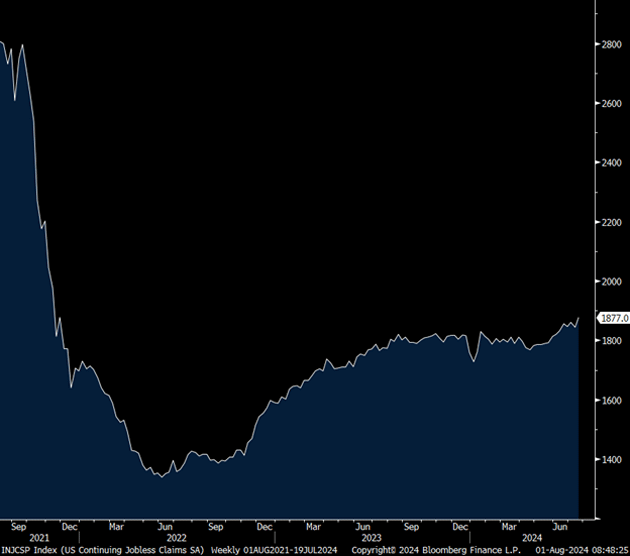

Continuing claims are also rising and they’re clearly on a trend:

Source: Peter Boockvar

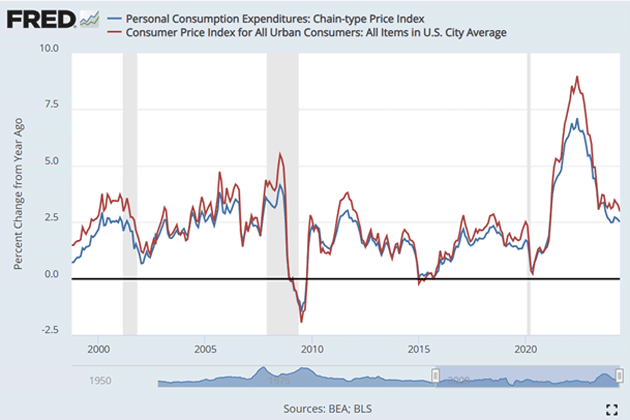

And inflation, in terms of the Fed’s favorite measure, Personal Consumption Expenditures (PCE), is trending down, now at 2.5%.

Source: FRED

More half empty? Non-prime office buildings are selling at steep discounts. Amazon came out this week essentially blaming the consumer for weaker than expected sales.

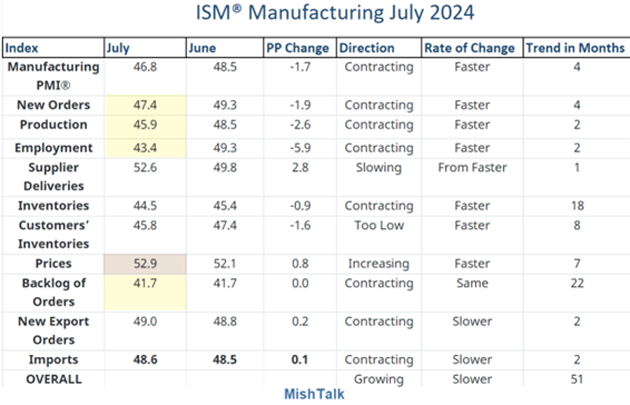

The ISM (Institute of Supply Management) index is the worst since 2020, a deep recession year (H/T to friend Mish via Michael Boyd):

Source: MishTalk

The ADP numbers this week suggest small business payrolls are getting smaller. Small business is the true driver of the US economy.

And I’m sure no one is paying attention, because it is vacation time, but some of the stock market leaders are beginning to roll over. More than just a point or two. Not all stocks, as there are good values out there, but the high-flying tech stocks? The Nasdaq?

Stocks are selling off globally as hopes for a September rate cut give way to the realization that the lagged effects of the Fed’s historic rate hikes are coming home to roost. Japan’s Nikkei Stock Index suffered its second-largest daily drawdown in Friday trading, losing 5.81% (Black Monday was its worst day ever) while its TOPIX (Tokyo Stock Price Index) entered correction territory after its worst two-day rout since 2011. US markets are selling off sharply again after Amazon and Apple continued a string of disappointing Q2 earnings reports by the tech giants.

Dr. Lacy Hunt shared this with me via email after the jobs numbers came out:

“Payroll jobs, although weakening, indicates that the economy is still struggling forward. The average workweek, household employment, full-time employment, overtime, and the U3 and U6 employment rates all indicate the economy is in recession. However, the payroll jobs are the least reliable and their levels will be revised sharply lower when the Quarterly Census of Employment and Wages are incorporated into the payroll data.

“Although few will make the connection, this recession is a direct result of monetary and fiscal policy failure during the pandemic and its aftermath.”

Rate cuts might not be the salvation markets think they will be. Three of the worst sell-offs post WW2 have been preceded by rate cuts. Other sell-offs saw later cuts. I am sure this time is different, though.

