August 30, 2024 | A Massive Glut of Unsold Condos Will Ruin The Toronto Housing Market

A massive glut of condominium apartments in Toronto threatens to sink the housing market.

Condominiums were gobbled up by aggressive, highly levered speculators as a way of participating in the housing boom with minimal capital outlay.

But now those apartments are hanging over a re-sale market with very few buyers.

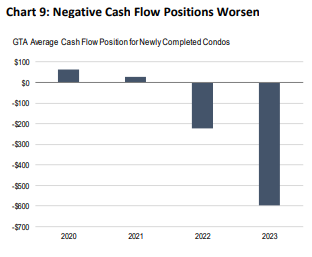

Investor-owners are losing money every month, as much as $1,000, and the average loss for those who bought recently is about $600 per month, according to Urbanation in a July 25, 2024 report.

Source: Urbanation

The owners of Toronto condominiums had very little chance of making money, even in the biggest housing bubble in the history of housing bubbles. The reason is simple. With a condo a speculator gets a very small amount of land and a large piece of a building that is depreciating in value from the moment of the first occupation.

In “When the Bubble Bursts: Surviving the Canadian Real Estate Crash” Second Edition 2018 — pages 214 to 217 — I outline the arithmetic.

A high-rise tower condo development total cost is typically 10 percent land and 90 percent building. Included in the building cost is the developer’s profit, advertising, interest on construction loans, realtor commissions, design fees, permit costs, taxes etc.

If the building depreciates at just 2 percent per annum — a 50-year life span — this implies a loss of $18,000 per annum per unit on an individual unit that sold for $1 million.

To offset that loss, the land value, originally $100,000 per unit, would have to appreciate by $18,000 per year, or 18 percent. This is unlikely if the initial land purchase was made during a housing bubble.

The current glut is dominated by small condos, under 700 square feet, that few people want to live in. These units were built for speculators, some foreign based, who wanted to place some capital in the booming Canadian housing market but had no intention of living in them. Many were speculating or laundering money by purchasing large numbers of units in the pre-construction phase and then flipping before the final payment was due. For those long-term investors who bought and held, a short-term solution was to rent them to students and young individuals and couples, but this often meant absorbing a small monthly loss after expenses.

In some cases, young people might buy condos hoping that the value would increase, giving them enough for a down payment for the more expensive low-rise dwelling that they preferred.

But the glut has put an end to those dreams.

The problem is described by Ron Butler, @ronmortgageguy, in a recent Globe and Mail article.

“First-time home buyers are shunning today’s shrinking condos: ‘Is there any appeal to them whatsoever?’

The inventory of unsold condos is at record high levels and there are about 20,000 small condo units under construction coming to the market in the next 18 months.

Another interest rate cut or two by the Bank of Canada will not be enough to solve this problem.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Hilliard MacBeth August 30th, 2024

Posted In: Hilliard's Weekend Notebook