July 22, 2024 | Cutting Time

Happy Monday Morning!

Headline CPI inflation decelerated in June to 2.7% year-on-year, slightly cooler than expected. The average of the Bank of Canada’s preferred core inflation measures also held steady at 2.8%. Some people would argue the job is not done, inflation must be returned to 2% and not a basis point higher, the same ridiculous line of thinking that was used to justify rates being kept near zero for a decade because inflation was stubbornly stuck at 1.8%.

I’m no economist but I do live and breathe housing. I figured i’d chime in here considering shelter is nearly 30% of the CPI basket.

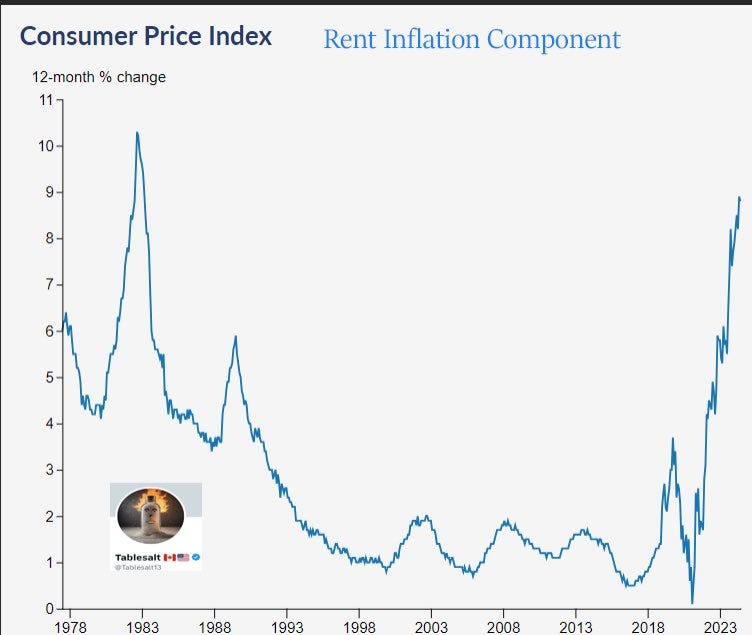

According to Stats Canada last month, shelter inflation pushed higher to 6.2%, which has been led by an 8.8% annual increase in rent and a 22.3% year-over-year increase in mortgage interest costs.

Rent inflation is surging, inflating at its fastest pace in 40 years!

