July 12, 2024 | Canada Lags Far Behind Other Countries in Expenditure on Research and Development as a portion of GDP

Canada remains far behind many other developed countries in the OECD when comparing expenditures on research and development as a portion of GDP. This lack of investment will continue to hurt Canadian economic growth and productivity for years to come unless changes are made.

Can Canada boost its research and development spending?

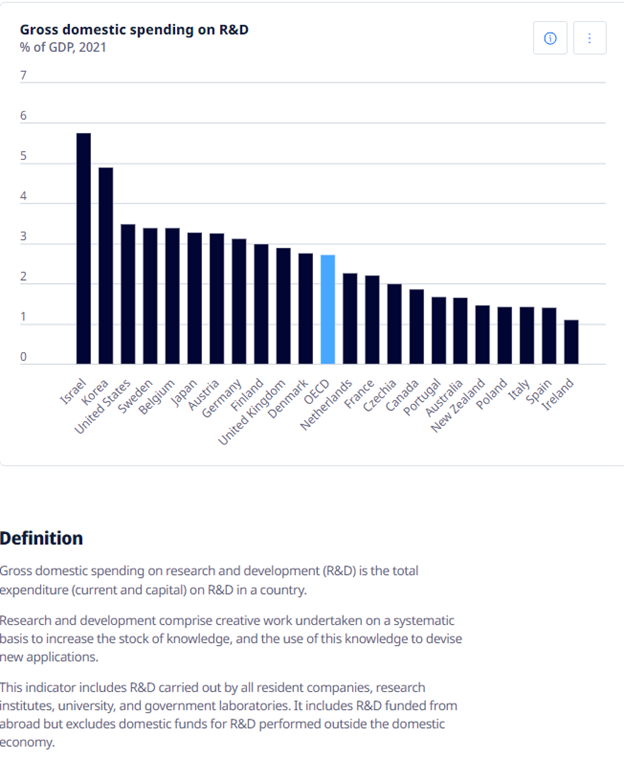

Total research and development expenditure includes government laboratories, business, universities and research institutes. The chart shows expenditures as a percentage of GDP in constant 2015 dollars and is adjusted for purchasing power parity between countries.

The average of OECD countries is 2.7 percent, while Canada is only 1.9 percent.

The leaders — Israel, Korea and the United States — were 5.8, 4.9 and 3.5 percent respectively in 2021.

Source: OECD

In an opinion piece published in May 2023 in the Globe and Mail, David Parkinson laments the low amounts of R&D spending by the private sector when compared to other countries. In a survey by Statistics Canada Canadian businesses indicated that they intended to increase their spending by 4.7 percent, well below the rate of inflation at that time.

And Statistics Canada reported that in 2022 R&D spending increased only 0.5 percent in the private sector.

In a report released May 29, 2024, the C.D. Howe Institute examined options to spur investment in R&D in the private sector using an existing tax incentive called the scientific research and experimental development tax incentive program (SR&ED).

These tax incentives are currently offered as accelerated depreciation write-offs and a tax credit. These programs will lower the taxes payable for some businesses and/or generate a tax credit. There are also provincial tax credits for R&D activity in most provinces and the combined incentives are quite generous. Apparently small firms increase R&D spending more than large firms, after receiving these incentives.

But these incentives are not working as intended or perhaps are not large enough to induce private sector operators to expand their research. And this problem might get worse as other governments, especially the United States, have introduced generous incentives (I.R.A act) to develop new facilities in renewable energy.

Both Canada and the United States are planning to introduce very large tariffs on Chinese exports of automobiles to North America. President Joe Biden has proposed a tariff of 100 percent on battery electric vehicles that are being manufactured in China and exported at very low prices.

Tariffs act like a tax by raising consumer costs and are unlikely to spur more R&D expenditure in Canada. The U.S. is having some success in getting large manufacturers of items like semiconductors, batteries and vehicles to locate on U.S. soil.

Canada is too small a consumer market to use tariffs to entice research and manufacturing to relocate.

The best approach for Canada could be to pick a sector as a focus for both government expenditures and private sector incentives.

Choosing a niche sector might generate better results than tax incentives. But getting agreement on that sector choice could be really difficult.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Hilliard MacBeth July 12th, 2024

Posted In: Hilliard's Weekend Notebook