July 8, 2024 | Recession Watch: Jobs and Real Estate Head South

US financial headlines remain in Goldilocks territory (prompting all those “Why don’t Americans know how good they have it??” diatribes from the MSM). But under the surface, the drumbeat of negative data continues. Today, let’s consider jobs and real estate:

Jobs

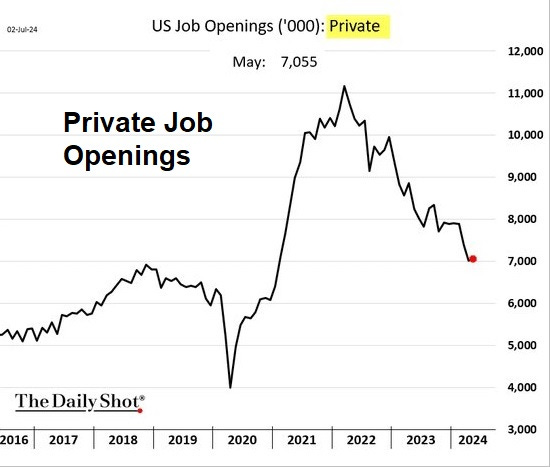

Official reports of plentiful jobs and low unemployment are possible because the government is on a hiring binge. But over here in the private sector, job openings have been falling steadily since 2021.

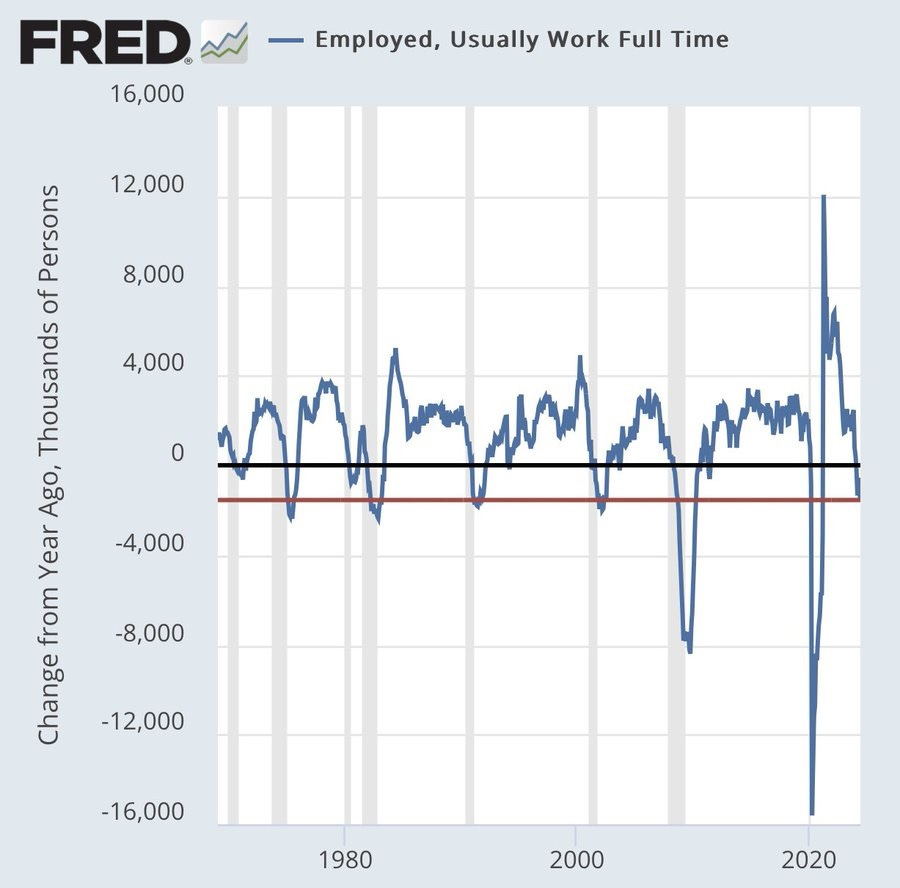

And full-time employment is actually contracting. According to economist David Rosenberg:

The YoY trend in full-time jobs is running at -1.2%, a big swing from +1.7% a year ago and +5.1% two years back. This not only represents a significant loss of momentum but is a fool-proof recession indicator. There is nothing soft about this landing.

