August 16, 2024 | Inflation Will Be Sticky and Keep Interest Rates Up

U.S. consumer inflation has returned to normal. This week’s 2.9 percent year-over-year gain for the CPI is not low in the historical context. Expectations for more good news on inflation are unrealistic outside of recession.

And interest rates will not come down enough to satisfy both equity investors and highly indebted borrowers.

In the chart below we see the last twenty-four years of inflation, shown as the CPI rate each month compared to the rate of the prior year. Notice how unusually high the rate was in the last three years and note how rare it was for CPI to go above 4 percent prior to this abnormality. Only in 2008 was the rate over 4 percent outside of this recent period. So, consumers, economists and investors were shocked when the CPI went above 8 percent in 2022 and stayed high for two years.

Inflation is a major concern leading up to the U.S. election. While economists and investment professionals use the CPI to describe what is happening with prices, most people measure inflation by what they see daily at the gas pump, the grocery store and restaurants. This is why the Republicans are trying to make inflation a major concern leading up to the vote in November. They know that for most people inflation is cumulative as they compare prices of familiar items bought now versus what was paid a few years ago.

Source: Bloomberg

If we examine CPI inflation since 2020 the cumulative increase is over 22 percent. Even if inflation is only 3 percent for the next three years, the cumulative increase will be 30 percent by 2027.

And inflation might not stay at current rates. While the recent trend is encouraging there are signs of upward pressure. If there is no recession there will be loud calls for increased wages and salaries. Wages have not kept up with costs, and a sizeable backlog of potential increases is building. If there is a recession and unemployment spikes to 7 or 8 percent those demands will be put on hold, but not forgotten. And if businesses have to pay higher wages, they will raise prices even more.

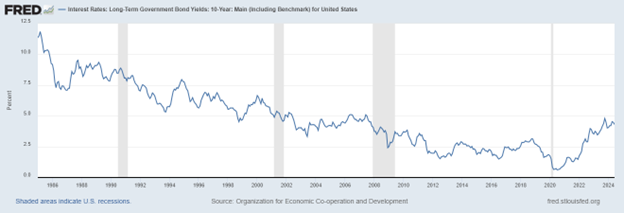

Another aspect of this unusual period of inflation is the effect on interest rates. Rates surged higher during this bout of inflation, but they are not high in historical terms at 3.8 percent.

Source: FRED – St. Louis Fed

Except for the period from 2007 to 2023, interest rates stayed above 5 percent on the U.S. government 10-year maturity bond for more than 4 decades.

Even if CPI inflation stays below 3 percent for a substantial period, the interest rate on government bonds is not likely to fall much further. It is destined to remain between 3 and 5 percent, slightly above the rate of inflation. After all, who would invest in a bond with a negative return after inflation?

We should expect a period of steady inflation and interest rates near current levels for a few more years. And that would be unremarkable.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Hilliard MacBeth August 16th, 2024

Posted In: Hilliard's Weekend Notebook