July 29, 2024 | Cash Flow Problems

Happy Monday Morning!

As expected, the Bank of Canada slashed rates another 25bps this past week. It was a dovish press conference, with Tiff emphasizing excess supply in the economy.

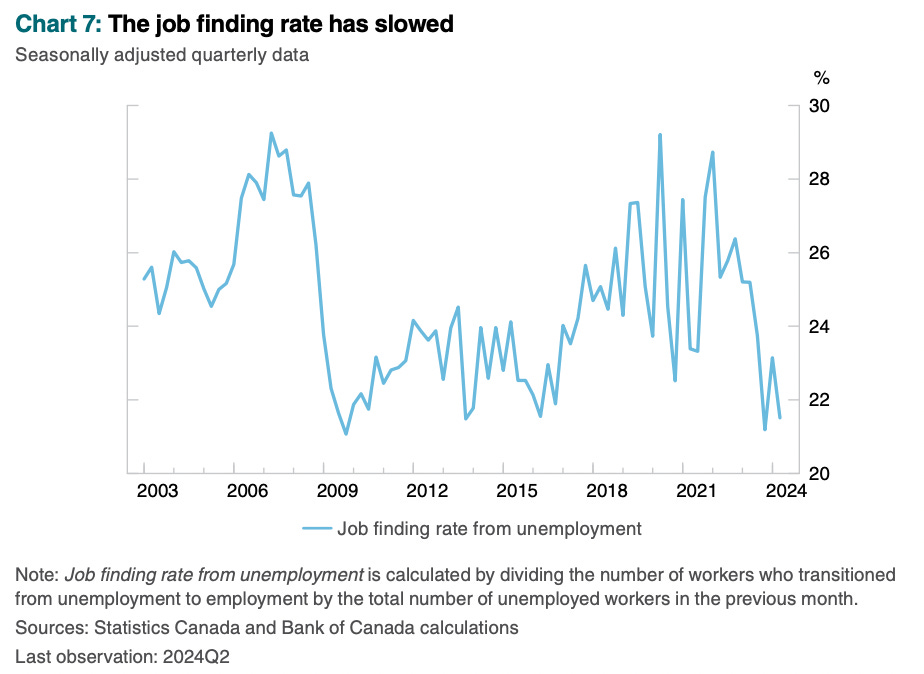

In the words of the BoC, economic growth likely picked up to about 1.5% through the first half of this year. However, with robust population growth of about 3%, the economy’s potential output is still growing faster than GDP, which means excess supply has increased. Household spending, including both consumer purchases and housing, has been weak. There are signs of slack in the labour market. The unemployment rate has risen to 6.4%, with employment continuing to grow more slowly than the labour force and job seekers taking longer to find work.

In other words, we’re adding more people than jobs available, and the economy is already in a per capita recession. Nothing regular readers of this newsletter weren’t already aware of.

