August 26, 2024 | Just a Hunch

Happy Monday Morning!

For an overly indebted Canadian household sector grappling with rising interest payments, there was a lot to be pleased with this week.

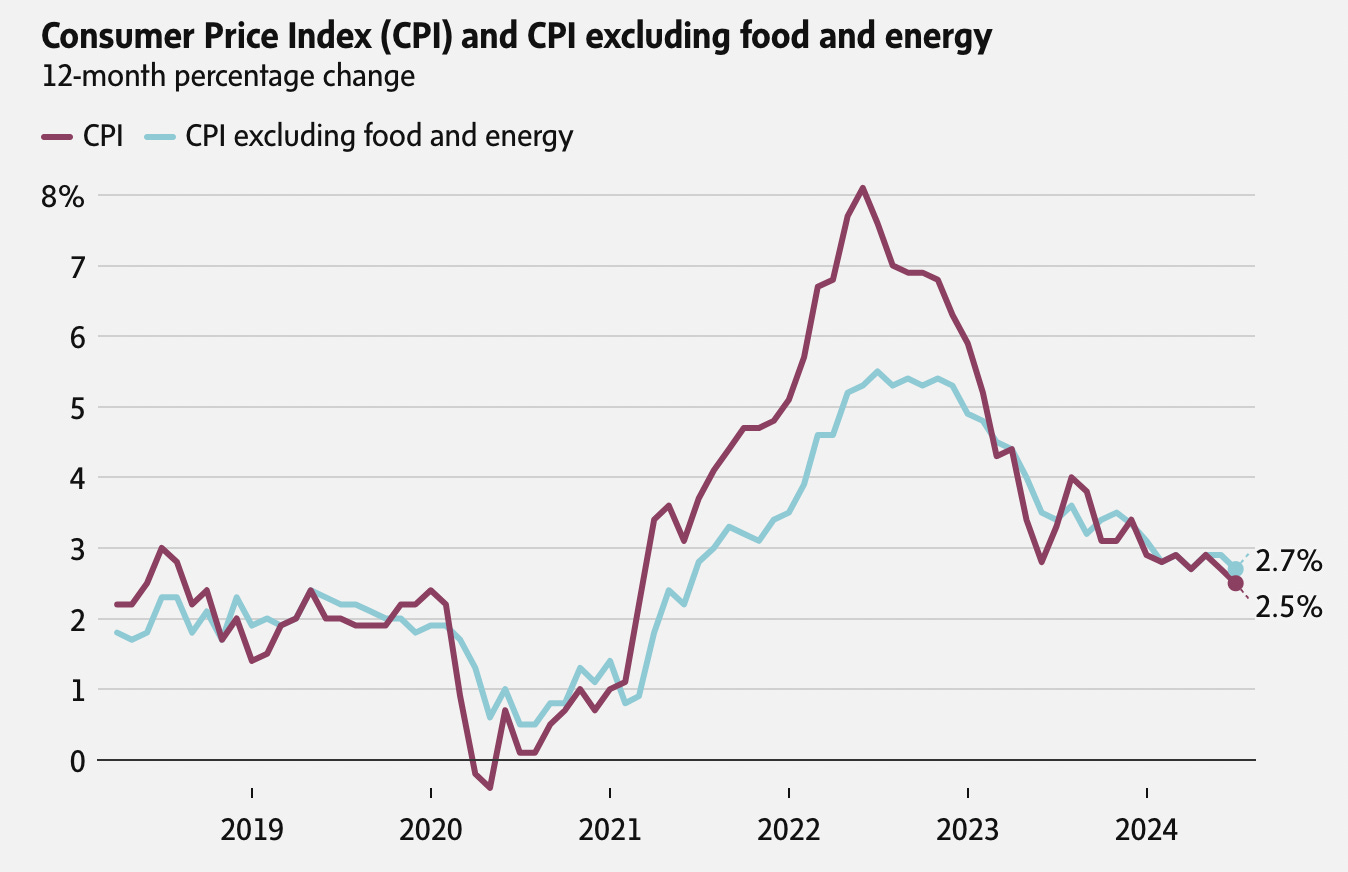

Canada’s CPI inflation came in at a breezy 2.5% in July. The deceleration was broad-based and marked the seventh consecutive month of headline rates running within the central bank’s target range. It also marked the lowest rate of annual inflation in the country since March 2021.

The central bank’s two core inflation measures also decreased, averaging a 2.55% yearly pace.

While it’s quite possible inflation could reemerge, that does not appear to be a concern in the very near future. Per the BMO Economics team, just 30% of categories were showing year-over-year inflation above the 3% mark, historically, about one-third of categories run above 3%.

