July 27, 2024 | Recession Watch: The Un-Inverted Yield Curve and Plunging Copper

Headline economic stats like GDP continue to look pretty good. But the list of reliable indicators screaming “imminent recession” continues to expand. Some of the latest:

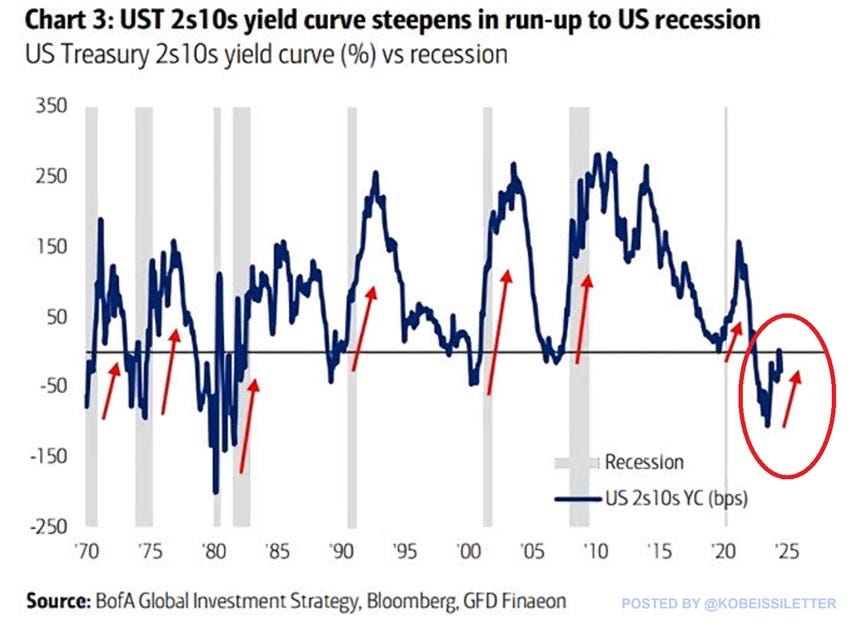

Un-Inverted Yield Curve

An inverted yield curve (where short-term interest rates are higher than long-term rates) is a well-known recession signal. But it really starts flashing when it un-inverts, i.e., when long-term interest rates rise back above short rates. That’s in the process of happening:

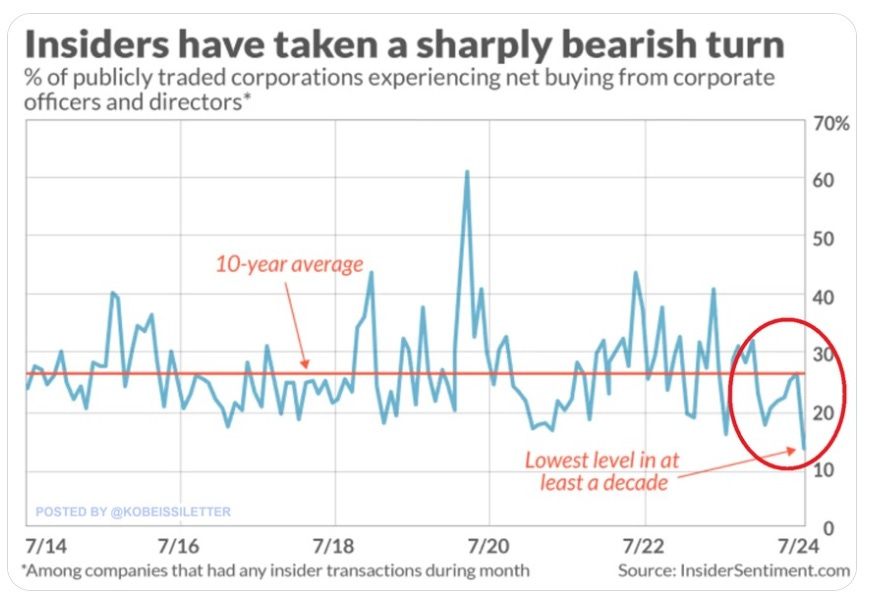

Insider Selling

No one knows a given company’s sales and profit trends better than the guys running it. When they like what they see, they buy their companies’ shares—and vice versa. Lately, insider trading has been hugely negative.

The next three recession signals and accompanying analysis are from the (very sharp) Francis Hunt at Market Sniper:

Plunging Copper Price

The decline in copper prices is significant. Copper represents industrial metals and is widely used in construction. A fall in copper prices typically signals a contracting economic cycle due to reduced building activity.

Copper Falling Verusus Gold

What you’ll notice is that generally the trend is down. This broadly highlights an end of the macro cycle for the current financial system. Generally the relative valuation of copper to the monetary benchmark of insurance against collapse is decreasing [Gold]. The dotted red line shows a regression analysis downtrend, indicating growing fears about the debt situation. Essentially, more money is flowing into gold than into construction as we approach the end of a failing fiat, debt-based financial system. Notice in this chart that every time we cross with the copper price down from above the dashed red line with any degree of momentum, it’s associated with a recession.

Yen Carry Trade Unwind

This downturn coincides with the unwinding of the carry trade involving the Japanese Yen. The carry trade has the tendency for the big institutions to borrow substantial sums in Japanese Yen at very low interest. This allows them to make higher-risk investments in other higher yielding instruments and skimming the difference between the payment on the Yen debt versus the return they achieve either in other bond instruments or equity investments.

Typically, when we see the Yen trade (USDJPY) reversing violently to the downside, we are witnessing a de-risking. People are taking profits and cutting gains that they’ve made maybe in the Magnificent Seven or in other debt instruments and electing to pay back the borrowings they took in Yen. This typically leads to outflows, usually from America returning to Japan.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino July 27th, 2024

Posted In: John Rubino Substack