July 24, 2024 | Housing Is Seriously Rolling Over

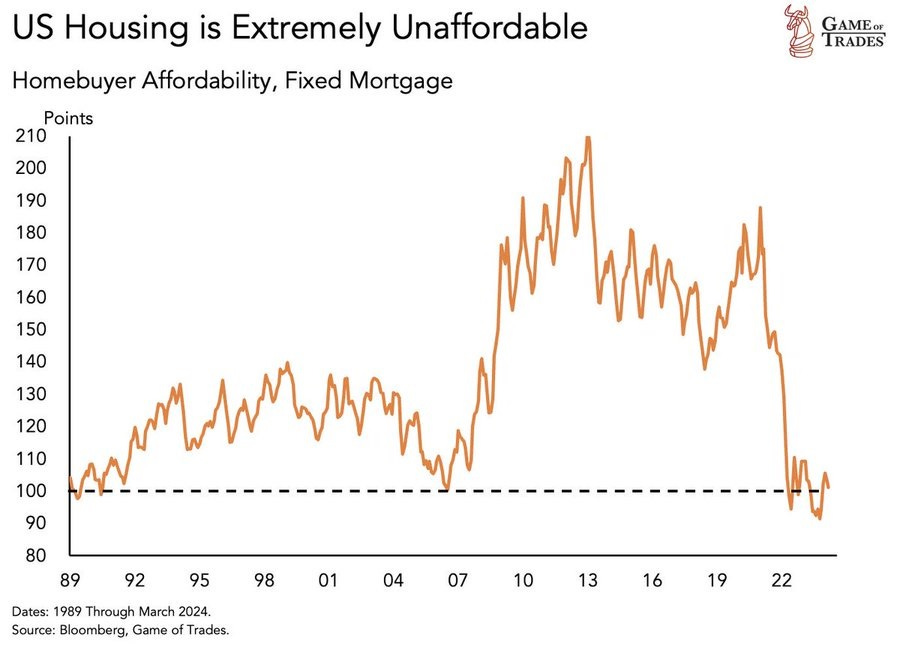

Let’s start with the fact that the average American can’t afford the average house. Not even close:

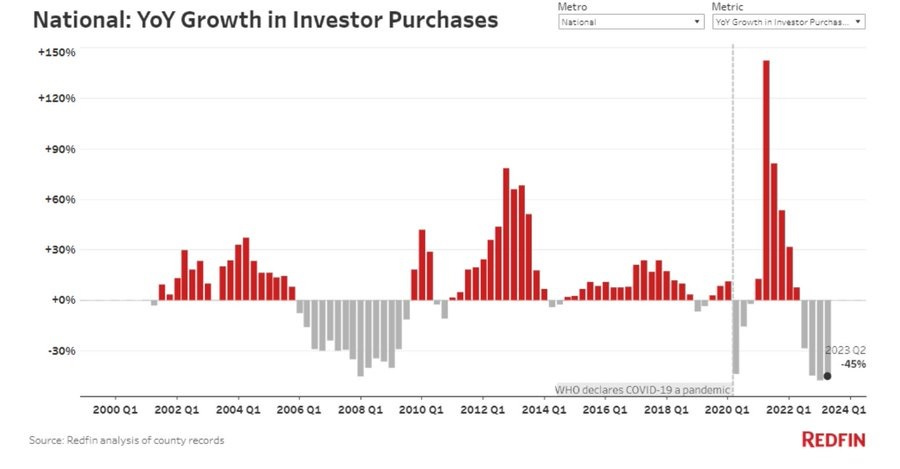

Houses have been unaffordable for a while, but for a while, “investors” — i.e., private equity companies with access to cheap credit — took up the slack, sometimes buying entire neighborhoods and converting the houses to rentals. Now they’ve begun to retreat:

