August 12, 2024 | Slinging Mud

Happy Monday Morning!

The cost of living and housing affordability remain the top areas of concern amongst Canadians, according to recent polling surveys. We’ve got an important provincial election this fall in BC, and the feds next year. If you’re a policy maker it’s time to look busy and that’s exactly what they’re doing- slinging mud against the wall and seeing what sticks.

In July, the BC Government announced they were extending the time required for eviction notices. Landlords would have to provide four months’ notice to tenants before a personal-use eviction, up from the previous two months. Not that there was anything wrong with the two month requirement to begin with, it’s been that way for decades, with little to no issues. However, it’s election season, after all, so why not four months?

The new requirement would mean purchasers of a property would have to issue a minimum of four months notice to the tenant in order to get vacant possession. Most purchasers today are end-users, and thus, require vacant possession. So if you issuse notice today, August 12th, the clock starts ticking as of September 01. A purchaser would not get vacant possession until January 01, 2025! Since most purchasers don’t want to inherit a tenant, completion and possession would be set for early January. That’s a long time for both the buyer and seller to wait! More importantly, and here’s the kicker, banks do not hold mortgage commitments for longer than 120 days!

In other words, the BC government, in their infinite wisdom, were asking buyers to assume significant risk in purchasing a home without being able to obtain a mortgage commitment. Furthermore, Canada’s mortgage insurance policies (buyers with less than 20% down payment) do NOT allow for purchasers to inherit tenant occupied homes. So if you can’t assume a tenant, and lenders don’t provide mortgage commitments for longer than 120 days then you how can you possibly purchase a tenanted property? You are, as they say, up shits creek without a paddle.

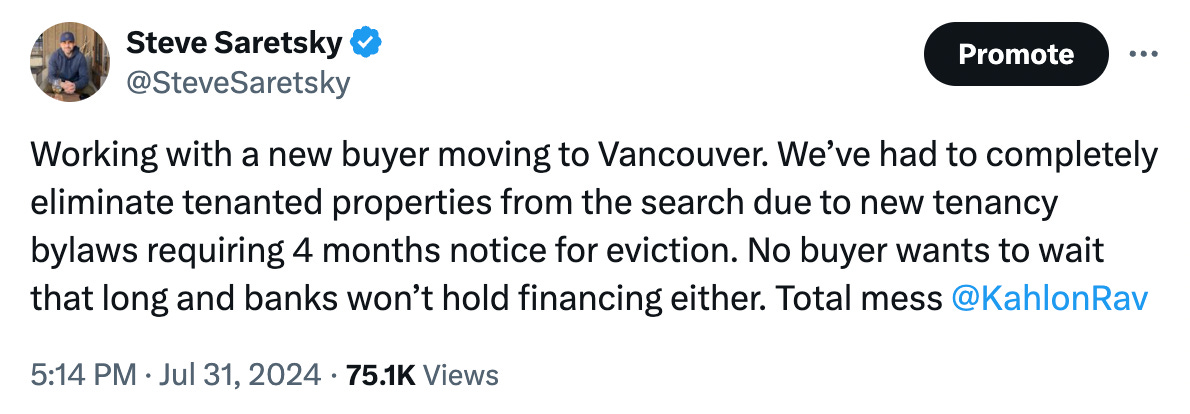

Some of our buyers were having to avoid tenanted properties altogether from their search.

This is what happens when you sling mud against the wall and enact policy without consulting anyone in the industry. I am perplexed as to why they didn’t pick up the phone and call a property manager or a banker prior to making such drastic changes to the tenancy laws.

To the BC Governments credit, the day after my tweet above, they walked back the eviction notice from 4 months to 3 months. A happy medium, I suppose.

Still, it begs the question, how many other policies are being created on a whim, without thoughtful consideration or input from those in their respective industries?

Look no further than the recent AirBnB bans. I’ve talked a lot about AirBnb policy in recent weeks. It is clear that we need to regulate short term rentals, but figuring out where to draw the policy line is certainly up for debate. The BC Governments heavy hand effectively banned AirBnb, limiting it to individual rooms in your primary residence, or basement suites. The city of Kelowna, a tourism hot spot, took it one step further and banned it entirely.

It’s going about as well as one would have expected.

They squashed AirBnb, but they’re taking Kelowna’s $2.4 Billion tourism sector down with it. It begs the question, is the juice really worth the squeeze?

