August 29, 2024 | Recession Watch: Deep-Discount RVs, Worst-Ever Stock Market Breadth, Frozen Housing

Let’s start with the concept of “big toys.” These are things like boats, jet skis, and RVs that people (okay, guys) tend to buy after they’ve had a few good years and conclude that job security and rising pay are now guaranteed for life.

Because this hubris peaks near the end of expansions, spiking demand for big toys signals that the economy’s clock is about to strike midnight. After that comes collapsing big toy demand and plunging prices for things like RVs, followed by the inevitable recession.

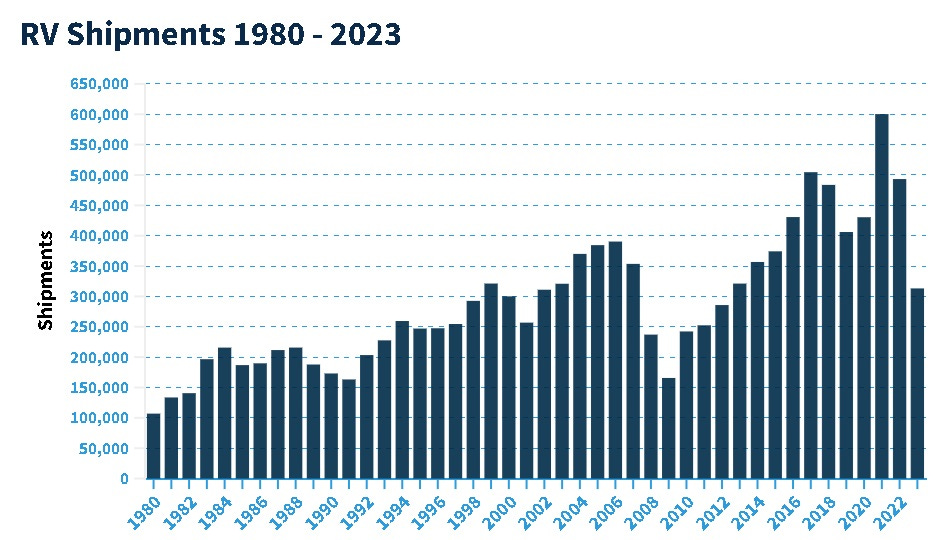

What’s the “RV indicator” saying these days? According to the RV Industry Association, shipments fell hard in 2023, and so far this year the biggest RVs (type A) are down another 31% y-o-y.