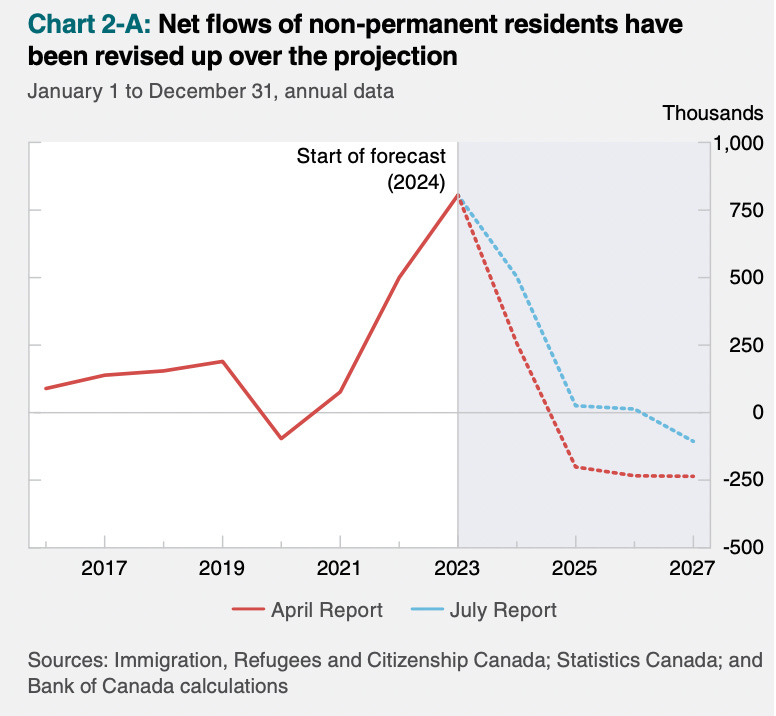

Although, the BoC is concerned population growth isn’t slowing as quickly as the feds had promised.

On March 21, 2024, the federal government announced plans to reduce net inflows of NPRs (non permanent residents) to lower their share of the total population from 6.2% to 5% within three years. Overall, this implied that the annual population growth rate would decline by about 2 percentage points in 2025 and 2026. NPRs represented 6.8% of the population at the beginning of April—much higher than at the time of the March announcement—and the share is expected to continue rising over the near term. This suggests that it will take longer for planned policies to reduce NPR inflows to achieve the 5% target.

This is prompting the Bank of Canada to highlight upside risks to shelter inflation. However, as we highlighted last week, we believe those risks are misguided.

In real time, home prices, and rents are flat or declining across the majority of most major metros. Furthermore, mortgage interest costs, which are directly controlled by the BoC have also peaked. We had shelter inflation, the worst in 40 years! But that ship has sailed, and now the hangover is here.

The excess leverage and speculation used to enhance gains on the upside is now sowing the seeds for losses on the downside. There is perhaps no better example of this than in the pre-sale condo space where roughly 70% of all units are sold to investors on spec.

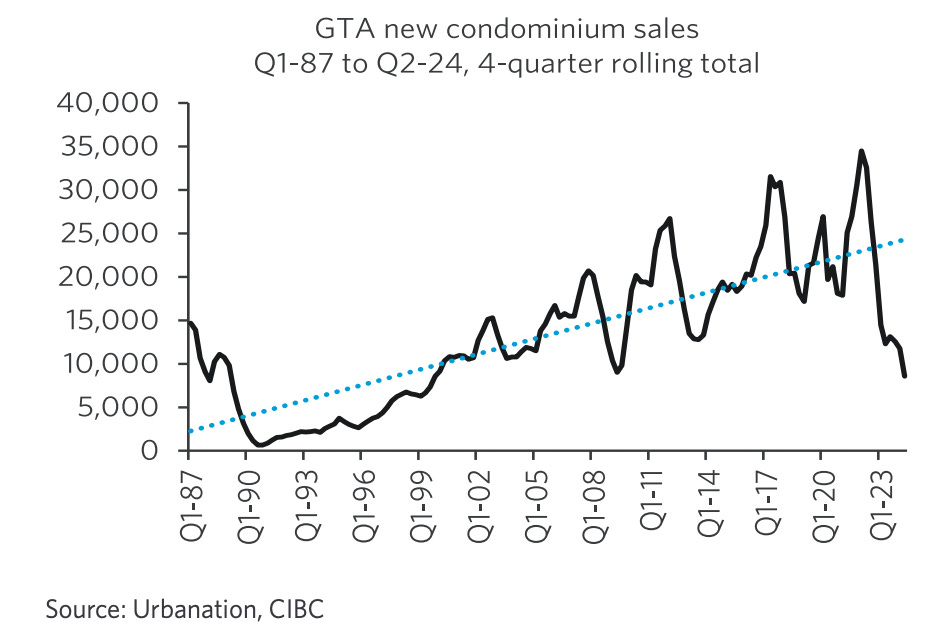

A recent report from CIBC and Urbanation spells out the troubles brewing in the GTA, also known as the pre con capital of Canada. New condo sales have suddenly crashed from record highs to near 30 year lows!