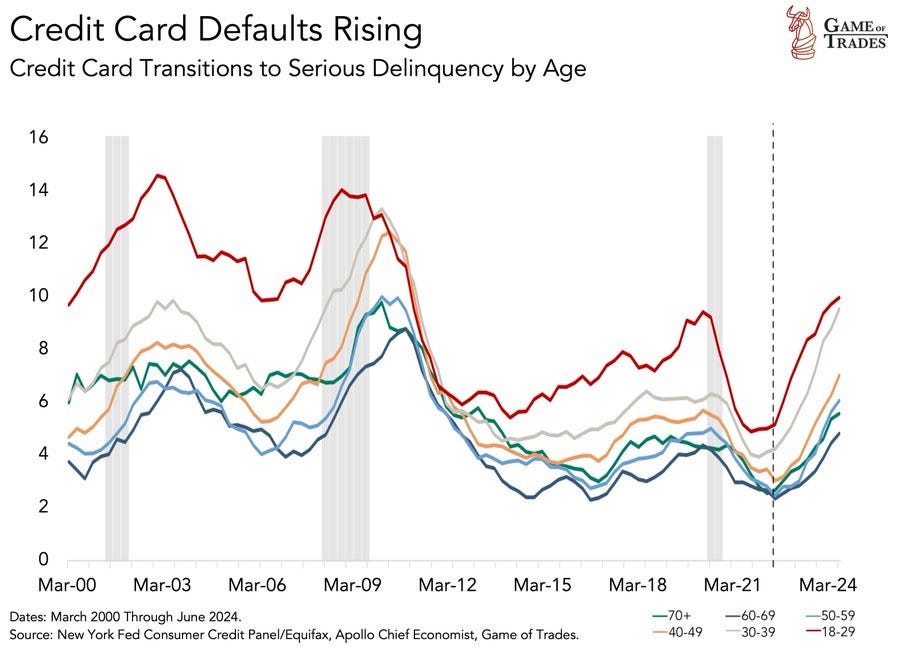

As the past few years’ inflation forces more people to put day-to-day life on plastic, credit card defaults are spiking, especially for the young.

