July 9, 2024 | Used Car & Truck Prices Spiral Down Further in Historic Plunge, Surrender 60% of Stunning 2-year Spike

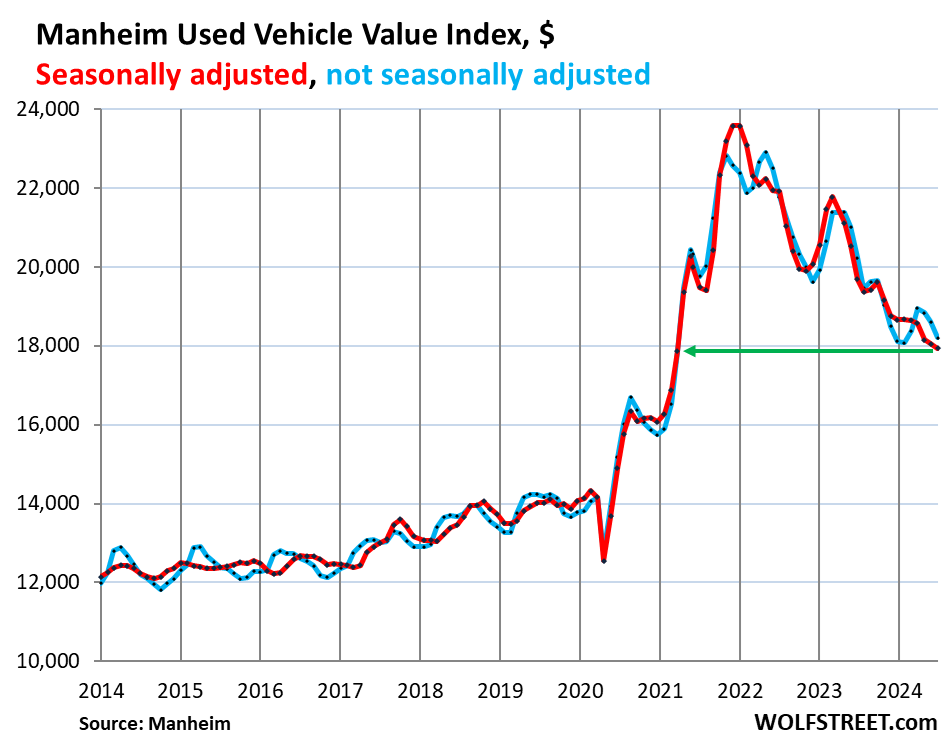

Prices of used cars, SUVs, pickup trucks, and vans that were sold at auctions across the US fell by 0.6% in June from May, and by 8.9% year-over-year, to $17,934, seasonally adjusted, the lowest since March 2021, having given up 60%, or $5,640, of the mindboggling $9,443-spike between January 2020 and May 2022 (red in the chart).

Not seasonally adjusted, wholesale prices fell by 2.2% in June from May, and by 10.0% year-over-year, to $18,206 (blue), having given up 52%, or $4,690, of the $9,088-spike between January 2020 and May 2022, according to today’s Used Vehicle Value Index by Manheim, the largest auto auction house in the US. The index is adjusted for changes in mix and mileage.

The question on everyone’s mind: How much further will wholesale prices fall to work off that mindboggling spike that should have never occurred in the first place? When will they bottom out? For consumers, prices haven’t fallen nearly enough and remain very high:

The biggest price drops in June from May occurred in these categories:

- Full-size van: -8.9%

- Sportscar, all: -6.4%

- EVs: -6.3%

- Full-size car: -6.2%

Dealers buy at these auctions to replenish their used-vehicle inventories. Supply comes from rental fleets that sell some of the vehicles they pull out of service, from finance companies that sell their lease returns and repos, from corporate and government fleets, other dealers, etc.

The steep month-to-month price drops in June may have been a secondary effect of the crisis when operations of nearly 15,000 dealerships were catastrophically interrupted from June 19 through the end of June when CDK’s cloud-based dealer management system that these dealers were using was shut down due to a ransomware attack. The biggest publicly traded dealers – normally massive buyers at these auctions – already warned about the potential impact for Q2. Automakers also referenced the CDK crisis in their reports for new-vehicle deliveries in June and Q2.