It took 475bps of rate hikes, but the speculative fever the grappled the GTA has been put to bed. Sure rents have risen tremendously on the backs of record immigration, but surging mortgage rates, condo fees, and property taxes have rendered most newly completed condos a financial black hole.

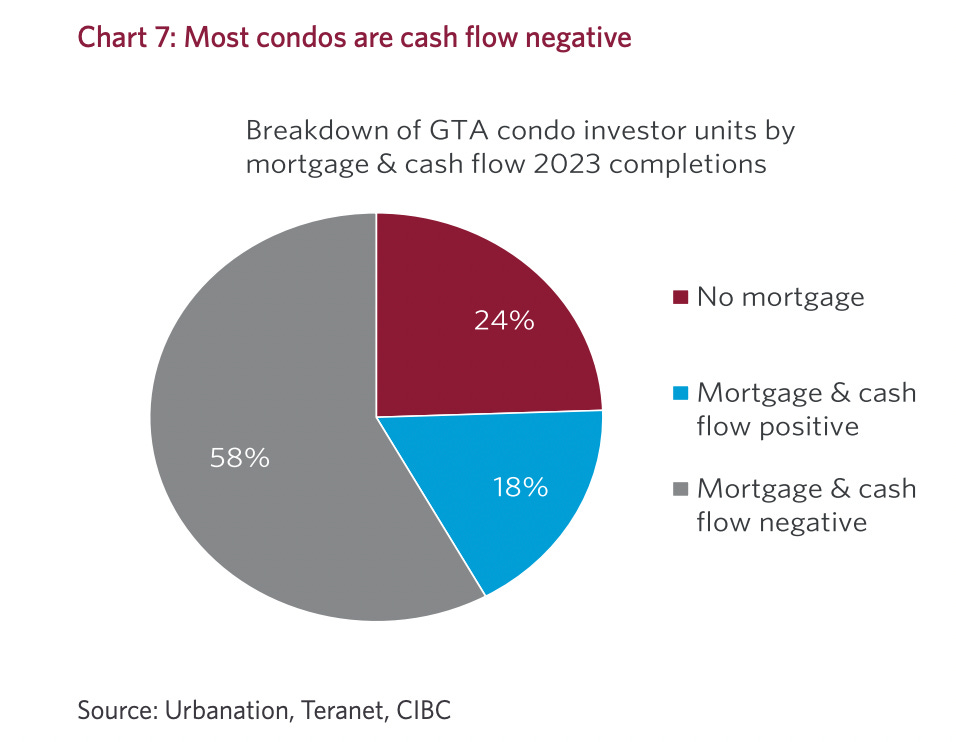

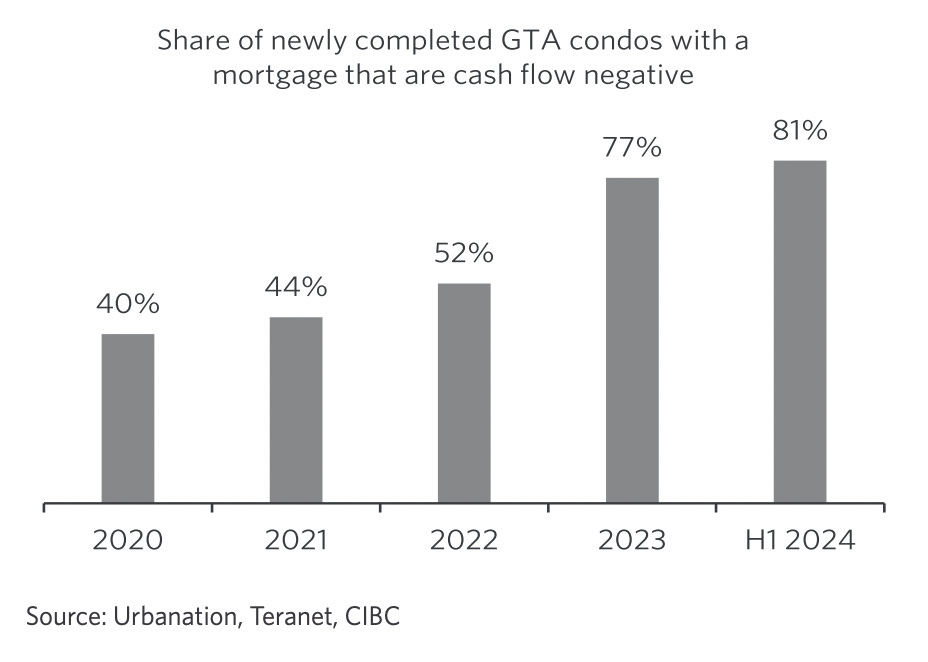

Of all the investors who completed on their condos in 2023 and then rented them out on the MLS, 58% of them took a mortgage and were cash flow negative.

If we focus solely on the levered investors, we see that 77% were cash flow negative in 2023. First half results for 2024 show the situation worsening still, with 82% of leveraged investors in a cash flow negative position.

CIBC’s analysis of the data found that, on average, condo investors that closed on their newly completed units in 2023 experienced negative