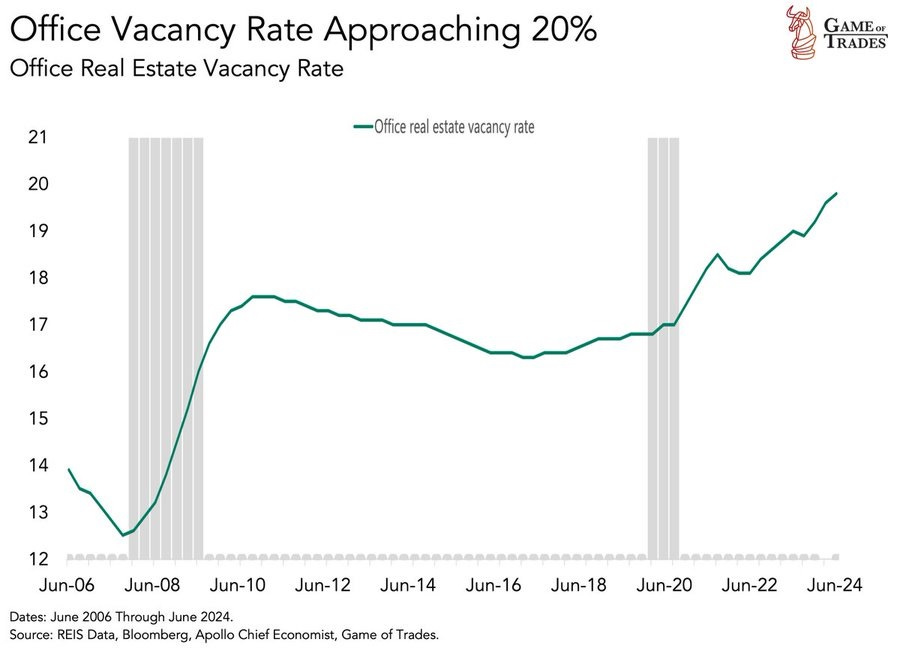

Real Estate

The commercial real estate bust is proceeding toward its inevitable firey end. Office vacancy rates now exceed Great Recession levels, with about half a trillion dollars of unrealized losses currently marooned on bank balance sheets.

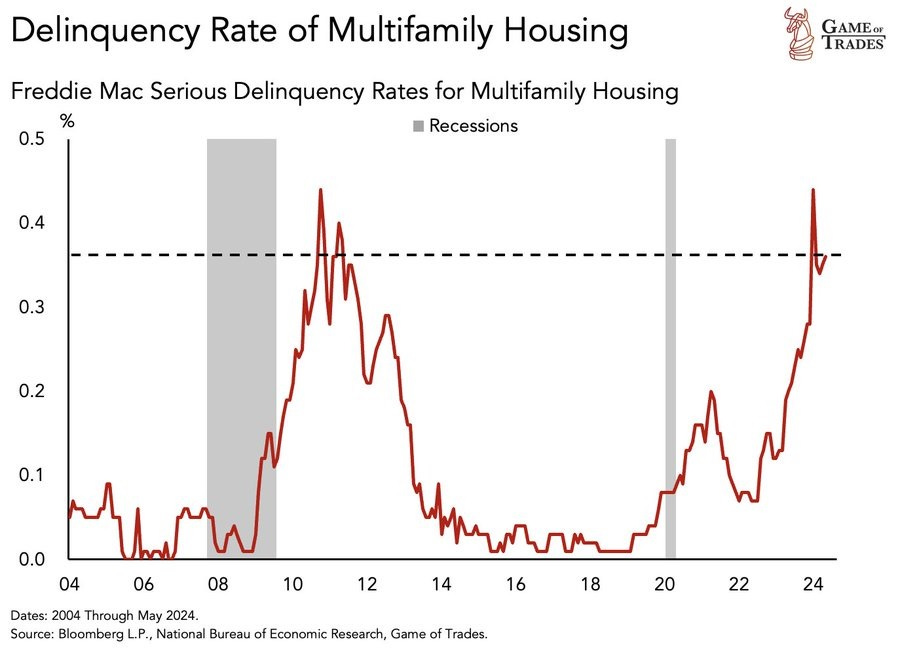

And the bust is spreading beyond offices.