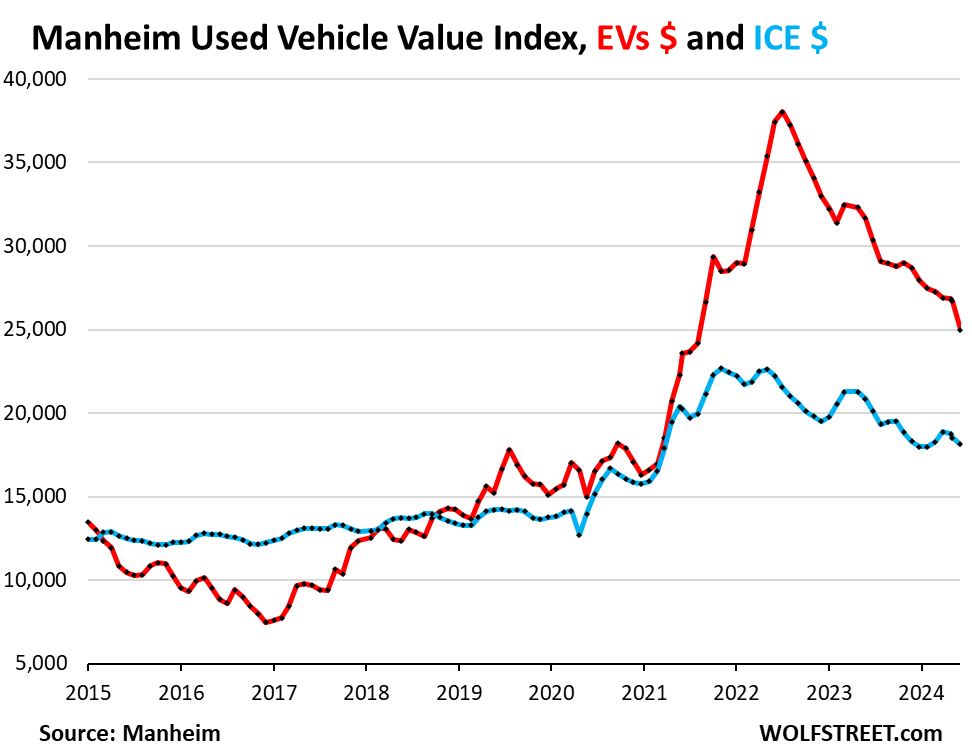

EVs versus ICE Vehicles since January 2020.

There was a time during the pandemic when Tesla-flipping was a thing, when people bought new Teslas from Tesla and resold them within a short period as essentially new, but legally used, at a big profit because used vehicle prices in general had shot up so much, and Tesla prices even more because Tesla’s output couldn’t meet demand.

Tesla-flipping contributed to a massive 145% spike in used EV prices from January 2020 through the peak of the spike in July 2022. Then Tesla cut its own prices in 2022 and thereby killed Tesla-flipping. There were hopes that Cybertruck-flipping would be profitable, but those hopes have also vanished. A used vehicle should sell for far less than the same new vehicle, that’s the essence of the car business, and that’s where we are again. And all this Tesla-flipping nuttiness is now in the rear-view mirror.

Used EVs: Prices had spiked by a mindboggling $22,568 from January 2020 through July 2022, by far the most of any vehicle category, a sign of absolute frenzy. Prices have now surrendered 54% of that spike, but are still 61% higher than in January 2020 (red in the chart below).

Used ICE vehicles: Prices also spiked during the pandemic (+64%), but not nearly as much as EV prices (+145%). And they also plunged, but from less-lofty highs. And they have now surrendered 51% of the pandemic spike (blue).

