July 21, 2024 | Big Selloff Was Tightly Scripted

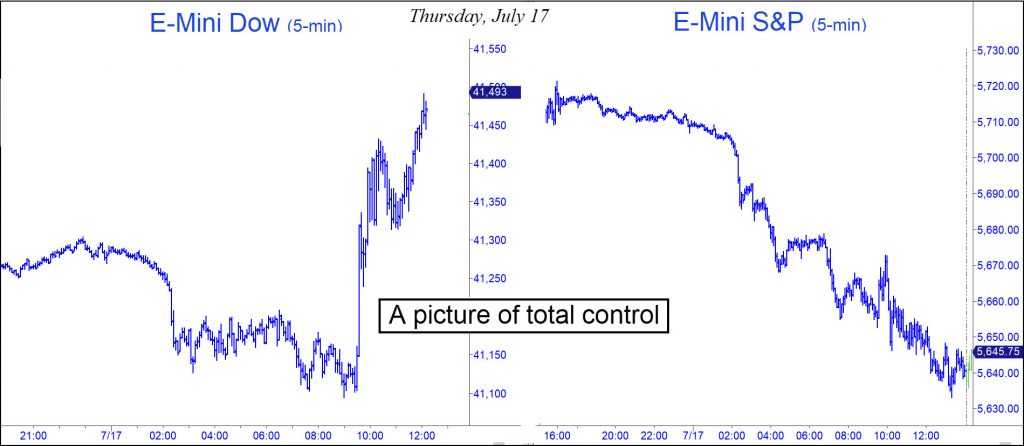

Bears shouldn’t get their hopes too high just because the S&P 500 plummeted for three straight days last week. The selloff seemed tightly scripted, given that the Dow Industrials were rising just as sharply at least part of that time. This is shown in the chart above, which captures price action on Thursday. The implication is that portfolio managers were simply shifting money from one simmering vat to another, an efficient way to keep stocks bubbling without expending much capital.

Someday their ingenious siphon pump will be overwhelmed by honest-to-goodness selling. You’ll know the weakness is real because it will last for three or more days, it will encompass all of the broad indexes, and it will gain in momentum. Three straight days of selling has been an extremely rare occurrence since this gaseous bull run began in March 2020, just before the covid hoax laid seige to the U.S. economy. But four days? You’d have to go back many years to find an instance of this.

Lessons to Unlearn

Even the 1987 crash didn’t last for three full days. It began on the afternoon of Friday, October 16, but by mid-morning on Tuesday, October 19, selling had dried up and stocks were poised to come roaring back. Bears who were slow to cover short positions got savaged almost as badly as bulls who’d been trapped in the initial avalanche. The downtrend had drawn enormous power from huge open positions in far-out-of-the-money put options. For years, selling them ‘naked’ was considered a reliable source of free money. But when stocks started to fall hard on that fateful Friday, the ordinarily docile puts turned into a water-cannon enema for short sellers.

Traders learned their lesson, and more than a few of my colleagues in the pits of the Pacific Stock Exchange were pitched into bankruptcy. There should be no doubt, however, that we will see that the lesson has been thoroughly unlearned when the next bear market comes bellowing from the deepest cavern of of hell.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Rick Ackerman July 21st, 2024

Posted In: Rick's Picks

Next: Going, Not Gone »