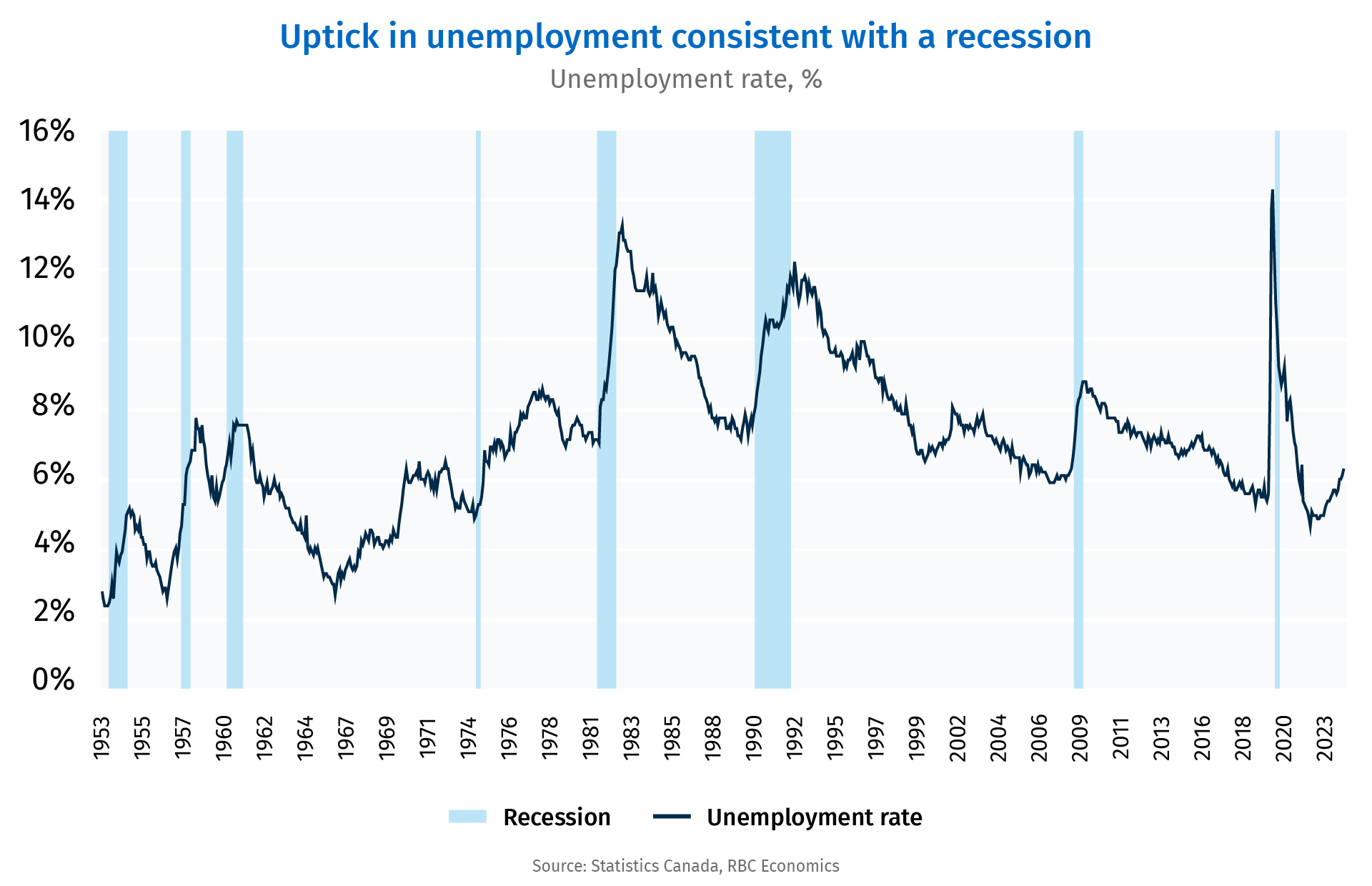

Canada’s June unemployment rate of 6.4% was up 160 basis points from the cycle low of 4.8% in June 2022. Since the 1970s (as shown below courtesy of RBC), Canada has never had this trough-to-peak rise in the unemployment rate without the economy going through a recession (blue bars). The increase following the 2000-03 dotcom bust maxed out at 150 basis points, and Canada did not officially follow America into recession (though our stock market halved along for the ride).

Technically, to date, the Canadian economy has narrowly avoided the consecutive headline GDP declines that would qualify as a recession. However, that’s only due to adding 2.1 million new consumers to the economy from Q2 of 2022 to Q1 of 2024. RBC economists explain that Canada’s economy may not be in a recession, but it feels like one:

Technically, to date, the Canadian economy has narrowly avoided the consecutive headline GDP declines that would qualify as a recession. However, that’s only due to adding 2.1 million new consumers to the economy from Q2 of 2022 to Q1 of 2024. RBC economists explain that Canada’s economy may not be in a recession, but it feels like one:

Without higher population boosting demand, the Canadian economy almost certainly would have contracted outright over last two years. Per person after inflation household spending is 2.6% below its post-pandemic peak and down 2% from pre-pandemic 2019 levels as higher prices and interest rates cut into purchasing power. Per capita GDP has declined in six of the past seven quarters to 3.1% below 2019 levels. The per capita GDP decline in Canada has been milder than in more recent downturns. In 2008, real per capita output fell 5% from peak to trough, similar to the contraction in the early 90s. The drop in the 1980s was a larger 7%. But the current per capita GDP decline is larger than in earlier periods that were considered recessions.

The BoC’s easing cycle is underway after an initial 25 basis point interest rate cut in June. We expect three additional back-to-back cuts in subsequent meetings will bring the overnight rate to 4% by year end.

The loosening of monetary policy to less restrictive levels will ease some of the pain. Mortgage renewals in 2025-26 will still challenge households, but it should be manageable as long as the slowdown in labour markets does not significantly intensify.

Counting on labour market strength is a low-probability bet at this point. Historically, (as the chart shows above) the unemployment rate accelerates through recessions and well into subsequent economic recoveries while central banks slash interest rates. The present rate-cutting cycle has barely begun in Canada and, not yet, in America.