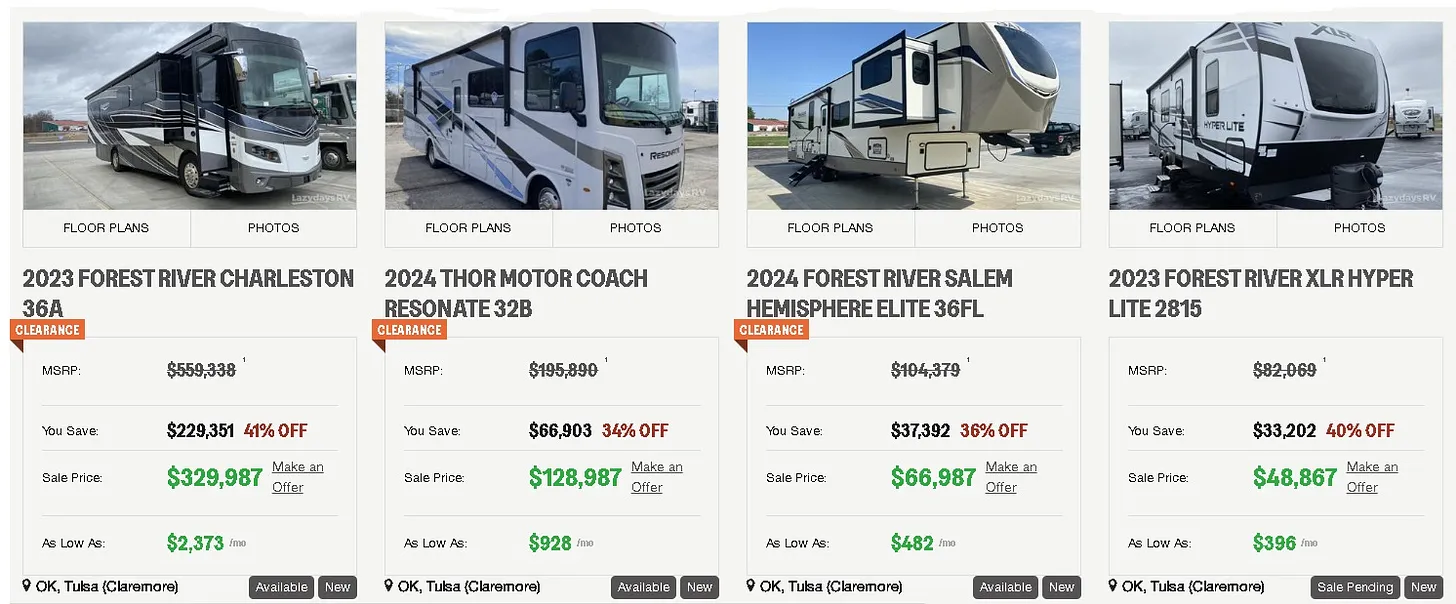

On the LazyDays RV website, many high-end trailers and motor homes are being discounted aggressively.

To sum up, big toys have entered the “crash” stage of their boom and bust life cycle.

Stock Market Breadth Is Terrible

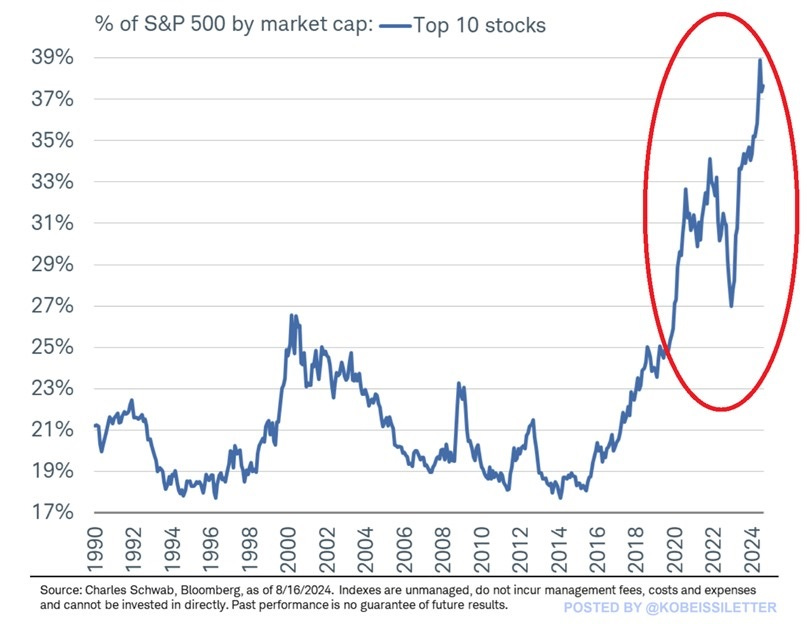

Late-stage bull markets are usually supported by an ever-narrowing group of stocks that seem, for various (always false) reasons, to be bulletproof. This time around it’s Big Tech, in particular AI stocks like Nvidia. And today only 10 of them account for nearly 40% of the S&P 500’s market cap. Note on the following chart that this reading is even more extreme than during the 1990s dot-com bubble.

Homebuilders Are Confident, Home Buyers Are Emphatically Not

Builders can offer perks like mortgage subsidies, which individual sellers can’t match. So new houses are selling.

