July 24, 2024 | Hoisington Q2 Review and Outlook

Hoisington’s Q2 Review and Outlook is now available; see Monetary and Fiscal Extremes.

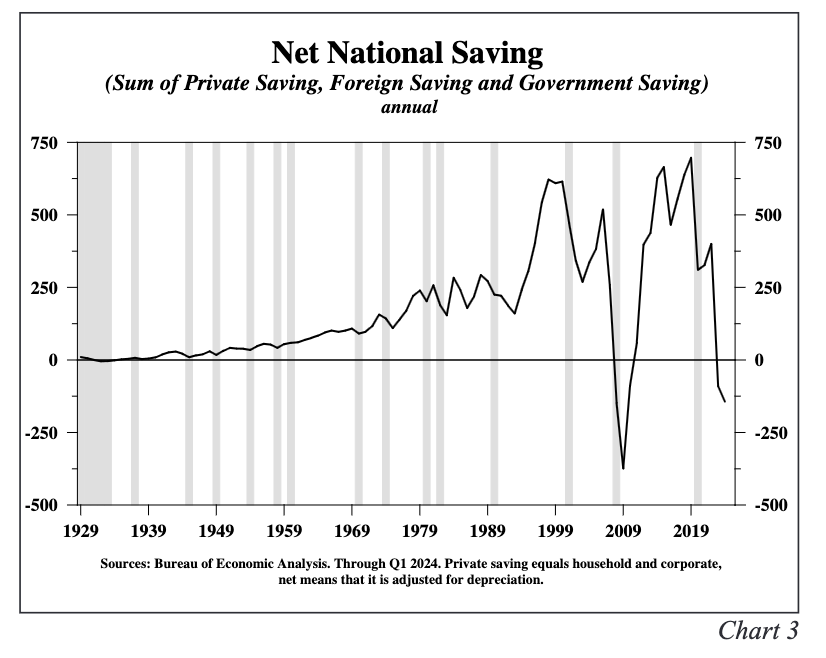

One of several standout charts shows the US Net National Savings Rate since 1929, negative in 2024 for only the second time ever, as the federal budget deficit (dissaving) exceeds the total of household, corporate and foreign savings.

Hoisington notes that, as in 2008, negative national net savings (NNS) create an unusual and significant restraint on economic growth that is increasingly driving down employment, inflation and bond yields (Treasury prices rising):

The Quarterly Census of Employment Wages (QCEW) of 11 million institutions recorded an extremely sharp cyclical deterioration in the third and fourth quarters of 2023. Confirming the QCEW, household employment was nearly unchanged in the last 12 months, with a significant loss in full-time jobs. Real personal expenditures for goods fell in the first half, with significant weakness in durable goods. Despite AI spending, the dominant monthly component of capital spending (shipments of nondefense capital goods, excluding aircraft and adjusted for inflation) turned down in the second quarter.

The critical measures of housing demand set new lows this year, and average hours worked in June fell below the levels when the economy entered the 2001 and 2007 recessions.Reflecting poor business conditions in the Euro Area, China, Japan, the UK, other trading parties, and the strong dollar, the high multiplier real trade deficit was 8.6 % worse in May than a year ago.

Cyclical economic deterioration and constrictive monetary and fiscal factors point to a weaker economy, less inflation, and lower Treasury bond yields.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Danielle Park July 24th, 2024

Posted In: Juggling Dynamite