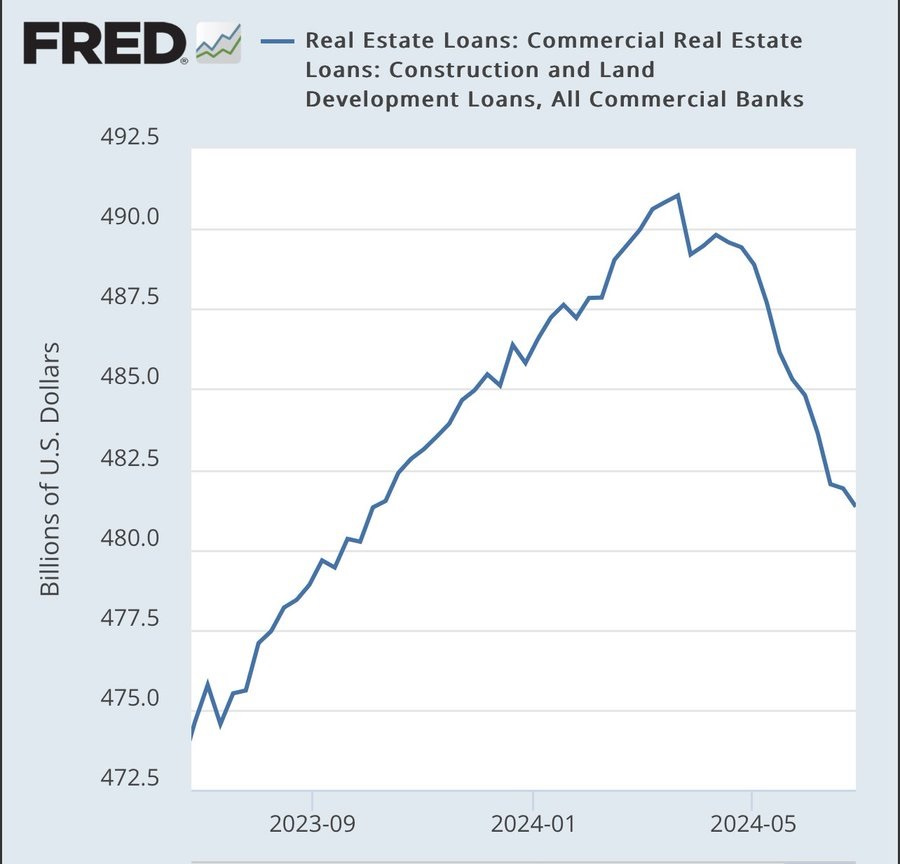

Banks, already on the hook for so much of the above, are increasingly reluctant to throw good money after bad.

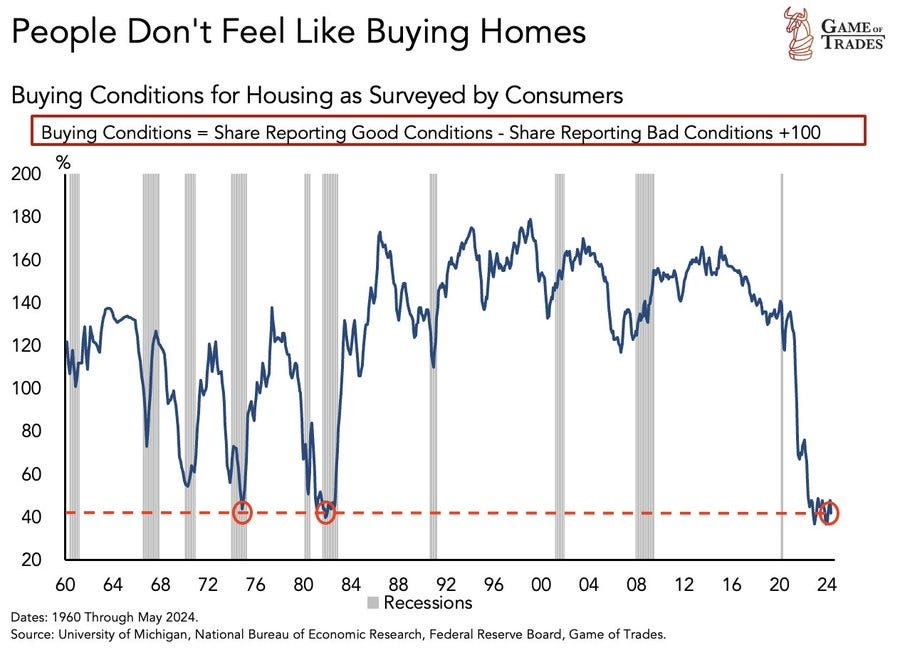

Last but not least, housing is frozen. From prolific chart maker Game of Trades:

BEWARE: Buying conditions in the US housing market have collapsed, reaching levels only seen 2 times since 1960:

– 1974

– 1981

Both instances ended in a recession.

The housing market is a key leading indicator of the business cycle. And it tends to react very quickly to interest rate changes.

Are We Already There?

The start date of a recession is usually recognized after the fact. So it’s possible that the above — and the many other negative trends — are saying that we’re already there.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino July 8th, 2024

Posted In: John Rubino Substack