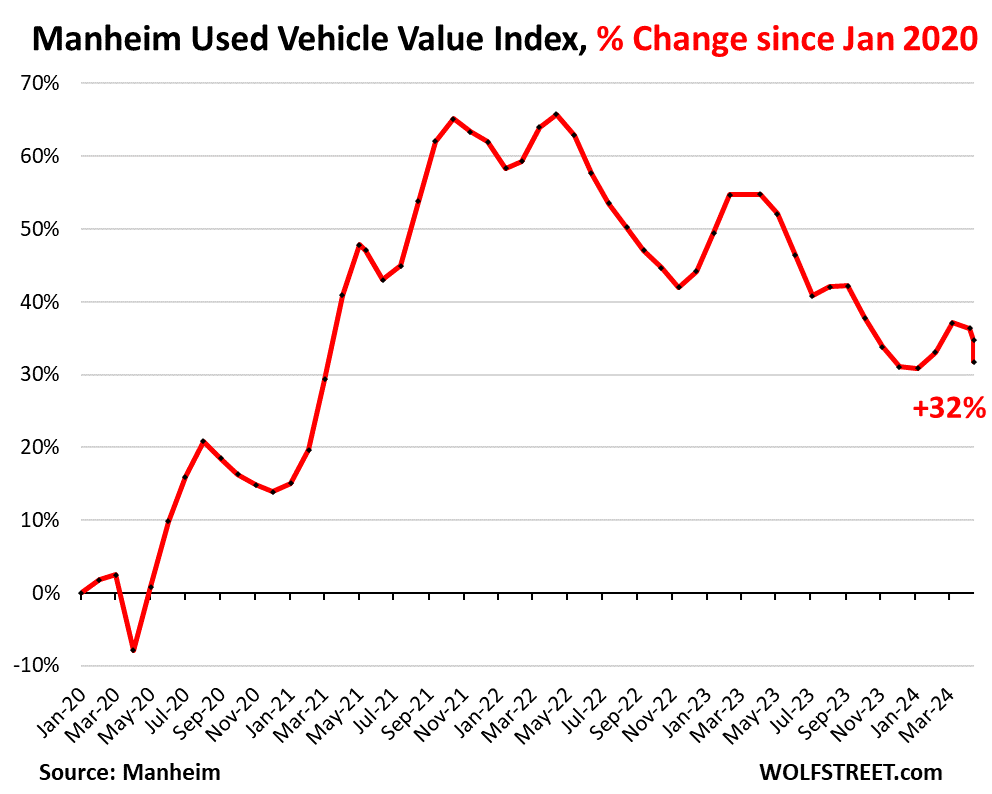

Used car and truck prices since January 2020…

Auction prices had spiked by a mindboggling 65%, or by $9,088, from January 2020 through the peak in May 2022, not seasonally adjusted, and then began to spiral down, by now surrendering 52% of that spike.

But seen the other way: since January 2020, despite the historic plunge underway, wholesale prices are still 32% higher than they had been in January 2020. The data below is not seasonally adjusted:

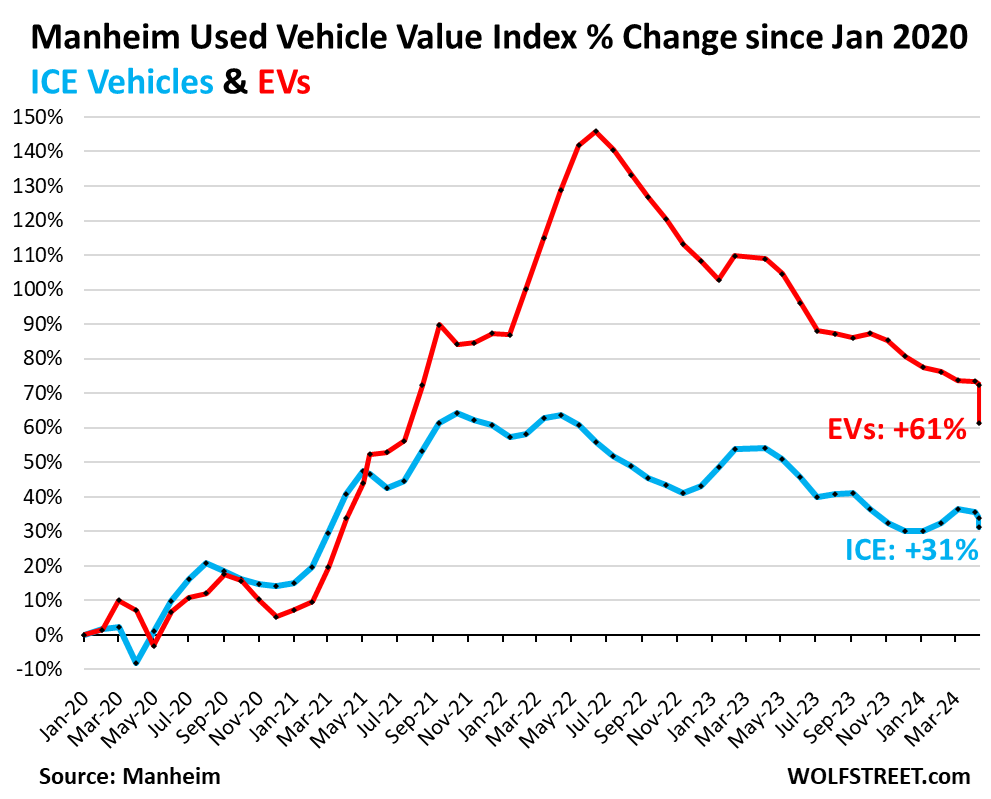

Seen from that direction, since January 2020, EV prices are still up 61% (red in the chart below). Prices of ICE vehicles are still up 31% (blue):