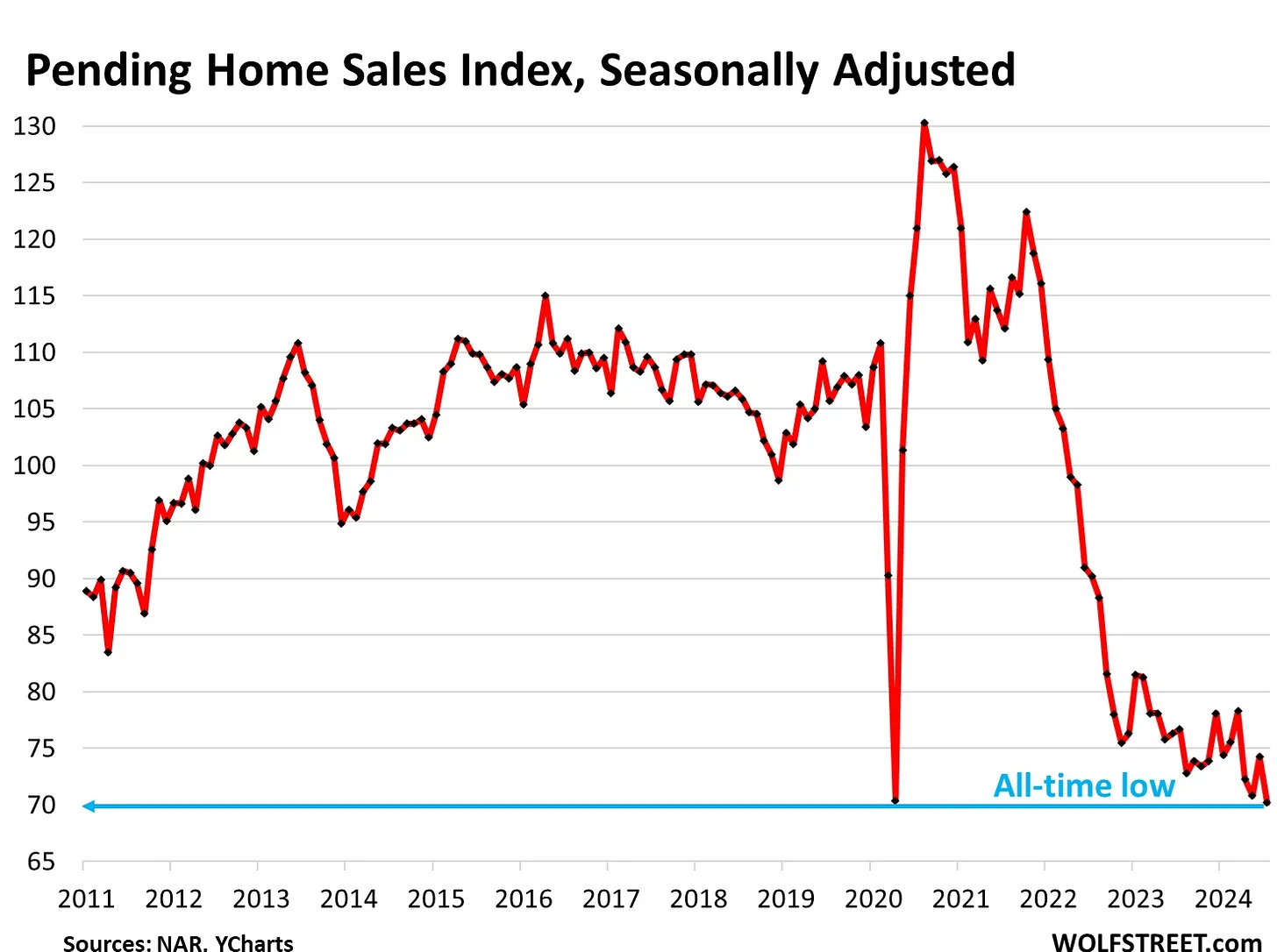

But home buyers have lost confidence in their ability to find a decent home at today’s prices. The red line below illustrates what happens when the average American can’t afford the average house.

Pending Home Sales Fall to Record Low

People who can’t afford houses aren’t buying them. Duh. So pending and existing home sales ( the red and green lines on the next chart) are at record low levels. Housing, in short, will impede rather than drive GDP growth in the year ahead.

