August 30, 2024 | Disappointing Demand is Dominant Theme

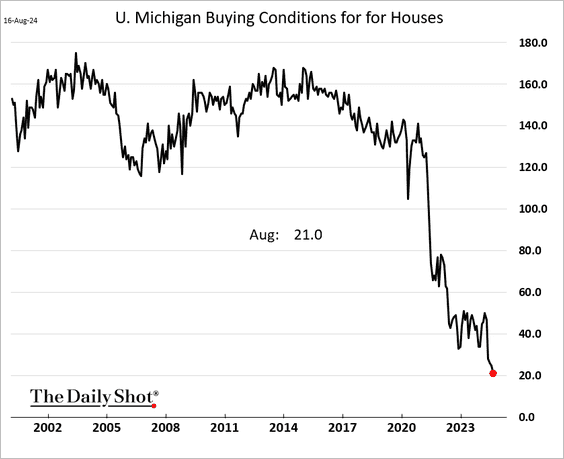

One after another, consumer-driven sectors are warning of tumbling demand amid still inflated prices and the highest real interest rates in 17 years. Although mortgage rates have fallen year-to-date, auto and home sales have continued to slump, with buying conditions the worst in decades (U of Michigan Home buying conditions below since 2000, courtesy of The Daily Shot).

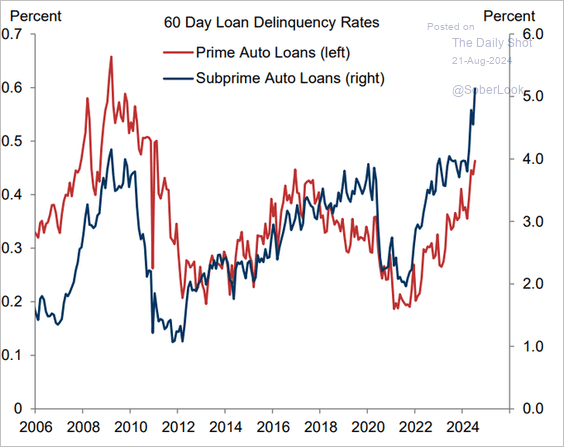

Typically, people prioritize auto payments where possible. The spike in prime and subprime loans now 60 days delinquent is the worst since 2008 (below since 2006).

Dollar General shares fell 30% this week as the company joined a long line of retailers warning that consumers are in retreat. Sales of seasonal, home and apparel fell in the quarter, and although traffic rose, shoppers spent less per trip.

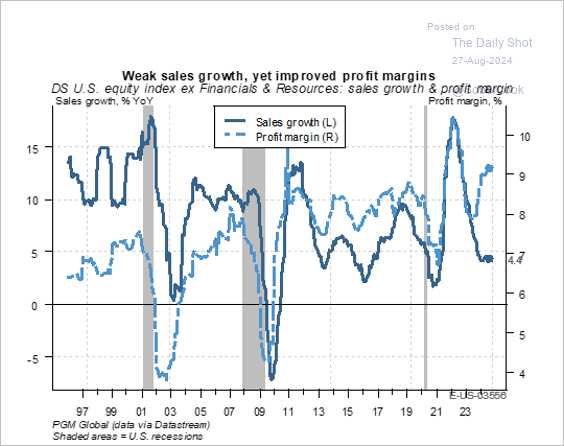

Companies are relying more on promotions and price cuts, hurting profits. As shown below since 1995, the outsized gap between elevated profit margins and plunging sales growth typically resolves with profit margins joining down to sales trends during recessions.

Meanwhile, the savings of households are the most risk-exposed in decades with record concentration in heinously over-valued equity funds and products. This is going to leave a mark for years to come.

Markets pricing in rate cuts for this year — DiMartino Booth and Charles Payne of FBN break it down. Here is a direct video link.

Happy Labour Day Weekend!!

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Danielle Park August 30th, 2024

Posted In: Juggling Dynamite