July 26, 2024 | A Worried Bank of Canada is Cutting Interest Rates

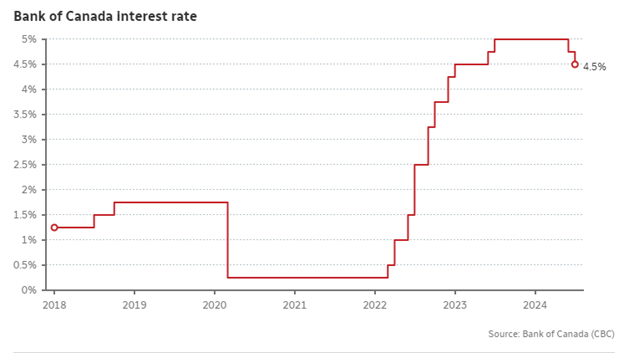

Central bankers in Canada went out on a limb by cutting a key interest rate this week. The Bank of Canada cut its benchmark rate for the second time, by 0.25 percent to make a full ½ point reduction this year.

The most powerful central bank, the U.S. Federal Reserve, has yet to make its first cut in the Fed Funds rate.

Why is Canada moving ahead of the U.S.?

The conventional wisdom is that Canada never deviates from the Fed for long when it comes to setting interest rates.

In both countries Interest rates were pushed higher in an abrupt fashion from close to zero percent in February 2022 to about 5 percent at the recent peak, reached in the summer of 2023, about eighteen months after the start of the increases. The Fed made almost identical interest rate hikes, starting and ending only a month apart.

In June 2024 Canada made its first reduction and in late July has doubled the size of that discount. But the Fed has yet to cut, perhaps worried about appearing to exert influence over the November election.

While two cuts in two months seems like a trend the chair of the BOC emphatically asserted that they are “not on a predetermined path”. Policy decisions would be made “one meeting at a time”, he said.

The next BOC meeting is in early September while the Fed meets next week.

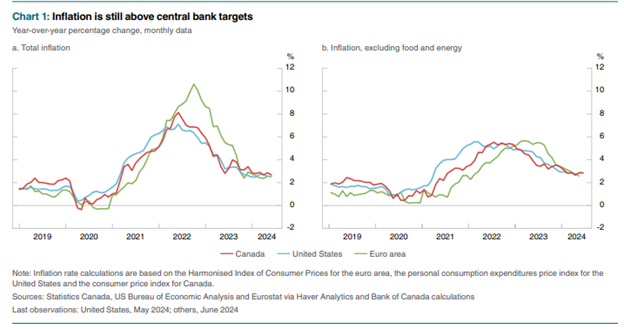

The official justification for cuts is the reduction in inflation since the peak in mid-2023.

Has inflation come down faster in Canada than in the U.S., making an early cut in Canada more reasonable? No, we see on both headline CPI and core CPI (excluding food and energy) the red and blue lines are very close. So, we would expect that the U.S. and Canada would match in their official lending rates. But right now, they are moving apart.

Why did the BOC cut rates twice ahead of the U.S. Fed?

It could be a worry about a weak Canadian economy. The forecast for Canada’s GDP growth rate is 1.2 percent in 2024 and 2.1 percent in 2025, from the Monetary Policy Report.

But the same report also predicts mediocre growth in the U.S., and a Bloomberg survey indicates a consensus forecast for U.S. GDP of 2.3 percent and 1.8 percent, not significantly higher than in Canada.

Perhaps the BOC believes that Canada needs lower rates more urgently than the U.S. despite similar data on inflation and GDP growth.

And that concern is valid given higher levels of household debt in Canada. Canada has the highest ratio of household debt to income in the OECD, at 180 percent, compared to 100 percent in the U.S.

The Bank of Canada could be trying to avoid a debt crisis by lowering rates more quickly, but these two small cuts won’t be enough to avoid a credit crunch.

If Canadian mortgage and credit card defaults spike, look for more rate cuts soon.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Hilliard MacBeth July 26th, 2024

Posted In: Hilliard's Weekend Notebook