July 15, 2024 | The Speculator as Hero

Happy Monday Morning!

We’re now in the dog days of Summer, a historically slow time for housing markets that is being compounded by weaker economic activity. The unemployment rate in Canada is up 1.6 percentage points from the lows, which is already a larger increase off the lows than in several recessions over the past 30 years. Meanwhile, small business delinquencies are higher today than they were during the GFC. Suffice to say things have been better. The 500bps of rate hikes are finally working through the system.

Tiff started cutting rates in June but let’s be honest, 25bps isn’t going to move the needle for anyone. Homeowners are renewing their mortgages today at 5%, basically double what they’re used to. There’s not a lot of spare cash kicking around after renewing your mortgage these days. This is particularly the case for investors, many of whom are hemorrhaging cash on rental condos.

This is a tough market to figure out right now, but one thing is glaringly obvious, investors are under pressure, investors are in short supply these days, and the number of investors hitting the sell button on recently completed pre-sale units is significant. Many of these recent pre-sale investors are left with two options, hold the unit and rent it out and be deeply negative cash flow, or resell it at a loss net of fees and taxes.

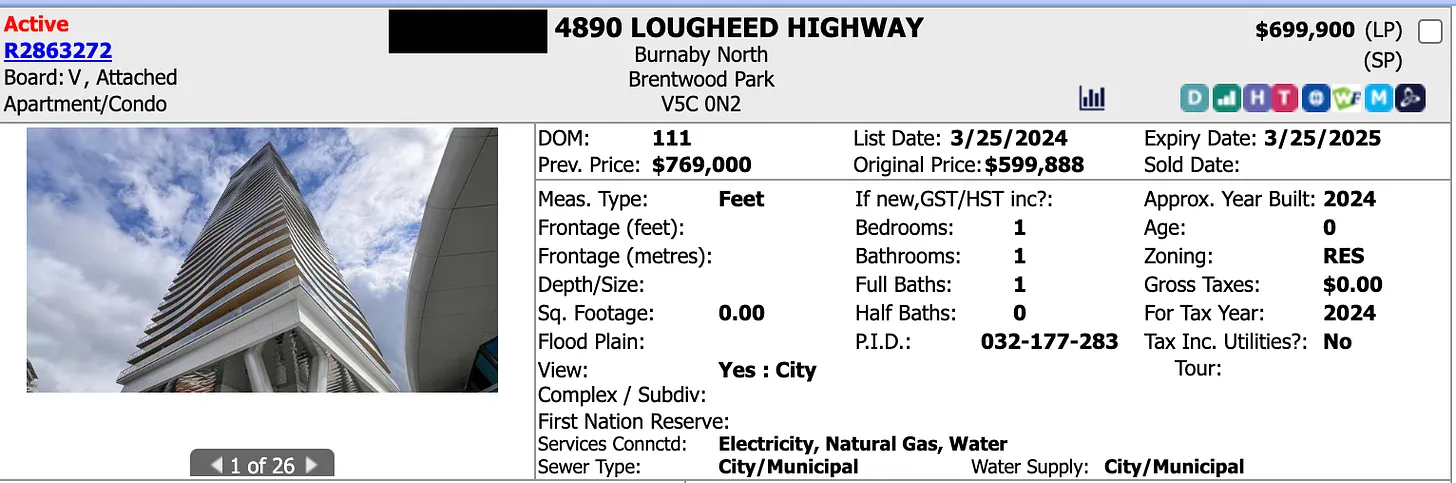

Here’s a prime example.

This unit was purchased as a pre-sale for $699,000 several years ago. At the time mortgage rates were much lower. They’ve now closed on it, and after multiple pricing strategies and 111 days on market, they’re currently asking what they paid for it. Assuming they sell at the current asking price they will lose just north of $70,000 after fees.

Or they can opt to hold it and rent it out. Assuming 80% LTV, they would take on a mortgage of $560,000 on a 30 year amortization at 4.99%. Monthly mortgage is $2985, plus another $550 for strata fees, insurance, and property taxes for a total carrying cost of $3535. Market rents are about $2600 today. This brings the negative cash flow to $935 on a monthly basis.

This is a very common scenario today. How long are you willing to carry a monthly loss of $935?

The math worked a lot better when rates were at 1.5%. It would have brought the monthly mortgage down by $1000 and this condo would have carried itself!

It’s funny, people blamed speculators for driving house prices higher, not realizing they were just a symptom of the policies government enabled with a zero interest rate policy. Money was free, of course they piled into real estate! And now, just like in any open market economy, the speculators have over extended themselves, sowing the seeds for excess supply and lower prices. Imagine that.

Have you ever read the popular speech, ‘The Speculator As Hero’ ? Originally printed in the Wall Street Journal back in 1989. Written by American Hedge Fund manager Victor Niederhoffer.

I am a speculator. I own seats on the Chicago Board of Trade and Chicago Mercantile Exchange. When my daughters ask me if my job is as important as the butcher’s, the doctor’s or the scientist’s, I answer that the speculator is a hero, and has been throughout history.