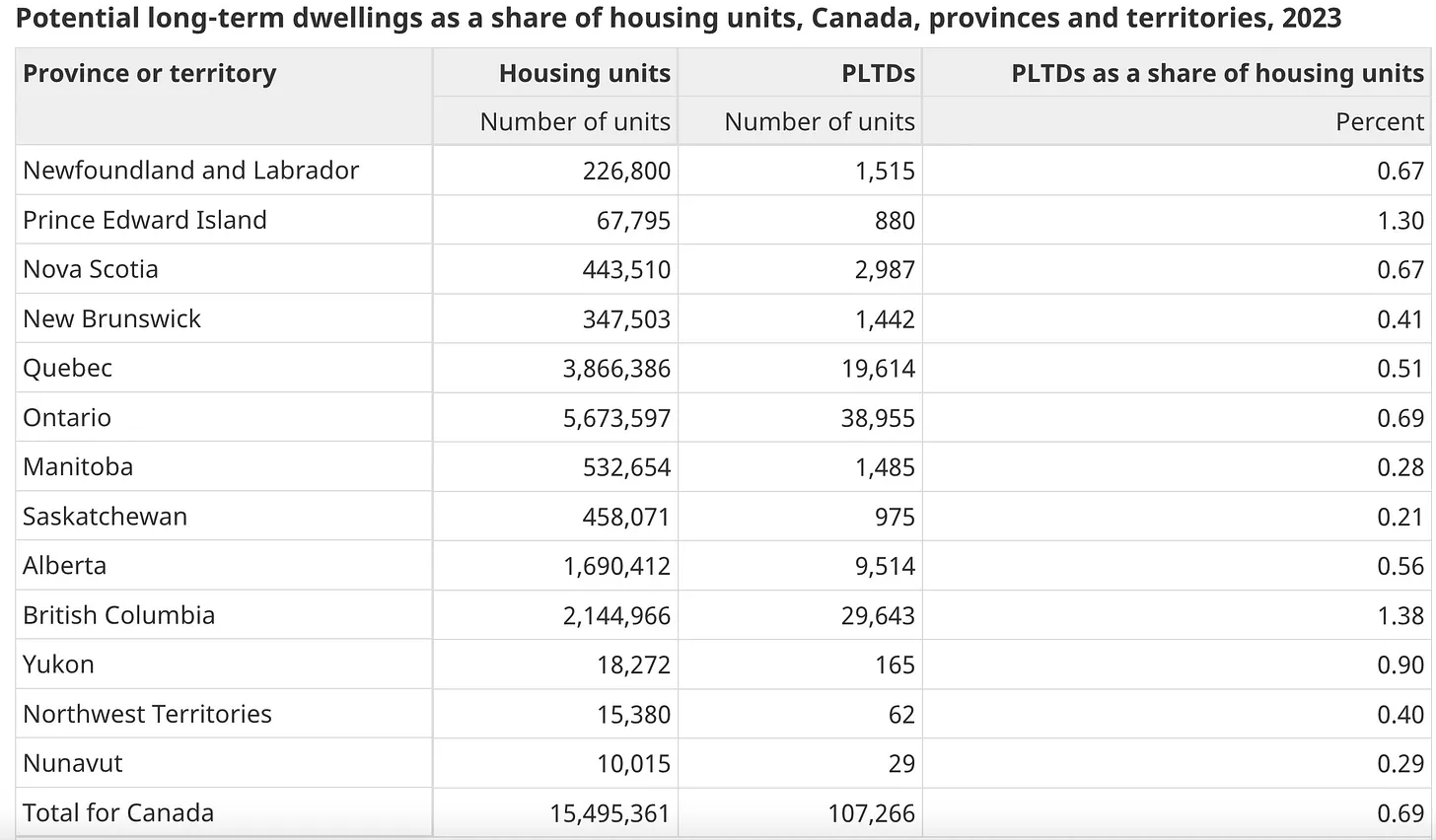

Recent data from Stats Canada suggests AirBnb, while growing, still remains a very small fraction of the overall market. In fact, in BC, they account for 1.38% of the total housing stock.

In other words, if we completely banned all the AirBnb’s operating in Canada this would free up 107,000 homes. I suppose if we were to assume all of these homes hit the market immediately all at once it would put a dent in home prices and rents. But when you zoom further out, this one time addition of 107,000 homes is less than HALF our annual housing completions in any given year. At the current run rate of immigration, it’s enough housing to accomodate about three months worth of immigration!

Quite simply, we are missing the forest for the trees.

Again, nobody is suggesting we don’t set policy and regulation on AirBnb, however, a one size fits all approach is certainly not the answer.

We can’t magically build a whole bunch of new hotels overnight. In fact, thanks to government policy it actually takes several years, and that’s just for the permits.

Ironically, investors seek out stability in government and government policy when deciding to deploy their capital in things such as housing and hotels. Something to consider.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky August 12th, 2024

Posted In: Steve Saretsky Blog

I would never buy a home with a tenant in it. I would think it extremely un-gentlemanly to kick someone out of their home simply because I have more money. There IS something called “class” you know.