Nancy Lazar, Piper Sandler global chief economist, joins ‘Money Movers’ to discuss whether Tuesday’s economic data changes any of the economists’ forecasts, whether the Federal Reserve has room to focus on its employment mandate, and more. Here is a direct video link.

Also, see, Investors return to bonds as recession fears stalk markets:

Investors are piling back into bonds as recession replaces inflation as markets’ main fear, and fixed income proves its worth as a hedge against the recent stock market chaos.

US Treasuries and other highly rated debt staged a powerful rally during last week’s equity rout, pulling yields to their lowest level in more than a year. While the sharpest moves subsequently reversed, fund managers say they underscored the appeal of bonds in an environment where growth is slowing, inflation is falling and the Federal Reserve — along with other major central banks — is expected to deliver multiple cuts in interest rates by the end of the year.

…“The best protection against a downside scenario like a recession is Treasury bonds,” said Robert Tipp, head of global bonds at PGIM Fixed Income.

“The arguments for fixed income are really strong. Sometimes people need a shove to move out of cash. The drop-off in employment has really made that [happen],” said Tipp.

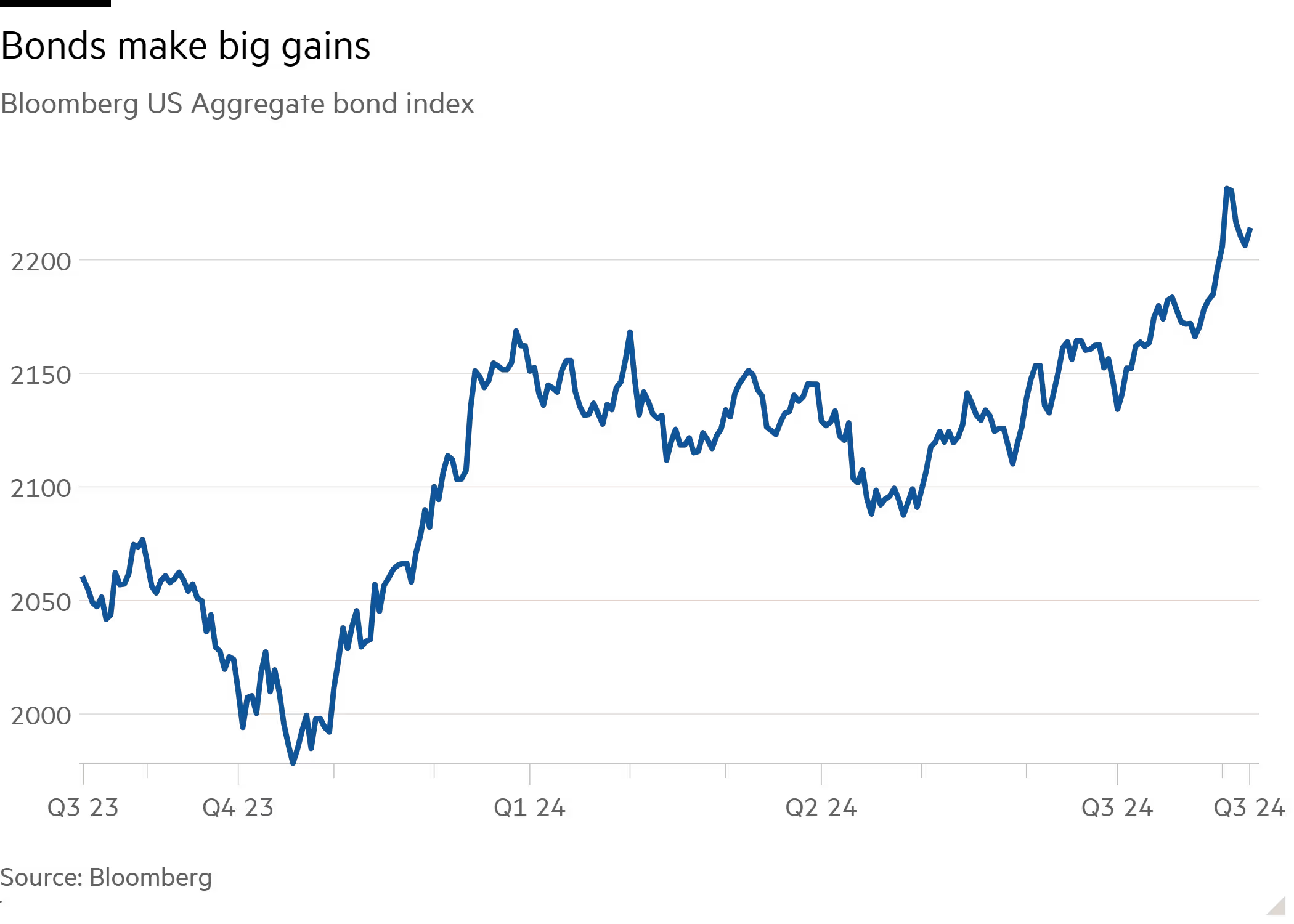

A Bloomberg index that tracks both US government and high-quality corporate bonds has gained 2 per cent since late July, contrasting with a 6 per cent loss for the S&P 500. The biggest gain for bonds came on the day of the employment report when stocks sank sharply.

August 15, 2024 | Recession to Slow Inflation and Spike Unemployment

Portfolio Manager and President of Venable Park Investment Counsel (www.venablepark.com) Ms Park is a financial analyst, attorney, finance author and regular guest on North American media. She is also the author of the best-selling myth-busting book "Juggling Dynamite: An insider's wisdom on money management, markets and wealth that lasts," and a popular daily financial blog: www.jugglingdynamite.com

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Danielle Park August 15th, 2024

Posted In: Juggling Dynamite

Previous: « The Case for $3000 Gold