Inflation, while still above the 2% target, is well within the BoC’s control range of 3%. Furthermore, mortgage interest costs, which are in the direct control of the BoC are still running the show. Mortgage interest costs are still humming at 21% but decelerating. If you strip that out, CPI has been hovering at 2% since January.

Rents are still up 8.3% which is adding another 0.6 percentage points to headline CPI. However, as we have noted before, in real time rents have peaked and are flat or declining in many major metros across the country.

In other words, when you add this all up, it’s chopping time for Tiff and co. Rates will be slashed again on September 04, brining the overnight rate to 4.25% with markets expecting rates to settle at 3.75% by year end.

Concerns over a weaker loonie may soon get some breathing room with the Fed signaling a pivot this past week. Powell’s speech at Jackson Hole was incredibly dovish. Noting,

“The cooling in labor market conditions is unmistakable.”

“It seems unlikely that the labor market will be a source of elevated inflationary pressures anytime soon.”

“We do not seek or welcome further cooling in labor market conditions.”

“The time has come for policy to adjust. The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.”

“We will do everything we can to support a strong labor market as we make further progress toward price stability.”

This is the green light for rate cuts.

So what does this mean for the housing market?

It means the prime rate here up North could settle at 5.95% by the end of this year. That would bring most variable rate mortgages down to about 5%. Fixed rate mortgages are coming in around 4.5% today but should drift modestly lower. Will this be enough to stoke demand and reverse downwards pressure on home prices?

Maybe not. I would certainly expect more buyers to come off the sidelines, purchasing activity will pick up. However, we are also fielding a flurry of phone calls from prospective sellers who are anticipating further rate cuts and hoping to offload in what is expected to be a better housing market. It is deeply engrained in the Canadian psyche to believe, rate cuts down, home prices up. It would be rather ironic if all the rate cuts actually just induced more sellers.

Remember, when rates surged higher everyone expected a flood of listings. Instead, for about eighteen months we saw near record lows of listings! Sellers held back inventory waiting for rates to come down. It was only this year that the floodgates opened as some investors could no longer stomach holding their negative cash flowing condos.

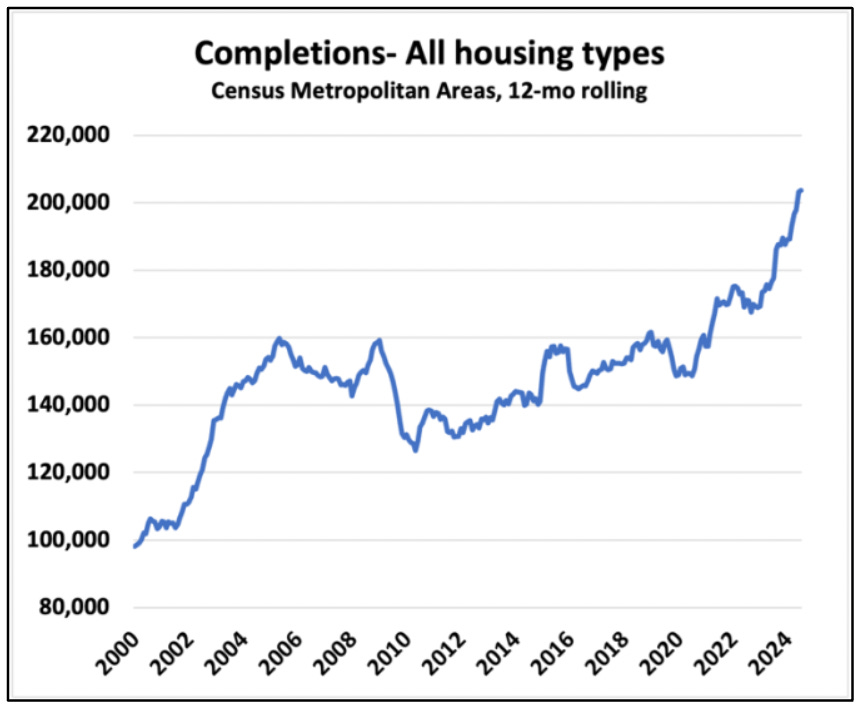

Even with mortgage rates at 4% I am skeptical that the math will work for a lot of investors. The selling may continue. Furthermore, we are still have a record number of units under construction, and completions are running at record highs.

Rate cuts cometh, but there’s no guarantee that this bear market is over. Home sellers might want to temper expectations. Just a hunch.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky August 26th, 2024

Posted In: Steve Saretsky Blog

Next: Is this the Peak? »