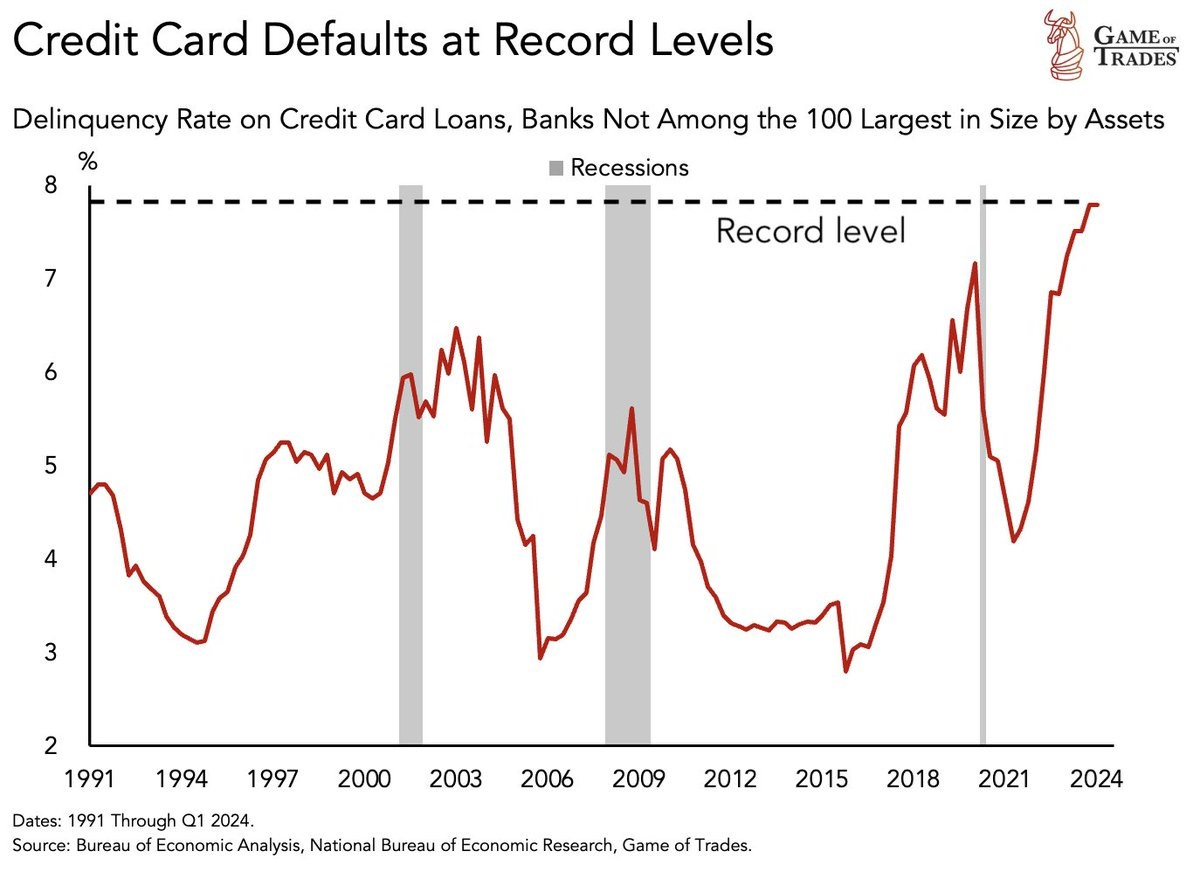

Consumers Are Tapped Out, And Getting More So

The other reason Americans can’t afford a home is that they’re out of money. Credit card defaults are at record high levels, which means a large and growing number of people won’t be consuming much of anything for the foreseeable future.

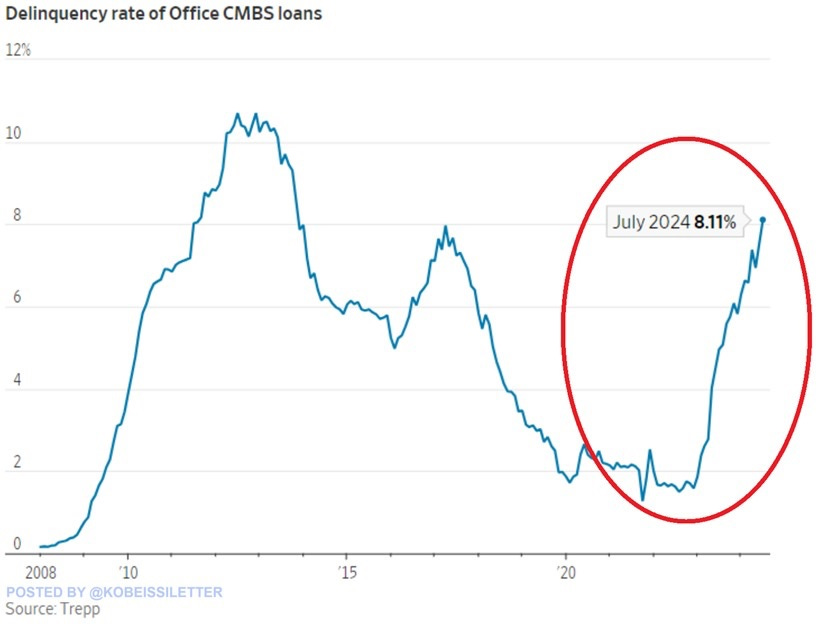

Office Buildings Are Even More Precarious Than Houses

Office building loans are going bad at an accelerating rate, which might devastate local and regional banks that own the related paper. The steepness of the trend implies that the office crash becomes front-page news in short order.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino August 29th, 2024

Posted In: John Rubino Substack