cash flow to the tune of $597 per month, which was more than 2.5 times greater than the negative cash flow that investors that closed in 2022 experienced (-$223) and a far cry from the days of positive cash flow in 2020-2021. While rents achieved on leases of newly completed condos rose 8% last year to a record high average of nearly $2,700, average monthly ownership costs rose 21% to reach nearly $3,250 per month.

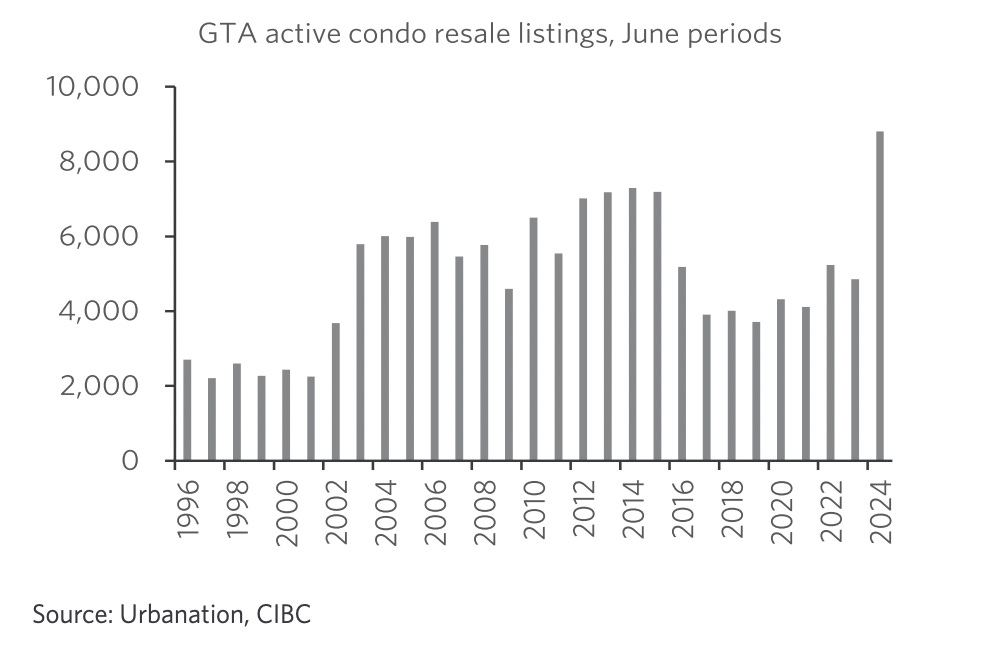

How many of these investors are just barely holding on, waiting for a better time to unload? As it stands right now, active condo listings in the GTA are at record highs!

Yes, the GTA is in a world of its own, but there are similar problems here in Vancouver, just on a much smaller scale.

Shelter inflation? I think not, Mr. Macklem.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky July 29th, 2024

Posted In: Steve Saretsky Blog