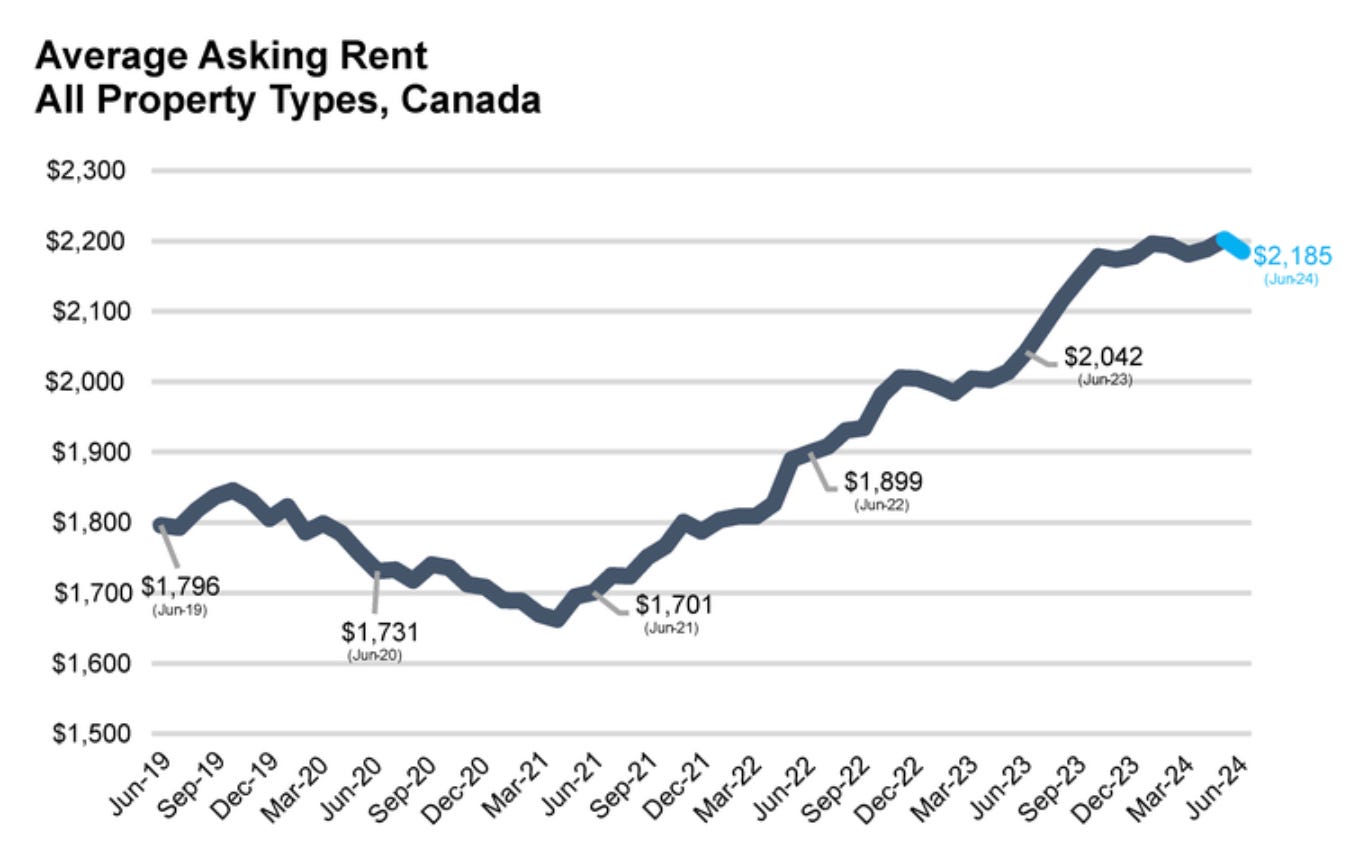

However, this only tells us what happened, as Wayne used to say, skate to where the puck is going to be, not where it’s been. On the ground, in real time, rents are falling in Canada’s two largest metros.

According to Rentals.ca, asking rents for apartments in Vancouver ticked up 1.1% month-over-month but were down 7.8% annually in June to an average of $3,042. In Toronto, average purpose-built and condominium rents declined 2.5% monthly and 3.5% annually in June, falling to a 22-month low of $2,715. Apartment rents in Toronto have declined on an annual basis for five straight months, while Vancouver rents have declined annually for seven consecutive months.

The data coincides with the anecdotes, asking rents peaked last year and are now declining modestly in Vancouver & Toronto. In most major markets, other than Calgary, rent growth has pancaked.

Asking rents across the country decreased 0.8% from May, the largest month-over-month decline since early 2021 during COVID-19 and reversing the typical seasonal trend of increasing rents at this time of year.

On the other side of the equation we have mortage interest costs growing at 22%. However, this function is directly influenced by the Bank of Canada.

Ironically, as my good friend Ben Rabidoux points out, Stats Canada adjusted the CPI basket weightings a couple months ago, allowing the interest component to go from 3.5% to 5.2% of the basket. This meant mortgage interest costs added 1.3% percentage points to headline CPI in June! Inflation ex-mortgage interest costs was 1.4% in June, the lowest since early 2021.

So here’s what we know for sure across most of the country. Rents are flat and falling, home prices are falling, mortgage interest costs are easing. In other words, 30% of the CPI basket, in real time, is deflating.

It’s no wonder Tiff and friends are expected to cut rates again this week, with markets placing greater than 90% odds of a 25bps cut. The BoC is behind the curve, just like they were a few years ago. Remember they only started raising rates in March 2022, one month after the housing market had peaked and home prices had inflated at the fastest pace in 40 years.

A few meesily 25bps rate cuts here and there aren’t going to turn this ship around either. The housing market, which got too large, too quickly, is now going through a painful contraction which we got reminded of this past week with the latest figures from Urbanation.

New condo sales in the Toronto region have plunged to their lowest level in nearly three decades through the first half of this year, hitting their lowest levels since 1997.

A rate cut in July isn’t going to stem the tide. New home sales lead housing starts, and housing starts are what keep approximately 8% of the Canadian labour force employed.

There’s no denying housing needed to go through a correction, the tricky part is stopping them once they get rolling, and limiting the collateral dammage.

It’s cutting time and Tiff’s on deck.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky July 22nd, 2024

Posted In: Steve Saretsky Blog

Next: US Recession in Motion? »