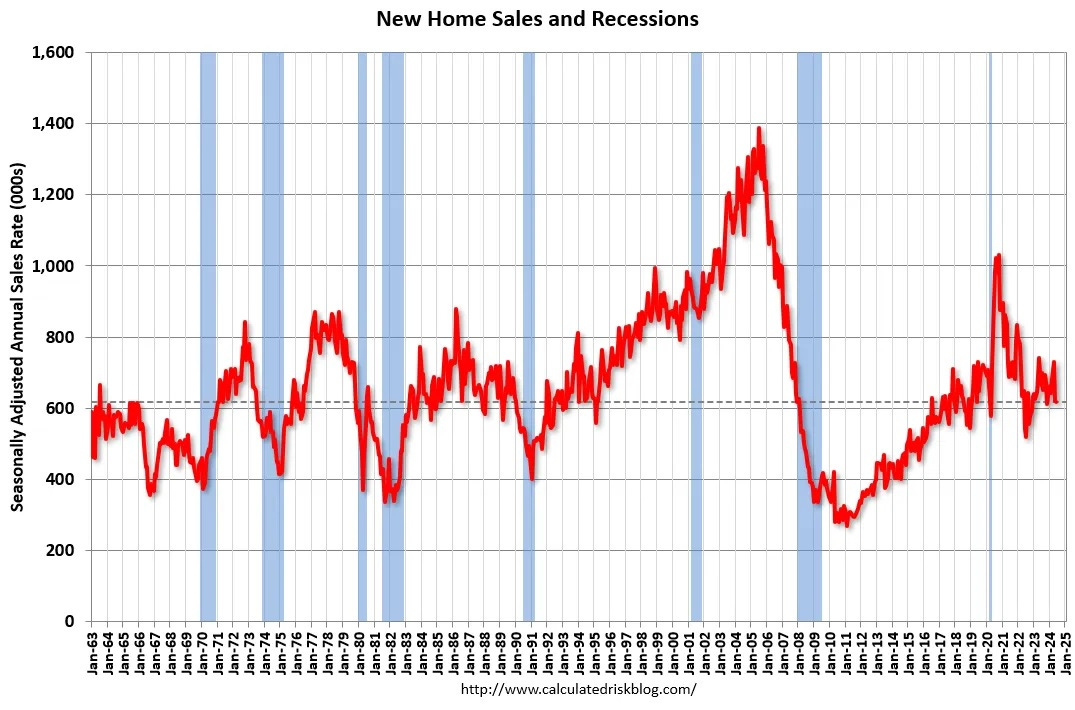

As a result, sales of new homes are back down to pandemic lows:

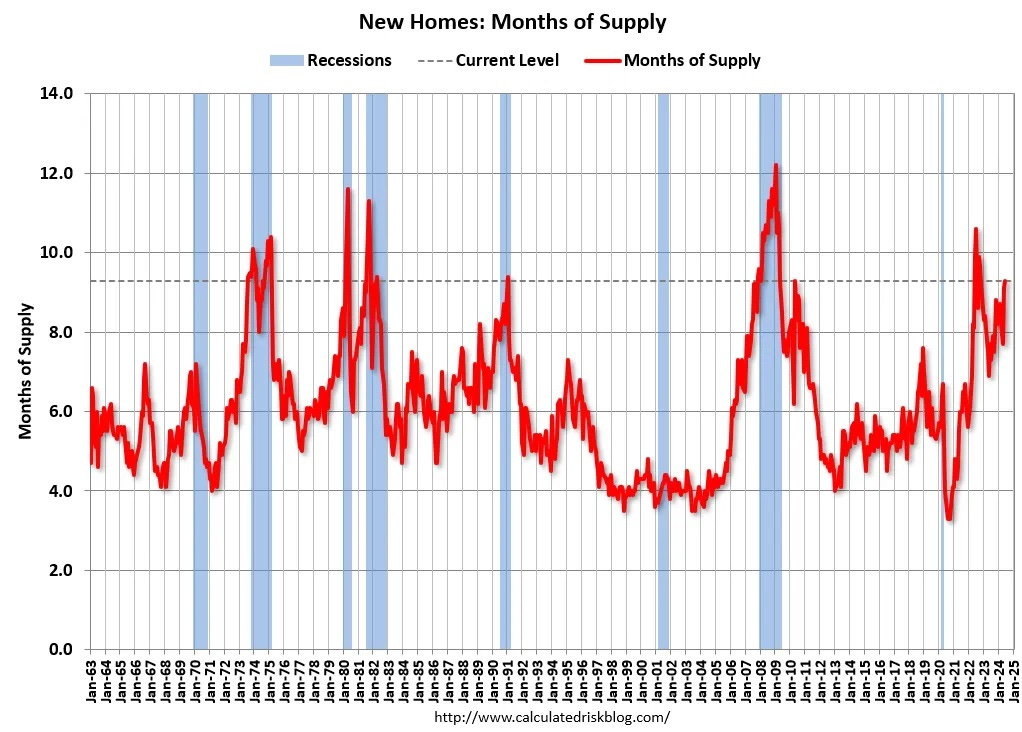

Builders, meanwhile, continue to build, sending the supply of new homes for sale back up to historical past pre-crash levels:

Rising supply and falling demand are leading would-be buyers to cancel contracts:

Homebuyers are backing out of deals at a record pace: Redfin

(Yahoo) – Deals are falling through in the housing world. Roughly 56,000 home purchase agreements were called off last month, which translates to almost 15% of homes under contract at the time, “the highest percentage of any June on record,” according to Redfin (RDFN).

“House hunters are having trouble committing because buying a home is more expensive than ever,” an analysis from Redfin published today read. It pointed to the median home sale price, which rose 4% from a year earlier to $442,525 in June, and the average 30-year fixed mortgage rate, which was 6.92%.

Sellers even cut their prices, but it didn’t seem to be enough. About one in five homes for sale last month had a price reduction, the highest amount of any June on record. It was up more than 14% from a year ago and barely below a record set in October two years ago. “Some sellers are reducing their prices because their homes are sitting on the market and getting stale—the result of an ongoing affordability crisis impacting buyers,” Redfin said.