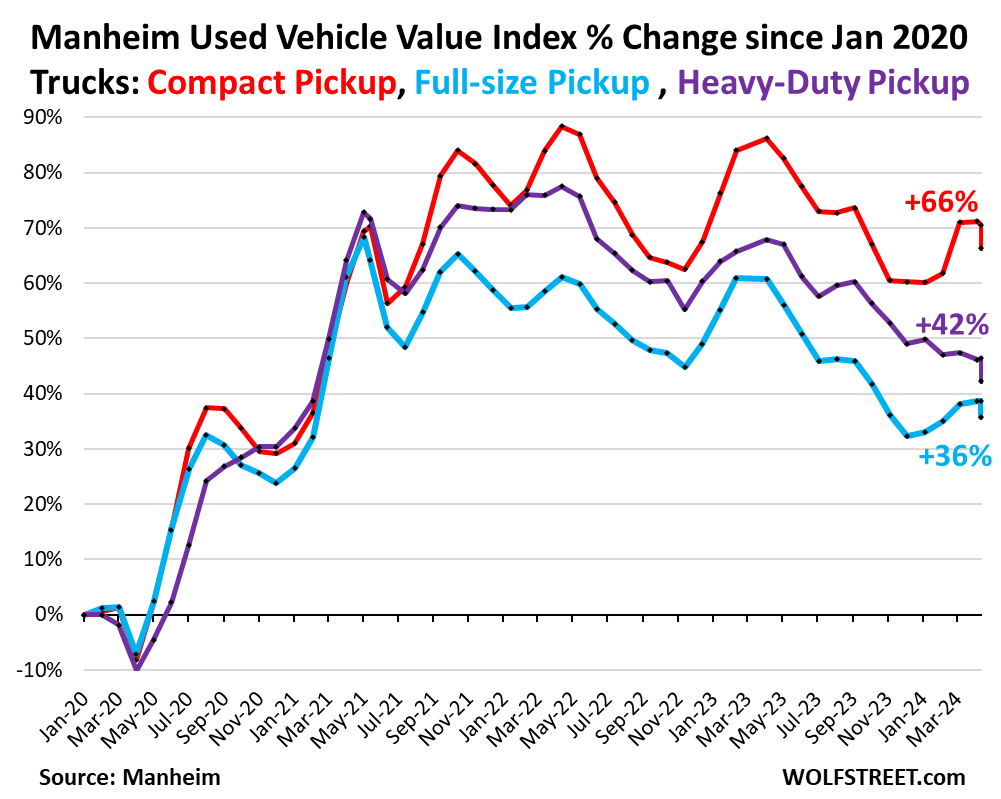

Prices of used pickup trucks since January 2020.

Full-size light-duty pickup trucks: Prices had spiked by 68% from January 2020 through the peak in May 2021. And then they spiraled down, and gave up 48% of that spike, but are still up 36% from January 2020 (light blue in the chart below).

Compact pickups: Prices had spiked by 88% from January 2020 through May 2022. But they have not come down much, have given up only 25% of the pandemic spike, and are still up by a mindboggling 66% from January 2020 (red line).

Heavy-duty pickups: Prices had spiked by 78% from January 2020 through May 2022, and have now given up 46% of that spike but are still up 42% from January 2020 (purple)