I could go on and on, but there are reasons to be concerned about the economy softening. And Powell seems confident about inflation heading in the right direction (I mean, you have to trust the Fed economists), so maybe signal a rate cut which the market wants anyway?

My old friend Dennis Gartman stopped writing his daily letter several years ago, which I had read religiously for decades. He still writes the occasional letter which circulates among some of his friends. I got this note from him today which summarizes Powell’s current position:

“Speaking recently to the Economics Club of Washington, DC, and effectively reiterated at his post-FOMC press conference Wednesday, Fed Chairman Powell was clear when he said second-quarter economic data has provided monetary policymakers with greater confidence that inflation is heading toward the central bank’s 2% target thus raising the odds of near-term interest rate cuts. Making his case, Mr. Powell pointed to the three latest inflation readings. He also made clear mention of the potential risks to the labor market, alongside the Fed’s continued focus on taming prices. He said:

“‘We didn’t gain any additional confidence in the first quarter but the three readings in the second quarter, including the one from last week, do add somewhat to confidence… Now that inflation has come down and the labor market has indeed cooled off, we’re going to be looking at both mandates… They’re in much better balance.’

“Notably, Chairman Powell has consistently said that he and the others on the committee remain committed to their dual objectives of price stability and maximum employment and are firmly committed to getting inflation down to its 2% goal. However, he has noted several times that the path to 2% shall indeed be quite disconcertingly bumpy and the past several months of inflation data offered up just those sorts of bumps along the way; hence, more data and more time would be necessary.”

We should note that several FOMC members have been outspoken in their belief that there should be no rate cuts. I think those objections changed Friday morning. Former New York Fed president William Dudley differs, recently saying they should cut rates now. This is what happens at inflection points. There is no consensus, but the Fed chair clearly sets the tone after what I am told is “rigorous” discussion.

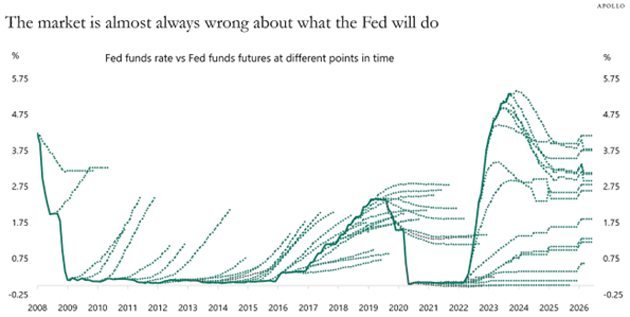

The Market Doesn’t Know Jack

The market expects a rate cut in September, with nearly 100% confidence. But I would remind you, as this year began the market expected multiple cuts in 2024. Here’s another good Torsten Sløk chart via Barry Ritholtz:

Source: Apollo Global

Katniss Everdeen, the heroine of The Hunger Games, was a young lady placed into a position where she had to make decisions she was simply not qualified by experience or heritage to make. But there she was, and she had to make them. There were numerous individuals trying to make her choose one direction or another, all competing for her to rally to their cause, but in the end, she chose her own way.

The FOMC in general and Powell in particular are being pushed and prodded by various interest groups. Just as The Hunger Games was about life and death and ultimately freedom, in a real sense so is the Fed’s decision. Maybe not as directly as the books or movies, but in real life it makes a significant difference. In the past, the Fed has seriously disadvantaged savers and favored large businesses and borrowers. This had consequences. Immediate life and death? No, but it seriously impacted income and the economy for the lower 80% of Americans. That affects health outcomes.

This is damn serious business. I get that the free market can create volatility. But the regulated market can create stagflation and worse outcomes, not to mention cronyism and the unintended consequences of rates that are set too low. Living in the real world, we are forced to live with 12 people setting the price of money. We have to deal with that reality.

Right now, it looks like the Fed will cut in September, pause in October because of the election, and then if the data still softens cut more after the election. Where does it end? What will the data say? It is the future, which no one knows. So, stay tuned.

New York, Salmon Fishing, and my 75th Birthday

I will be in New York next weekend for a few days, with lots of meetings. At the end of the month, I will be fishing with 31 of my readers in British Columbia for salmon, halibut, and cod. I am really looking forward to that. I might make a trip back to New York sometime in September and then the weekend of October 4th will be my birthday, with some friends coming in to help me celebrate.

I am actually surprised at how over-the-top busy I am. Trying to finish a book, which I think is important, plus launching a new business with Dr. Mike Roizen which I think could be very successful because it will help people live longer and better lives. I am actually energized by the challenge and I’m enjoying the team we have assembled, including my daughter Tiffani, to build out 100+ locations around the country and in the world. Honestly, I am getting up earlier in the morning every day, excited about the challenges and opportunities. Retirement is for sissies.

And with that, I will hit the send button. You have a great week. Spend more time with your friends and family, and don’t forget to follow me on X.

Your happily not retired analyst,

John Mauldin

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Mauldin August 4th, 2024

Posted In: Thoughts from the Front Line