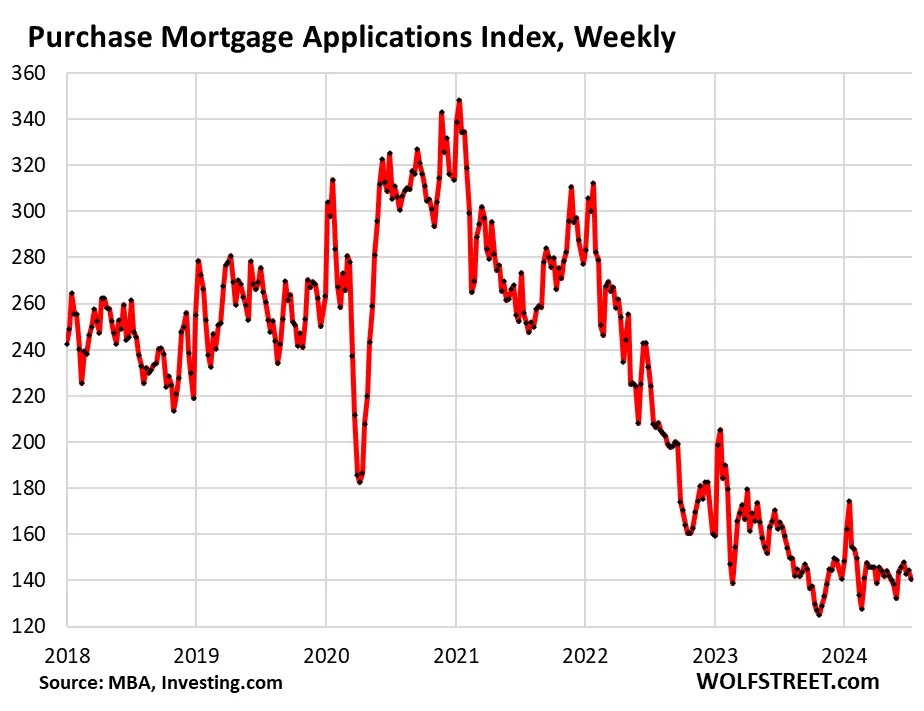

Purchase mortgage applications, as a result, have plunged:

Bursting bubble

Add it all up, and the housing bubble looks ready to burst:

Here Comes the Inventory of Vacant Homes: Supply Spikes to Highest in 4 Years

(Wolf Street) – A game-changer is underway. Even the NAR concedes this “shift from a seller’s market to a buyer’s market.”

Mortgage rates have dropped to about 6.8%, down by a full percentage point from October last year, and yet sales of existing homes have plunged, and vacant homes for sale are coming out of the woodwork, the same vacant homes that the industry said didn’t exist, the second and third homes that people had moved out of but didn’t sell when they bought a new home over the past few years in order to ride the price spike all the way to the top. So now it’s time to sell those vacant homes. And supply in June spiked to the highest level in four years.

Sales of existing homes of all types – single-family houses, townhomes, condos, and co-ops – fell 5.4% in June from May on a seasonally adjusted basis, and also by 5.4% year-over-year to an annual rate of 3.89 million homes, the third-lowest sales volume since the depth of the Housing Bust in 2010, behind only October and December 2023, according to the National Association of Realtors (NAR) today.

Sales in June were down from the Junes in prior years by:

- 2023: -5.4%

- 2022: -24.2%

- 2021: -34.8%

- 2019: -26.9%

- 2018: -27.8%

Inventory for sale jumped by 23.4% year-over-year, to 1.32 million homes, according to NAR data. Active listings surged by 36.7% year-over-year to 840,000 in June, just a hair below June 2020. According to data from Realtor.com, active listings surged the most year-over-year in:

- Tampa, FL, metro: +93%

- Orlando, FL, metro: +81.5%

- Denver, CO, metro: 78%

- San Diego, CA, metro: +72%

- Jacksonville, FL, metro: +70%

- Seattle, WA, metro: +62%

- Atlanta, GA, metro: +59%

- Phoenix, AZ, metro: +56%

- San Jose, CA, metro: +53%.

Price reductions continued to surge. Of the active listings, 37.6% had reduced prices in June.

Housing Market Entering ‘Crash Stage’ in Multiple Cities

(Newsweek) – The U.S. housing market is already entering a “crash stage” in multiple cities across the country, according to expert Nick Gerli, CEO and founder of real estate analytics firm Reventure Consulting.

Talking during a recent episode of the Thoughtful Money podcast, Gerli said that while the national housing market is still “in a record bubble,” with home prices significantly higher now than they were before the pandemic, many metropolitan areas are experiencing price drops on a month-to-month basis and even year-over-year.

“The housing market right now is very bifurcated,” Gerli said. “And we actually have many cities that are entering a crash stage right now. This is what the mainstream headlines on the housing market are absolutely ignoring.”

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino July 24th, 2024

Posted In: John Rubino Substack

Next: Hoisington Q2 Review and Outlook »