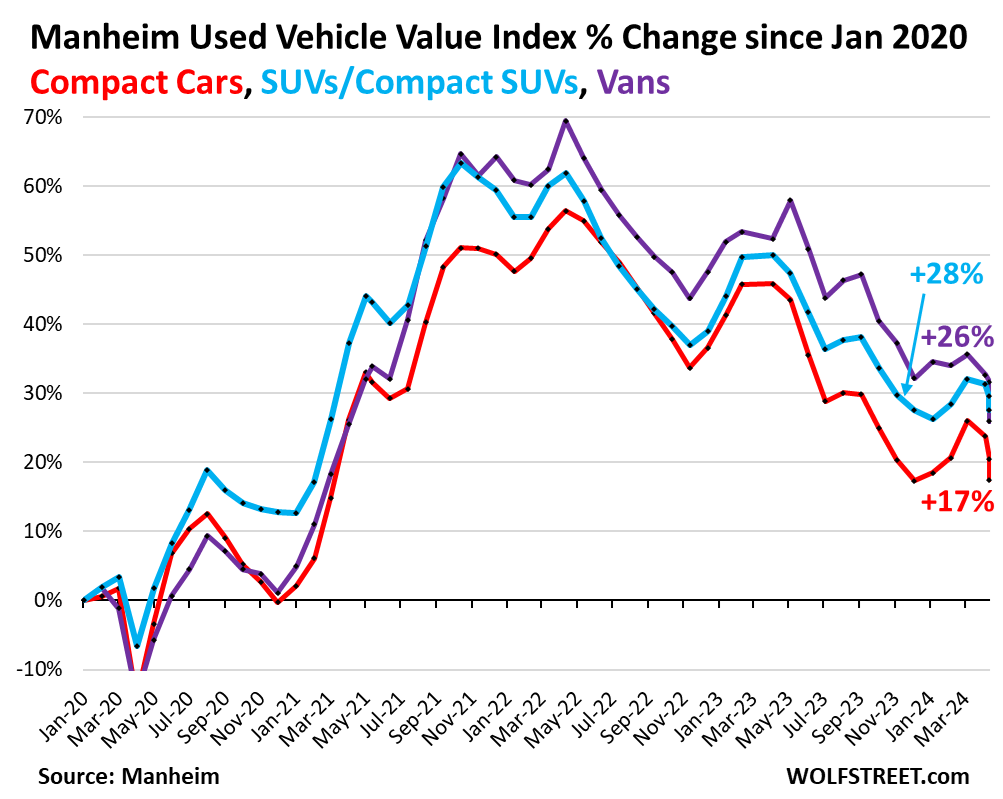

Prices of used SUVs, compact cars, and vans since January 2020.

SUVs and compact SUVs: Prices had spiked 63% from January 2020 through November 2021. And then they spiraled down and gave up 57% of that spike, but they’re still up by 26% from January 2020 (light blue).

Vans: Prices had spiked by 70% through May 2022, then surrendered 63% of that spike, but are still up 26% from January 2020 (purple).

Compact cars: Prices had jumped by 56% from January 2020 through May 2022, and then fell. By now they’ve given up 69% of the pandemic spike and are up “only” 17% from January 2020.

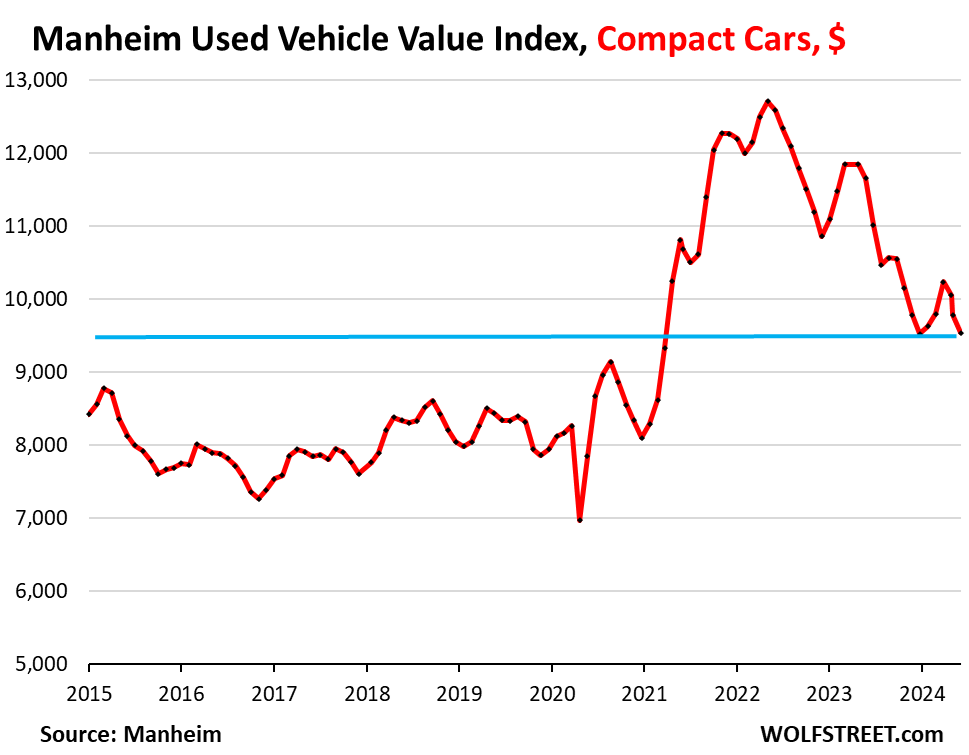

Affordability returns to used compact cars. Compact cars are now the closest to pre-pandemic trend, compared to the other major categories. With an index price of $9,500, they’re up “only” 17% from June 2015 – from nine years ago!

But Americans are no fans of compact cars. So retail demand for new compact cars remains moderate; the big buyers are rental fleets. For automakers, the category is a low-margin highly competitive business. US automakers exited ICE compact cars because they had trouble making money in it and were more interested in kowtowing to Wall Street with share buybacks. All recent-model-year ICE compact cars are foreign brands. Among the older compact cars, there are American brands. But thanks to these dynamics, used compact cars are approaching affordability once again:

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Wolf Richter July 9th, 2024

Posted In: Wolf Street