Some speculators are discoverers like Christopher Columbus, creators like Henry Ford, or inventors like Thomas Edison. Their job is easy to place on a high plane. My role in the grander order is indirect, relatively invisible and unplanned. The only discoveries I make are the routes that prices will travel. Like hundreds of thousands of other traders, I try to predict the prices of common goods a day or two in the future. If I think the price of an item will go up, I buy today and sell later. If I think that the price is going down, I’ll sell at today’s higher price. The miracle is that in taking care of ourselves, we speculators somehow ensure that producers all over the world will provide the right quantity and quality of goods at the proper time, without undue waste, and that this meshes with what people want and the money they have available.

Politicians eager to “do something” about high prices often make laws to punish the speculator. A representative incident occurred during the reign of Emperor Diocletian in Rome in A.D. 300. Speculators were withholding scarce provisions from the hoarders, hoping to unload when the demand was even more intense. To remedy this, Diocletian set the highest price for beef, grains, clothing and several hundred other items. Anyone who sold at a higher price would be put to death.

The result? As reported by Lactantius in A.D. 314, “Much blood was shed upon slight and trifling accounts. The people brought no more provisions to the markets, since they could not get a reasonable price for them, and this increased the dearth so much that at last after many had died by it, the law itself was laid aside.”

Another representative incident occurred during the siege of Antwerp by the Spanish in 1585. Antwerp was then the leading commercial town of Europe. The Spanish decided to blockade the port to force surrender when supplies gave out. Knowing this, Antwerp farmers and bakers produced large amounts of bread. Privateers ran the blockade at great peril to provide needed supplies. Prices began to rise. Speculators, guessing that bread was going to be scarce, contributed to further price rises through shrewd purchases.

But Antwerp politicians thought it wrong for greedy speculators to profit from war. The politicians fixed a very low maximum price to everything that could be eaten, and prescribed severe penalties for violators. The consequence was inevitable. Privateers stopped running the blockades and the supply of grain dried up. Consumers had no incentive to economize. The citizens ran out of all their provisions after six months of the siege and the Antwerpers starved. They surrendered and were quickly annexed.

Let’s consider some of the principles that explain the causes of shortages and surpluses and the role of speculators.

When a harvest is too small to satisfy consumption at its normal rate, speculators come in, hoping to profit from the scarcity by buying. Their purchases raise the price, thereby checking consumption so that the smaller supply will last longer. Producers encouraged by the high price further lessen the scarcity by growing or importing more. On the other side, when the price is higher than the speculators think the facts warrant, they sell. This reduces prices, encouraging consumption and exports and helping to reduce the surplus.

Of course, speculators aren’t always correct.

When they am wrong, their actions contribute to scarcities or gluts. Manias such as the Tullipmania, the South Sea Bubble, the Mississippi Bubble, gold panics, stock-market crashes, and violent swings in the value of the dollar are frequently cited as examples of occasions when speculators contributed to instability and imbalance.

But who could do the job better?

Bureaucrats have little incentive to improve, invest or innovate. When speculators are wrong, however, they are punished severely for their mistakes by losses of their own money. If left unchecked, the tendencies of our modern kings to interfere with the natural working of the marketplace would lead to destruction. But speculators, searching for profit, send signals to producers and consumers as to the forces of destruction and good.

Perhaps the most positive impact of our current-day speculators is to check at inception governmental activities that would have an inflationary impact Governments are prone to spend more money on their activities than they take in through taxes. The consequence often has been substantial inflation, followed by war, revolution and destruction of civilization.

Nowadays, however, bond traders are so alert to the long-term consequences of such activities that they immediately send debt yields up significantly at the first sign of inflation. The increased yields have such a negative and immediate impact on government revenue, business activity, and consumer spending that governments have all but given up trying to sneak increased spending past the market. As a result, the rate of inflation slowed markedly throughout the Western world during the 1980s.

Granted, speculators am not angels; many are motivated by gambling and greed, and when given the chance will take advantage of the public as much as the next person. But the efficiency of a competitive marketplace helps to ferret out and reduce unscrupulous conduct.

The intellectual raises his eyebrows at the economic and historical analysis and contemptuously says, “Man cannot live by bread alone.” To this I respond that without us, there would be no bread.

I am proud to be a speculator. I am proud that my humble attempts to predict Tuesday’s prices on Monday are an indispensable component of our society. By buying low and selling high, I create harmony and freedom.

It’s funny, we despised the speculator, we tried to get rid of them and now we ridicule and low ball them.

We tried to tax our way to affordability, but it’s going to be the speculators who funded risky new development, that ultimately usher in a period of excess supply and lower prices. Here’s condo units under construction in Vancouver & Toronto.

The Speculator as hero, who could have imagined.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky July 15th, 2024

Posted In: Steve Saretsky Blog

Canada needs to completely stop all immigration into this country for the next 10 years. Watch how quickly real estate prices across this country collapse by at least -75% from current levels. This outcome is guaranteed and that’s why none of the corrupt politicians in this country is offering to do this obvious solution.